“The future of asset management is to combine fundamental approaches with quantitative techniques,” explains Denis Panel, who is Chief Investment Officer and Head of MAQS at BNPP AM, as well as being Professor of Asset Management on the MBA programme at the top-ranked HEC business school in Paris. He continues, “We have introduced new quantitative signals, based on macro or monetary policy factors, alongside discretionary fundamental input which comes from the investment committee, for timing beta in equities, and will soon do so for fixed income. Neither part is an overlay and sometimes the two views are opposing. For instance, our discretionary managers have strong conviction on US equities, but our quantitative models are negative on them. The objective is for the quantitative models to help mitigate the behavioural biases that can come from discretionary management.”

Discretion also informs market selection in BNPP AM’s purely quantitative strategies. Japanese government bonds were removed from one of its models after the Bank of Japan announced measures to strictly control long term yields in 2017.

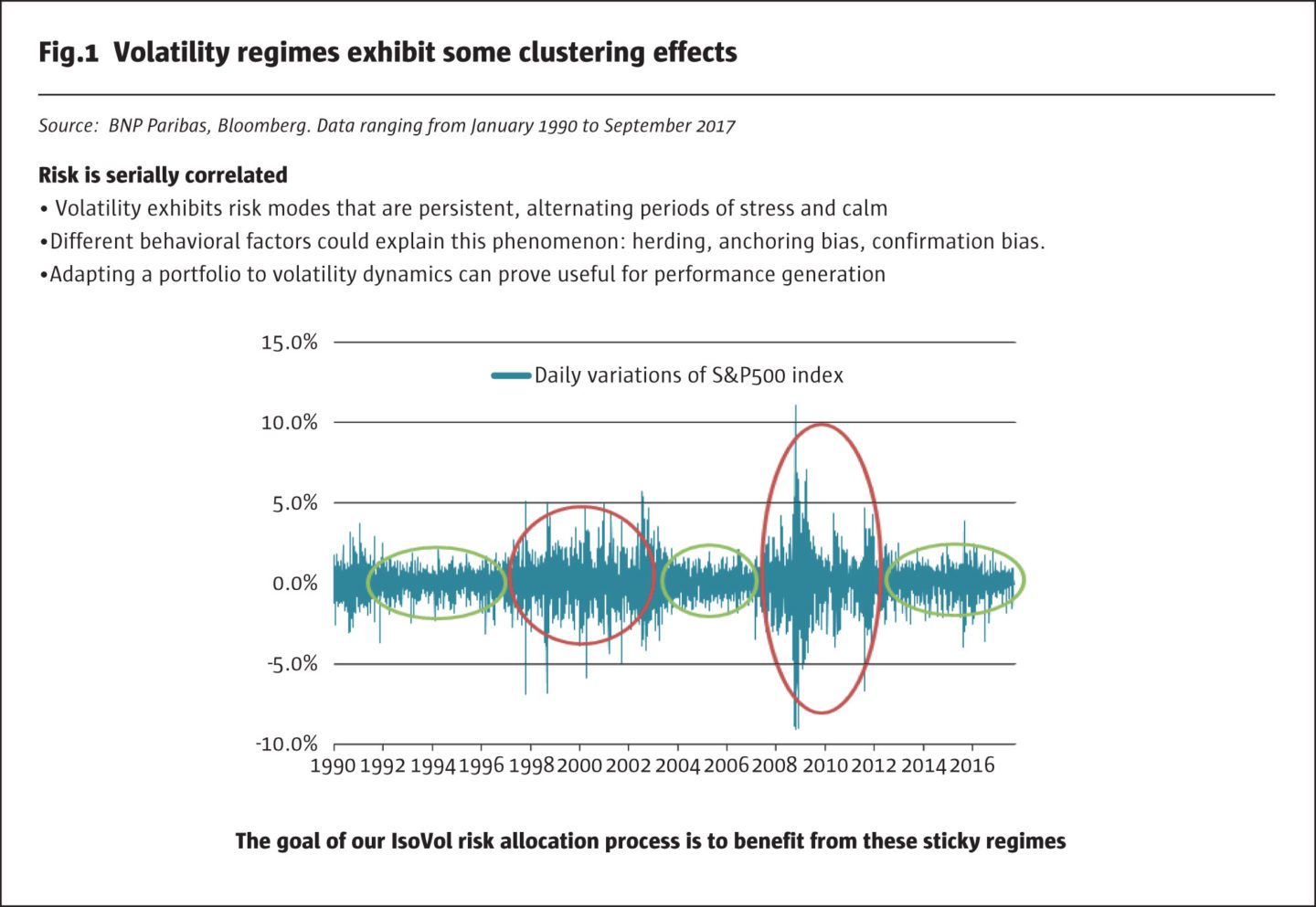

“The latest innovation is a new optimiser which has been developed for multi-factor allocation, based on an in-house research paper,” he adds. “It is more stable than a traditional Markowitz mean/variance optimiser, resulting in more stable, robust and intuitive results. It has been used for strategic asset allocation for some time and is now being used for tactical asset allocation as well, on multi-asset and benchmark products.” By contrast, the ISOVOL range rebalances exposures based on judgement and recent market volatility, to maintain a constant volatility target, using GARCH techniques to forecast volatility. Unlike risk parity, ISOVOL does not imply equal risk contributions per asset class and both long biased and long/short MAQS products have had lower weightings in bonds than many risk parity strategies.

Quantitative macro

Indeed, the Multi Asset Diversified long/short strategy, which uses an entirely quantitative, proprietary trend signal, has had somewhat less exposure to government bonds such as US Treasuries, German Bunds and JGBs than have other CTAs, due to a cap on duration. The duration ceiling is being raised for a more defensive version of the strategy, but the existence of any duration cap sets both variants apart from peers. “As a daily dealing UCITS product, the strategy cannot pick up illiquidity premia and BNPP AM are cautious on taking too much interest rate risk given that fiscal stimulus could at some stage contribute to a backup in interest rates,” says Panel. The investment universe also differs from most CTAs in that it trades real estate equities, currencies were removed in 2014, and agriculturals are excluded from the commodity basket. This strategy has received The Hedge Fund Journal’s awards for best risk-adjusted returns in the quantitative macro category over various periods, including most recently four- and five-year periods ending in 2018. The absence of a performance fee and low ongoing charges of 0.76% have boosted net returns.

Fixed income long/short

There is also a long/short strategy focused only on government debt: BNP Paribas Multi-Factor Bonds Long-Short, which uses carry and fundamentals as well as momentum. Carry is partly based on the shape of the yield curve, fundamentals are partly based on employment rates and money supply aggregates, and momentum is based on price movement. “This builds on a fixed income model dating back to 2009 originally created for the Japanese investor market,” says Panel. “It takes long or short positions in the largest six government bond markets: US, Canada, Germany, UK, Japan and Australia. The product was created in response to reverse enquiries from clients who are frustrated by low interest rates.”

Multi-asset with put option overlay

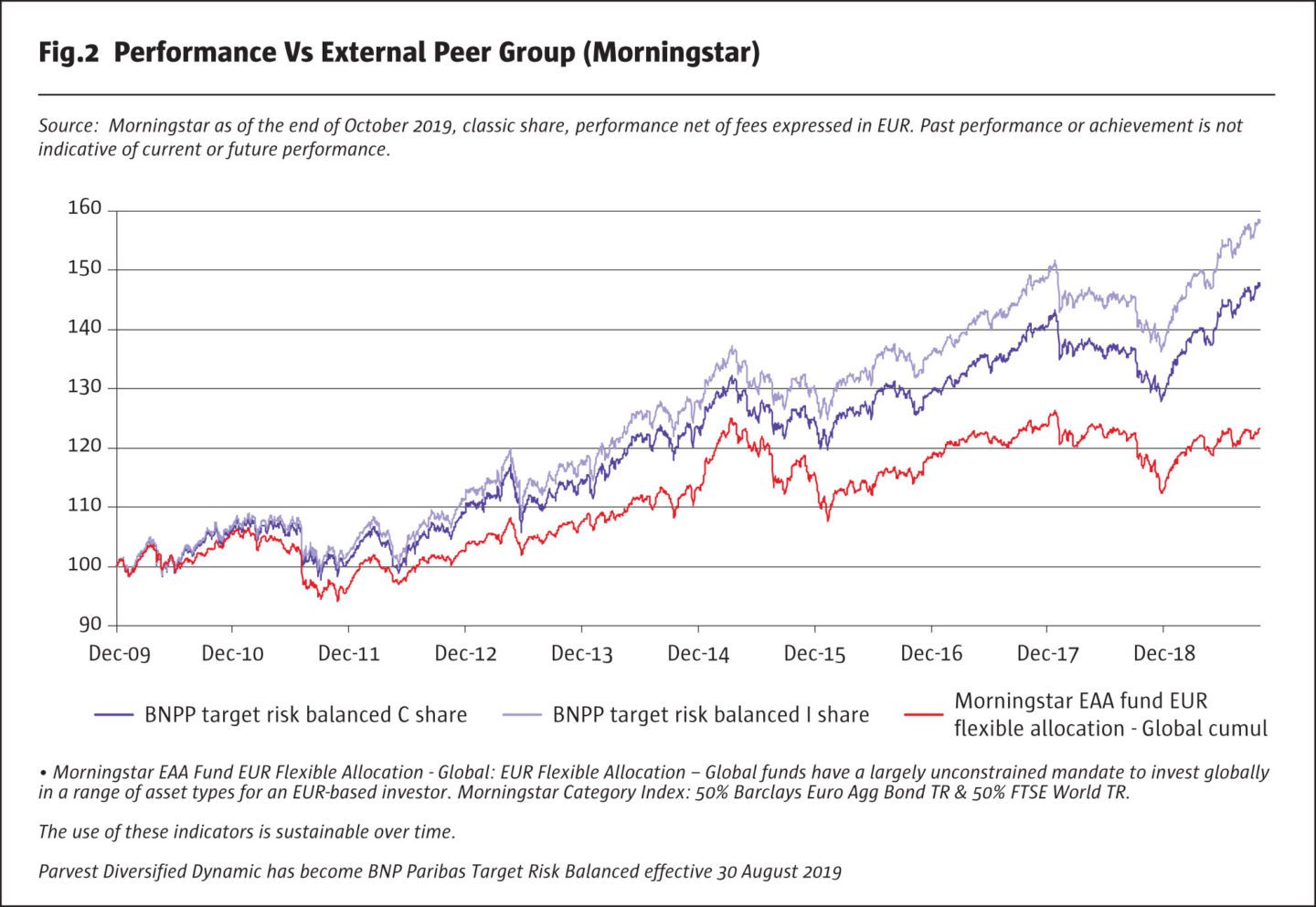

The flagship multi-asset program is BNP Paribas Target Risk Balanced (formerly called Parvest Diversified Dynamic), which runs circa €1.7bn in an ISOVOL product targeting constant volatility of 7.5% that is ranked in the top quartile by Morningstar over one, three and five-year periods. It has predominantly long exposure to US, EU, and emerging market equities, fixed income, commodities and gold. This is a hybrid between quantitative model signals and a judgmental, discretionary approach, which can also hedge equity or fixed income exposure with put options, for instance on the S&P 500, STOXX or Treasury bonds. The puts could be outright or could be put spreads to reduce costs. This strategy is also available as a pure long only approach, as are multi-factor credit funds for European and US credit, which are “smart beta” approaches based on four factors: quality, momentum, valuation and low risk.

Equity market neutral

BNPP AM launched a market neutral version of its multi-factor equity investing approach in 2017: Theam Quant – Equity World DEFI Market Neutral. This is based on the four factors of low volatility, valuation, momentum and quality, which are defined using a combination of academic and proprietary research, including behavioural finance identifying cognitive and emotional biases behind the factors. Between inception and November 2019, the strategy has been roughly flat, but performance has been a tale of two halves. It had a strong first nine months before retracing. “Equity market neutral in general has faced a challenging climate, and the value factor has particularly detracted from returns in 2019 but the strategy has kept inside its risk limits. We expect that the performance of value should eventually mean revert,” says Panel.

