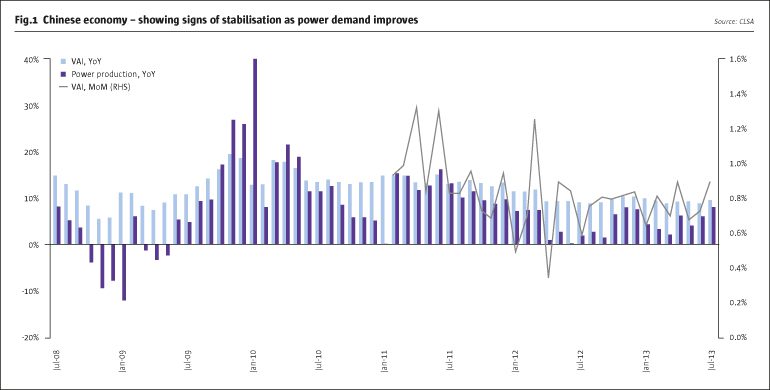

It has become extremely popular to be a bear on China, and the reasons given vary from genuine long-term concerns to extrapolation of a couple of recent dodgy data points. Yet Armageddon is likely to be postponed. Recent economic data has been reasonable, and in some cases better than expectation. Housing and auto sales are growing at a decent pace despite efforts from Beijing to handicap them. (Note that the BoE and the Fed’s policies to re-ignite a boom in unaffordable – at a sensible interest rate, anyway – housing continues to be applauded by the market). Recent policy moves to deregulate energy pricing and slowly move towards a market-oriented interest rate structure have been uniformly pooh-poohed by the financially chattering classes as too little, too late. Yet the stock market is showing signs of life, and some of the most beaten down sectors such as discretionary retail are demonstrating a Lazarus-like recovery. Commodity prices such as iron ore and copper have also confounded the naysayers, and there are signs of life in the share prices of the mining sector too – though here we think the bull case is more of self-help by reductions in costs and slowing new supply.

CLICK IMAGE TO ENLARGE

The longer-term concerns of the George Magnus camp are valid. It will not be easy to re-orientate the supertanker-sized Chinese economy. On the other hand, we are not aware of anyone who thinks it will be a walk in the park. Again we contrast this glass half empty attitude to the complacency over the unsustainability of the West’s social and medical spending. Local government debt is a problem in China. Yet they are not reneging on pension promises or defaulting on debt obligations (unlike Detroit). Beijing is solvent and will bail them out. We would advise against investing in Chinese banks, but we do not expect to see a big spike in non-performing loans (NPLs) associated with these potentially poor assets. The Chinese financial system will not freeze up as ours did in 2008 because the state still controls the credit-creation mechanism, and this will remain the case for the foreseeable future even if (as we expect) there are further moves towards financial de-regulation.

Some Chinese infrastructure is overbuilt. Airport capacity is ample, and a few industries such as steel exhibit very well-known overcapacity. For the bears this is proof-positive that China doesn’t need to build anything else, and if one’s experience of China is restricted to the environs of Pudong airport, we can understand why one would come to this conclusion. We suggest that they get out into the hinterland a little more. The quality of the housing stock (absent a few upmarket apartments in tier 1 cities) is poor, and much infrastructure in public transport and water and gas reticulation is still desperately needed. Growth rates will decelerate, but this is as much to do with arithmetic as it is with policy.

China (and China-related) equities are priced for a bad outcome. It does not have to be a great one to get the marginal global dollar to look again at what is still the economic story of the century. China is already a superpower and is rapidly becoming a force in everything from sophisticated engineering to the major source of global tourists. To dismiss it as just another ‘emerging market’ would be both an economic and geopolitical error. As fully paid-up contrarian investors, we find a lot of cheap opportunities in the market, at a time when the valuation of ‘developed’ markets leaves little room for macroeconomic or corporate missteps.

Mark Fleming is a partner at Tiburon Partners. He is the lead manager of the Asia Pacific ex-Japan long only accounts and has been with Tiburon since 2003.

Tiburon Partners is an FCA-authorised and regulated fund management business. The firm has an exclusive Asian focus and manages a range of strategies, the first of which was launched in 2003. Tiburon’s assets under management are approximately $500 million.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 88

China Could Surprise the Bears

The new consensus view may be misguided

MARK FLEMING, PARTNER, TIBURON PARTNERS

Originally published in the August 2013 issue