I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I-

I took the one less travelled by,

And that has made all the difference.

As we prepare to close out the first half of the calendar year, it seems like a lifetime ago that investment committees were convening as equity markets were hitting highs to decide upon the path forward for 2020. Although there were reasons for concern (resulting in some advocating for building out an uncorrelated, defensive exposure for some portion of portfolios), the global pandemic, a true “black swan” event, was certainly not contemplated. Markets were calmed when central banks and governments responded to the rapid shutdown of the global economy and liquidity concerns with fast, broad, and massive programs aimed at lessening the global shock, but there remain compelling reasons to adopt or maintain a cautious stance. Investors can now look back upon March and get some sense for how different strategies and managers behaved and perhaps the trade-level contributors to that return profile. It will, however, be some time before we will have clarity on the full crisis cycle and investors will be able to reflect upon the wisdom of both strategic and tactical portfolio decisions. Robert Frost in “The Road Not Taken” speaks about two paths forward, similarly worn, but one a bit more attractive and perhaps easier to choose. Here we have more than two choices, but this is the inflection point at which the choice(s) allocators make may have full cycle consequences.

There is optimism around a return to some state of societal and economic functionality as the world begins to reopen. However, this optimism is fragile.

Jim Neumann, CIO, Sussex Partners

What has happened?