Some equity market neutral strategies are also sector neutral. DEFI is not and in September 2019 it had a substantial long exposure in healthcare and a substantial short in financials. This might perhaps look like a defensive, recession bet, but the sector exposures are just a consequence of the stock picks. It also had net long exposure in basic materials, energy and technology, and net short exposure in consumer non-cyclicals, industrials, telecoms and utilities. The product has remarkably low fees: an ongoing charge ratio of 0.60% including management fees of 0.35%, and no performance fee.

The creation of MAQS

After Theam was created in 2011 – merging the Harewood Corporate and Investment Banking (CIB) business, which developed quantitative strategies in an investment banking environment, and the SIGMA (structured, indexed and multi-alpha generation) products unit – the group underwent a further streamlining reorganisation: merging Theam, CamGestion and Multi-Asset Solutions into BNPP AM in 2017. Its four pillars are equities, fixed income, private debt & real assets – where THFJ has in 2019 profiled the launch of BNP Paribas Capital Partners (BNPP CP) European Special Opportunities – and MAQS (multi-asset, quantitative and solutions), which houses the long/short and market neutral absolute return product range. MAQS’ 130 people manage circa €130bn of BNPP AM’s total AUM of circa €436bn (as at 30 September 2019).

MAQS’ four areas of expertise are: circa €50bn in multi-asset portfolios run by 26 experts in Europe and London; circa €40bn in structured management, which includes guaranteed products targeted at retail investors as well as institutional management in LDI (liability-driven investment), CDI (cashflow driven investment) and overlays for clients who want to hedge equities, fixed income or currencies; circa €40bn in quantitative and index management, including ETFs, all based on models or engines designed by BNPP AM; and a solutions team, which leverages the global teams – in London, Paris, Amsterdam, Hong Kong – and advises institutional investors on asset allocation, capital regulations, and internal constraints. The solutions team has won over €3bn of mandates so far in 2019.

ESG and the Sustainable Investment Roadmap (2019 – 2022)

A pioneer

The ALFI (Association of the Luxembourg Fund Industry) Global Distribution Conference 2019 identified ESG as the key issue for global asset managers. BNPP AM was heeding it many years before. “ESG is at the heart of our strategy, with BNPP AM amongst the first asset managers to integrate ESG criteria into all investment processes and products. It is also an integral part of risk management as poor governance could impact investments,” says Panel.

BNPP AM was prescient, introducing ESG policies back in 2002, joining the Institutional Investors Group on Climate Change (IIGCC) in 2003, becoming a founder signatory of the Principles for Responsible Investment (PRI) in 2006, and launching a low carbon ETF in 2008. “This ETF now runs circa €800m of assets; and BNPP AM is the third largest provider of ESG ETFs,” says Panel. In 2012, BNPP AM introduced and implemented the United Nations Global Compact Principles as a standard across investment funds and in 2015 set minimum standards for human and labour rights, protecting the environment and ensuring anti-corruption safeguards. BNPP AM may engage with underperformers and ultimately exclude them if they fail to improve. In 2016, the firm committed to aligning portfolios with the Paris Agreement. It has attained the highest rating, A+, from PRI in 2016, 2017 and 2018.

Ambitious roadmap

BNPP AM is now upping the ante. “Our Global Sustainability Strategy, announced in March 2019, sets firmwide targets for sustainability, and a sustainable investment roadmap for stewardship, to transform all products, processes and strategies by 2020,” says Panel. BNPP AM will report annually on progress towards the targets set out in its roadmap and its governance structure makes ESG a priority at the most senior levels. The sustainability committee is part of the investment committee, which is chaired by the CEO and Head of Investments and approves the Global Sustainability Strategy. It reports to the BNPP AM France Board of Directors. The group head of engagement sits on the BNP Paribas group executive committee. ESG also permeates frontline asset management activity: 45 ESG Champions are spreading the word, and some portfolio managers’ bonuses are partly linked to non-financial analysis. BNPP AM has devoted substantial resources to ESG, with in-house research capabilities in its Sustainability Centre, where 25 people work on proprietary research, scoring, voting, and stewardship. BNPP AM has Heads of Stewardship in the US, Europe and Asia.

Philosophy

BNPP AM’s philosophy is that ESG is an under-researched source of alpha that can enhance risk adjusted returns; that ESG forms part of its fiduciary duty; that stewardship is an obligation; that the growth of the future needs to be sustainable, low carbon and inclusive; that ESG can contribute positively to the stability and sustainability of growth and market returns; and that in house practices should match those demanded from investee companies. BNPP A include carbon and climate change targets, using resources more efficiently while equality criteria improve opportunities for women and minorities, promote board diversity and also look at remuneration and tax policies.

Exclusion/negative screening

BNPP AM’s exclusion of controversial weapons from index products in 2008 predated the Luxembourg law on excluding controversial weapons from Luxembourg domiciled funds. Other exclusions are tobacco, synthetic crude oil from tar sands, coal, and asbestos (which I have not often seen in other lists of exclusions) as well as persistent issues arising from the UN Global Compact Principles. BNPP AM has already screened 7,000 companies against the UN Global Compact Principles and will by 2020 have increased this number to 11,000 (also taking into account the OECD Guidelines for Multinational Enterprises). This is likely to increase the number of exclusions and engagements.

BNPP AM was one of the first large investment managers to sign the Montreal Carbon Pledge, in May 2015, and to join the Portfolio Decarbonisation Coalition (PDC).

Stewardship: engagement, voting and advocacy

BNPP AM defines stewardship broadly to include proxy voting, company engagement and policy advocacy. It engages with companies at risk of breaching one or more UN Global Compact Principles. Voting is carried out for all products including indices and quantitative ones. The target is to increase the voting tally from 1,500 to 2,000 AGMs per year in 2020. The firm will file and co-file resolutions and may vote against selected companies that do not report Scope 1 and Scope 2 emissions. Its voting record is transparent in a proxy voting report. On company engagement, BNPP AM has led or supported Climate Action 100+ (CA100+) engagements with seven companies and plans to increase this number to 10 from 2020. Advocacy activities will be expanded to call for greater transparency in corporate reporting on: climate change, water risks, pollution, lobbying, taxation, executive remuneration and gender pay ratio.

BNPP AM collaborates widely within the industry, belonging to a wide variety of industry initiatives and regulatory bodies: IIGCC, International Corporate Governance Network (ICGN); Ceres; PRI Policy Group; European Fund and Asset Management Association (EFAMA) Stewardship; Market Integrity and ESG Investment Standing Committees; Association Française de la Gestion Financière (AFG) Responsible Investment and Corporate Governance Committees; TCFD and the European Union’s Technical Expert Group on Sustainable Finance. BNPP has also supported the Sustainable Stock Exchanges Initiative, the Business Benchmark for Farm Animal Welfare and the Access to Medicine Index.

Carbon and climate reporting, environment, and coal

BNPP AM was one of the first large investment managers to sign the Montreal Carbon Pledge, in May 2015, and to join the Portfolio Decarbonisation Coalition (PDC). Now the aim is to align portfolios with the goals of the Paris Agreement by 2025. Overall, “carbon footprints have been reduced by 20% on equities and multi-factor credit, with a plan to cut them by 50%. For market neutral strategies, this applies to the long book,” says Panel. “ESG scores have been increased by 20% versus the benchmark,” he adds. A zero carbon ETF was launched in 2019.

Reporting matches the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) recommendations. Other environmental metrics monitored include companies committing to NDPE (No Deforestation, No Peat, No Exploitation) and water efficiency.

The coal policy illustrates the desire to foster positive change in corporate behaviour. It excludes most coal producers and companies generating a high proportion of electricity from coal, but also allows some latitude to remain invested in companies that have credible plans for decarbonising their portfolios by divesting coal assets and shifting into lower carbon capacity.

Impact investing

Impact investing is pursued through private investments in SMEs, and thematic funds involved in energy transition, green bonds, water, human development, food, the global environment and climate change, which are geared to various UN SDGs. SRI funds invest in best of class strategies. BNPP AM’s latest ETF launch in March 2019 focuses on the “Circular Economy”, which recycles resources, as opposed to the linear economy, which uses them up. Readers should watch this space for more ESG product launches, starting with the Environmental Absolute Return Thematic Fund (EARTH), slated for early 2020.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical