Dormouse deliberately chose a low key name as a reaction against big and bold hedge fund appellations belonging to behemoths that manage tens of billions. Dormouse CIO, Dr Martin Coward, estimates that capacity for the Dormouse futures hedge fund strategy is $2 billion, under current liquidity conditions (but is higher for the firm’s separate long only asset allocation strategy).

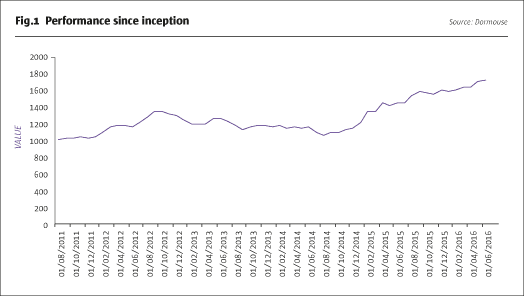

Dormouse set up a corporate structure in June 2011 and has spent five years quietly building up a track record (shown in Fig.1) in managed accounts, attaining a Sharpe ratio above one. Given that Dormouse’s 2015 performance (+30.27%) would probably have garnered a clutch of awards, Coward might regret waiting until now to launch an offshore fund structure. But Dormouse is well resourced with proprietary capital and so has had the luxury of awaiting an opportune moment to ready the Cayman vehicle, now launching in summer 2016 with discounted fees for early investors. This year Dormouse has also opened an affiliated US office in Miami to expand its team of quantitative researchers, as the manager raises its game to attract institutional allocators seeking a diversifying strategy.

Trading a web of interconnections

Coward, who was founder, Chairman and Chief Investment Officer of one of Europe’s largest systematic hedge fund managers, holds the conviction that increasing interdependency and interconnectedness between markets make diversification harder to achieve, particularly for traditional directional strategies. Hence he favours strategies that include “applying statistical arbitrage to futures, to trade the connections between asset classes, markets, regions and economies.”

An example of inter-market relationships could be commodity currencies, whereby oil and gold have some correlation with the Australian and Canadian dollars. Dormouse also looks at relationships amongst groups of commodities, such as grains and energies. There is always some mix of technical and fundamental signals but the latter are around 20% of the total, and will not necessarily grow beyond that level. One example of fundamental economic signals could be how China’s economy influences commodities.

Though some associations between markets might seem obvious or intuitive, Dormouse keeps an open mind about what drives links between markets. Dormouse aims to identify short term statistical relationships by decomposing markets into factors and then trading the residuals. “We use statistical factors and do not predefine them,” Coward outlines. This approach seems relatively unusual. Anecdotally, we most often see directional strategies being applied to futures markets, and we frequently see statistical arbitrage being applied to single equities. Dormouse is doing something different and expects to be lowly correlated to other CTAs, by design. “Focusing on statistical arbitrage in futures removes risk factors, so that the remaining risk is smaller and orthogonal to other managers,” Coward explains.

Dormouse aims to neutralise exposure not only to market betas such as equities and bonds, but also to ‘risk on/risk off’, the USD and popular factors such as trend and carry, that are forms of exotic beta, which can be particularly important return drivers for some systematic and quantitative funds.

Dormouse is also targeting a considerably higher Sharpe ratio than many CTAs. Coward thinks that a Sharpe of between 1 and 1.5, roughly double that of a traditional trend follower, is realistic as the Dormouse strategy models are much more diversified, and it neutralises many risk factors. The process by which Dormouse reduces its exposure to common risk factors has been enhanced, and is the only part of the strategy that entails some discretion.

Process and risk evolution and enhancement

Dormouse’s models are not set in stone, and should evolve at a varying pace. Coward estimates that between 10% and 20% per year, or sometimes less, of models might change. The pace of evolution might accelerate as more staff are hired. Performance at variance with expectations can provoke rethinks. Coward was somewhat surprised by the strategy’s drawdown between June 2012 and October 2014, and he attributes the pullback to “common risk factors that did not do well under risk on/risk off markets.” These factors were not conventional asset class exposures, nor exotic beta such as trend or carry, but rather Dormouse’s beta to the rest of the hedge fund industry at that time. Consequent model enhancements should “reduce transaction costs, improve Sharpe ratios, and reduce correlation,” Coward expects.

Dormouse has enhanced risk management in several areas over the past year. “We have looked at different covariance matrices, time scales, factorising risks, and improved risk factor neutralisation without adding too much transaction costs,” enumerates Coward. The net effect is that Dormouse aims to make the same alpha for less risk.

To give one example, a shorter term, adaptive covariance matrix, adapting to recent behaviour, harks back to Coward’s Cambridge University PhD in control theory. “This is useful to monitor changing patterns of correlation and how risk on/risk off phases affect models and risks,” Coward explains. When correlations spike, the strategy automatically dials down risk. Target volatility is 10% and realised volatility has been pretty close within a range of 9-12%.

Another advance is the ‘Ensemble Averaging’ approach, “a new research area that Dormouse has pursued to improve diversification and robustness,” Coward goes on. The basic principle is simple: combining a basket of, say, trend following CTAs, generates a better Sharpe than each one alone because they are less than perfectly correlated. Coward draws analogies with weather forecasting: “We take models, tweak them, average them, and diversify over all choices including time scale, inputs, smoothing function, and type of model.” The net effect is a 0.2 improvement in the Sharpe ratio, based on simulations.

Dormouse is also anxious to avoid unintended factor concentrations, and has put in place two safeguards. The programme’s diversification rules have always included hard caps on exposure to certain securities. Dormouse also exercises discretion in one area: rebalancing weightings of models to reduce correlation and overlap to other hedge funds. Coward feels confident that he has a reasonably accurate idea of how other popular models, such as momentum and carry, will be behaving, and Dormouse scales back exposures accordingly. “This process probably could be automated but we have not fully implemented it yet,” adds Coward. No other discretionary over-rides are employed.

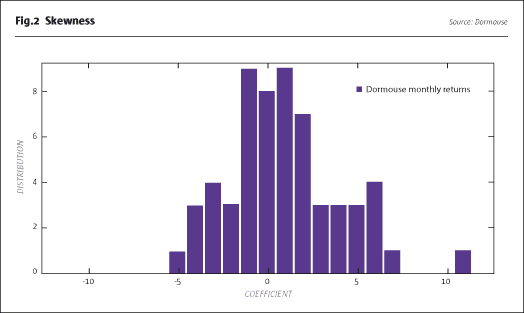

The ongoing research process isdesigned to deliver a positively skewed return distribution and this has been achieved, as shown in Fig.2.

Developed markets

Dormouse applies its models to around 50 of the most liquid developed markets, in contrast to those, systematic strategies have diversified into many hundreds of markets including emerging markets. Dormouse essentially “trades complexes of G10 economies, with bond futures, short term interest rates and currencies being an example,” says Coward. The strategy avoids emerging markets as Coward argues “it is only in the G10 that you get a level playing field, and ease of trading contracts across the full range. In emerging markets like China and Brazil, there is a limited range of trades and you are not on a level playing field with the insiders.” Coward wants all observable information to reside in the market and not with individuals.

Asset class weightings to commodities, FX, bonds and equity indices, are broadly even and each asset class makes a roughly equal contribution to portfolio volatility, but this is not a risk parity asset allocation approach. Dormouse looks at standalone asset class volatility because patterns of correlation between asset classes can change. Coward expects performance attribution from asset classes to be broadly equal over a full cycle but the balance of P&L contributions will move around. For instance, bonds have recently made a stronger contribution, but when the programme started commodities were doing best. “All asset classes have done their job in terms of diversification and returns,” summarises Coward.

Short term interest rates (STIRS) account for the overwhelming majority of gross notional exposure for some systematic funds, according to their AIFMD leverage disclosures. In contrast, Dormouse has had very little exposure to STIRS so far, as the manager’s models suggested STIRS had insufficient volatility to cover expected transactions costs. However, the ballooning pool of sovereign debt with negative interest rates ($10 trillion in June according to Fitch Ratings) could open up a new universe. “Negative rates make STIRS potentially more tradable due to the additional volatility as prices are no longer bounded at 100,” explains Coward.

Liquidity and execution

The perception that bonds and rates may be larger and more liquid markets than other asset classes may explain why they have high weightings in some of the largest systematic investment programmes. Dormouse has considerable sympathy with concerns about worsening liquidity. For Coward, financial market liquidity has seen a sea change post-crisis. “Until 2008 you could guarantee that market liquidity kept increasing and transaction costs kept falling, which was a tailwind for investment strategies. Now this can no longer be taken for granted,” he observes. Dryer markets are partly an unintended consequence of regulations that reduce bank warehousing of OTC derivatives. Coward recognises that regulations such as clearing are making some markets more transparent, but also sees others becoming more risky.

Market liquidity has not posed problems for Dormouse’s trading however. It did not even notice ‘flash crashes’ in the data, and was not impacted by the Swiss Franc spike in January 2015. The real implication is for strategy capacity, where Coward thinks “you can no longer guarantee that capacity will double every few years,” so he estimates that current assets of $50 million in the futures strategy could grow to $2 billion.

These less liquid market conditions increase the onus on paying careful attention to execution. Dormouse staggers trade execution throughout the European trading day “to take advantage of short term opportunities and minimise market impact,” Coward explains.

Dormouse’s trading day is 7am to 7pm European time. Coward does not think there is enough overnight liquidity to make it worthwhile trading during the Asian trading day. Given that Dormouse specialises in trading inter-relationships between markets, he wants to trade when most things are open. Dormouse also increases its potential menu of liquidity by selecting from a range of contracts including the front month.

Dormouse is not a high frequency trader. The strategy’s shortest holding periods are 24 hours and its longest are six months. Dormouse’s execution periods do not fall below five minutes, and certainly not down to fractions of a second. Coward sees a limited future for HFT, viewing it as “an expensive arms race that has some regulatory problems.” Nonetheless, he is well aware of the need to execute tactically and carefully, pointing out “all traders try and disguise their intentions and algorithms must do the same thing.”

Recruitment and research

Proprietary capital has allowed Dormouse to develop the business without giving away any economics to providers of seed or acceleration capital. The Dormouse management company is owned by the staff. Says Coward: “We have a small, efficient and capable core team of people who all program in Python and we intend to keep it that way. We do not want a large, inefficient group.”

Coward has worked for large organisations before. His investment career began trading foreign exchange for Goldman Sachs, before moving to Investcorp to trade equity derivatives. Coward was active when Goldman was just starting to make electronic markets in options, recalling how Goldman bought Hull Derivatives (where Ernst Jaffarian also worked). The other three key Dormouse people at present are General Manager George Dowdye, Portolio Manager and Researcher Dr Hans Joachim-Drescher, and US office head Dr Eric Westphal.

Dowdye also started in options, trading both listed and OTC options for BZW, Morgan Stanley, SG Warburg, and UBS. Today, Dowdye is mainly involved with the business and marketing side but does sit on the investment committee. Drescher had an academic background in theoretical nuclear physics and particle physics, before moving into finance. Westphal has researched theoretical particle physics and has experience as a fund selector and commodity trader for Koch Industries. Westphal meets potential investors in the US. Dormouse will hire business development staff in London and Switzerland but the main recruitment drive is for researchers, which Coward expects to make up most of the team.

In February Dormouse opened an affiliated US research unit, called Dormouse Nest, as a place to grow ideas. US national Westphal, manages the office and plans to hire 15-20 people to perform model research and software engineering. The intention is to hire hard sciences PhDs direct from US universities, as well as some more experienced people but “it is always best to grow your own talent,” Coward has found over his decades in the business.

Jim Simons’ Renaissance famously recruits PhDs from any discipline bar finance, and Dormouse has some overlap with this philosophy. Though experience of working in financial markets is not ruled out, Dormouse does not generally look to hire doctors of finance. Dormouse’s preference will be for PhDs in Applied Maths, Physics and Engineering (though Dowdye caveats that there have always been some exceptions of those from different subjects who turned out to be capable researchers). Disciplines sought could include Machine Learning or Artificial Intelligence, though Coward still thinks “the low signal to noise ratio in finance makes it difficult to harness these techniques and signal processing is more understandable than machine learning.”

Neural networks could be another subject area, where Coward (who plays both Chess and Go) admits he is “is very impressed by how Google’s GO programme beat the Go champion by building up the same experience as a human in very little time.” Neither Pure Maths nor Statistics have generally been the most fruitful PhD disciplines for investment researchers and neither have most computer scientists, Dowdye has found.

Operations and regulation

The business’s locations, in Malta and Miami, reflect team preferences for a clement climate, and their dislike of cities, rather than fiscal incentives. Dormouse has built up a scalable infrastructure. The firm uses proprietary, STP (Straight Through Processing) technology, having previously used a FIX engine.

All systems, including settlements and operations, are now proprietary and built on Python code. In terms of business continuity, Dormouse has two trading server platforms that back up every 10 minutes, can remotely access systems, and write to encrypted cloud. Having started with Morgan Stanley as its prime broker, Dormouse may add Societe Generale Prime Services as a move towards a multi-prime broker model.

With assets currently only in managed accounts, Dormouse is regulated by the Malta Financial Services Authority (MFSA) as a ‘de minimis AIFM’ with less than €100 million under management. When gross fund assets exceed €100 million, Dormouse expects to become a full scope AIFM, and may also register with the SEC.

Malta’s regulator is far from a ‘light touch’, according to Dowdye, who finds that the MFSA may even be tougher than the FCA on some issues. “The FCA has more experience and applies more the spirit than the letter, whereas the MFSA applies the letter of regulations,” Dowdye has noticed. He appreciates the MFSA’s swift response times and deals with a group of people at the regulator. Dormouse also files quarterly and annual returns with the NFA, as part of its CFTC registration.

Dormouse shares the widespread industry concern over the CFTC’s Regulation AT proposal. Having started his career as a UK Government statistician Coward is well aware of “potential for leakage of IP, particularly as people working for regulators may move to commercial enterprises.” Coward also questions whether regulators really have the resources to identify errors in source code, as this would be an extensive exercise that could require running programmes over multiple scenarios.

Vehicles

Dormouse’s investors are mainly institutional. The firm has used proprietary capital both to seed its two strategies and to provide working capital for the business. The Cayman vehicle will charge a management fee of 1%, below the 2% charged by many funds. It plans to offer reduced performance fees of 10% for a founder class, and will thereafter charge 20%. A Delaware feeder for onshore US investors might be added. Dormouse would not rule out customisation via managed accounts “but we would probably prefer not to as excluding any asset class, such as commodities or equities, could significantly reduce the opportunity set for a strategy that emphasises inter-relationships between asset classes,” Coward points out.

In addition to $50 million in the futures strategy, Dormouse has $30 million incubating a new strategy called ‘Hedgehog’, which is a flexible, long only asset allocation strategy that includes commodities and can go to cash. Hedgehog is to some extent intended to cater for the same types of investor mandates as the Bridgewater All Weather fund.

Unlike mice, hedgehogs hibernate in winter, and Dormouse’s erstwhile low profile may make it feel as if the firm has been hibernating for a few years. But the strong and lowly correlated performance profile suggests to us that Dormouse is forging a niche as a leading quantitative investment group spanning hedge funds and long only. The mouse may yet metamorphosise into a powerhouse.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical