A pioneer of liquid alternatives for nearly 20 years, the pan-European firm, Candriam, was already in the 1990s (long before UCITS IV) managing hedge fund strategies within the UCITS framework, including convertible arbitrage strategies, and launched the first European high-yield fund in 1999. With its long experience as a UCITS management company, Candriam easily adjusted to being an AIF manager.

Freed from the uncertainties around its former corporate parent, and having found a very good cultural fit with its new owners, New York Life Investments (NYLIM, a wholly owned subsidiary of New York Life) Candriam is now very much on the offensive in terms of public relations, marketing, recruitment and new product development.

The Hedge Fund Journal met CIO of alternative investments, Fabrice Cuchet, and deputy CIO of alternative single strategies, Emmanuel Terraz, to discover the aspirations of the firm, which is one of The Hedge Fund Journal’s “Europe 50” managers.

Rebranding and rejuvenation

Candriam has always functioned as an autonomous investment boutique, previously with Dexia and now with NYLIM. So the ownership shift has “changed nothing in terms of management, product development, sales strategy, or people,” says Cuchet, who stresses that his unit’s autonomy is complete. NYLIM operates a classic multi-boutique approach, where each of the boutiques need not worry about being micro-managed, and meetings with NYLIM are done on a regular basis. Most of the boutiques have kept their own brand name. Candriam’s brand name is unique in being an acronym that represents the core values of the firm: “Conviction and Responsibility in Asset Management”. The name was arrived at rather democratically through a survey of staff, and has been welcomed by both NYLIM and clients. Rebranding has thus made a big difference in terms of investor perceptions of the group.

Now “Our new shareholders are more dynamic,” asserts Cuchet. Although Candriam is completely at arm’s length from NYLIM, the US giant is still keen to support Candriam’s growth, through its resources and potentially US distribution – and Candriam finds “the quality of the name helps with recruitment.” Already Candriam’s long-only unit has had its emerging markets equity team selected by NYLIM’s mutual fund distribution arm to manage a slice of its emerging markets equity portfolio, and Candriam’s alternatives division may soon act as a sub-adviser for other ’40 Act products. How straightforward would it be for Candriam to copy and paste its alternative UCITS funds into a ’40 Act wrapper? Cuchet recognises that there are some differences between UCITS and ‘40 Act rules, in terms of eligible assets and fiscal rules, but says the two frameworks are “similar enough in terms of the rules on diversification, leverage and liquidity.” Therefore, going forward Candriam is hungry for a piece of the growing ‘40 Act pie.

Candriam’s alternatives assets have already recovered to €5.5 billion – up from the trough of €3.5 billion, but down from the peak of €10 billion, so a wide-open runway of growth lies ahead, with very few products closed, and most of the very liquid strategies being highly scalable. Marketing is decentralised, with outposts in Amsterdam, Brussels, Dubai, Frankfurt, Geneva, London, Luxembourg, Madrid, Milan, and Paris, while asset management for alternatives is centralised in Paris.

Robust compliance and independent teams

Paris is the nerve centre for alternatives, with roughly 45 managers and analysts, whereas long-only management of around €75 billion is run from Brussels and Luxembourg. If Candriam is a boutique of NYLIM, then Candriam’s alternatives unit is also a boutique within the larger Candriam organisation – perhaps a boutique within a boutique. The long-only business is dubbed “traditional investments” and has a separate CIO, Vincent Hamelink. Both he and Cuchet sit on the executive committee, and ultimately report to CEO, Naim Abou-Jaoudé, who is well versed in alternatives, having launched and managed Candriam’s first hedge fund, in convertible bonds arbitrage, back in 1996.

The shared corporate functions are sales, support and information technology, where Candriam makes use of vendor packages including RiskMetrics, Charles River, Sophis and Salesforce. But the traditional and alternatives units have separate reporting lines, with separate dealing desks for execution, and Cuchet says that “Candriam is not exposed to the issues faced by some UK insurers”, one of which was recently found to have been inappropriately allocating trades amongst accounts. In fact, not only is alternatives execution separate from traditional execution, but each of the teams within alternatives executes their own trades, so there is no mixing of orders. Cuchet summarises: “We have a boutique culture within a large asset manager, with small dedicated teams of between two and eight people, and each of the teams is accountable.”

“People are key, as this is a people business,” adds Cuchet. AIFMD rules on deferring remuneration may come as a shock to some firms, but Candriam has been deferring bonuses since the early 2000s, as this is how the business was built over 18 years. Says Terraz, “it’s an arbitrage between long-term and short-term.” Candriam actually welcomes the AIFMD rules, because any historical disadvantage versus firms that paid out bonuses in full at year end has now been ironed out. “It is now even easier to attract talent, and we get so many CVs each day as people want to join Candriam and leverage the NYL story,” he explains. Candriam wants to build a long-term business, and incentivises staff accordingly. Shared ownership solutions helps to foster a cohesive culture. “There are strong links between the team, because we have been through difficult times together, and these links are stronger than they would be if we had no history,” says Terraz. These ties have been cemented by an average of 14 years’ tenure with the firm, impressive longevity in an industry where the life of the average hedge fund may be only a few years.

And NYLIM has not weakened these bonds, nor the rigorous compliance culture. Candriam, as Terraz insists, has “always been extremely cautious on compliance, and this can sometimes take a bit more time. As a fund manager I would like things to move more quickly, but the culture is to follow rules and do things properly. This does not fit everybody, but if you agree with the culture you become loyal to the company”. Candriam has not adopted the HFSB (Hedge Fund Standards Board) rules, as in 2009 a gap analysis exercise found their standard policies already applied most of what was required. Candriam’s alternatives division combines strong controls in some areas with great freedom in others.

When it comes to compliance, risk management and remuneration, there are clearly strict rules to abide by – “if you want to make a lot of money very quickly this is not the right place,” says Terraz. But as far as investment decisions are concerned, no house views are imposed upon managers. Views are shared amongst the teams, and brainstorming can be insightful, but they are individually accountable and get paid on their own results. “You have to let people deploy their strategies,” emphasises Cuchet.

Resilient performance and organisation

The performance of these strategies has been as resilient as the team longevity, which is a source of pride for Terraz and Cuchet. Candriam’s managers have survived crises and challenging periods, such as 2001, 2008 and 2011, with 55% of strategies positive in 2008, and 64% in 2011. The products offer daily, weekly or monthly dealing, and in 2008 all redemptions were paid out in full without any change to the liquidity profile of the single-strategy funds; Terraz recalls his own fund halving to €600 million from €1.2 billion in just a few months in 2008, as investors used Candriam as an ATM. (Candriam’s fund of hedge funds that allocates externally did in fact need to invoke a gate, but only for the two first quarters of 2009). Candriam has also weathered the cosmetic disruption caused by repeated bail-outs of Dexia. While this had no operational impact, it impacted assets under management as some clients blacklisted Candriam.

Candriam has generated very consistent returns, and historically most products have had low to mid volatility, although some more aggressive launches are on the cards. In the past the return profiles have been more like tortoises than hares – occasionally topping league tables for individual years, but generating some of the most consistent and competitive risk-adjusted returns over multi-year periods that encompass a full cycle for the various strategies. We briefly touch on a few distinctive and differentiating features of Candriam’s growing suite of 14 alternative strategies.

Although UCITS is not the only route for accessing Candriam’s strategies, the firm may have a competitive advantage in terms of structuring hedge fund strategies in accordance with the UCITS rules. “NEWCITS was not new at all for us,” says Cuchet, who points out that Candriam has a long experience with UCITS-regulated hedge fund products. Candriam started a convertible arbitrage fund in 1996, which was to be the first of 10 strategy launches shown below. This illustrates how “We are a leading provider of UCITS-compliant hedge funds,” says Cuchet.

Negative rates and credit

How is Candriam adapting to the brave new world of quantitative easing in the Eurozone? Candriam is not yet being charged negative interest rates to hold cash at any of the banks and custodians it deals with – but some of its clients are, which creates a strong opportunity for Candriam’s low to medium-volatility product range to act as potential bond substitutes. In this type of environment, even a single-digit percentage return over cash seems increasingly attractive. Hence the liquid alternatives are gathering strong inflows, particularly in credit.

Head of high yield and credit arbitrage, Philippe Noyard joined the firm in 1987, has been investing in fixed income and credit for 28 years, and leads a team of eight, including four analysts, one of whom is a quant. “The inputs are mainly fundamental, but we also mix quant inputs from in-house models on pricing,” says Cuchet. However, all of Candriam’s credit strategies are discretionary. Candriam Credit Opportunities aims to beat risk-free rates by 4-6%, with volatility also of 4-6%, using a blend of directional and long/short strategies. Candriam also has long-only high-yield funds. All of the credit funds are seeing strong inflows – indeed the very low volatility long/short credit fund targeting returns of 1-2% above EONIA has already soft closed at assets of around €900 million.

This lower-volatility product has commensurately lower fees, of 0.80% with the 20% performance fee applying above EONIA, and this hurdle is floored at zero. Credit is one of the fundamental strategies, whereas other strategies are largely or completely quantitative. The two approaches are very complementary, argues Terraz, who finds that Candriam benefits from having quants and fundamental people in the same group. “Very few in finance can combine both approaches,” he says, and opines that “quants are not good at looking at how the world is changing, whereas fundamental analysts are not so interested in looking at the numbers.”

Macro

Some Candriam strategies are indeed hybrid, such as Candriam Global Alpha, which uses a mix of quantitative and qualitative inputs to trade macro markets. The other macro fund, Global Opportunities, in contrast, is purely fundamental and more short-term-oriented. The macro hedge funds team of three is completely independent of the GTAA (Global Tactical Asset Allocation) group in Luxembourg, and may take different views from the GTAA strategies.

CTAs

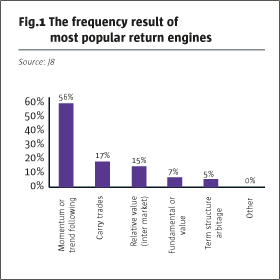

Candriam’s purely systematic strategies include its CTAs or managed futures strategies, launched in 1997. Candriam is seeing net new cash coming into CTAs. Says Cuchet, “CTAs must have a position within client portfolios as they are de-correlated (and sometimes even negatively correlated).” Candriam’s CTAs are 70% trend and 30% contrarian, which is evenly split between 15% mean reversion and 15% pattern recognition. However, the contrarian signals are never weighted large enough to outweigh the trend signals, so Candriam will not trade against the prevailing trend. Nonetheless, the CTA team of three, supported by a team of three quantitative analysts, led by Steeve Brument, has given investors a somewhat smoother ride than many in the space, with only two losing years since 2006, compared with four for the Barclayhedge CTA index. Although some UCITS CTAs have obtained commodity exposure in various ways, including indices, swaps, notes and certificates, in deference to the cautious compliance culture Candriam’s UCITS CTA avoids commodities while its AIF CTA includes commodities.

Systematic long/short equity

A subset of the CTA models has been extracted to provide the foundation for the newest strategy, a quant equity long/short fund that launched in December 2014. Some 80% of its models are a carve-out from the CTA, where they have been running live for many years, while one of the five models is a back-test. Terraz wryly recalls how his first boss said, “Back-testing is worth nothing”, but he steadily learned that “back-testing is worth something, although it does not mean money will be made consistently.” Terraz draws analogies with flying a plane: “back-testing is the simulator, which you need, but it’s different from piloting a plane. With real positions the process of discovery is to work out why you lost money and learn from what you do on a day-to-day basis.” The five models are comprised of two trend models, two contrarian models and one volatility model. The fund is differentiated from other equity long/short funds in that it does not have any positive equity bias, and is intended to be uncorrelated to equity markets. Seeded with €15 million in December 2014, the strategy has already grown to €60 million.

Merger arbitrage and event driven

In merger arbitrage Candriam runs a very cautious low-volatility strategy that has only had one losing year out of 15 – in 2008 it lost only 2% – but has made money every other year since launch in 1999. This consistency has come from being disciplined about only doing announced deals, avoiding leverage, sizing positions appropriately, and applying stop losses. So, for instance, the fund had some exposure to Shire Pharmaceuticals in 2014, but the position was below 2%. In fact, the Shire deal break was a blessing in disguise, as it opened up the opportunity to add to other deals at much wider spreads, helping the fund to end 2014 in positive territory. Candriam’s somewhat more aggressive event driven fund in the mid-volatility range still only targets volatility of 6%, and predominantly focuses on pre-announced deals, but can also invest in other event trades such as spin-offs, restructuring or holding company discounts.

Index arbitrage

Thinking laterally, corporate events can be very important for the index arbitrage strategy, although it is not doing anything exotic or esoteric. “Textbook index arbitrage still works,” says Terraz, who continues to manage this strategy, which has delivered a very good track record since 2003, alongside his duties as deputy CIO. He admits that the strategy is very plain vanilla, and has been pursued since the 1980s in the USA. The reason for the persistent returns, he contends, is that there is a reward for providing liquidity to the index funds industry, which makes up a large chunk of equity assets globally. Terraz feels at home arbitraging indices, as his very first job was doing cash and carry on equity indices at SocGen in 1997, which simply involved arbitraging index futures versus baskets of constituents in a mechanical way. “I thought this was too easy and would be arbitraged away, but it was profitable then and it still is now,” says Terraz.

The bread and butter index arbitrage trade revolves around adds and deletes of index constituents. Terraz sometimes awaits announcement of changes and sometimes anticipates them. “Where there are very precise and predictable rules, we can take a position before announcement, whereas for CAC and S&P it’s difficult to anticipate, so we usually await announcement,” says Terraz.

The rebalancings typically occur quarterly, so a colleague joked that Terraz was retiring when he moved into index rebalancing arbitrage but, in fact, he says, “I have never worked so hard as over the past 10 years.” In between quarterly reshuffles, corporate actions such as mergers and acquisitions, bankruptcies, spin-offs and rights issues can occur more often, and require more creative analysis. Even the quarterly rejigs can be traded in different ways – says Terraz, “When a stock enters the index it is basically a trend-following position, and then after the addition it becomes a mean reversion position.” This fund also does a tiny bit of closed-end fund arbitrage and relative value trading.

Although some index arbitrage strategies are known for employing large amounts of leverage, in keeping with Candriam’s circumspect disposition no leverage is used – to the contrary, the fund is typically only 20% short and 20% long.

Candriam plans to enhance its current offering by on-boarding new teams and rolling out new products, with more aggressive funds targeting higher volatility a current priority. Investors should keep an eye out for a fundamental long/short equity strategy launch later this year and even a direct lending strategy is not inconceivable – “Candriam does not do private lending today, but does have capabilities within its high-yield and credit teams,” says Cuchet.

Clearly Candriam is one of the most versatile and resilient players in European alternatives, and the seasoned team are well incentivised to drive forward the long-term growth of the business.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical