Seeyond Volatility Alternative Income, which is part of Natixis affiliate Ostrum Asset Management (Ostrum AM), has received The Hedge Fund Journal’s UCITS Hedge 2024 award for best performing strategy over 10 years, ending in December 2023, in the Volatility Trading (Discretionary) category.

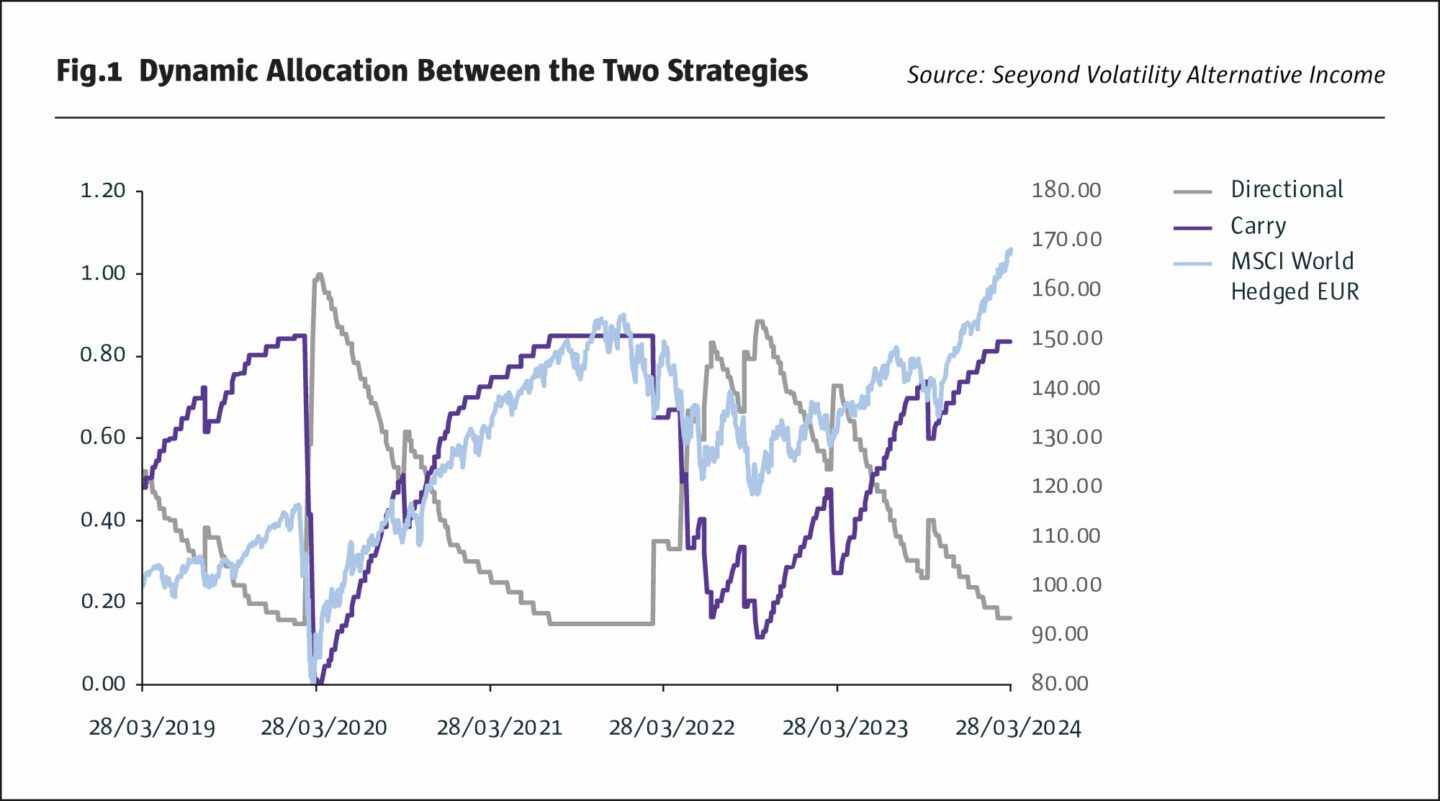

The “alternative income” name was conceived in the ZIRP era, but the strategy should now be perceived as volatility risk premium (VRP) and equity risk premium strategy, which is distinguished by trade types, global coverage, and somewhat contrarian risk management and rebalancing. It dynamically allocates between two complementary short volatility strategies: delta-hedged short strangles and short puts. Broadly, the strategy initiates or increases sales of puts after a shock, to increase directional equity exposure, but focuses more on harvesting the carry from the volatility risk premium in calmer conditions.

You need to be able to survive a crisis to add more risk during it. We sometimes need to win by not losing.

Simon Aninat, Lead Manager, Seeyond Volatility Alternative Income

Whereas most VRP strategies only trade US equity volatility, this strategy also trades it in Europe and Asia. Only exchange traded instruments are used and there is no OTC exposure.

While some VRP strategies maintain steady (or even procyclical) exposure to the VRP, this strategy’s models have a contrarian element by increasing overall risk exposure when implied volatility is higher. Some discretion to reduce risk has been helpful, for instance ahead of events such as the Volmageddon of 2018.

Volatility and quant expertise in Ostrum AM

Ostrum AM’s first volatility strategies were long volatility when lead manager Simon Aninat joined around 2011. Today, most of the circa EUR 1 billion in volatility strategies are in customized hedging mandates, including long volatility approaches and long equity strategies with option protection. Currently, the comingled UCITS is consistently short volatility, managing EUR 40 million evenly split between external capital and internal sub-allocations. Aninat oversees volatility, option trading and quantitative models, supported by another dedicated portfolio manager, and three implementation specialists covering regulation, risk, balance sheet and cash management, all belonging to a quant team of 15.

Simon Aninat, Lead Manager, Seeyond Volatility Alternative Income

The persistent VRP

The VRP endures due to the well documented behavioural finance phenomenon of loss aversion, which makes losses (roughly two times) more painful than gains of the same size, as well as various regulatory constraints. Taken together, these create more demand than supply for protection.

Taming the monster

The VRP, defined as the difference between 1-month implied volatility and the subsequent 1-month realized volatility, fluctuates over cycles, but overall has historically been somewhat more stable and persistent than the credit risk premium. “Yet it still has a fat left tail and black swan risk, blowing out to minus 65% in the month after Covid, when realized volatility of 90% was more than triple one-month implied volatility on 26 February. Therefore, an active and dynamic approach is needed to truncate the tails and create a more stable return profile,” says Aninat.

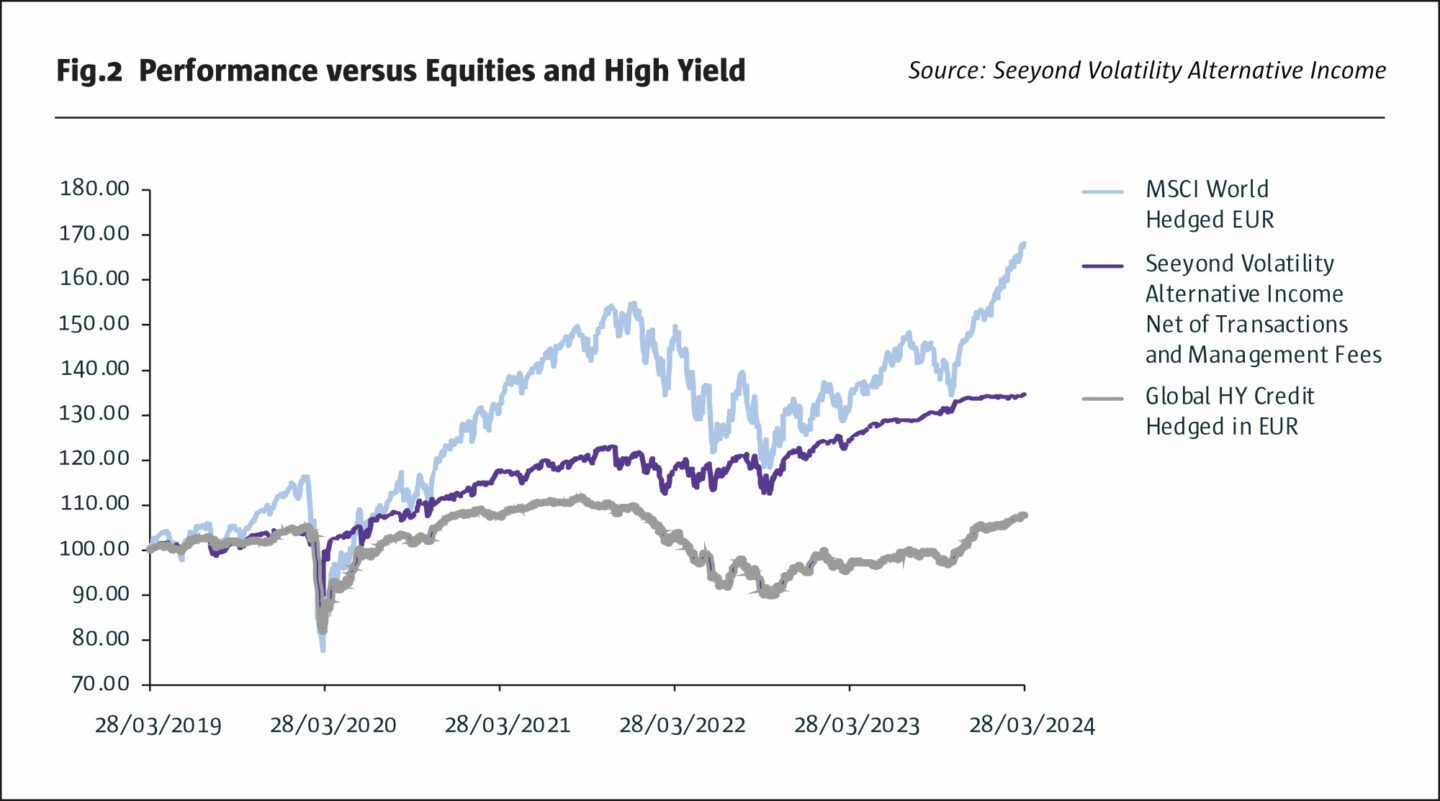

This active management helped this strategy to weather the Covid-19 crisis with a reasonable drawdown around -13% and still deliver circa 40% between December 2017 and February 2024.

Moderate equity beta, high yield return profile absent duration

Though this strategy does not trade high yield credit, the return profile has historically been more like high yield debt than equities, with smaller rallies and drawdowns than either high yield or equities and a return profile consistently between high yield and equities, but without the interest rate duration risk of high yield. The long-term average beta of 0.3 to 0.4 versus equities is typical for a short volatility strategy.

Rather than an absolute return target, this strategy has a total return target based mainly on the VRP, with some alpha from opportunistic directional put selling, and contrarian and tactical adjustments to risk exposure.

Cash booster to returns

The strategy runs no interest rate duration risk. Cash, managed by dedicated implementation specialists, is mainly in short term commercial paper and some money market funds (which are subject to Ostrum ESG exclusions). “This has to be very liquid and there is no tolerance for drawdowns,” says Aninat. ESTER of 3.9% is a good approximation of cash returns in March 2024, and a huge improvement on zero a few years ago, adding to returns.

Realistic Sharpe ratios through the cycle

“The base case Sharpe ratio target for a single risk premium strategy would be a modest 0.5, though we aim to beat this with no guarantee or promise. The base case would imply cash plus 2.5% for a 5% volatility target, though the latter was exceeded around Covid,” explains Aninat.

The live performance exceeded this objective with a Sharpe around 0.7 to 0.8, net of fees, since 2017. “The Covid-19 crisis wiped out so many short volatility strategies that most risk managers or regulators would not allow short volatility strategies. This created a higher VRP, which started to normalize in 2023,” explains Aninat.

Contrarian exposure

Whereas some VRP strategies increase leverage in a low volatility climate, to meet a return, this strategy is more contrarian in adding exposure upon a spike in volatility. Some strategies buy distant puts to hedge against crises, but Aninat is more inclined to reduce volatility selling in quiet markets and then add to short puts after a crisis, to capture a higher risk premium: “You need to be able to survive a crisis to add more risk during it. We sometimes need to win by not losing”. (Incidentally, exposure is not exactly leverage per se, but instead uses a proprietary “intensity” measure, because the risk of the delta hedged positions is lower, and can accommodate more notional exposure, than the opportunistic pure short puts.)

10yr

Seeyond received The Hedge Fund Journal’s UCITS Hedge 2024 award for best performing strategy over 10 years in the Volatility Trading (Discretionary) category.

Regime sensitivities

Beyond some contrarian exposure management, this strategy does not run a regime identification strategy as such. The opportunity set for the strategy can however be categorized into five regimes, of which two can overlap.

“The VRP was rich in a period such as 2022 after the invasion of Ukraine, when implied volatility stayed quite high. A post-recession recovery, such as April and May 2020 after Covid, can also be very good for the strategy. The lightning strike in a clear blue sky happened in February 2018, when the VIX blew up. At that time, volatility had been very low with the market melting up by 0.50% per day. The sudden shock then pushed the VIX up from 10 to 25, without any warning. An upwards shock occurred after the Covid vaccine in November 2020, and led to a massive one-day rally. A bear market regime saw equity markets drop 20% in 2022, or 50% peak to trough in 2020. A bull market regime can surprisingly lead to upside realized volatility exceeding implied volatility. If the market keeps rising 50-60-70 basis points a day and goes up 5-7% in a month, that is far more than suggested by implied volatility. A VIX of 9 as seen in 2017 means that a 5% monthly move is 3 to 4 standard deviations,” says Aninat, who senses something similar in February 2024 as well: a very strong equity rally well ahead of the shallow implied volatility, which usually implies that the market is overheating.

Delta hedged strangles

The intention is to isolate a pure VRP with minimal equity delta. Selling variance instruments could be used to the same end, but Aninat argues that “The implementation of short volatility through short variance swaps includes too much tail risk”.

Ostrum AM’s deep data dive showed that daily volatility was most overpriced, and therefore daily delta hedging of a strangle, using futures, is designed to monetize this daily risk premium, resetting deltas to zero at least daily. “ODTE options are not used due to their explosive gamma,” points out Aninat.

The strangle ratios are not adjusted for relative pricing of puts and calls. “We want a symmetrical convexity profile. Strangles are used rather than put spreads so that the gamma risk is symmetrical for upside and downside shocks,” explains Aninat. Gamma risk in either direction is higher after a crisis, but then this strategy is likely to have less, and sometimes no, exposure to it since the carry weighting is downsized in favour of the directional strategy.

Short puts

For simplicity, the delta hedged strangles are viewed as mainly generating a VRP, even if time lags between rebalancing the hedges can sometimes result in some degree of intraday directionality. Meanwhile the short puts are viewed as being mainly directional equity risk, even if they can also earn some degree of time decay and VRP.

The pure put selling strategy aims to capitalize on the tendency to ‘buy insurance after the house has burned down’. After the first leg down, investors rush to pay up for more expensive protection, which provides a good entry point for selling volatility.

Dynamic allocation between the two strategies

The strategy nearly always has exposure to both the VRP and ERP strategies but did briefly in March 2020 have 100% in the directional strategy, as shown on the chart. This was swiftly rotated back to the carry strategy. “After a big selloff, the first move is typically to increase directional exposure, and the second one is to expand carry,” says Aninat.

Correlation between the two strategies

The correlation between the two short volatility strategies is unsurprisingly usually in a positive range of 0.2 to 0.8 but has occasionally been near zero or negative. “The correlation can break down in a crisis at the peak of stress when a massive ‘upwards crash’ rebound leads the directional strategy to do very well, while carry could briefly suffer from realized volatility exceeding implied volatility,” points out Aninat.

Geographic diversity

In common with many volatility strategies, implementation is staggered to reduce timing and model risk, as well as pin risk and gamma risk. Trading UK, European, Japanese and Hong Kong volatility, as well as the US, adds some further diversification to returns, by diversifying timing and model risk. Though currency is hedged, additional diversification benefits partly come from second order currency effects. “For instance, currency strength can be an important driver for export-oriented equity markets including the UK and Japan,” says Aninat.

The usual split is 50% S&P 500, 20% Eurostoxx50, and the rest in UK, Japan and Hong Kong, broadly in line with market cap weights when the strategy was launched.

There will occasionally not be any exposure to an individual market, such as Japan in early 2024 after a strong bull run. The strategy can also make some tactical adjustments based on key events such as elections, central bank announcements and corporate results.

The two Asian markets only trade the opportunistic put strategy, because time zones would make daily and intraday delta hedging impractical.

Alpha attribution

Ostrum AM developed a proprietary aggregated measure of ‘beta to one year At-The-Money (ATM) implied volatility’, blending vega and delta, as most investors are more familiar with VIX and ATM volatilities than fixed strike vega and delta. “We called this proprietary measure ‘adjusted vega’. It helps investors to have an ex-ante estimated performance of the strategy. A -1% adjusted vega means the strategy should deliver +1% performance if the 1Y ATM volatility moves down by one volatility point, for e.g. from 19 to 18. Performance above this in-house beta is a kind of ‘alpha’,” says Aninat.

Tactical risk reduction

Discretionary decisions are made based on parameters outside the models. “Usually, we are comfortable with the model, and discretionary decisions would not be more than 10% of the risk budget, but at certain times discretionary decisions have cut model risk by 50%,” says Aninat.

Tactical discretionary risk management also, unusually, bought some puts in early 2018, which reduced losses around the Volmageddon event. “Just after we launched the strategy, there was a melt up rally from low levels, which felt unsustainable in an overheating market. We decided to buy downside protection in case of a sharp reversal, and absorbed part of the blow, saving a few percentage points of performance,” explains Aninat.

Tactical views would only be expressed on macro if there was a clear timeline for catalysts occurring within one month.

Macro outlook for volatility

Tactical discretionary management will not however reverse the return profile into long volatility, or short equities since there is a commitment to maintain a consistent style.

The strategy will be short volatility regardless of any fundamental macro views that the team may have. As of March 2024, Aninat believed equity volatility could carry on going lower, due to the internal sector dynamics of the US equity market. “There have repeatedly been battles between winners and losers from: Covid lockdowns and reopening, inflation and disinflation and from artificial intelligence. These create negative correlations within the equity market, which reduce index volatility even when single stock volatility often appears to be high,” explains Aninat. Of course, this outlook could change over time as this actively managed strategy will be constantly assessing the fundamental and technical drivers in the global equity volatility markets.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical