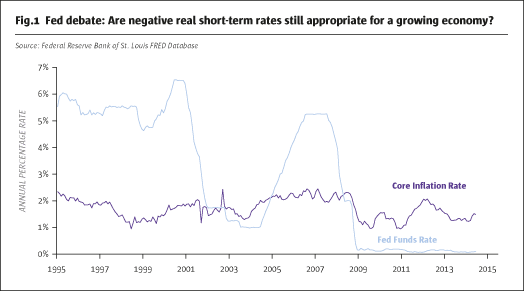

The European Union, European Central Bank (ECB), and International Monetary Fund (IMF) spent the first half of 2015 struggling over whether to allow Greece to default and possibly exit the euro, or to impose another round of austerity in return for more debt assistance. The austerity measures are severe, and if implemented as now planned, will almost certainly extract a high price from the Greek economy, potentially making it less able to service its debt in the future. Unless Greece gets some debt relief, as the IMF has advocated and Germany has resisted, we look for a much more difficult Greek crisis in 2017 or 2018. Also, the interest rate implications of the recent rounds of Greek debt negotiations for the ECB are that it will want to keep its low-rate policy on hold for a long time to come and continue its asset purchase program, meaning virtually no volatility in short-term euro Ibor. The results are a mixed picture for the euro and suggest that future euro strength will depend on more improved economic growth across the continent than on a change in ECB policy. (Fig.1 shows fluctuations in the euro).

Among the EU, IMF, and Greece, there is plenty of blame to go around for excesses of the past. Looking to the future, though, the Greek economy is in the midst of a depression that is already worse than the one experienced in the US in the 1930s. The cash flow of Greece is in no way able to service its mountain of debt to the EU, ECB, or IMF. Greece faces debt default or massive debt restructuring at some point.

So far, the EU has prevailed on Greece to adopt significantly more fiscal austerity in return for another massive increase in new debt. Despite posting a real GDP gain in Q2/2015, if Greece implements the new fiscal austerity then the economy may well suffer a further drop in real economic activity and be even less able to pay off the debt it already has, not to mention the additional debt that it will be provided. This means the EU deal will postpone the crisis until 2017 or 2018 when it will be much worse than the current episode, unless there is debt relief in the form of lower rates and extended maturities.

In terms of economic impact, the Greek economy has already been isolated from the rest of Europe, and makes up less than 2% of the eurozone GDP anyway. Equity markets from this round of the Greek tragedy came mostly from the uncertainty of how the crisis would be resolved.

The political side of the story is much more interesting. The challenge for European politicians, from German Chancellor Angela Merkel to French President Francois Hollande to the bureaucrats in Brussels and central bankers at the ECB, is how to handle the political fallout from taking huge losses on their loans to Greece. Since the shrunken Greek economy cannot generate enough cash flow for current debts, let alone more debt, the eventual question for EU governments and politicians is whether the debts will be extended, payments deferred, or written down. And, if the value of the debt is effectively reduced by some combination of debt relief, will taxes need to rise in Germany and France due to the losses? Or how will Germany and France’s credit rating be impacted? None of these are very attractive political outcomes. Hence, there has been a strong desire by European politicians, especially in Germany, to kick the can down the road, force more austerity on Greece, and postpone the next crisis until a new round of leadership in Europe takes over.

We note that debt default does not necessarily mean that Greece has to leave the single currency (Grexit), even though the issues are tightly linked. Eventually, there is likely to be a blame game to be played here, as to which institution would be the one to force a Greek exit from the euro. Currently, the IMF is the institution advising for a more realistic approach and recognizing that the Greek economy cannot sustain its current debt load, let alone a larger one. This stance from the IMF has not been welcomed by the EU, which prefers a rosy scenario and postponement of any crisis. This puts the ECB in an awkward position. The Greek banks are dependent, now and in the future, on the ECB’s provisions of liquidity to survive. If the ECB were to pull the plug, then a Grexit would be forced. The ECB, however, is likely to take its cues from the EU and Germany, rather than choose to be the institution that causes Greece to exit the euro. The sequel in 2017-2018 may be quite spectacular, and outdo the 2015 version, if Greece is not provided some debt relief between now and then.

For the ECB, the resolution of the current Greek crisis does not change the monetary policy outlook. Growth for the eurozone depends on encouraging more credit to be supplied, and that suggests no change in ECB short-term rate policy for a long time to come – meaning little to no volatility in euro Ibor even if European government bonds remain subject to sharp swings due in part to a lack of liquidity.

Interestingly, the euro was stronger during the crisis, then weakened a little afterwards, and is no clawing back some gains. The main reason for the short bout of weakness was that the way the Greek crisis was resolved suggested that the ECB would be on the hook for even more money to Greek banks and needed to maintain its QE program for a long time into the future. This put market attention back on the Federal Reserve’s likelihood of raising rates before the end of 2015, and resulted in a weaker euro against the US dollar when the current crisis was resolved. When the China currency devaluation broke, some analysts suggested the Fed might delay and this gave the euro a small boost. Down the line, whether the euro rises or falls against the US dollar probably depends as much on whether European economic growth starts to rise, as we think it will, or not. Stronger than expected (by the market) real GDP performance might well be enough to counter a 0.25% rise in US federal funds rates that has been exceptionally well telegraphed.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 106

Europe: Taking Stock after Greece’s Bailout

Why a lack of debt relief will cause another crisis

BLU PUTNAM, CHIEF ECONOMIST AND MANAGING DIRECTOR, CME GROUP

Originally published in the August 2015 issue