Joel Greenblatt is the managing principal and co-chief investment officer of Gotham Asset Management, the successor to Gotham Capital, an investment firm he founded in1985. He has a long history of being a successful value-driven investor. At Gotham Capital Greenblatt built one of the best 10-year track records around: compounding his capital at 50% per year from 1985-1994 (net return for this period was 34.4%). At the end of that period Greenblatt returned all of his partners’ capital. For a time he then continued investing the same way he did previously, but only with his own money.

For most of his career Greenblatt has been a value investor with a particular focus on special situations. Periodically Greenblatt has adapted his investment style, always value-driven, but gradually assuming less concentrated specific (company-level) risk.

So it is a natural progression that his firm Gotham Asset Management now offers a series of well-diversified long/short equity hedge funds available in mutual fund form. The funds are managed by Joel Greenblatt and his long-time collaborator (and co-CIO) Robert Goldstein, who joined Greenblatt in 1989. All of the Gotham funds share the same investment philosophy, process and research used by Gotham Asset Management’s private funds. The Gotham funds are not a diluted version of the firm’s institutional offerings.

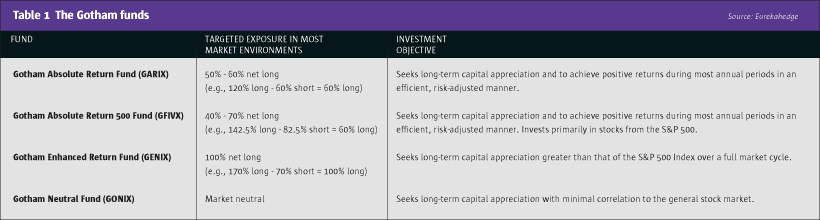

The range of Gotham Funds is shown in Table 1.

CLICK IMAGE TO ENLARGE

The Hedge Fund Journal spoke to Joel Greenblatt in New York just over a year after the launch of the Gotham Neutral Fund. The Gotham Neutral Fund carries the ticker GONIX, in homage to Greenblatt’s beloved New York Knicks basketball team.

The core activity is valuation

The core activity of Gotham Asset Management is the valuation of quoted companies. Greenblatt lays out how it works: “Our process is to analyze financial statements from approximately the 3000 largest U.S. companies based on our assessment of value. We then buy the companies we believe are the cheapest and short the ones we believe are the most expensive. GONIX generally holds more than 300 positions on each side.”

The co-CIOs and their team of equity analysts employ Gotham’s proprietary analytical framework to evaluate stocks within the coverage universe on measures of absolute and relative value. Greenblatt expands: “We only use measures of value [so not momentum or other technical indicators]. For example, we do extensive cash flow analysis, and we utilize measures of absolute relative value, including current and historical data. We ask ourselves, what do we believe is the fundamental valuation of each business and how much is that worth?”

Greenblatt is keen to emphasize that in the investment process of Gotham Asset Management the companies are not pieces of paper: “We are looking at pieces of businesses. That is how we assess them all. We analyse each company individually.”

“There are 13 of us on the analytical effort, including Rob and myself. We rotate analysts around randomly through sectors and companies, so they don’t make the same mistake twice,” he deadpans. In terms of co-ordination, there is no weekly research meeting. Rather, there is communication through the analytical team throughout the working day, headed by Director Of Research, Adam Barth

“Research at Gotham is a shared job. We have many checks and balances in our process so that when there is a change to our analysis of a company it is reviewed on several different levels,” explains Greenblatt. “We update our valuations on companies all the time, and those updates ultimately get reviewed by Rob and me.” The thinking is that the senior management want many different pairs of eyes on each stock under active consideration. This is one means of taking account of the fact that people make mistakes, according to Greenblatt.

Ideally companies in the stock universe of Gotham are analytically reviewed several times a year. Taking the analytical resources of the firm, each stock would have an average of around 1.2 man-days of analytical time per year, excluding the oversight time of the two principals. But some companies are more complicated than others, and some change shape more often. For all of the 3,000-stock universe there is an existing analytical framework that is available. That is, it is important to emphasize that only changes to analytical processes take up research time – the resulting valuations and rankings that drive selection are created structurally, not on a piecemeal hand-crafted basis.

In terms of prompts to analytical review, obviously company announcements would focus attention on a company. The announcements can be management change, or guidance on earnings or earnings releases, or corporate activity. Changes to valuation processes/methods resulting from such a change are subject to multiple reviews before they are traded on at Gotham.

Greenblatt recognizes that the stock market can readily disagree with the valuations that Gotham Asset Management puts on a stock in the short term. The value-driven approach requires patience from the portfolio managers and from their investors. “If I can’t wait around for a year or two for the market to get it right, I shouldn’t be in stocks in the first place,” is Greenblatt’s take. As he tells his students at Columbia, in 90% of the cases two to three years is enough time to be rewarded for a correct assessment of value (Greenblatt teaches a class on value and special situations investing at New York’s Columbia Business School).

“If we do good valuation work the markets will end up agreeing with us. Time horizons of most investors are shrinking, not expanding, because patience is in short supply, and investors can check prices of what they own 27 times a day,” Greenblatt admonishes.

He continues, “No matter how good our investment strategy, there will always be a period when the market will not agree with us. Then we won’t get the returns we want, whether it is in our longs or long/short spreads. We only use valuation as the foundation of our strategy because at that point I don’t want to turn to my partner, Rob Goldstein, and say ‘What do we change, what do we do?’ It is important that we stick to our process.”

“Our secret, if we have one, is that we stick to our guns. I have been doing this for a long time – over 30 years valuing businesses – so what am I supposed to change? I’m not going to change anything.”

Risk control strategies

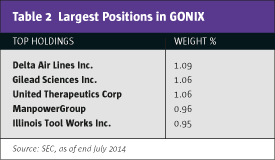

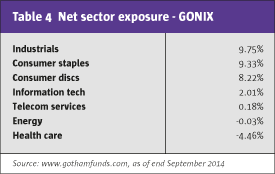

At Gotham Asset Management risk is managed by diversification, by sector and by name (see Table 4 for a snapshot of net sector exposures in GONIX). “We don’t concentrate risk in any sector,” affirms Greenblatt. The sizing of positions takes account of the liquidity of the stock. “When we like a company we size the positions as big as we can, given the liquidity constraint,” he says. Using this framework, the largest position in GONIX was 1.1% on the long side, and close to 0.8% on the short side as a percentage of equity, on the day of the interview.

Using the ranking, Gotham Asset Management buys the most of a company that it finds the most attractive, and has the second-largest position in the stock which has the second best value. Table 2, showing the largest positions, illustrates the moderation of position size. Of course the stock market imputes a value of a company every day, and so the management of portfolios is about managing the change in value for most portfolio managers. Greenblatt describes how he and his team manage it: “Taking the long side, over the medium term stocks move towards fair value in a noisy way, and as a position moves towards fair value we sell some of it down. We may sell all of it down if it moves very quickly. We take that cash raised from selling some of a (long) position and put it into companies that are selling at a bigger discount.” So the capital is constantly recycled to the companies trading at the bigger discounts to the in-house estimates of fair value.

Managing the risk of short positions is conceptually different from long-side risk because of the theoretically unlimited losses for a short. Gotham Asset Management addresses this. “We manage our short risk, [specifically the risk of loss through multiple expansion] by adjusting position size with discipline,” says Greenblatt. “Even our favourite shorts are no bigger than 80 basis points. So we control risk through being very diversified and by cutting back on losing short positions. That way we don’t lose too much on any single position. We make money because on average we are very good at valuing stocks.”

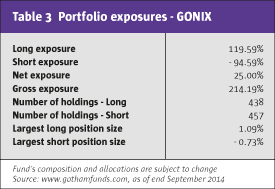

Turning to managing risk at the portfolio level, Greenblatt says that they manage the volatility of both the long and short sides. He explains, “We will let our net exposure roam in most of our funds, but not in the market-neutral fund. In the Gotham Neutral Fund we keep our beta to a range of plus or minus 0.05 (in aggregate across the portfolio). So that means when we change our long exposure in that fund we have to change the short exposure at the same time. We want to be structurally balanced, because staying hedged for the long term is how we generate what we need to.” He continues, “We don’t care about beta on individual names, but when you aggregate the betas across 300 names a side we do care, and it is a meaningful portfolio management measure. It is a pretty good measure of how your portfolio will react to the market.”

As Table 1 shows, the net exposures vary by fund. “In the 170/70 fund (Gotham Enhanced Return Fund (GENIX)) we generally keep the net exposure in a range of 75% to 100%.”

A snapshot of the actual portfolio disposition of the market neutral mutual fund GONIX (as at the end of September) is shown in Table 3.

There is no distinction at Gotham between stocks and companies. The analysts at the firm spend their time valuing companies. Greenblatt explains how they conceptualize this: “We are trying to find out how much to pay to own a piece of the business. So we look at it like a potential owner would: how much would we pay for the equity? How much debt are we assuming? Where are the liabilities (off balance sheet or on balance sheet)? So taking account of all the debt and how much it costs. We then try to figure out what is the company earning on a cash flow basis, and how much are they earning now versus historically? Then we ask ourselves how would we contextualize this versus other companies we could buy?”

The analysts at Gotham do not run stock screens. “Our analysts go to the original financial statements of the companies we look at – the balance sheet and income statement and the cash flow statement. The analysts ask what is that deferred tax item, what is that pension liability? Does the company factor their receivables and when they take write-offs, do they do they do that on a serial basis? What reporting periods do those write-offs belong in? We tear apart income statementsand cash flow statements to value businesses. Clearly our process involves a lot of elbow grease and blocking and tackling. There is no database we go to. There are certain things that my partner, Rob Goldstein, and I believe are important in valuing companies, and we use those metrics.”

Beyond the analytical team, Gotham Asset Management has a technology group that deliberately consists of non-financial people. One of the things they get involved with is trade implementation. That is, frequently Gotham has to carry out trades because asset flows are positive. The technology group also helps with risk management systems, and helps the investment professionals carry out their valuation and portfolio management work efficiently.

Greenblatt has written about and taught about investing in spin-offs. Although this can be a lucrative area to invest in for the investor prepared to do the work, it is a small part of the investment universe of Gotham. At any one time only, say, 30 companies in the universe may be in the process of a spin-out. Then the spin-out may be for only 10% of the value of the market capitalization of the whole company. That means that except for very large companies (say S&P500 companies) the stub securities issued may be too small and illiquid for a substantial investor like Greenblatt’s firm to get involved.

One of the challenges of committed value investors is the value trap. Greenblatt suggests that he and his colleagues can avoid value traps because they care about capital efficiency. “We tend to like companies that are good at using their money and avoid those that aren’t. Yes we buy companies when they are cheap (à la Benjamin Graham), but we much prefer to buy good companies when they are cheap (as Ben Graham’s pupil, Warren Buffett, advocates). So buying stuff that is cheap-and-good is what keeps us out of value traps,” he summarizes.

The stock market can go through phases of over-valuing a particular sector or type of stock on a thematic basis. Think of the TMT bubble, or the nifty-fifty phase. Greenblatt says that the approach he now uses has a couple of elements that should help cope with these extreme environments, which might occur less than 10% of the time, in his estimation. Firstly, the funds run by Gotham are very diversified by name. And second the time frame for investing is long compared to many investors, at two and maybe up to three years. The second point means that if the investor holds the funds for two to three years, congruent with the investment approach, then with the good hit rate the impact of the manic/theme phase of the market will be overtaken in return terms by returns derived from normal and normalizing markets.

Gotham Funds lift off

The investment approach of Gotham has worked for its private funds (hedge funds, if you like) for some years. The firm has a substantial institutional asset management business – total institutional assets under management are $3.45 billion (as of 1 October 2014). This total includes hedge funds, long/short separately managed accounts (SMAs) and long-only SMAs. But the commercial opportunity is shown in the growth of the Gotham Funds (mutual fund) range.

The first fund launch in the Gotham Funds range came at the end of August 2012 when the Gotham Absolute Return Fund (GARIX) came to market. GARIX has since grown to $2.78 billion in AUM. The Gotham Enhanced Return Fund (GENIX) was launched in May last year and already has $1.18 billion in assets under management. Next came the launch of the market-neutral fund (GONIX) in August of last year. GONIX had assets of $818 million in the middle of October. August of this year saw the launch of the Gotham Absolute 500 Fund (GFIVX). GFIVX currently has $5 million in assets.

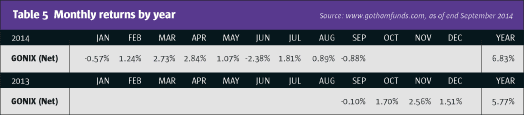

So from a standing start just over two years ago, Gotham Asset Management has added $4.78 billion in AUM through the Gotham Funds mutual funds range. The absolute returns of GONIX are shown in Table 5.

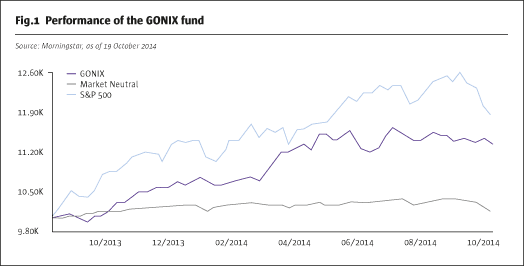

To put the returns of Gotham Asset Management’s GONIX fund in their competitive context, the fund is ranked by Morningstar in the second percentile of market-neutral funds for one-year performance. The Gotham Absolute Return Fund is ranked in the sixth percentile of long/short funds for the same measuring period.

Joel Greenblatt has long made money for his investors in private funds. The addition of the Gotham Funds to the Gotham Asset Management range has been a conspicuous success in return terms (percentile rankings) and in commercial terms (assets under management). Greenblatt has characterized the firm’s investment process that has driven that success. He says “We are disciplined, and it is deliberately unemotional.” #detachmentrewarded.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical