The senior management of Henderson Global Investors showed themselves to be capable of spotting an opportunity and taking it when they bought Gartmore in January 2011. Gartmore, which had listed in 2009, had been damaged by the suspension of leading portfolio manager Guillaume Rambourg in March 2010. Then the firm was commercially much reduced by the retirement of star hedge fund manager Roger Guy, Rambourg’s fund management partner. That was in early November 2010 – before the end of the month Gartmore had returned $4 billion of high-margin hedge fund capital from Capella and Tucana, two of the AlphaGen funds. It was holed below the waterline and needed rescuing.

The rescuers, Henderson Global Investors, had some experience of acquiring damaged asset management companies, having picked up New Star Asset Management not long before. Some fine judgements have to be made at the point of pitching an offer. “We had budgeted for losing 20% of the remaining assets under management,” discloses Henderson’s Chief Executive Andrew Formica. As investors ultimately withdrew a further 12% of the Gartmore AUM, the outcome was better than the bid tactic calculation, which meant the deal could be seen as constructive at an early stage. However the strategic logic of the deal went well beyond acquiring assets under management.

Andrew Formica lays out the case: “We were looking to rebalance the shape of the existing business. As it was, Henderson had strengths in the European markets and in UK retail. In the Gartmore acquisition we were getting a very, very loyal hedge fund client base, a distribution capability that was different to ours, a complementary product mix, and some first-class portfolio managers.”

The acquisition of Gartmore by Henderson was completed in April of 2011, and the rest of that year was about integrating the two companies. According to the Henderson CEO, this year has been a return to normality, in which there has been a period of letting people find their way within the organisation. He observes that the flow of information across the investment teams has been a demonstration that the integration has been a success on a professional-to-professional basis.

A key element in the success of the integration has been the choice of who assumes control when there was duplication of roles. Andrew Formica states there was a clear choice whenit came to appointing the overseer of the hedge fund management activity of the combined group. “The managers have total authority over their portfolios, just as they had before they came here. Gartmore had a good client support capability for their hedge fund clients so we kept that. And we wanted keep the ethos and culture of the hedge fund business of Gartmore. So it was an easy decision to make Paul Graham the Global Head of Hedge Funds across the combined group.”

Re-shaping the ranges and distribution

Paul Graham was headhunted to join Gartmore in late 2008 to oversee the hedge fund business, and with a view to improving penetration in the US. He had quite an impact on the Gartmore hedge fund range, and the effectiveness of that distribution.

“We have three contrarian bets on at the moment. Firstly, we have been bullish in European equities for most of 2012 and we think the best way to play this opportunity is through a long/short strategy on a variable net basis. Secondly, (and I appreciate that this will cause some raised eyebrows) we are big fans of Japan equity long/short, the situation and developments in Japan are very, very interesting to us, particularly as we are one of only a handful of survivors in the space. Thirdly, we also find the US market very exciting, particularly for nimble, concentrated strategies,” explains Graham.

Adding “While the hedge fund world seems to be focusing on macro factors, we focus on what we can control and therefore we remain fully committed to our deep fundamental company analysis which is in our DNA. Long term, I honestly believe that this will pay dividends”.

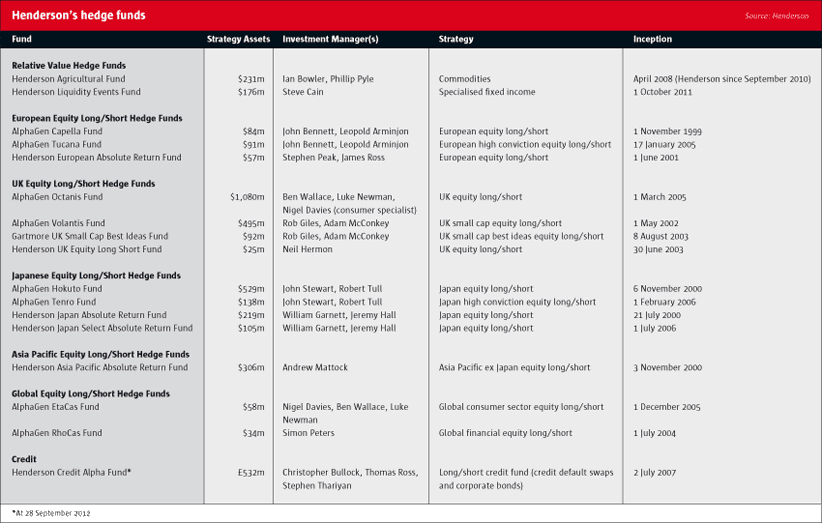

As a firm Gartmore had a broker-dealer license in Japan. The combined AlphaGen/Henderson has well over a billion dollars in long/short Japanese equity and the two entities had been there a long time, in Gartmore’s case since 1999. So Japan was a territory where it made sense to open an office to help build relationships for the long term. “Today we are pushing hard into the Japanese market again,” explains Graham. “We think equity long/short, whether domestic or global, is a sensible allocation for Japanese institutions. Japanese investors don’t typically like complicated strategies, and what we do is a good fit. It is a contrarian bet to commit to Japan – people have given up on Japan. But we want to do the ground work now to be ready for when Japanese investors do want to commit to hedge fund investing again.” That point is being reinforced at the moment, as a new CEO (Shiro Tsubota) has been appointed to take activities in that office forward.

A similar strategy has been adopted for Australia where Henderson has a stock market listing. “We have recently hired industry veteran Rob Adams to spearhead our investment management business in Australia. The development of a pure fund management business in Australia is part of Henderson’s strategy to grow its footprint in the Asia Pacific region, including China, Japan and Australia,” explains Graham. It helps that there are already two big clients of the AlphaGen range in Australia.

It is clear that Paul Graham is able to be decisive in managing hedge fund activities. A hard-nosed attitude prevailed when Graham took over management responsibility for the Henderson hedge funds in addition to the Gartmore hedge funds. “My first 12 months involved a lot of conversations along the lines of, “I’m sorry, but I’m putting you out of business”, to people running hedge funds at Henderson.” In fact, a number of them in the range were not true hedge funds, “They just weren’t a good flag bearer for the combined business. If the funds did not do well in 2008 specifically, a lot of hard questions had to be asked.”

So, for example, the concentrated version of the Henderson Asia Pacific Absolute Return Fund was closed, as was a currency strategy, a total return fund, Asia multi-strat fund, Europe Select, a European QIF, Acamar, Crucis, Regulus, Eltanin, Credit L/S, Global Macro and Aldebaran. Paul Graham’s analysis was that there were just too many funds when two ranges came together. “The environment had changed beyond recognition; as a firm with a multi-boutique model with many different strategies we needed to re-focus. I was concerned that we were trying to do too much and this is confusing. We were carrying a lot of fat post-2008, and this was compounded further by the acquisition. This meant directing all our efforts on our core strengths – namely teams and strategies where we have a distinct edge. These decisions are always tough to take. Handing cash back to investors comes at a cost but ultimately I had to think about the long-term success of the hedge fund business at Henderson”.

Graham had already taken difficult decisions in the aftermath of the credit crunch – Gartmore had not imposed gates during the period when many other funds had. The challenging part was sticking to that decision as the capital flowed out and the private equity owners of the firm queried the sanity of that decision. “That was a tough time,” confesses Graham. However, there was a medium-term benefit to the business. “We were rewarded for our good behaviour (in keeping to the stated liquidity terms of the funds). In March 2009 we received a large cheque from a new client, an American investing institution, and that was an early sign of what was to come,” says Graham. In 2009 investors asked themselves which funds performed well in 2008, and which firms behaved well towards their investors in the credit crunch. One of the firms which could answer positively to both points was Gartmore. “All our European-based investors came back to us, initially with smaller tickets. The same investors had been putting in $100m a month in 2007, so the flows from Europe were a fraction of what they were committing on a regular basis pre-credit crunch. The Americans were asking who the survivors in Europe were – and it was all about AlphaGen,” he states.

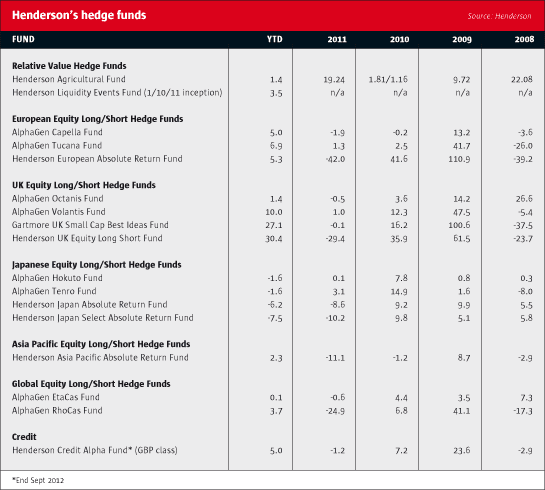

In 2009 Gartmore had told their client base that their fund managers saw a great environment for their hedge funds. The 2009 returns proved that to be the case – Tucana was up 41.7% in 2009, Volantis was up 47.5%, Octanis was up 14.2% (after being up 26% in 2008) and AlphaGen RhoCas was up 41.1%. Flows were excellent. By the first quarter of 2010 aggregated assets across the AlphaGen range were back to almost $9 billion. That is, Gartmore had taken in new capital for the hedge funds of $5 billion in a year, and the inflows for Gartmore had started six months before they did at the industry level. The firm seemed very well positioned for commercial lift-off, and then the Guillaume Rambourg suspension happened.

AlphaGen practices prevail

In management oversight of the combined Henderson absolute return funds and the (Gartmore) AlphaGen funds it is mostly the AlphaGen practices which prevail. An example is in risk management. “We imported all of the systems we used at Gartmore to run the combined hedge fund range,” says Paul Graham. Those systems in risk measurement terms are RiskMetrics and Imagine. The management processes using those systems are as they were at Gartmore. “The most significant development since the groups were combined has been the introduction of stress tests. The two risk managers for the hedge funds run 25 stress tests for each portfolio,” he expands. The risk managers identify the risk factors at play and share with the portfolio managers those they suspect are unintended risks – a recent example was a gold factor bet.

A consequence of putting together the hedge fund ranges of Gartmore and Henderson has been that between them they were served by seven prime brokers. Whilst that might seem like an awful lot of duplication, it does give some information advantages. Each prime broker provides stock borrowing information – their own colour and take on the availability of stocks, and the price of the borrowing by market, sector and stock. It is quite plausible that a major asset manager like Henderson, if they put the effort in to combine the inputs from the different sources (and they have), has more complete market information on shorting and borrowing than the intermediaries that execute it.

Another initiative in the area of risk measurement was to measure portfolio liquidity more effectively. As maybe 50% of trading in FTSE names is off-exchange it has become important for large asset managers to collect data on dark pool activity and crossing networks. This becomes particularly important in measuring market depth for small cap names, an area in which Henderson has particular expertise in the hedge fund format.

The risk managers meet with Paul Graham regularly to discuss the reports they generate on the range of funds. This meeting can last from 20 minutes to up to four hours. Once a month Graham and the hedge fund risk team meet with the portfolio managers of each fund and run through the risk reports. On the same frequency all the portfolio managers gather for the AlphaGen Short View meeting – including those in Japan and Singapore. In this meeting there is an exchange of views, and it is the forum in which managers can debate why they have opposing positions on the same stock or sector, as well as stimulate idea generation by discussion.

Click to enlarge

The next step

Henderson is close to implementing a significant strategic step in the development of its hedge fund business. And it is one that may surprise. Paul Graham is going to hire a US equity specialist to run a long/short fund. That has been done before by a London-based group – Threadneedle had a successful US equity hedge fund (managed by Mike Corcell) run from St Mary Axe in the City. However Henderson is going to hire a US-based manager to run US investments from over there.

The context is that Paul Graham has put a lot of emphasis on North America from the point of his arrival at Gartmore in April 2009. In his mind European investors in hedge funds were very damaged by the events around the credit crunch (Madoff, over-leverage, and structured hedge fund product as well as returns). US investors were less HNWI-related and were more of the endowment and pension plan type – and so were more likely to stick with their hedge fund investments.

This thinking led to appointing Bill Kelsey as the first hire for the AlphaGen part of Gartmore in the United States. Graham explains, “I had a very particular background in mind for the person to head our North American hedge fund effort. I did not want some flashy investment banker-type, nor did I want someone with a marketing-focused background. I was looking for someone with a hedge fund research background. Bill’s career included work at the MIT Endowment and he joined us from Cardano, the investment consultancy, where he was a long/short equity specialist.” The appointment said a lot about the target markets for AlphaGen under Graham’s command.

The initial experience of working for Gartmore was tough for Kelsey. “He signed his contract over a weekend, and Roger Guy resigned the following Monday,” says Paul Graham. “$4 billion left the business over the following four weeks, and Bill was wondering what he had done. However, I managed to persuade him that he should adopt a wait and see attitude: stay with it for six months, and see how we get on as a business without Roger Guy. To his credit he did just that, and he is still with us. He has been a great asset to us. For my part I try and spend 50% of my time on or in the United States trying to build up the business there with him. We have very deep business relationships in the US today and we want to build on them. That was all born out of that period in 2009 when we were about fostering relationships in America – demonstrating that we behave, that we are transparent and straight-forward.”

Since the initial hire of Bill Kelsey, who is based in Boston, Henderson have added several more staffers in that office, and there are more hires to come to support the hedge fund initiatives. Mark Toomey is there to deal with group institutional accounts. It is indicative that Toomey came from Morgan Stanley Investment Management and was previously with Fidelity Management Trust Company.

By now Graham can state confidently that American investors in hedge funds see the AlphaGen brand as very strong for European and Japan equity long/short. “When investors come over here, they come to see the big names – Lansdowne, Marshall Wace and us.” Graham explains, “North America is a tremendous commercial opportunity for us. A lot of my own career has been spent over there and I know it well. We’re going to add a good fundamental, focused equity long/short manager. I have spent 18 months looking for a team with the right attributes. I want guys with alpha generation capabilities on both sides of the balance sheet; good stock pickers, nothing too fancy. We don’t want someone that expresses complicated views on companies through complex derivative trades. We like managers that do a fundamental, deep-dive private equity-type analysis on companies. We’re after somebody that will give us exposures beyond Apple. There are 150 managers who own Apple. We are after a team that can differentiate themselves from the herd; a unique style and high conviction – someone who doesn’t go after crowded trades. Given how we see things, that sort of manager will make a lot of money for investors over the next five years.”

While many investors are deserting the equity long/short space in favour of macro, CTAs and credit, Paul Graham thinks that giving up on equity long/short altogether is the wrong call. “At the start of 2012 investors swapped their equity exposures for other non-equity and classic hedge strategies. Here we are at the end of the year and most equity long/short funds have produced decent risk-adjusted returns beyond expectations.” As stock dispersion improves, correlations break down and corporate balance sheets continue to improve equity long/short managers are expected to continue to find significant opportunities. “This is a slightly contrarian view, but manager talent will always shine through. We are particularly excited about Europe, Japan and North America on a risk-adjusted basis.”

Graham makes strong statements of intent. “We are going to do this properly by investing time and money in our expansion in the States. We absolutely intend to get this right, because this is a big move for us. Seventy percent of our investor base is now in the US.”

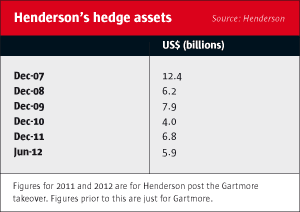

This geographical bias is a recent development for Henderson’s AlphaGen unit. The Gartmore book of hedge fund business was overwhelmingly European: in 2008 AlphaGen was $12 billion in total, of which $500m was US-sourced, and only $1.5 billion came from Asia. So AlphaGen under Henderson’s ownership has had to change to become more US-focused like the rest of the industry.

The addition of a North American equity capability will not just fill a space on an organogram. “I’m massively excited about this next step – it will be complementary to what we have, in terms of what we offer investors.” Paul Graham says that he has been looking for the right manager in the United States for 18 months. “We have considered managers with a significant sector bias. We want really experienced guys, though the track record is not considered the most important thing in the selection process. That means someone who has made their big mistakes already and learned from them. At the same time we don’t want somebody who has had a blow-up. They will have to bring with them a good framework for risk management.” He also needs to see particular personal attributes in the manager to fill the US equity long/short slot at Henderson. “I need to see someone who lives and breathes their fund – that is hard-working and ethical. To get the alignment of interests I’m after the manager coming in must have committed their own money to their fund. Skin in the game is the number one critical factor for me.” However there is a limit in the mind of Graham: “It is no good if the manager already has $150 million in the bank from previous success. They have to be like this organisation – still hungry.”

Graham is emphatic in stating that he thinks there is an over-emphasis on monthly NAVs amongst potential investors in hedge funds. “Eliminating a manager for consideration because they have a loss of 5% in a month is just crazy. I want to see conviction in a manager – yes, an understanding of the risks involved, but a willingness to say that they have done the fundamental work and will hold on to a position.” That is how to get the pay-off for the research effort expended, according to Graham. “Too many equity long/short guys are now wrapped up in the macro factors. Of course it’s important to understand all of this noise, but what real advantage do they have? A better angle on the fiscal cliff, oil prices or Greece? I don’t think so.”

There will be no investment input from Europe to the new team. But they will be brought into the Henderson AlphaGen risk management framework and infrastructure. So the managers can get support in legal and compliance and distribution, and that will enable them to concentrate solely on running the money. Paul Graham himself will oversee the on-boarding of the new US team by spending half of his time over there. It is hoped that the new team bring some marketers or investor relations professionals with them to expand the marketing capability for the whole of AlphaGen.

A positive 2013 environment

Andrew Formica, the Henderson Chief Executive, is very positive for the hedge funds of the firm for 2013. “We think we are positioned well for the kind of market environment we can forsee. I spend a lot of time talking to clients, and what they have been saying is that they have been holding back on commitments of fresh capital to Europe. In one extreme case, an American insurer with tens of billions of dollars committed to markets has absolutely nothing in Europe.” The expectation is that asset allocation changes and a change in risk attitude towards the Euro/European assets will cause a pronounced flow to this side of the pond.

Formica continues, “It might surprise some, but we think you are going to see a move from cash to equities. With low bond yields in the UK, the US and Continental Europe, and better value in European markets than elsewhere, the set-up is good. A lot of flows will be about filling the underweight in European stocks. The trigger could even be end-year reviews being conducted now and in the next month or two. But we are looking for a good equity investing environment and for a bit more dispersion within that. That is good market background for the kind of stock-picking skills we demonstrably have at Henderson.”

He discloses, “My discussions with clients reflect a change in demand from the pre-crash period. There is a lot of demand for cash-plus-type returns, even by retail and HNWIs. We may have to educate/persuade that client base that the solution is a hedge fund product, but that is our aim.”

The Henderson CEO has seen demand for a 6-7% yield from property investment amongst sophisticated investors, and he thinks that that demand can be met by some of the hedge funds the firm runs. He concludes, “The aversion to equities that has been quite pronounced in recent times will not last into next year, and we are ready for that.”

The absorption of Gartmore into Henderson was completed legally some time ago. In the period since completion the hedge fund professionals that came with the assets have settled in to their new surroundings on Bishopsgate and work well alongside the managers of the Henderson absolute range. There had to be pruning because of a duplication of people and products. But that is done. The next phase was about getting proactive and adding to the capabilities of the combined entity. Paul Graham has done that in adding to the distribution capabilities in the Far East, and to an extent in North America. The challenge now is to provide good domestic product for the American investors who have been warmed up by the building of relationships over the last few years.

Given the scale of opportunity in asset flows to hedge funds from American investing institutions, and the potential to build a US equity hedge fund product range with a variety of risk profiles it is no wonder there is a sense of excitement building under the AlphaGen name.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical