Market behaviour in June was arguably the most extreme we have seen so far in 2013. The two current dominant driving forces for world finance – Fed policy and Chinese economic data – both roiled markets during the month. Ben Bernanke’s speech on 22 May, and the subsequent Federal Open Market Committee (FOMC) statement released on 19 June, raised the possibility of tapering stimulus in the near future, which, despite being widely expected, served as a catalyst for much of the market activity during the month. This was exacerbated by a series of muted announcements from China – where growth prospects were reduced, inflation and industrial production both missed consensus expectations and the ruling party increasingly emphasised other social factors as being as important as headline economic growth.

The market reaction was material. US 10-year government bond rates widened from 2.13% to 2.49%, reaching a high of 2.61% mid-month (and all this after already widening by nearly 50bps in May). Equity indices sold off, more so in Europe than the US, as the S&P 500 Index returned -1.5%, the DAX -4.7% and the FTSE 100 -5.6%. Precious metals continued their recent slide, with the gold spot price down 12.3% during the month, taking the Q2 return to -23.4%, and the silver spot price down 11.7%.

In places, emerging markets equities were very ugly, with the Shanghai Composite down 14.0% and the Brazilian Bovespa -11.3%. The move in US government yield (forcing investors to re-price EM assets), fundamental worries and outflows all combined, resulting in the large magnitude of moves seen across both EM debt and equities. In addition the Shanghai interbank offered rate (SHIBOR) soared in June, as the People’s Bank of China (PBOC) refused to injectliquidity into a stressed interbank lending market. The rate peaked at 13.4% for an overnight loan on 20 June, corresponding with a -2.77% daily move in the Shanghai Composite Index. As a footnote, it is interesting to note that the Nikkei was largely flat on the month – all of the marginal sellers may have been pushed out of this market in April and May and therefore it is more resilient than it might have been earlier in the year.

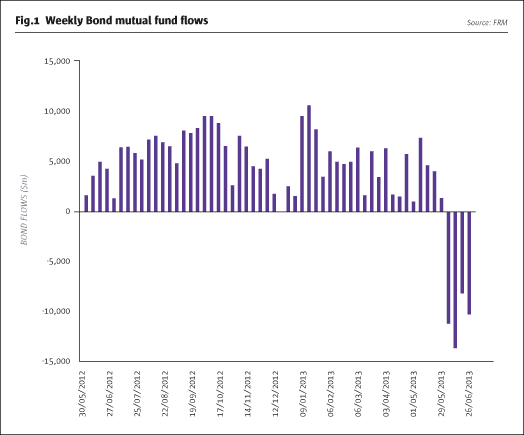

More than any other recent month, June felt like an inflection point in investor behaviour, particularly in government bonds. Overbought areas of the markets sold off the most as flows turned substantially negative after five years of almost monotonic inflows to mutual bond funds (see Fig.1). Technical pressures were also prevalent in the short end of the government bond yield curve. Whilst the long end of the yield curve is expected to be somewhat driven by investor flows, the short end is fundamentally anchored by interest rate decisions. It was therefore incongruous to see September 2014 Eurodollar futures at 99.25 on 24 June. Considering the yield curve as an indicator of expected future interest rates, this was effectively the market pricing in two base rate rises within the next 15 months – which is by no means the central case.

Looking forward, it feels that June might be a harbinger of a choppy summer for markets. The Fed should act as a dampening mechanism breaking trends as they start to develop – strong data could lead to stronger suggestions of tapering; whereas weak data could lead to a more supportive Fed. This situation was observed in the back end of June, as poor economic growth numbers (year-on-year nominal US GDP fell marginally, as did other country GDP measures) heralded a rise in global equity indices after a weak start to the month. We would therefore not be surprised by range-bound markets in the near term. Indeed, many analysts have commented that 10-year rates have a fundamental ceiling at 3% while interest rates remain close to zero. In other words it is improbable that the yield curve will be able to steepen significantly further, unless driven by a highly technical investor sell-off.

Europe continues to be a concern. Only US data is likely to affect actions taken by the Fed; it is therefore easy to envisage a scenario where US data remains strong. Fed talk of tapering is increased but this translates into market weakness in Europe (as foreshadowed by the underperformance of European indices in June). The recent apparent failure to find a consensus on banking union, combined with over-zealous regulation and austerity programmes, means that Europe remains mired in difficulty for the foreseeable future.

We also believe that there is further risk of dislocation in credit markets, which have been relatively unaffected by the recent shock. There remains a liquidity mismatch in much of the retail product sold on high-yield bonds, loans, RMBS, EM debt, etc. A widening government bond yield coupled with a widening spread can lead to material absolute losses in the credit complex, which could come under increased pressure if investor flows also turn negative here.

Hedge funds

Nearly every hedge fund manager we have spoken to over the past six months has highlighted the risk of a sell-off in rates, driven by the possibility of the removal of policy stimulus – a situation which partly played out in June. Despite knowing the source and shape of the risk, the hedge fund industry still lost money in June, as the HFRX Global Hedge Fund Index returned -1.3% during the month.

This only serves to highlight the difficulty of hedging against points of market inflection. Whilst some of the hedge fund index losses are attributable to beta (naïve hedge fund indices typically contain more equity market exposure than a well constructed portfolio of hedge funds), most of the losses can be attributed to a general worsening of the landscape for hedge fund alpha generation. Correlation between stocks and between assets increased back close to levels seen in 2012. While it would have been possible to hedge against the market direction risk (buying puts on equities or bonds), it is hard to avoid the manifold small losses associated with markets behaving less rationally. Lots of fundamentally sensible positions, constructed by excellent managers, lose money when markets become more correlated.

Market volumes have also reduced back to their 2012 levels. Many market participants reduced risk during June, and it is unlikely that this will significantly revert back to higher levels during the summer (traditionally a period of seasonally lower volumes). This leaves markets open to sharp rallies as short positioning can be more fragile in thin markets – which can make it harder for hedge fund managers to find short positions with conviction. Conversely, thin markets may also be more sensitive to fundamental data releases, leading to marginally higher volatility in the short term, which is broadly positive for hedge funds.

The worst-performing managers in June were macro specialists. Managed futures managers lost money in trend reversals in short-term rates, equities and FX, but made a little back on the continued sell-off in precious metals. With our expectation for the markets to be choppy, thin, and range-bound over summer, strategies that lean on price momentum to generate returns may struggle. Additionally, return generated from bond trading, often a significant contributor for managed futures managers, will be difficult to generate if the recent inflection persists.

The more discretionary global trading managers also had a difficult month in June. Whereas in May these managers appeared to be weathering the market moves well, June was much more reactive with managers reducing risk and unable to correctly position their portfolios. As a result, managers in commodities (aside from agricultural specialists, see below), emerging markets and FX appear to have lost money during June. It is, however, true that there remain large regional discrepancies, with divergent economic growth, and variations in central bank activity. In these conditions we would expect our discretionary macro managers to be able to generate profits, as these discrepancies are often most prevalent in interest rates and FX markets, two typical strengths of traditional macro managers.

Equity long/short managers were flat to slightly down on the month. As expected, longer-biased managers lost more than their market-neutral peers, but even those without explicit directional exposure struggled to add meaningful value as the conditions which contributed to alpha generation in the first five months of the year reversed. Correlations across regions noticeably picked up, as market volumes fell towards levels more congruent with 2012 than any period so far this year. Additionally, company-specific factors dropped away in June; with earnings season completed there were very few corporate results announced in June. This is a marginal factor but has been a good source of alpha over recent months. We expect these conditions to broadly remain unchanged over summer. We mentioned above that this is traditionally a period of lower equity market volume, and are therefore marginally less confident in our outlook for equity long/short managers.

Relative value managers appear to have emerged from June relatively unscathed. Statistical arbitrage managers made money in most areas, with the main detractors being momentum signals (there is speculation that losses by managed futures managers caused them to cut risk in unison, hurting any momentum signals across the quantitative finance landscape) and in Asian quant signals (which continue to give back some of their very strong returns from the start of 2013). Our conviction in this strategy remains high. These managers operate a repeatable process able to consistently deliver returns, helped by the lack of proprietary trading desk activity. However, we are wary that liquidity provision can become a dangerous game in certain conditions.

Elsewhere, many event arbitrage managers made profits from the Pfizer tender offer for shares in Zoetis, leading to a positive month despite the continued subdued M&A activity and marginal net negative equity beta. Managers in this space are adapting to the environment of subdued deal activity, with many managers now profiting from numerous other sources relating to corporate activity. Across the hedge fund universe risk levels have reduced slightly during June, both on a net and gross exposure basis. We expect to see managers remaining well hedged through the third quarter in light of potential market risks. These risks, together with the lower exposure levels, are consistent with our view that the next three months will present conditions far less conducive to return generation for the hedge fund industry as a whole. However, we should not have expected the very strong environment seen through the first five months of the year to continue ‘indefinitely’, and a few months of more challenging conditions should not greatly detract from 2013 hedge fund expected returns.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical