There is a palpable uptick in investor demand for portfolios built on environmental, social and governance (ESG) issues. Today, over half of the world’s institutional assets under management ($59 trillion) incorporate ESG criteria in their portfolio or have pledged that they will incorporate ESG criteria in the near future – up 45% in the past four years. 72% of individual investors – especially next generation investors – believe that companies benefit when they focus on sustainability. In fact, multiple studies point out the clear connection between ESG and long-term Corporate Financial Performance (CFP).

However, the massive and steadily growing volume of ESG-related information presents a challenge. Manually reading and analysing volumes of ever-changing unstructured data sources continues to be extremely costly and slow, human analysts inevitably bring a subjective point of view to their undertaking. The methodologies used, analysis and recommendations typically lack transparency. Short-term volatility that significantly impacts a stock is missed using human only-based methods, or reporting happens long after the fact without any actionable or negative impact on the managed portfolio.

Until recently, no rating or ranking firm has tracked sustainability/ESG data in real-time using big data analytics, even though this is widely used in other arenas such as marketing and consumer understanding, business informatics and analytics, and internet search and recommendations.

Materiality drives performance

Paradoxically, even with the evolution of stock data from blackboards to real-time telemetry, the ability to actually find material information on environmental, social and corporate governance continuously in real-time has been slow to evolve.

Ambiguity, subjective perspectives, and phenomena such as confirmation bias, inherently prevent an objective and consistent approach to providing useful, timely information.

Rate The Raters Project commented in their report, Understanding the Universe of Corporate Sustainability Rankings, that all this activity and growth has created considerable confusion:

“There are a dizzying number and variety of external ratings, rankings, indices and awards that seek to measure corporate sustainability performance. Stakeholders of all kinds — investors, consumers, employees, etc. — are increasingly relying on these ratings to help inform their decisions (to invest, purchase, work, etc.). Companies also rely on such ratings to gauge and validate their own sustainability efforts, with some even linking management performance evaluation and compensation to external ratings. These ratings, therefore, must be robust, accurate and credible.”

To the words ‘robust, accurate and credible,’ this statement could also have included “materiality” and “tracking changes in real-time.” Current technology makes this possible.

Change the game: detecting dynamic sustainability signals

Artificial Intelligence (AI) and cognitive computing systems incorporate data mining, pattern recognition, and natural language processing to imitate how the human brain works – while working with massive data sets no human could grasp. Over the last decade, big data sustainability analytics and the applications to ESG of AI and cognitive computing have begun to augment human decision-making.

When “big data analytics” using cognitive computing are applied to sustainability and ESG analysis, it is possible to detect in real time dynamic sustainability signals impacting performance. Alpha potential inheres in such signals.

Access to real-time, material sustainability information enables a fund to respond to the growing demand for sustainable processes, products, and investment vehicles. On the investment side, portfolio managers and analysts can stay on top of current information more easily, and can track, quantify, and report on larger amounts of information. Investment product creators can assemble investment indexes, ETFs, and other vehicles to take better account of data-based dynamic sustainability signals (DSS) changes in the composition and weightings of those products. Long-term investors can track portfolio sustainability movements and scan the investment horizon for future sustainable investment prospects. Corporate governance monitors can similarly follow real-time events more easily, including both ongoing engagements and potential future engagement prospects.

When signal can be distinguished from noise information arriving at Internet speed, what was once opaque, qualitative and material ESG data can be more easily deciphered and used to separate stocks more likely to perform better over time.

A 2015 study Corporate Sustainability: First Evidence on Materiality by Mozaffar Khan, George Serafeim and Aaron Yoon of Harvard Business School found significant evidence that “…investments in material sustainability issues can be value-enhancing for shareholders while investments in immaterial sustainability issues have little positive or negative, if any, value implications.”

With so much data available for informed decision-making, investor expectations of fund managers are at an all time high. Defining ‘materiality’ as distinct from the more generically ‘important’ is especially critical for sustainability-oriented investors (large and small) in order to make a strong ‘business case’ for responsible investing. Yet what is important today, but not material, may become ‘material’ in the future, but that process is complex and the rate of this ‘materiality in process’ can vary significantly. It is nonetheless important to track. AI and cognitive computing is able to specify and analyse this process.

ESG going mainstream

Many leading asset anagers would probably agree that the cataclysmic event that brought ESG onto the main stage was the Volkswagen AG emissions cheating scandal that broke in September of 2015. While VW has been struck by corporate governance issues in the past, a scandal of this materiality and magnitude was not expected from an industry leading company. News that the Wolfsburg, Germany-based auto maker altered cars to pass emissions tests had a material impact on a variety of ESG performance vectors, including Product Integrity, Marketing, Corporate Governance and Environmental Performance.

From an ESG perspective, VW built product that does not adhere to various environmental guidelines, and the discovery that they concealed this information rocked and punished the stock.

In this case, quarterly or low frequency reports did not pick up any “Dieselgate” signals until well after the fact. Real-time sustainability data is what illuminated ESG issues as they were happening. AI and cognitive computing made material, relevant, and timely insights available to decision-makers at the speed of current events.

Volkswagen’s global diesel-emissions scandal continues to have repercussions for the company. On June 23, 2016, VW settled a $10 billion class-action suit which will be finalised by a federal court judge. As a result, Volkswagen AG will be remunerating owners of polluting diesel cars as well as funding an environmental remediation program to clean the environment.

As we put forth initially, there are indicators that could suggest a correlation between ESG performance and stock performance: the material elements of ESG contribute to and potentially could enhance returns. In fact, the act of disclosure itself contributes to the market looking favorably on a company’s performance.

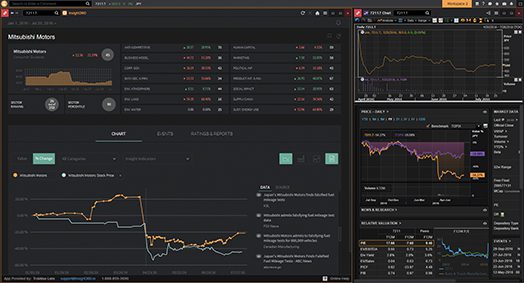

The orange line below shows the correlation between stock performance and real-time ESG in illuminating Volkswagen’s marketing, product integrity, corporate governance and environmental issues between June 2015 and June 2016.

It all comes back to performance

Unlike the older style ‘socially responsible investing’ that unilaterally avoids specific stock categories based on moral, ethical and/or political guidelines, study after study points out the clear connection between material ESG and long-term CFP. Big data analytics can contribute additional insights into patterns, providing fund managers with tools to understand and unearth ESG data previously unavailable.

While science-fiction portrayals of cognitive computing and artificial intelligence systems referto self-aware systems, in practice they augment human intelligence by helping to overcome cognitive biases, including how we approach ambiguity and our tendency towards confirmation bias.

The potential that new cognitive computing and AI technologies offer the hedge fund industry in tracking “real-time” corporate sustainability signals is profound. Cognitive computing systems provide a better understanding of hidden relationships, augmenting the ability to make better hypotheses and helping to inform better decision-making. Results prove that firms with good ratings on material sustainability issues significantly outperform firms with poor ratings on these issues. It is now possible to track signals of ESG materiality in real time.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 115

ESG And The Search For A Materiality-Based Alpha

Tracking sustainability and ESG signals in real time

HENDRIK BARTEL, GREG BALA AND JIM HAWLEY, TRUVALUE LABS

Originally published in the July | August 2016 issue