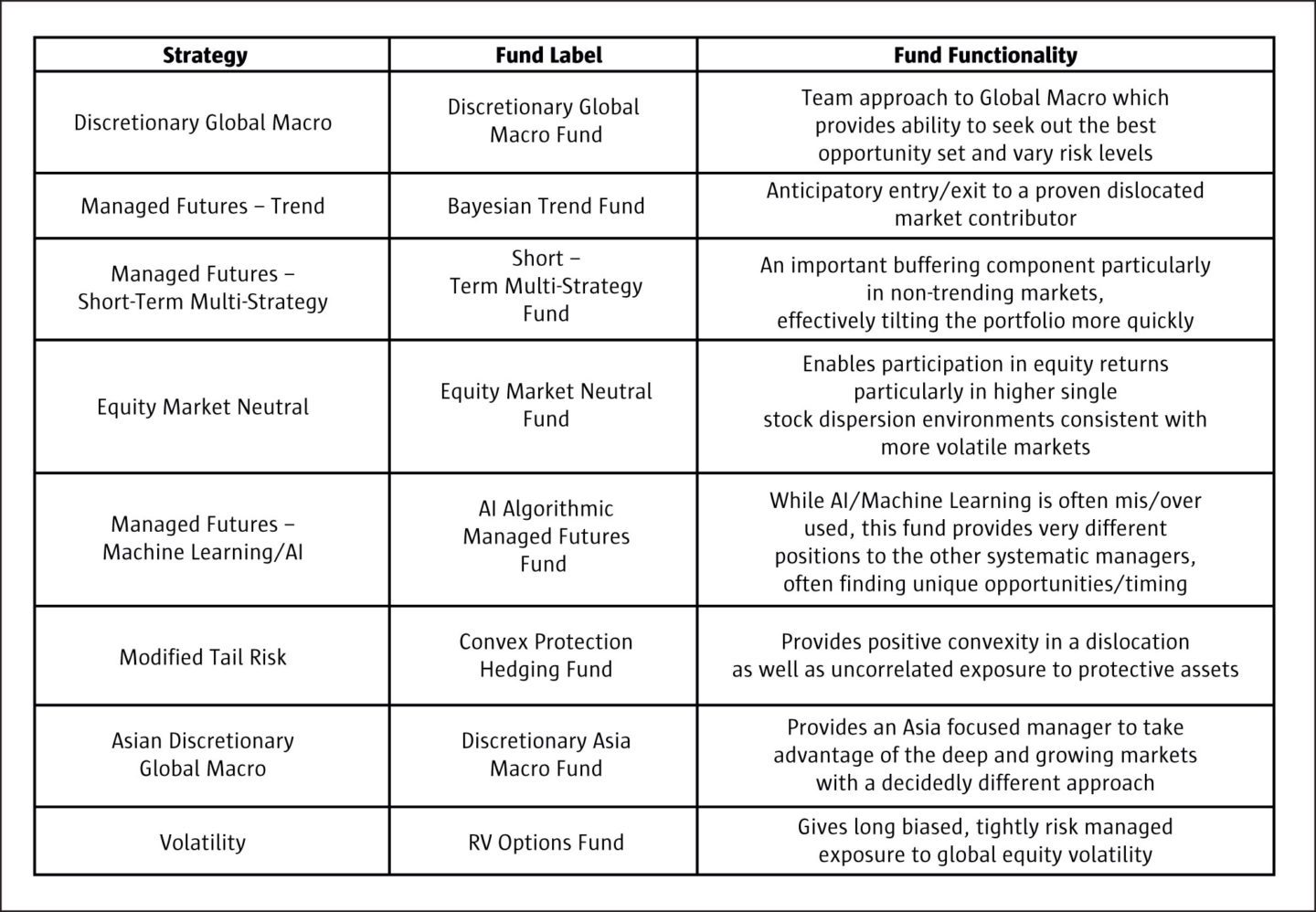

A quick rehash of the elements included in the diversified, liquid, and uncorrelated benchmark portfolio Sussex Partners developed in 2017 is warranted, as is a brief examination of the performance. The table above lays out the constituent strategies, funds, and a brief description of the intended functionality.

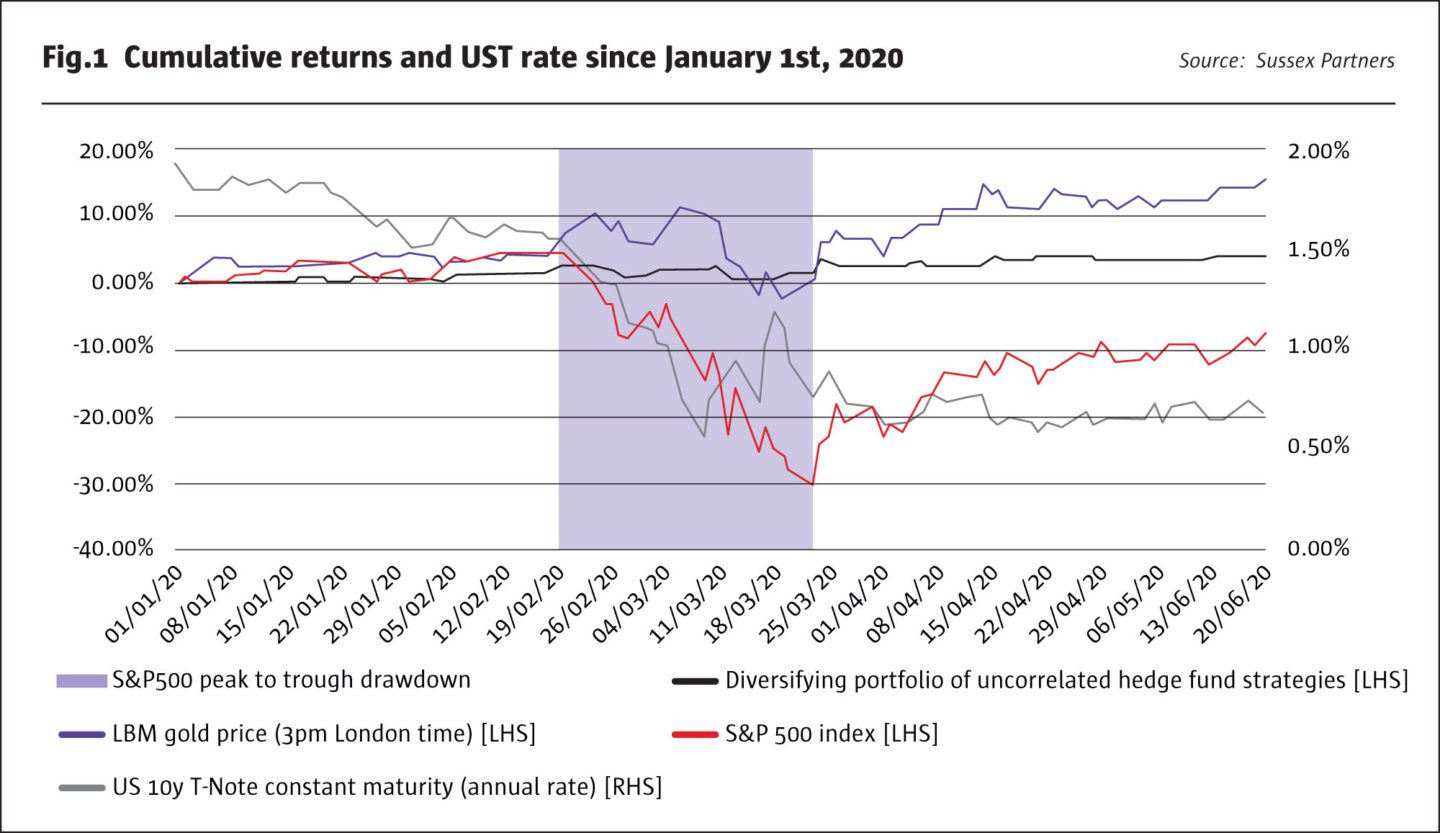

Through April, 2020 has been a mixed year with outliers on both sides. All the managers within the portfolio had performance and risk statistics within the bands expected. It may be a bit of a fool’s errand because of the single data point problem, but much time has been spent going over the performance in March to garner any insights available from return attribution, positioning, and risk management in practice versus theory. While the financial press seems to relish featuring negative hedge fund return news, the reality is that, at the more liquid end of the universe, hedge funds largely protected capital as advertised. In Fig.1, one can see how the defensive portfolio has fared prior to the crisis, through March’s craziness and into the recovery (or stabilization?) period. There is no way to know how this particular portfolio may have fared if the March bloodbath had not been met with massive intervention, but daily behavior during March was quite encouraging. Even during the few days of complete risk-off (including safe-haven assets like gold and US Treasuries having epic moves), the portfolio held up well and ultimately produced positive returns for the month.

As losses mounted across markets, it was concept confirming to see this portfolio hold up under multi-standard deviation price swings in both directions and in correlation changes between strategies/asset classes. Not to malign strategies, but those with more fundamental value biases and those more reliant upon the adoption of illiquidity for returns, suffered the most marked NAV swings. It became a question of the manager or fund’s ability to stay in the trades that determined any subsequent recovery prospects. It seemed like a long battle, but in fact the extreme market movements and record volatility was relatively short lived in mid-March. In fact, some of the “baby out with the bathwater” re-pricings were met with astute buying by month end, particularly in investment grade credit where default probabilities priced in had no connection to reality.

Where are we?

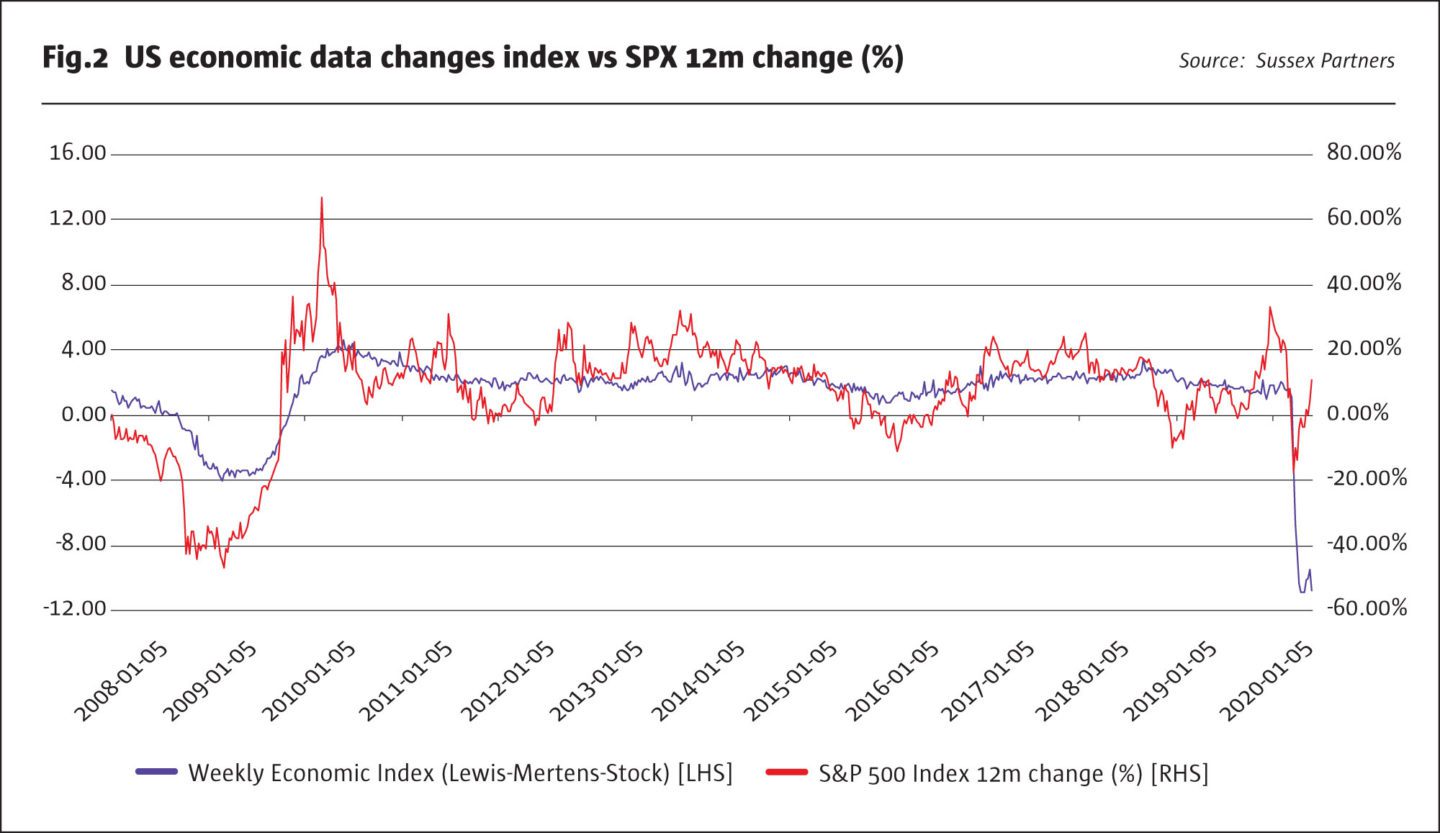

Global markets have proven quite resilient, particularly compared to the Global Financial Crisis, clearly giving a lot of weight to the crisis’ origins in human health rather than in a financial system meltdown. From a hopefully objective standpoint, the continued rally in global equities, against the economic devastation of the shut-down, seems to be quite forward-looking, particularly in growth stocks. On the opportunity front, it should be noted that some interesting dispersion is taking place at sector, geography, and single stock levels. Other markets including rates, credit, currencies, commodities and volatility all seem to have found levels which, at least for a time, have some basis in the underlying economic reality. This “reality” also includes levels on assets that have been set or supported by the vast fiscal and monetary response by global governments and central banks. As these programs come online, further value assessments will be made by the market. These value assessments will include a careful examination of the cost of all these programs and the increased indebtedness required by the countries to provide the economic buffer. While it has been clear that the US equity market had taken on the role of a global money market prior to the crisis, it is a bit surprising that the mid-crisis technicals still hold sway over the broad economic landscape. The chart below highlights the rebound in the S&P against the stark backdrop of recession or worse which is still unfolding.

The huge issue overhanging the market is obviously the global pandemic and all its primary and derivative effects on all aspects of life, including financial. There is optimism around a return to some state of societal and economic functionality as the world begins to reopen. However, this optimism is fragile and will eventually need to be augmented with full or partial health solutions (i.e. vaccine, therapeutics, testing, etc.) The market must also come to grips with the potential for future pandemics, potential anti-globalization, and the role of China as an economic superpower post crisis. (Oh, and there is a pivotal US election now just months away with an increasingly polarized electorate, racial tensions exploding, and the pandemic made a political football.) It is not to be decided here how the pandemic black swan will resolve itself or if it is the first of many to visit, but the landscape is one in which investors need to be protecting portfolios against known and unknown unknowns.

As one considers managers with strategies that have defensive characteristics, it is important to understand the assets and financial instruments underlying each strategy. Often there will be some exposure to so-called safe haven assets, which might include precious metals, especially gold, G-3 sovereign debt with US Treasuries being the main choice, and the related FX positions viewed as safe, again the US Dollar being a favorite. The question to ask when those assets reach historical extremes is if they will have the range left to serve as effective buffers.

What is the path forward?

Benefiting from the positive returns (and avoidance of losses) over this tumultuous period leads to a dilemma of its own; whether to stay the course, make changes, or reverse direction altogether. The diversifying portfolio was designed to be all-weather, which means that it should be able to produce acceptable returns in a variety of environments and through major cycles. It contains convex elements to really perform during major disruptions, but also managers capable of taking on significant risk when markets are moving up or down. Given the current environment, a period of sideway markets with declining volatility (the toughest for such a portfolio) seems an unlikely outcome. Many other risks outside of the pandemic still exist (e.g. China trade, US elections, social unrest, etc.) and will occasionally serve to unsettle the markets to some degree.

Prior to the pandemic, it seemed that there was a reason for investors to begin investigating strategies like credit with a distressed capability and “heavy lifting” (i.e. creating and managing one’s somewhat unique opportunities) idiosyncratic event driven strategies. The good news/bad news development is that getting ready for the next cycle as suggested was prescient and that because of the economic shock the recovery opportunities will abound at some juncture. For example, the dispersion in single stocks, between sectors and geographies, as well as factor rotation also point to tight net or market neutral equity long short becoming an interesting opportunity set, convertible bond issuance/re-pricing is leading to attractive technicals, etc. As investors maintain an appropriate core, which should continue to include the defensive uncorrelated bucket, a careful tiering of the opportunities should be conducted. Anecdotally, pensions and others with dry powder have already been allocating to distressed and credit managers adept at sorting through some of the damage. There does seem to be an imbedded sense of FOMO (fear of missing out), perhaps emanating from the inability to deploy capital post-GFC by many large institutional investors who did not have the liquidity or cash to do so.

Rules of the road

As per usual, getting the concept right is critical but executing the concept using the right managers is perhaps just as crucial. It is like any trade emanating from a theme in which choosing the right financial instruments and structure can mean the difference between success and failure. In the case of our benchmark diversifying portfolio, there was first a consideration of top down construction utilizing a range of historically uncorrelated, somewhat defensive or even convex in a crisis strategies, as outlined in the table above. This process also entails constantly combing for the new trade (think short sub-prime) unique to this cycle that perhaps possesses great asymmetry. Unfortunately, that search is still underway, but not for lack of investigation. Investable peer groups, where possible, needed to be deep and differentiated prior to final selection. Based on last year’s returns, some manager selection observations, both positive and less positive, are apt to emerge. However the analyses should not be return-based only, but should seek other lenses with which to view performance. Since this portfolio has two outliers, one ~+25%+ and another -11%, it might be easy to point to the negative performance and make a change. This however might lead to more turnover and the potential compounding of any sense of disappointment. Instead the rotation should be considered based on both qualitative and quantitative metrics. The first should be around expected performance and risk ranges being exceeded. In this case both the positive and negative were within expectations and in fact it was felt the outperformer required closer scrutiny due to the extreme rally in the protective underlying assets.

Anecdotally, pensions and others with dry powder have already been allocating to distressed and credit managers adept at sorting through some of the damage.

Jim Neumann, CIO, Sussex Partners

Deep breath and move forward

Investors/allocators as a group are often paid to be pessimists, or at least sceptics, when evaluating prospective investments. The old adage of a pessimistic investor being an optimistic investor with experience may or may not play out in the months ahead. There is a disconnect (or very forward-looking view) between the broad economic damage inflicted globally and certain asset prices, particularly larger cap growth equities. This leads to the conclusion that maintaining a protective core allocation within an alternatives or traditional portfolio remains prudent. The sizing of this core can be in concert with the objectives of the portfolio but generally in the 20%+ range. Importantly, given the cash efficiency of many of the strategies, the portfolio can be accessed as an overlay with just variation margin required. The goal of the program is that it be all-weather and absolute return which differentiates it from many hedging or tail strategies in which the investors must pay away until some dislocation. The issue with the latter is that, given long periods of low volatility (warning, like after massive government intervention) it becomes harder for investors to stay the course. The result is that investors end up dropping the insurance at just the wrong time or the insurance company simply goes out of business.

It is not too late for investors to add some diversifying, uncorrelated elements to their traditional or alternatives portfolios. This can be done via individual manager exposures or a multi-manager vehicle designed specifically to meet the clients’ objectives. Structures can also vary as suit the client needs and might be funds, certificates, or even indices accessed via swap. The widespread damage and unfolding new cycle, which will certainly see great dispersion of asset performance based on all kinds of variables, is also providing a launch pad for taking on risk assets which while damaged, will recover to generate an attractive return stream. It is this combination of the core diversifying portfolio and the opportunistic satellites which seem to be the most attractive road forward.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 149

“Continuing on The Road Less Taken”

Uncorrelated strategies as defense and offense, recap and road map

Jim Neumann, CIO, Sussex Partners

Originally published in the June | July 2020 issue