As Man GLG, one of The Hedge Fund Journal’s ‘Europe 50’ managers, passes its second decade, we visited its London headquarters. Man GLG today has three distinct pillars, led by co-CEOs Mark Jones and Teun Johnston, comprising hedge funds, long only and Collateralised Loan Obligations (CLOs). They characterise the firm as a discretionaryinvestment manager, offering a range of absolute return alternative and long-only strategies. “The culture here is entrepreneurial yet collaborative,” says Johnston. “Each team makes their own investment decisions, but they are supported by their colleagues and Man GLG’s high-quality infrastructure.” Mark Jones started his career at management consultant McKinsey and then joined GLG in 2005 to work on the investment side, before moving to the business side as COO. Teun Johnston was initially hired as head of strategy to develop the product range. Johnston had previously worked at Oakley Capital and Credit Agricole Asset Management (now called Amundi), where he had become deputy CIO of the Alternative Investment business, having begun his career as an accountant with Arthur Andersen. Mark Jones manages the alternatives and hedge funds strategies, and also has oversight of the CLO business, and Teun Johnston manages the long-only business.

Multi-strategy or multiple strategies?

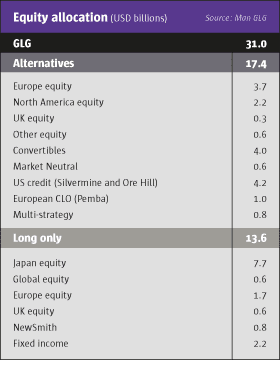

The three pillars offer multiple strategies – both as single-strategy and multi-strategy products. For some hedge funds, ‘multi-strategy’ means that they determine allocations to each strategy, team, manager or trader within one investment vehicle. Man GLG offers a range of hedge fund and absolute return strategies for investors. For a breakdown of Man GLG’s assets see Table 1. The largest Man GLG hedge fund strategy grouping is broadly market-neutral equity long/short, with over $3 billion of assets spanning small caps, mid-caps, and large caps globally. The firm’s European and global market-neutral long/short strategies have been running for 15 years, led by Pierre Lagrange, Simon Savage and Neil Mason.

Another equity-oriented strategy within the company is Goldman Sachs alumnus Pierre-Henri Flamand’s event-driven strategy, which passed its one-year anniversary in late 2015. Man GLG has always been renowned for equities, yet its credit strategies also make up a significant part of the business. In the credit space, the European team is led by Steve Roth, who has been with the firm since 2005, and strategies include European distressed, financials, and convertible arbitrage. The latest addition in the US is a special situations strategy, run by Himanshu Gulati, who was hired from THFJ ‘US 50’ manager Perry Capital. The CLO business is growing with the January 2015 acquisition of Silvermine Capital Management.

Recruitment and diverse thinking

Hiring the best people remains a key focus for many managers. Two of Man GLG’s founders are no longer with the firm, but they have passed the baton on to dozens of successors, illustrating the multi-generational nature of Man GLG. “GLG was always set up to outlive its founders, and that positioned the firm well for the Man Group deal,” says Jones. Indeed, Pierre Lagrange is the only one of the three still working at Man GLG, as Managing Director; Jonathan Green left in 2003, and Noam Gottesman in 2011. Man GLG’s talent scouting entails interviewing hundreds of applicants each year, says Jones. Sustainable alpha is the key quality sought. Says Johnston, “We want people who can perform for long periods, in scalable strategies, and who bring something different to the table”.

Man GLG is confident about its strong competitive position for hiring both proven and promising analysts and portfolio managers. Freedom of thought is one attraction, and Rory Powe, who runs a concentrated, high-conviction, European equity strategy, says, “Man GLG is a broad church, which importantly avoids group-think”. Johnston confirms that different fund managers can be on opposite sidesof the same trade, with one long and the other short, sometimes due to different time horizons but sometimes simply because “we never argue, we just disagree,” as Man GLG portfolio manager Henry Dixon says in the firm’s 20-year anniversary film. Man GLG is a group of independent thinkers, and is not reliant on the views of a single investor, such as a CIO. “There is no messiah figure,” says Jones. Johnston comments, “We have a whole variety of styles under one roof, which allows us the ability to attract highly talented people, who are the lifeblood of a discretionary fund management business”. One of the more recent hires, Pierre-Henri Flamand, commented, “It’s teamwork-orientated, in an industry where there is a fair amount of individualism.”

Man GLG is always on the lookout for new talent, and if this was historically dominated by hires from investment banks, now the firm tends to hire from other asset managers and hedge funds, and also has a graduate training scheme. Another example of Man GLG nurturing internal talent is through launching products to be managed by existing talented analysts. Man GLG’s ongoing search for investment managers is made easier by the escalating costs and stresses of starting a standalone fund management business. Powe, who joined Man GLG after having had his own hedge fund firm, has spoken about the headaches of handling regulations, and how running a business can take time away from investing. Man GLG provides comprehensive infrastructure in terms of regulatory authorisations, legal and compliance, back office, middle office, fund literature, marketing staff, distribution networks, and existing relationships with service providers, trading counterparties, exchanges, venues and platforms. Setting up all of this from scratch can consume thousands of hours of time and a vast amount of upfront capital.

Another boon for Man GLG’s hiring is that, as Johnston states, “working in a bank is much less attractive these days than it once was”. One factor is the flexible compensation at Man GLG, but equally as important are the lower levels of bureaucracy. Jones confirms that the few people Man GLG has hired from banks “find it much more efficient to be able to focus purely on managing money without distractions.”

Diversity

As well as encouraging diverse investment views, Man GLG casts the recruitment net just as widely and, therefore, “Man GLG cares deeply about diversity issues,” says Johnston, pointing out how Man Group’s executive committee has formally discussed the issue. As Pierre Lagrange says, “You really want to have diverse points of view”. Man GLG’s graduate programme also monitors statistics for women and the firm “fosters a meritocratic environment where success is based on talent, commitment and teamwork,” says Johnston. “We just want the best people.”

Two Man GLG portfolio managers, Galia Velimukhametova and Ide Kearney, have appeared in THFJ surveys such as ‘Leading 50 Women in Hedge Funds’, and ‘Tomorrow’s Titans’, sponsored by EY; the award-winning European distressed strategy that they run has also been profiled in THFJ. The firm’s asset-backed securities strategy is managed by Sarah Barton, who joined the firm from Morgan Stanley in 2008. Senior women on the non-investment side include Man Group’s Global Head of Legal and Compliance, Robyn Grew, and Man GLG COO, Carol Ward, who also belongs to the AIMA Research Committee. The firm’s view is that gender is only one dimension of diversity, which also encompasses ethnicity, sexual orientation and disability.

Rotation

There are no artificial territorial boundaries within Man GLG. The only person with an office at Man GLG’s London headquarters is the GlobalHead of Legal and Compliance: “It is an open plan office and an open plan culture,” says Johnston. “Investment professionals comment on what a great work environment we have, and this is a key recruiting tool.” The potential to move within the firm is also attractive to recruits at all levels of seniority. Man GLG’s new COO, Carol Ward, had been COO of Man AHL, and of course Manny Roman now runs the whole of Man Group.

Man GLG traditionally made lateral hires, but has increasingly recruited graduates, through a rotational Man Group programme, and Jones’ move from investment to management sets an example. “We believe we have one of the largest and most open equity and credit trading floors in the world, and the right investors are able to learn from each other through sharing expertise,” says Jones. Graduates are trained with individual teams but benefit from centralised coaching, which includes behavioural finance techniques.

Synergies amongst Man GLG, Man AHL and Man Numeric

Staff rotations are one example of how Man GLG benefits from being part of a larger asset management group. Mark Jones helped to integrate Man GLG with acquirer Man Group in 2010, and in 2014 Man Group bought Boston-based quantitative equity manager Numeric. There are significant synergies and regular dialogue amongst Man AHL, Man GLG and Man Numeric, and all three participate in weekly investment meetings. Specific synergies include some of the Man AHL quant team being brought into Man GLG and, Jones claims, “the infrastructure and architecture of the firm’s quantitative research platform can save us years of development work and get tools in front of the team far faster”. Would Man GLG ever run a pure quant strategy? Not at this stage, as that is the province of Man AHL and Man Numeric, but “the general direction is that everyone is getting more quantitative year by year,” says Jones. Man Numeric is also providing expertise and technology for investment teams – as well as feeding into firm-level product development. Man Group also has a discretionary multi-strategy solution, described internally as “the best of the firm in one place,” run by David Kingsley, which allocates across the full breadth of the Man AHL, Man GLG and Man Numeric strategies.

Alpha

Man GLG’s guiding star is alpha generation, and Man Group President Luke Ellis says, “What we seek to deliver is alpha”. This comes from Man GLG’s core competence of forming active views on equity and credit through bottom-up analysis of individual companies and securities. Man GLG makes extensive use of sell-side analysts, and its own, buy-side analysts are highly regarded: Man GLG has been awarded 'Leading Pan-European Hedge Fund' in the Thomson Reuters Extel Survey for the past three years – in 2013, 2014 and 2015.

These votes of confidence from the market and corporate management reflect the quality of dialogue that Man GLG has with companies, with various parts of Man GLG investing in, and trading, various parts of the companies’ capital structures. As well as traditional company analysis, Man GLG has had its finger on the pulse of more modern approaches such as behavioural finance. For instance, equity fund manager Simon Savage contributed an article to THFJ on how the psychological traits of fear, overconfidence and irrationality can impair stock-picking.

Performance priority

Stock-picking is the main part of the performance ethos, which comes before asset growth. “There is no specific target for asset raising, as performance is the priority,” says Johnston – and indeed Man GLG has sometimes closed funds to new investment in order to avoid diluting performance. The largest strategy on the long-only side, Japan Core Alpha, has only recently re-opened after a period of restricting inflows. Though Man GLG is not having difficulty executing trades for its daily dealing funds, Jones admits “worsening liquidity does alter capacity at the margin, as we would want to restrict flows into a fund before returns deteriorate.”

Johnston agrees and says Man GLG’s “truly active, alpha-seeking, long-only business is less scalable than passive or ‘closet index’ strategies”. At the same time, the long-only business is far more scalable than hedge funds that need to source security borrowing for shorting, so it has historically seemed odd that the long-only business runs less in assets, at $15.3 billion, than the alternatives business, at $18 billion, as of June 2015.

Seeding and launching

That may be about to change. The long-only business has historically had a narrow focus on two or three core areas but is now being expanded, with the hires of Rory Powe for European equities; Henry Dixon from Matterley for UK equities; Jon Mawby and Andy Li for corporate bonds; and Simon Pickard and Edward Cole from Carmignac Gestion to run an unconstrained emerging markets equity strategy.

Hiring individuals and teams are two ways in which Man GLG adds new strategies. The firm also promotes internally, seeds in-house teams and makes acquisitions. Starting with seeding, Man GLG is not constrained by the Volcker Rule that can limit bank-affiliated fund managers to owning 3% of funds. Man Group’s first half 2015 results identified “seed capital and loans to funds” of almost $600 million, though it sounds as if the company could deploy far more than this if it wished to. Jones claims, “In our view Man Group has one of the strongest balance sheets among alternative asset managers, with excellent liquidity and listed equity”.

The unconstrained emerging markets strategy illustrates many qualities sought from launches. Says Johnston, “We believe there is an opportunity for sustainable alpha generation, this is the right team for Man GLG, and the asset class is scalable, with persistent demand.” Man GLG also hopes to plug a gap in the market as clients report it is hard to find talented portfolio managers for emerging markets equities. Meanwhile, Moni Sternbach was hired from Cheyne Capital to start a mid-cap European long/short strategy. An example of an internal promotion was Ben Funnell. The acclaimed former Morgan Stanley strategist was able to demonstrate a repeatable strategy and now runs European and global equity strategies.

Man GLG’s award-winning Japan Core Alpha strategy dates back to the acquisition of Societe Generale’s fund management business in 2008, and the acquisition of NewSmith LLP’s investment team in 2015 now plugs an important gap in providing a Tokyo-based Japan long/short strategy to complement the London-based long-only strategy. NewSmith, which added $1.2 billion of assets, has been integrated into Man GLG’s open-plan trading floor.

The European CLO capability became part of Man GLG following the acquisition by Man Group, and has taken advantage of Europe’s recovering securitisation market with a CLO launch this year being the first since 2007 for the unit. The structure includes 5% risk retention as required by new rules; and Man GLG expects that similar rules will soon apply to its new US CLOs created by Silvermine, a Stamford, Connecticut-based manager running $3.8 billion which was acquired in May 2015. CLOs are an important asset class for Man GLG, as Jones finds them “good strategies and good structures”: corporate credit CLOs survived the crisis in part because their locked-up leverage meant they were not forced sellers.

Institutionalisation

Man GLG has come a long way from its origins as a unit of Lehman Brothers in 1995. First launching long-only products, GLG quickly moved into hedge funds to pursue absolute return strategies. 10 years post-launch, “The institutionalisation of GLG was accelerated by the arrival of Manny Roman from Goldman Sachs in 2005,” recalls Jones. When GLG became the first pure-play hedge fund management company to be listed on the New York Stock Exchange (NYSE) in 2007, the associated compliance and disclosure requirements underscored its institutional credentials. The acquisition of Societe Generale Asset Management UK in 2008 – which Jones was heavily involved with – brought in strong distribution capability in Europe, reaching out to more end investors. Man Group’s purchase of GLG in 2010 was also a huge project for Jones, who describes it as “a deal that took us to a new level of scale in terms of infrastructure, distribution capabilities and breadth of client relationships.” The respective distribution footprints dovetailed well together, as “GLG had deep client relationships in the UK, France, Italy and Spain, while Man Group was stronger in the Far East and German-speaking countries.”

Running some retail products can impose a heavier compliance burden than purely institutional products, and Man GLG’s strong compliance culture is also sought after by institutional investors. Jones asserts: “We prioritise controls, with automated systems and tests developed by technology specialists making it easier to monitor compliance”. The firm views compliance as going beyond the confines of regulation: “it is about hiring people with the right approach, ensuring they fit in with the team’s culture of responsibility”.

Compliance is just one part of the institutional framework. GLG and Man Group were both founders of the Hedge Fund Standards Board (HFSB), with Manny Roman still on the board. Man GLG was an early adopter of the CFA Institute’s Global Investment Performance Standards (GIPS), and Man Group’s Head of Middle Office Accounting, Colin Bettison, participated in a joint CFA Institute and CAIA Association breakfast briefing on ‘GIPS and Alternatives’, hosted by EY in London in March 2015, with THFJ publishing a transcript of the extensive discussion. Man GLG is also a signatory of the United Nations Principles for Responsible Investment (PRI), and has two long-only accounts so far that take account of sustainability issues. On this topic, Man GLG’s Jason Mitchell and Man Group’s Steven Desmyter contributed an article to the Alternative Investment Management Association (AIMA) Journal, which was later reproduced in THFJ, discussing ‘Hedge Funds and the State of Responsible Investing’. This was after Man Group in May 2015 hosted a seminar in London entitled ‘How do responsible owners view hedge funds?’ in which AIMA and UN PRI participated. As well as Man GLG, the speakers at this event came from firms including Europe’s largest pension fund, APG; the UK’s largest pension fund, Universities Superannuation Scheme (USS); the Church Commissioners of England; Finnish insurance company, Varma Mutual Pension Insurance Company; Mariner Investment Group; and consultants Albourne Partners.

Distribution

All of this helps to meet the criteria of allocators such as giant pension funds, and Man GLG distributes globally. Man GLG finds that passporting of funds throughout Europe is working smoothly, partly due to its well-established Irish UCITS platform, where Man GLG was an early mover in rolling out UCITS hedge funds. Man GLG is also keen to attract more assets from the US and Asia. Says Jones, “The majority of hedge fund assets globally come from the US, and as a European firm we have historically been underweight the US.” For the US market, Man GLG has not yet launched any ’40 Act funds, but Jones thinks they could easily create the structure, and indeed Man AHL has acted as a sub-adviser to a ’40 Act fund.

“We have been at the forefront of the European industry for over 20 years, focused on creating an optimal environment for our existing teams as well as attracting and developing the next generation of investors,” says Jones, who thinks it would be difficult to replicate what Man GLG has built because “no start-up can add 150 staff in over six countries overnight”. Man GLG’s first two decades are just the beginning, as Jones expects the firm will continue adapting to address evolving client needs “for the next decade, and the next decade, and the next decade after that”.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical