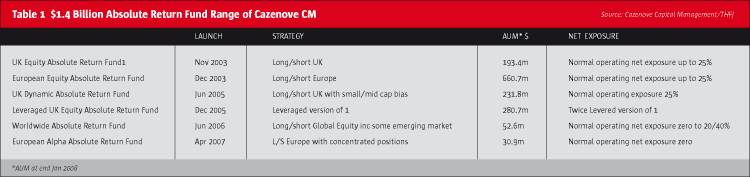

Cazenove Capital Management jump-started their entry into the hedge fund business in 2003 by hiring an experienced pan-European team from HSBC headed by Tim Russell. The positioning of the products developed was very deliberate: these were absolute return products that would prioritise a low correlation with markets. To achieve this diversification within the product range, the Absolute Return family of long/short products are each run with a net exposure to markets that is towards the low end of the range in the industry.

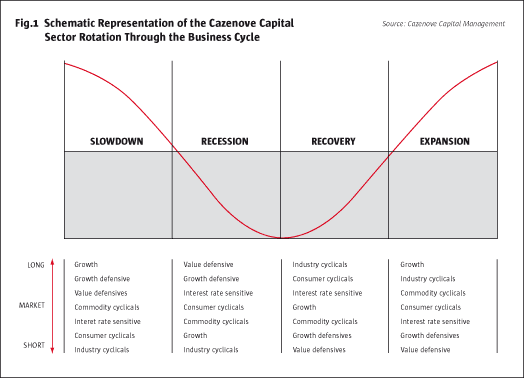

These seven style groupings give a framework within which to apply both the macro views of the managers and earnings-based security selection skills. So the central tenet of the house cannot be reduced to a simple label like 'growth', 'momentum' or 'value'. Rather the management enjoy classifying themselves as pragmatic managers. Plus, as the demand for products and services changes throughout the business cycle, then as the cycle unfolds positions can be taken both long and short for fundamental reasons. This is important as there is a bias against shorting to hedge, as these can often be low conviction shorts. Cazenove Capital's managers are not expected to be shaken out of shorts for technical reasons. This helps reduce turnover, and maintains portfolio stability as shorts are present on a structural basis. The templates and proving grounds for the fund range shown in Table 1 are the two funds launched towards the end of 2003, the UK Equity Absolute Return Fund and the European Equity Absolute Return Fund.

CLICK IMAGE TO ENLARGE

The Cazenove UK Equity Absolute Return Fund

The Cazenove UK Equity Absolute Return Fund, managed by Russell, has a return target of 10% per annum, and to achieve this, a gross exposure to large and mid cap that is normally between 100 and 175% of NAV is taken. The universe is the constituents of the FTSE 350 plus the next 100 largest stocks. At the end of 2007 there were 78 long positions summing to 65% of NAV, and 60 short positions adding up to a short side of 53.1%. So the fund is well diversified by individual name, and net exposure to major industry groups is limited to a maximum of 20% of the fund.

Towards the end of 2005 Russell, Head of the Pan-European Team at Cazenove Capital as well as portfolio manager of the UK hedge fund, took the view that the UK economy was going to slow down. Following his discipline he therefore was looking to be long of growth defensives (staples) and short of cyclical. Implementing this at the stock level is not as easy as it might appear for the UK stock market. Russell says "like my colleague Chris (Rice) has done on the European side I have wanted to short industrial cyclical stocks in the UK. Unfortunately for me, running UK assets, there are just not as many industrial cyclical stocks to play to the short side. The likes of Corus, RMC, BPB, Blue Circle, and Pilkington were classic plays for this stage of their cycle, but they are no longer quoted. As a proxy I have been short mining stocks and they just haven't worked the same way yet."

However he has not given up hope, partly because the expansionary phase of the economic cycle has been unusually extended in his view. Evidence is accumulating, and according to Russell the market is starting to worry as much about the economy as company specifics. Having been long of staples and short of cyclicals for the last year or more he has been heartened by recent company results. "BHPs recent results were not great," he states. "Operating profit growth of 6% is not very exciting to me. So the current environment gives me a feeling of Groundhog Day – the outlook from here is what we were looking for in 2007." He likes to draw a comparison with the previous market top. "That was marked by the hubris of the Mannesman/Vodafone deal, and we are now getting the equivalent in the bidding for Rios," he explains.

On the other side of the balance sheet his biggest long sector bets are in pharmaceuticals, media and life insurance. His largest single position is Glaxo. "The issues for Glaxo, such as drugs coming off patent, are not GDP related. So I will carry on holding defensives even if they do come down with the market," he states defiantly. "I might sell options against the holding to generate income from the position, to defray the carrying cost if you like, but I will hold on because of the positive fundamentals." Unilever is also a large long position for the fund.

The positive view on the staples (defensive sectors) may be one that will gain some traction in markets this year. This is not just because of 'group think' amongst Russell's colleagues on the European side. Support has come from a well regarded corner. It was made public in February that Warren Buffet, the Sage of Omaha and the world's richest investor, has acquired stakes through his Berkshire Hathaway insurance vehicle in Glaxo and Kraft, the American food manufacturer that produces Maxwell House. Buffet is some company for holding a medium-term view.

The mention of options also marks out Russell as an atypical hedge fund manager. Only a third of hedge fund managers across the various strategies are users of options. To use options effectively you have to be able to take a refined view of a stock – time-frame and specific stock levels come into play as well as a directional view. Russell is able to implement those views using options. He will write call options against long positions to enhance stand-still returns, and will undertake his own under-writing of stocks by selling put options to engineer attractive in-prices. In effect this can make running the hedge fund somewhat contrarian. For example, in January this year as stocks fell aggressively the fund was assigned on some put options such that the fund became a buyer at cheap prices across a number of shares. As a consequence the fund went from a net short position at the portfolio level to a small net long in the course of the month. A similar increase in net exposure in a falling market occurred in August of last year for the same reason.

Russell explains how he tries to make money for his investors. "Hedging shorts are not those where you expect to make much money," he says. "Yes, the long book has to out-perform the short book, but there is more to it. As a market-neutral fund manager we don't make our money being long and short two similar companies – an apple-to-apple comparison, whether it is BP versus Shell or Barclays versus Lloyds Bank. The real money is made being long apples versus short pears. We have to have an awareness of the correlation of returns amongst the holdings. Structurally we are taking directional views on the basis of different P&L models. The business models are similar by industry type. So, all cyclical stocks are by definition high fixed-cost businesses." In effect Cazenove Capital ends up having different business models on each side of the balance sheet of the hedge funds they run. Which side they are on is a function of the phase of the business cycle being experienced at the time.

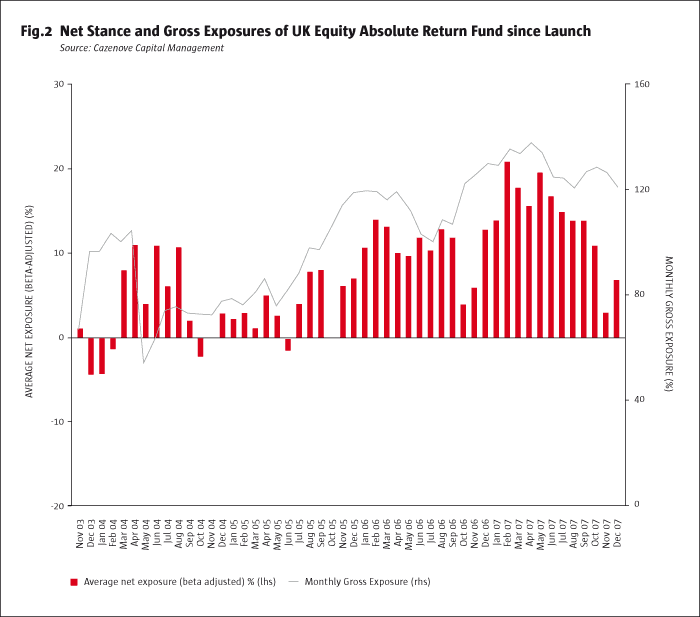

This also impinges on the amount of the balance sheet put to work. Figure 2 shows that the net and gross utilisation is relatively low.

CLICK IMAGE TO ENLARGE

It is only feasible to meet return targets with such exposures if there is high added value from stock selection and the shorts are a source of profits. Running shorts for hedging purposes in the context of a constrained balance sheet would require a very high profitability rate from longs or tolerance of small overall returns. The first is difficult for managers, the second for their clients.

Managing the human resources

Russell expands on the process and division of responsibilities. "We don't spend a lot of time building models of specific companies, partly as a matter of resource. We take street research and work with the consensus earnings. We are not like some houses with a team of 30-40 analysts and 10 fund managers. We are 14 people in total, and most of them have portfolio responsibilities. In addition every one (apart from me) has sector responsibilities. For their stocks they each have to determine a fair-value price. So given we are using consensus numbers, the key question becomes "what multiple of the earnings stream would you apply to the stock given the point where we are in the cycle?" For example looking at cyclical stocks, we are slowing down in economic growth so that marginal RoE is not worth as much at this point. In addition the forward earnings projections may not follow an upward projection."

The Cazenove European Equity Absolute Return Fund

Chris Rice, who co-manages the Cazenove European Equity Absolute Return Fund sees benefits from small groups working in asset management. "I have always believed in small teams, and in coming to Cazenove Capital we were able to stop the team growing, which I preferred. One of the key aspects of what we are trying to achieve is to make calls on valuation across the market spectrum. The business cycle approach gets a bigger payoff from making calls across sectors rather than stock calls within sectors – we are trying to get both alpha and beta into our process. It is too limiting for buy side analysts to make calls of preferring a particular stock in a sector. So we like to cover the whole market between us and try not to get too close to individual sectors so that we may see the wood for the trees. We prefer to take a step back in looking at a sector. Sector analysts are the enemy of making money from sector calls."

For his part Rice has sector responsibility for banks in Europe. The banking sector has contributed nearly 20% of the P&L of the hedge fund since launch. "Different sectors provide you with different levels of alpha," he says. "The banking sector can provide a lot of alpha as the matrix of potential decisions is huge. In European banking there are 15 countries with 15 different banking systems, and 5 or 6 business lines (such as wholesale banking, retail banking, investment bank, asset management, and distribution). "In the early 1990s I covered Japanese banks from 21,000 on the Nikkei down to 15,000. This makes me a money manager on the lookout for a bear market. European financials peaked at just over 30% of the capitalisation of the market and contributed 40% of the profits at their peak. The banks in particular benefited from 15 years of declining real rates. But that is over. Plus the perception is that in the Western world, debt is very high as a percentage of GDP. The market now views the banks as a structural short, and I tend to agree with that. A contention is that a bottom for banks is necessary for a bottom in equity markets and our view is that that won't happen until banks start to issue a lot of equity. The problem of banks is not the earnings, but the equity-to-assets ratio – capital adequacy is the issue for the market, as they may have insufficient capital to weather a recession." Rice's funds have ridden the banks on the short side, but are not short any longer. The gross exposure tobanks is very low at the moment – the lowest it has been since launch. "We are long strong balance sheets in banking (boring banks), and short over-leveraged markets such as Spain and Ireland. We have been short banking markets where the currency pegs could come under pressure this year, namely the Balkans and Baltic areas."

The philosophy of shorting

The general philosophy of shorting at Cazenove Capital is one of diversification. At the end of January the UK hedge fund had 60 shorts and the European fund had 73 shorts. Rice explains, "Shorting predominantly ETFs and futures is a very inefficient hedge. This is because it doesn't really protect you as it falls at the same rate as the market. Plus we see large cap stocks as the cheapest bit of the market, so why short what you see as good value? Instead we build our short book from three types of short: the classic stock short, the loose pairing, and, thirdly, expensive stocks." The classic short is the structurally challenged business; one that is going to struggle to provide positive earnings surprises. However Cazenove Capital doesn't want them to become too big a proportion of their short books because they are crowded shorts.

"The real problem is that they are great when markets are rising," says Rice, "but when markets are falling they are awful. There is a tendency for investors to book their profits. So investors won't sell more of this sort of successful short – they tend to drop with a beta of less than one. So we don't let the fundamental shorts dominate the short book."

The second category of shorts is the loose pairing. "Within an industry that we like, say beverages at the moment where we have 3 or 4 positions, we try to dampen our volatility by taking a relative view within it. So we really like Inbev, and last year we have been short Carlsberg against other beer producers because Carlsberg is issuing a lot of shares to take over Scottish & Newcastle. We are still net long the factor we like, but think the short-paired stock will rise less than others in the sector."

According to Rice the third category of short is the most difficult – shorting expensive stocks. "By definition expensive stocks are successful in the market. We have a natural, though not strongly expressed, value bias as investors. You have to do a lot of work to understand the companies intimately to stand the pain. To short expensive stocks successfully you have to be diversified and patient. In fact we have had to be really patient for a position similar to the one we had in Vallourec, the steel tubes manufacturer. This was a very popular long, and we took a contrary view. We held the short (losing money for well over a year) because we felt it was massively over-valued, even though it was on a nominal P/E of only 11-12x when we put the short on.

"The prevailing multiples for Vallourec were based on EBITDA margins of 32%, when the normal industry margins for steel tubes for the oil and gas industry were 10-15%. Obviously the supply can be constrained in the short term, as it is impossible to build steel tube plants overnight. So it was natural that the market clearing price went up considerably, but we were confident that the supply-side response would occur over the long run, say 3-5 years. And it did – both the Russians and Chinese built steel tube plants in the last 2-3 years to meet demand. The stock held up after we shorted it, but there were few earnings upgrades. The profitability was still incredibly high when the stock hovered at high levels. Now new supply has come on stream and the February news flow reflected margins of 25%. So the stock has come off and we had a profitable short. In fact we expect margins to go to 15% over the next two years, so we may be able to re-visit the short."

The consistent emphasis on shorting is a hallmark of the Cazenove Capital approach to hedge funds. "We're both slightly old fashioned in the sense that we think being non-correlated is the point of hedge funds," confesses Russell drolly. And he has succeeded in fulfilling that brief as well as the other targets for his fund.

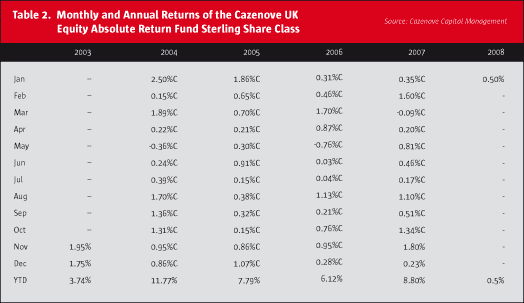

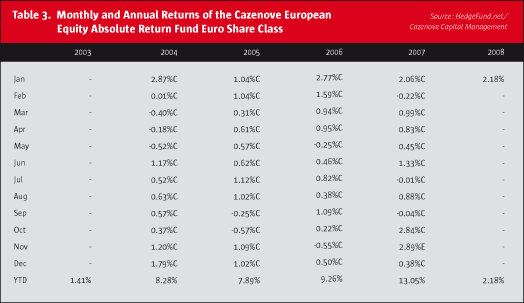

The Cazenove UK Equity Absolute Return that Russell manages has delivered 9.19% returns pa. since launch with a correlation to the index of 0.08 and a beta of 0.02. As the fund has exhibited volatility of 2.4% (versus market index volatility of 7.8% pa.) he has produced an excellent Sharpe ratio of 1.7 for investors. The equivalent statistics for the European hedge fund run by Rice and Steve Cordell are annualised returns of 9.76% pa. (to the end of 2007); a correlation of 0.08 and a beta to the relevant index of 0.03; volatility of 3.0% (versus index volatility of 9.7%), giving a Sharpe ratio of 2.3, according to the manager. 94% of the monthly returns of the Cazenove UK hedge fund have been positive, and 80% of those of the European hedge fund. The largest monthly losses experienced by investors have been small – 0.76% and 0.57% respectively. So these two funds have a very smooth return profile, with correlation and beta near to zero, and the realised volatility has been low.

The investment process of Cazenove Capital has a framework of managing through the business cycle. According to Robin Minter-Kemp, MD of the Hedge Fund Business at Cazenove Capital, it is only feasible to show the true qualities of managers after a full market cycle. Only then is it possible to see what they would really do when in a drawdown, and what adverse circumstances do to the long term returns and risk characteristics for the specific strategy. The oldest hedge fund products of Cazenove Capital come out very well when reviewed over the appropriate timeframe.

The house style cannot be reduced to a simple label like 'growth', 'momentum' or 'value'. The approach taken combined with the structural presence of a meaningful short book gives a chance for the return series to be more consistent than most funds over a multi-year period. And they have been.

TIM RUSSELL joined Cazenove in 2003. He is Head of Pan European Equities with specific responsibility for UK equity strategy, portfolio construction and performance across the range of CFM's UK institutional, charity, private clients and retail funds. He is also manager of the Cazenove UK Growth & Income Fund. Russell joined from HSBC Asset Management (Europe) Ltd where he also had overall responsibility for UK equities, He graduated from Keble College, Oxford University with an MA (Hons) in Politics, Philosophy and Economics. He has 21 years of investment experience.

CHRIS RICE joined Cazenove in 2002. As Head of European (ex UK) Equities, he is responsible for all aspects of European (ex UK) equity strategy, portfolio construction and performance. He is manager of the Cazenove European Fund (onshore) and the Cazenove European Equity (ex UK) Fund (offshore) and co-manager of the Cazenove European Equity Absolute Return Fund. He is responsible for sector research in Banks & Specialty Finance (including Property), Oil & Gas, Media, General Retailers, Personal Care/Luxury Goods and Support Services. Rice joined from HSBC Asset Management (Europe) Ltd where he held a similar position, responsible for their retail and institutional Pan-European and European equity funds. Rice graduated from the University of Salford with First Class Honours in Finance and Accounting as well as a MPhil in Monetary Economics from the University of Glasgow and he is IIMR qualified. He is a Managing Director of Cazenove Capital Management.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical