Fabienne Cretin and Stéphane Dieudonné moved from OFI Asset Management to Candriam along with their merger arbitrage strategy and UCITS fund in 2018. Candriam is the third corporate parent for the duo, who have worked together since 2004, and were at ADI Alternative Strategies before OFI. France ranks as the fourth largest centre for hedge fund assets under management in Europe, according to Preqin’s 2017 survey. Fabienne was lured to Candriam partly because she expects to benefit from various aspects of its platform.

Candriam, which is managing EUR 121 billion as of September 2018, operates autonomously as part of New York Life Investment Management (NYLIM). It has been running alternative UCITS strategies since the 1990s. Candriam’s alternatives single strategy range includes: long/short credit; long/short equity; equity market neutral; index arbitrage; quantitative equities; managed futures; global macro; unconstrained asset allocation; convertible bonds; corporate credit; unconstrained bonds, and the merger arbitrage strategy, which is called “risk arbitrage”.

Fabienne is exploiting positive synergies with other teams at Candriam, including its credit team, who manage strategies that have received The Hedge Fund Journal’s ‘UCITS Hedge’ awards. “We sit right next to the credit desk, who run over EUR 7 billion in high yield, and often finance some of the merger deals we are invested in,” she says. “They keep us informed about whether deal financings have closed, and could give us an early warning signal of problems in the credit markets.” As of November 2018, credit spreads have widened, as have deal spreads on LBO and MBO mergers, but Fabienne has not noticed any deals failing due to being unable to get away financing, and is still, selectively, invested in some deals that involve financing.

Candriam’s fundamental equity teams – both on the traditional and the long/short side – can also be helpful. For instance, the digital long/short technology fund has been active in a Dutch technology company [Gemalto] that is being bid for by a French company, so the two teams have compared notes on antitrust issues. The merger arbitrage duo have also had a long discussion with the tech team about a substantial bid for an open source technology provider [Red Hat].

Candriam’s equity dealing and financing desk, which has many counterparty and prime broker relationships, also helps with trading, execution, sourcing stock borrow and equity swaps. These were functions that Fabienne and Dieudonné had to handle by themselves at previous firms.

Candriam additionally carries out currency hedging, which is strictly applied to hedge portfolio exposures to the Euro denomination of the fund.

ESG

Candriam Risk Arbitrage is the first merger arbitrage fund to have explicitly told us that they are incorporating ESG factors. This is consistent with Candriam’s name – an acronym of Conviction And Responsibility In Asset Management (on the long-only side, Candriam has launched some ESG ETFs). Candriam has been an early mover in this area, pursuing sustainable and responsible investments for over 20 years.

Today, Candriam’s ESG policies rule out certain stocks altogether. Since 2009, the firm has been applying a controversial armament exclusion filter to all its assets under management. Any companies exposed to the weapons industry are permanently excluded if: they are involved in the manufacture or sale of anti-personnel mines, cluster bombs, or depleted uranium; or more than 3% of their revenues are generated from the manufacture or sale of conventional weapons. This year Candriam has introduced additional exclusions: companies with more than 10% exposure to thermal coal; any companies which add new thermal coal projects, and all companies with more than 5% exposure to tobacco. The firm’s ESG research can also measure the ‘G’ in ESG – and help the merger arbitrage team to appraise governance risks in deals.

Announced deals only

ESG apart, Candriam pursues a pure, “plain vanilla”, merger arbitrage strategy, trading only announced deals, with no pre-event trades, “rumour-trage”, or other corporate events, such as special situations, share class arbitrage or holding companies. The team did trade other event driven strategies before 2008 when at ADI, but ceased after analysis showed that losses in that year – their only losing year – were caused by the event-driven bucket. “We think an alternative fund should be more alpha and less beta,” says Fabienne, who featured in The Hedge Fund Journal’s 2018 “50 Leading Women in Hedge Funds” survey in association with EY. (Candriam’s Head of External Multi-management, Maia Ferrand, has also featured in another edition of this survey, and was interviewed by THFJ in issue 110).

The merger arbitrage sleeve of the ADI strategy generated a small profit in 2008, despite seeing over 10% of its deals break in a market environment where around 20% of US merger deals fell through. This fits in well with the profile of the firm’s alternative offering: some 55% of Candriam’s alternative strategies also profited in 2008 – and 64% did so in 2011.

All of Candriam’s single strategy alternatives funds – and the ADI merger arbitrage fund that Fabienne and Dieudonné were running at the time – remained liquid in 2008. Candriam’s daily dealing risk arbitrage UCITS IV fund currently contains close to EUR 400 million of assets. Fabienne envisages capacity of around EUR 1 billion for the strategy, and invests across mid-cap, large-cap and mega-cap merger deals, generally with a market capitalisation of at least EUR 300 million in Europe or USD 500 million in the US.

The risk arbitrage strategy is among a number of Candriam alternative strategies that are essentially targeting “cash-plus” returns through a full cycle, and are viewed as attractive bond substitutes, particularly given that interest rates remain negative in the Eurozone. Over the last five years, the strategy has generated a Sharpe ratio around 1.6, with low correlation to equities and bonds, and much smaller drawdowns than many other merger arbitrage funds. This smooth return pattern has come both from a deal break rate roughly half that of the global merger universe, and from portfolio construction.

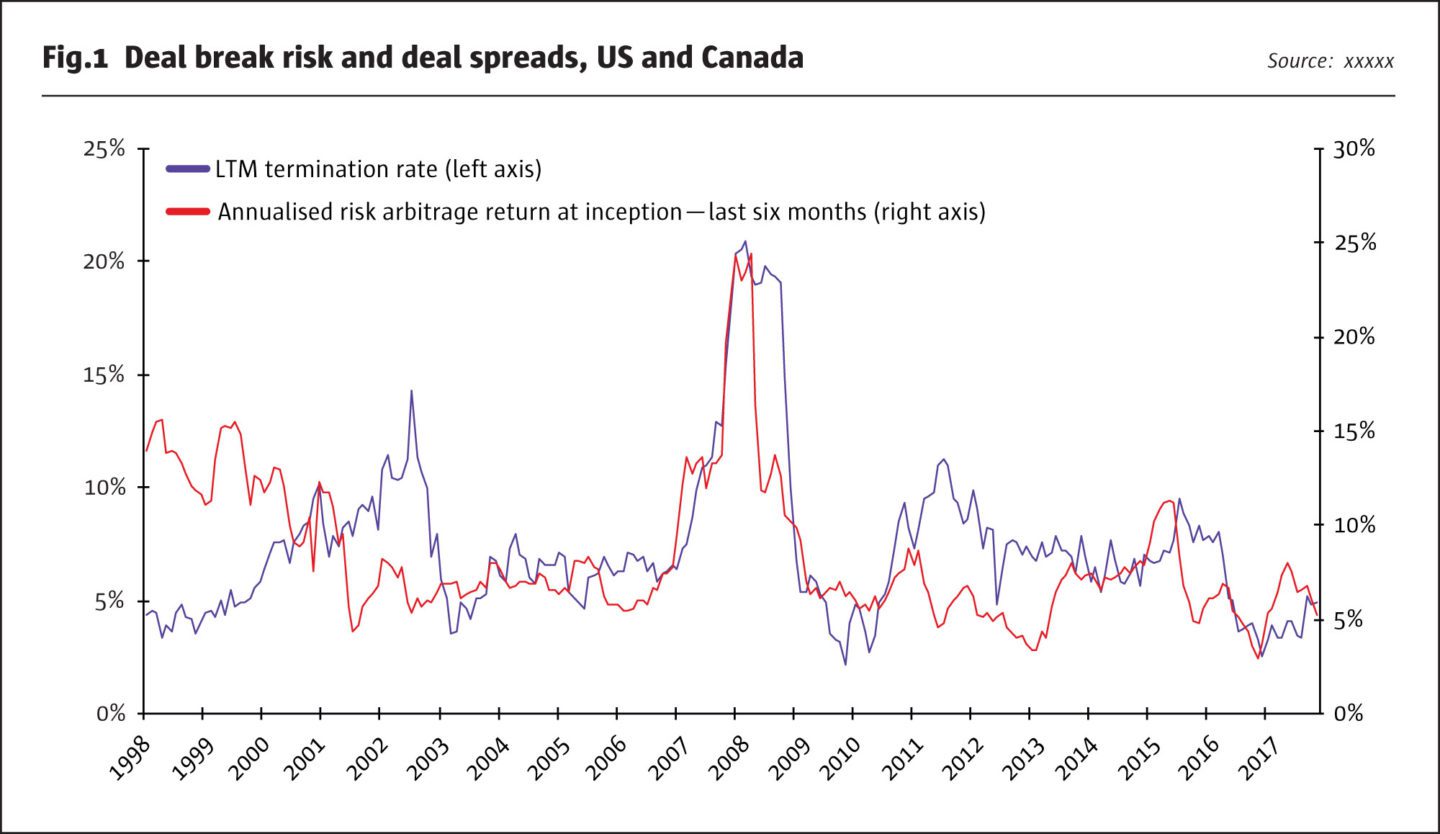

Deal break risk

On average, 7% of deals break, but Fabienne’s strategy has seen a break ratio 49% lower since 2000. Country selection is partly responsible: the strategy only invests in deals in developed countries. In practice, this means mainly the US and Western Europe. Within Europe, Fabienne would currently require a higher return to compensate for the regulatory and political risks of certain sectors and countries, such as an Italian bank merger. In Asia, exposure is focused on countries such as Japan, Taiwan, Hong Kong, and Australia, but positions tend to be more intermittent, as safe deals do not crop up so often, and the pair have less experience of more complex deals in Asia. Outbound acquisitions by Chinese corporates are a different matter, which have sometimes been invested in. However, Fabienne remains cautious, due both to China’s desire to control capital outflows and the geopolitical dimension. In the US and Europe, Chinese acquisitions can be sensitive because of the perception that acquirers may profit from local intellectual property.

The strategy’s outperformance has also come from sizing riskier deals smaller. The team’s historical quantitative analysis of 5,000 deals since 1998 has identified four key risk factors for deal breaks: 31% of hostile deals; 19% of those where the target is larger than the acquirer; 18% of deals subject to antitrust risk, and 13% of financial deals, have broken – against the average of 7% across all deal types. Therefore, deals facing one or more of these four risks, will be smaller position sizes.

Portfolio diversification was increased in 2012, which typically results in 40 to 60 positions. Fabienne is humble enough to admit that, “we do not have a crystal ball to predict where every black swan will land. We have to accept that any merger deal may break and construct the portfolio with that knowledge”. Thus, portfolio construction and position sizing take account of the team’s downside estimates.

Trading around deal spreads has not made a big contribution to returns, but the strategy is not always exposed to deals over their full timeline. The pair will not necessarily invest in a deal as soon as it is announced, as they may wait days, weeks or months to get clarity and comfort on particular points. But once a position is established, in general the strategy will buy and hold until the deal closes or breaks, with only moderate amounts of tweaking position sizes in response to positive and negative news-flow. There is a strict discipline to sell upon a break. “We are not traders,” says Fabienne, who very seldom puts on a reverse merger arbitrage trade, which could profit from spread widening or deal breaks.

Qualitative analysis

Qualitative analysis complements the quantitative approach. The duo analyse: merger agreements; complexity; minimum conditions; regulation; politics; the strategic rationale for deals; deal timing; downside risks, and ESG considerations. Concerns in these areas can rule out some deals or result in smaller positions.

The relative importance of the risk factors changes over time. For example, “merger agreements and their material adverse change (MAC) clauses did contribute to some deal breaks in the past, but are generally of high quality now, and even in many financial deals, credit market weakness is excluded, so it cannot be used as a reason for the bidder to renege,” says Fabienne.

She is of the opinion that “antitrust has always been a wild card, with some degree of unpredictability”. Indeed, CFIUS has been used to block US acquisitions by Chinese buyers, but she thinks CFIUS is somewhat exaggerated – since most deals are not cross-border, and do not need CFIUS approval – and because the EU has actually blocked more deals than has CFIUS. “Though Trump is very much in focus now, the EU blocking of General Electric/Honeywell was a big event at the time, back in 2001,” she recalls.

For domestic and global deals, US antitrust regulators are now considering vertical concentration along supply chains, as well as horizontal concentration measures, adding another angle to the review process.

On balance, Fabienne judges that, “antitrust risk has not increased, termination rate remains very low, but the perception of that risk is higher, as deal spreads have increased”.

Current outlook

The portfolio split between strategic and financial deals varies over the cycle. In November 2018, Candriam had 79% of exposure in strategic deals, which is somewhere in the middle of the range. Fabienne feels comfortable investing in some leveraged buyouts partly because their risk profile has changed over the past decade: “private equity has a lot of cash; most deals are smaller; they use lower leverage than previously, and are sometimes syndicated deals. We cannot deny that they are riskier than strategic deals, but they are not as risky as in 2007.” While she could not envisage having as much as 80% in financial deals, she might still avoid them altogether in adverse market conditions.

Some deal risks go in and out of fashion. Tax inversions were all the rage a few years ago, but have since largely disappeared due to changes in tax rules, and tax reform. She had a small position in Shire/Abbvie in 2014, which broke, but avoided subsequent tax inversion deals.

Overall, she is upbeat on the outlook for merger arbitrage as a strategy. Notwithstanding uncertainties around trade wars and Trump, US tax reform is contributing to CEO confidence and credit markets remain open for business. Importantly, spreads are attractive relative to deal break risks, which have been running below the historical average of 7%, at 4.9% in the US – with US deals recently failing mainly due to FTC and CFIUS issues, according to her.

Deal break risk and deal spreads, US and Canada

There are also a few bidding wars, which can add to returns. And even in a turbulent month for financial markets, such as October 2018, a handful of deals were announced, mainly in technology, healthcare and energy. One of the technology deals [Red Hat] was also quite large at $32 billion. Some tie ups are aggressively motivated by gains in market share and entering new markets, while others are more defensively driven by cost-cutting. The twitter feed @RiskArbCandriam provides some news-flow on merger deals.

Recently, Fabienne has noticed fewer pure cash deals, and more pure stock or “hybrid” mixed stock and cash deals. Pure cash deals are, in effect, long only positions for the strategy as there is no publicly listed acquirer to short, whereas pure stock deals can be fully hedged by shorting acquirer’s stock, and mixed deals tend to involve a collar which requires a dynamic hedging strategy.

Though the pair have a sanguine outlook, they are quite cautiously positioned and have been for a few years. Gross exposure of 60% in November 2018 is down from 75% earlier in the year, and 100% two years ago; very seldom does Fabienne expect to come close to the ceiling of 120%. The pair are investing in roughly half of deals that are announced, avoiding those where spreads are too tight or where there is a material financing risk. Deals vulnerable to Trump and/or protectionism can also be sidestepped, and off course, deal picks will become more selective if market conditions warrant it.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical