Earlier this year Garraway Financial Trends UCITS received The Hedge Fund Journal’s ‘UCITS Hedge’ award for best performing trend-following CTA under $100 million at the strategy level, based on its risk-adjusted returns in 2016. As at July 31st 2017 the strategy runs $32 million, and the fund has just passed its three-year anniversary since this new strategy was implemented, though lead portfolio manager, Darran Goodwin, has been developing managed futures strategies for nearly ten years.

Garraway was amongst the top performing systematic hedge fund strategies in absolute as well as risk-adjusted terms in 2016, a year when volatility around Brexit, Trump and other events wrong-footed some systematic and quantitative strategies (not to mention many discretionary macro traders). Garraway’s model latched onto some of the largest market moves. Goodwin likes to be transparent on performance attribution and the biggest contributors were trades that were long the Japanese Yen, short the British Pound, and long government bonds. The short British Pound positions could be perceived as basically Brexit trades but as a trend-follower, Garraway was not short of ‘cable’ – the British Pound versus the US dollar – going into Brexit. The strategy was however short the Pound against the Yen before the vote, which illustrates the benefits of Garraway’s selection of markets including ‘cross-rates’: trading non-USD currencies against one another, as well as versus the USD.

Indeed, its investment universe is one element that distinguishes Garraway from other CTAs. While some CTAs trade as many as 400 or more markets (or even 700 plus including synthetic markets such as spreads), Garraway in July 2017 is trading 36, carefully chosen, markets. What makes Garraway still more selective is that the strategy does not have positions in all markets at all times.

Commodities, the USD, and cross rates

No commodities are traded. Some UCITS do use instruments including notes, certificates, indices and swaps to obtain indirect exposure to commodities. Garraway interpreted the Central Bank of Ireland’s February 2013 ruling on ESMA’s 2012 guidance as too restrictive – for instance by limiting indices’ trading frequency to weekly – to permit continued trading of commodities in a manner consistent with its models.

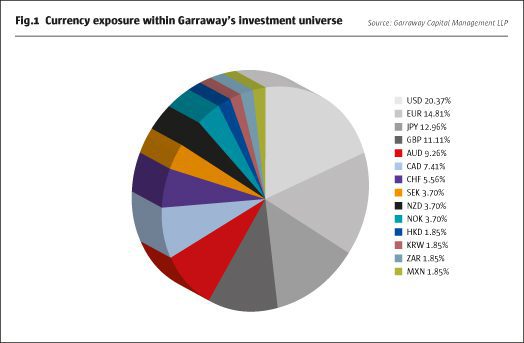

Goodwin’s decision to replace the commodity sleeve with cross exchange rates, as part of the new strategy, was also part of a wider project researching the numeraire of markets. Most investors look at markets in the currency they are customarily quoted in, but sometimes currency denominator moves can offset or outweigh those in the underlying market. The USD denomination of most futures contracts could mean that some strategies end up having more USD exposure than might be intentional, or optimal, from a diversification perspective. “Our original investment universe had 60% USD denomination, partly from commodities, and we decided to diversify horizontally rather than vertically,” says Goodwin. The portfolio’s USD exposure has been reduced to approximately 20%, with 15% in Euro, 13% in JPY and the balance in other currencies, as shown in Fig.1. “If we had remained 60% exposed to the USD it would have been a real headwind during most of 2016,” claims Goodwin.

Arguably, Garraway’s opportunistic exposure to certain currencies that are often dubbed ‘commodity currencies’ – namely the Norwegian Krone, Canadian Dollar and Australian Dollar – can provide a form of proxy for commodity exposure, as could equity indices in some of the same countries. If markets are thus converted into factor exposures then the exclusion of commodities starts to look potentially cosmetic. However, in practice, whether measured directly or indirectly, Garraway has less commodity exposure, and this is a deliberate source of differentiation. “Our path of travel is different as we do not trade commodities,” confirms Goodwin. The absence of direct commodity market exposure is one important reason for Garraway’s performance decoupling from that of other trend-following CTAs, over some periods. For instance, in late 2015 Garraway underperformed peers but in early 2016 the strategy avoided getting whipsawed by the violent rebound in commodities.

Equity and bond markets

Garraway’s choice of equity indices and bond markets is also designed to maintain effective diversification. “We do not trade the CAC or DAX as they would, to some extent, double count the EURO STOXX 50 exposure,” explains Goodwin. Similarly, in fixed income, Garraway prefers the ten-year maturity, because Goodwin claims that the limited choice of 30 year, 5 year and 2 year contracts (that trade on exchanges) would lead to additional US and German exposure. Garraway also avoids short-dated interest rate contracts because a meaningful position size in markets of miniscule volatility – like Eurodollar contracts – tends to entail huge notional exposures. Consequently, some funds do have prospectus leverage limits as high as 50,000% (or 500 times NAV), but Goodwin did not want to employ such a high leverage limit.

The relatively small number of markets traded does not always mean that Garraway is trading only the most easily accessible ones. Garraway’s investment universe includes Korean Government bonds thanks to prime broker Societe Generale International Limited (SGIL), which has been profiled in, and has received numerous awards from, The Hedge Fund Journal. Goodwin finds SGIL “a top quality FCM (Futures Commission Merchant). They can trade markets such as Korean Government bonds that many other brokers cannot access, giving us flexibility in what we can include in our investment universe.”

Selective and opportunistic

If some CTAs are always exposed to all markets traded, Garraway’s models are opportunistic in determining which markets to trade. On average, Garraway will have either long or short exposure in each of its markets around half the time and no position at other times. Sometimes, Garraway could be exposed to less than half of the markets it trades. At the end of July 2017, the strategy had five long equity index positions, three long currency positions vs the US Dollar, a number of short Japanese Yen positions in the FX Cross Rates sector, and two short positions in government bonds.

Garraway’s approach to sizing positions inversely to their recent volatility (so that a ten-year Gilt’s notional position size could typicallybe two to three times as big as a FTSE 100 trade) is quite typical of many CTAs, but Garraway’s approach to overall fund volatility is different. Some CTAs target a fairly constant level of volatility, or margin to equity, which in practice is usually highly correlated to volatility. Garraway’s model instead opportunistically varies levels of volatility around a longer-term target. The volatility target, over a rolling three-year lookback, started at 17.5% before being reduced to 15%, but can typically fluctuate between about 10% and 20%. Similarly, margin to equity can reach 20% but was only 8.07% as at the end of July 2017. (Goodwin favours targeting fund volatility over rolling three-years because he feels a shorter lookback could result in wider swings in exposure.)

Goodwin argues that this flexibility lets him accentuate the positive periods for trend following, because its profitability is correlated with its volatility. “Given the positively skewed return profile of trend-following, the strategy is most likely to be profitable when its volatility is at the higher end of the range. So capping volatility at a one year target would top slice the best returns,” he contends. Conversely, “if our volatility is realising at 10%, it probably means we are not making money so we would not want to ramp up exposure,” he explains.

One strategy and one time frame

While Garraway’s volatility fluctuates around its target, its average trade duration is steady at around 60 days. CTAs can be categorised into short term (intraday and days, to weeks), medium term (several months) and long term (three to six months or more) traders, while some of them trade over multiple time frames. Garraway sticks to one time frame within the medium-term bracket and does not use multiple lookbacks. “We could have diversified over time frames, but believe there would have been a compromise in risk adjusted returns,” claims Goodwin, citing simulated performance under different model parameters.

Pre-emptive profit-taking

Garraway’s strategy analyses volatility as it looks for markets moving into an ‘action’ phase and its cue to enter a trade in one fell swoop – with a full position size on day one, rather than scaling in. But Garraway’s route out of trades can be more gradual and more similar to some other CTAs: scaling out as volatility increases. “If individual market volatility doubles we will halve the position size. So, in the second week of January 2016, we had full short position sizes in every equity index we trade, but took off approximately half the notional as volatility on average about doubled. This turned out to be just before markets bounced,” recalls Goodwin. Some CTAs would maintain full exposure while other CTAs will, like Garraway, automatically lighten up exposure upon a spike in volatility but often for a different reason, because they are targeting relatively constant fund-level volatility.

Garraway’s potential to get out of trades before trends reverse means it can sometimes suffer less from trend reversals, but will also sometimes miss out on the full extent of moves. “We may not hit the big home runs in a year like 2014 when the USD and equities went up steadily in a straight line. We are sacrificing some of those potential returns to stay in the game during the more difficult periods,” reflects Goodwin.

Thus, Garraway might pre-emptively exit most of a trade before the trend reverses but would never trade against the prevailing trend, in contrast to some of those CTAs that employ sleeves of counter-trend or mean reversion models. Goodwin is of the opinion that adding lowly correlated strategies to reduce strategy volatility could be suboptimal, and does not use mean variance optimisation to determine allocations across strategies – because thereis of course only one strategy.

A basket of CTAs?

The diversification benefits – in terms of ‘crisis alpha’ and positive skewness – of adding CTAs to either conventional asset classes or portfolios of hedge fund strategies are well understood by professional investors. Allocators are also increasingly aware that investing in a basket of CTAs can bring additional diversification gains, as most CTAs are far from perfectly correlated. Garraway may offer particularly strong diversification benefits alongside certain CTAs. Goodwin can share analysis with potential investors and clients that shows how, over short to medium term periods of one or more months, Garraway’s return profile has sometimes moved in the opposite direction of some leading CTAs.

Ongoing charge ratios: Conundrums over costs

A debate continues over which fees, costs and other items should be included in headline figures for investment fund expenses, which items should be separately disclosed, and which might not be mentioned at all. The regulatory obligations are in a state of flux and guidance might have changed by the time you read this. The UK FCA regulator has in July 2017 determined that funds will be required to disclose an ‘all in’ figure, which will include brokerage commissions where these apply (but for some over the counter market the commission is in effect a part of the bid/offer spread). The precise contents of the FCA’s proposed ‘standardised cost template’ remain to be agreed however.

The debate touches on philosophical questions around what should be deemed a cost of investment and what is part of an investment strategy. Financing and interest related costs are a contentious item that do not normally form part of ongoing charge ratios, but where explicit and discrete charges can be identified, they can sometimes be ascertained from financial statements. Therefore, some allocators choose to use audit reports to calculate what may be perceived as a more holistic cost ratio. But in some cases, where futures, indices, swaps, certificates, notes or other instruments contain an embedded, or implicit, financing cost, this is not normally disaggregated for the purposes of calculating either ongoing charge ratios or casting financial statements. Goodwin is of the opinion that some UCITS structures involving some of these instruments might entail extra levels of costs. Some funds do disclose swap fees on their newsletters and elsewhere. But in other cases, Goodwin raises the possibility that these costs might only be ascertained through extra research if the counterparties in question are prepared to disclose them (which might also involve signing NDAs and suchlike). Goodwin believes that structures using a large number of instruments to trade individual commodities could also add significant costs, particularly where large notional long and short positions in indices are used to manufacture synthetic single markets.

Garraway’s December 2016 KIID shows a total expense ratio of 2.74% for the institutional Class A Shares, but would be much lower as at the end of July 2017 as the fund has more than doubled assets in the first half of 2017. Goodwin projects a ‘proforma’ TER of 1.30% for this share class at assets of $100 million. He asserts that “our strategy has no other costs associated with a TRS or the use of certificates, all costs are included in the TER.” Goodwin acknowledges that, in comparison to an offshore hedge fund structure, administration costs associated with a daily dealing UCITS may be higher, but investors do of course benefit from the liquidity of the UCITS structure.

Distribution strategy

Goodwin decided to go down the UCITS route because the original strategy was previously run in an offshore British Virgin Islands structure that did not appeal to the types of investors that he was in touch with. Garraway decided to launch its own UCITS umbrella, rather than partnering with one of the platforms, partly because they felt they had little appetite for a $10 million vehicle but also because Garraway wants to be in the driving seat of what is a rather distinctive distribution strategy.

“We want to have direct contact with our own customer base and not go through the marketing division of a bank,” Goodwin explains. Garraway has focused on a segment of the asset management market that is neglected by many hedge fund managers: UK wealth management platforms. One quirk of this market niche is that an ‘intermediary’ share class without equalisation is needed for administrative convenience (Garraway also has a more typical institutional share class that does include equalisation for those investing direct. No minimum ticket size applies to the intermediary share class via platforms, who act as aggregators so that Garraway only sees any net inflow or outflow on each dealing day. The fund is currently available on fifteen platforms (AJ Bell, Alliance Trust Savings, Ascentric, Aviva, Hargreaves Lansdown, James Hay, Novia UK, Novia Global, Nucleus Financial, Nexus Funds, Old Mutual Wealth, Raymond James, Seven Investment Management, Standard Life and Transact). Garraway is also on the verge of signing up a new partner, one of the largest UCITS distributors in Europe.

Why Garraway?

All of this might be too onerous for a two or three-person shop, but Garraway Financial Trends is one of three (and counting) strategies under the regulatory umbrella of London and Edinburgh-based Garraway Capital Management LLP, which surrounds Goodwin with a foundation of infrastructure and back and middle office support. “This means my focus is purely on running money and not spending time on running the firm,” Goodwin sums up. A strong business development team can cross-sell all strategies through all distribution channels. For now, the other strategies are the VT Garraway UK Equity Market Fund (a long-biased UK equity fund) and a UK long only segregated mandate.

The long-term Garraway vision is to offer a suite of strategies in different siloes. For the time being, UCITS is an appropriate structure but Garraway is also open minded about offering managed accounts, potentially for ESG mandates including Shariah investing.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical