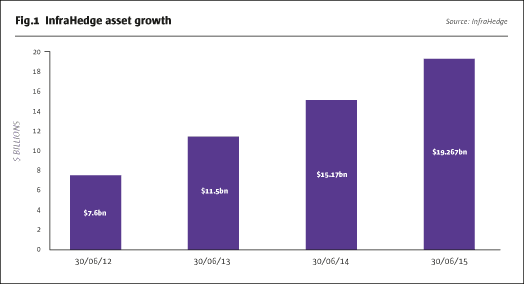

InfraHedge came to the managed account platform (MAP) world quite late, in 2011, but has more than made up for lost time. Within its first year it had more assets than most MAPs and by mid-2015 had already attracted $19 billion, as shown in Fig.1, over-taking the others to become the world’s largest MAP. This growth has not arisen from InfraHedge on-boarding and marketing fund managers as InfraHedge neither selects nor sells funds. The assets have come from large, sophisticated investors (including some other MAPs) that have chosen to partner with InfraHedge. The commitment to open architecture is impressive: one example is that InfraHedge sits inside State Street, which claims to be the largest administrator of alternative assets, but receives data feeds from more than 20 administrators selected by its clients.

Sponsored versus dedicated MAPs

MAPs can be categorized in various ways and InfraHedge divides them into two types. “We distinguish between dedicated and sponsored MAPs,” says senior managing director of State Street Alternative Investment Solutions, Effie Datson, who was selected as one of The Hedge Fund Journal’s Leading 50 Women in Hedge Funds 2015, in the survey supported by EY. The pure ‘sponsored’ model tends to be owned by asset managers or banks, contains some degree of asset management or manager selection, has a structure largely or entirely dictated by the sponsor, and is open to investment from all who meet eligible criteria. Examples could include two MAPs operated by Datson’s former firm, Deutsche Bank: Deutsche Liquid Alternatives and dbSelect, and two MAPs that have disclosed their relationship with InfraHedge: Milltrust International Group and Wilshire Funds Management.

A sponsored platform such as these, or advisers, are suitable for clients that need help with manager selection and due diligence: “We do not have a fiduciary license for giving investment advice in this business unit of State Street,” says Datson, though InfraHedge is authorized and regulated by the UK FCA.

In contrast, the pure ‘dedicated’ model is “fundamentally open architecture and built to specific end-investor requirements, including their choices of service providers and advisers,” explains Datson, who thinks BNY Mellon’s HedgeMark International LLC is probably closest to the InfraHedge business model; Man Group’smanaged account business, FRM, which set up a MAP for the Universities Superannuation Scheme (USS), may also have some overlap. Some MAPs may contain elements of both models – Lyxor, for instance, has set up MAPs for pension funds, such as PGGM of the Netherlands and CALSTRS of the US, and Amundi Alternative Investments also offers client-specific managed accounts or funds of one, while Guggenheim Fund Solutions operates its own investible platform as well as sitting behind UBP’s Alternative UCITS Platform. But InfraHedge is exclusively focused on the dedicated model. Other MAPs are only one of the large, sophisticated investors that InfraHedge caters for; pension funds, insurance companies, foundations, endowments, sovereign wealth funds, and large family offices also form part of the potential or actual client base. Only three clients (Milltrust, Wilshire and Nikko) are mentioned because the others have not given permission for their names to be disclosed. InfraHedge does not deal directly with retail investors, though some of its clients, such as Nikko, do offer retail products.

Indeed some ‘sponsored’ platforms act as aggregators, whereby a lower minimum ticket size allows smaller allocators to access certain managers that demand higher minimums for direct investment, and smaller investment advisers can also build more diversified portfolios in this way. But for InfraHedge, the bar is set quite high. Explains co-founder, and CEO of InfraHedge, Bruce Keith “You need critical mass to get the full benefits of your own structure,” and he reckons this equates to at least five to 10 managers. Given the various costs of running a dedicated vehicle, including administrators, auditors and directors, Keith thinks the entry level starts at $50 million for a simple strategy and perhaps $100 million or more for a complex strategy. If this is multiplied by five or 10 funds, we arrive at a sensible MAP level minimum of at least $250 to $500 million for InfraHedge. If the high minimums are not negotiable, almost everything else is.

Extensive open architecture menu

Maximum flexibility was embodied in the open architecture ethos from the beginning. “From the start, the business was organized around end investors and designed to be the optimal offering for them,” says Datson. For InfraHedge, customization means that asset owners have choice over all decisions – from selecting managers; to choosing jurisdictions, structures, legal frameworks, and investment guidelines; to selecting service providers including administrators, custodians, directors, and trading counterparties; deciding how the platform runs and operates, and how risk, analytics and reporting are delivered. Once the MAP is up and running, users will continue to make decisions on rebalancing, selection and de-selection of managers. Housing them all on one platform can speed up the process of dynamic portfolio management, although liquidity terms are for each client to decide.

Liquidity terms, and concomitant or other investment restrictions imposed by platforms, or those limits arising from certain regulated fund structures, can all be sources of tracking error between some MAP feeders and sibling or flagship funds pursuing similar strategies. But tracking error of InfraHedge MAP strategies versus fund structures has not been an issue so far, according to Datson. All of the relevant factors – as well as inflows and outflows – can be controlled by the client and InfraHedge does not impose any restrictions. No investment limits imposed on strategies, and nor is any uniform level of liquidity promised, by InfraHedge. Some clients could even choose longer lock-ups than apply to fund structures. If investors define constraints that may differ from those applying to other funds run by a manager, they should be making an informed choice.

Currently InfraHedge clients have chosen domiciles including Cayman, Luxembourg, Ireland and Delaware as well as some non-standard jurisdictions required by sovereign wealth funds that need to house funds in their home domicile. Meanwhile Nikko uses a trust structure for Japanese retail clients. Investment vehicles are also determined by client preferences. “The exact legal format varies a lot according to investor requirements,” says Datson. So vehicles can include UCITS, ’40 Act, Cayman offshore funds, funds of funds, sub-funds, funds of one, segregated accounts and segregated portfolio mandates. Adds Keith, “It can even be a custody account sitting on the balance sheet of asset owners.” Some types of managed accounts can fall outside the scope of AIFMD but so far Keith has found all of the onshore European structures have chosen to be AIMFD or UCITS compliant.

These investment structures can entail different models of governance, involving directors in some domiciles and/or depositaries or other service providers in others. InfraHedge has a board of directors, which is a standard company board for governance and strategic direction of the company but clients choose their own governance models for their own MAPs.

State Street or external service providers?

The balance between State Street and other service providers will vary, but State Street provides a core foundation of infrastructure services. “MAPs involve data, operations, accounting, control and assurance, operational oversight of collateral and margin, analytics, compliance, transparency and reporting.” Within this core blend, clients could pick and choose but would tend to use State Street as “the core MAP offering is not divisible,” says Datson.

Beyond that all bets are off and “we use the same operational infrastructure to deliver what the client wants,” says Keith. Datson notes that clients could select State Street (and its companies such as International Fund Services (IFS)) for functions including administrator; custodian; outsourced middle office (e.g., providing trade confirms and treasury functions); synthetic enhanced custody for stock borrowing; order management or trading operations.

The State Street custodian offering was pivotal for InfraHedge’s first client, emerging markets specialist Milltrust International Group. Says Simon Hopkins, CEO of Milltrust, “We have been committed to making this business an instrumental part of our offering since I first identified it and served as one of the first clients when it was adopted by State Street in 2012. The transparency, liquidity and safety afforded by the platform are perhaps more important in emerging markets than any other asset class with the exception of hedge funds, as these are markets where there is a lack of familiarity for international investors, and where a single custodial platform eliminates many of the risks that have held back increased institutional allocations.”

But a huge variety of service providers besides State Street are being used and Keith only recalls one occasion when he had to dissuade a client from using a provider that did not meet State Street’s operational risk criteria. There are 20 administrators, including State Street itself and some small and specialized ones. The number of ISDA and FCM counterparties, auditors and lawyers is even greater. There are, of course, sound reasons for clients to work with other firms. In contrast to some other service providers, State Street does not claim to be a “one-stop shop.” For instance in late 2014 State Street made a decision to exit OTC swap clearing, so clients that wish or need to clear swaps will work with other companies.

Analytics, risk, reporting and GIPS

Yet for risk and analytics systems the vast majority of clients choose to use truView, a versatile multi-asset class system developed by State Street. A few clients opt to supplement this with other systems, such as Sungard APT, but Keith admits that there are limits to how far the freedom of choice should be pushed in this area as “you may lose scale benefits with too many variants and then the ecosystem becomes more costly,” he says, and truView is a flexible system. InfraHedge’s Value at Risk methodologies include full revaluation, parametric, historic simulation and Monte Carlo and most clients are content with these. In contrast for leverage and liquidity metrics, different clients and managers use a wider variety of calculation methodologies that are more bespoke, including AIFMD leverage measures.

truView is also used for risk aggregation and State Street belongs to the working group for the Open Protocol Enabling Risk Aggregation (formerly known as OPERA) standards. InfraHedge’s daily analytics on exposures, correlations and so on are of most value for liquid assets that can be rebalanced often. Yet Keith finds some clients “want risk aggregation to cover their whole portfolio, including private equity and real estate” even though there is little point in putting physical assets, such as property, wine or art, into a managed account structure. Although illiquids do not sit inside InfraHedge, they can still be relevant from a reporting and portfolio context where clients want to see the full picture of private equity combined with long-only and fixed income assets. Asset classes on InfraHedge MAPs are mainly financial and mainly liquid – but not necessarily plain vanilla.

Indeed non-standard hedge fund portfolios are not a problem for InfraHedge: “It is helpful to sit on top of the largest administrator that can manage complex portfolios as we can use our in-house information on static data, valuation processes and procedures,” says Datson. For example, State Street has experience of valuing “level 3” or “marked-to-model” assets such as complex tranches of structured credit, where there can be substantial valuation subjectivity. This in-house know-how allows for cross-referencing, which Datson thinks is “an advantage over asset managers and banks that do not have this warehouse of data.”

On reporting, Keith claims that all of the InfraHedge MAPs use a Global Investment Performance Standards (GIPS) compliant performance methodology from the outset. “The whole ethos of the platform is oversight and a decision was made at the start,” he points out.

These well-developed risk and performance analytics are particularly useful for pension funds, which might need to invest considerable resources to replicate the frameworks in place at InfraHedge. State Street commissioned The Economist Intelligence Unit to interview 134 senior pensions executives from 15 countries, and the findings were presented in a report called “Pension Funds DIY: A Hands-on Future for Asset Owners” (later referred to as ‘the Pension Funds DIY survey’). It revealed that 58% of pension funds find it “a challenge to gain a complete picture of risk-adjusted performance” and more strikingly, only 18% “feel very confident that they have the operational infrastructure to respond to changing investment strategy and regulations.”

InfraHedge’s institutional DNA

These business challenges are encouraging many pension funds to set up MAPs with a range of providers. Keith is well aware that some other MAPs can offer varying degrees of customization, but he finds they will often be tied into certain counterparties or jurisdictions so might not match up to the length of the InfraHedge menu. Datson, too, accepts that there is a big overlap in the services offered by dedicated MAPs. “The differences are in the details, how does the interface look and feel, the risk systems, operational capabilities,” is her experience. Apart from possibly offering greater potential for customization, why might InfraHedge have grown so much faster than other MAPs?

InfraHedge has been advantaged by its corporate parent. “State Street is geared to large institutional clients so the existing client base is already the target audience,” says Datson, clearly hinting that State Street has had some success at cross-selling the InfraHedge offering. As well she argues that State Street “is accustomed to a business that operates at scale where all operations and technology need to be scalable so it can be priced competitively.” Datson further claims that InfraHedge is “far more cost effective than sponsored platforms.” The orders of magnitude that are palatable to large institutions do indeed seem to be tiny compared with the extra layer of fees (often at least 0.50%) levied by some sponsored MAPs. State Street cites a survey from CEM Benchmarking claiming that 19 large pension funds spent “on average 48 basis points on external fund management compared to eight basis points on internal investment capabilities.”

Keith regularly hears that pension funds want fees “as low as possible” and now even performance fees are up for debate. He suspects this has been sparked off by the shift into liquid alternatives where it can sometimes be difficult to charge a performance fee. As well as the level of fees, transparency over fees and costs are very much in focus. “Investors want absolute transparency on all fees – management fees, State Street fees, and other fees around the structure,” finds Keith, and imminent new MIFID rules in the EU will create a regulatory imperative for more granular disclosure. Pension Funds DIY: A Hands-In Future For Asset Owners (“the Survey”) reported that one pension fund “discovered that it was paying additional fees that were three to four times larger than the £70 million upfront fees.”

Cost control is one motive for pension funds bringing more asset management in-house and the Survey identified no less than 81% of pension funds surveyed “want to increase the proportion of their portfolio that is managed in-house.” But this need not always imply dis-intermediating asset managers – often the preferred model is a joint venture (JV), and the InfraHedge platform is well suited to customizing a JV, which need not always offer the lowest fees. The headline average figures for fees sound very low because the average is dragged down by passive mandates costing a single digit number of basis points. But the Survey identified that “innovative investment ideas will command a premium.”

Transparency and control

On top of cost management, pension funds perceive obtaining control of assets as one way to mitigate ‘agency risk’, or the possibility that their interests as principals deviate from the interests of their agents, the asset managers. The Survey showed no less than 52% “find it difficult to ensure that their asset manager’s interests are aligned with their own.” Transparency is one ingredient of alignment. Explains Datson “There is an increased requirement and desire for deeper and more timely understanding of portfolios by institutional investors, as part of the demand for governance and oversight.” The Survey found that “more than half of respondents view strengthening their governance as a high priority for the next three years.”

She adds “this involves immense amounts of data collected on a daily basis, which we make operational and useful for the end investor.” Using the raw data constructively is more of an operational than an IT challenge, according to Keith. Granted, basic IT is needed for data warehousing, feeds and analytics, but Keith argues that the real value added comes from the operational processes that InfraHedge has developed. “Our systems flag up risk limits and style drifts, in areas such as collateral, margin and cash, and then the investigative process of following up and closing down any breaches is really important,” explains Keith. The message is that transparency alone is of little value without control and “we know what levers to pull and when,” he adds.

But human intervention is generally only needed to remedy any failings. “The system was architected to function on an exceptions basis and to be highly automated,” says Datson. It generates alerts for breaks, duplicates, stale prices or other data gaps or errors, as well as counterparty exposures. These dashboards can be easily viewed through portals and mobile devices. “This gives comfort in strong oversight and governance and improves the quality of conversations with managers,” adds Datson.

This transparency is well geared to the evolving regulatory climate. “Control and transparency is helpful for meeting MIFID standards,” explains Keith. Managed accounts offering full, position level, transparency are one way to get the ‘look through’ that is required. MIFID rules taking effect in 2016 will demand transparency on fees at every level of a structure, while greater transparency and netting can also reduce capital requirements under Solvency II.

Dedicated MAPs in their infancy

Given the manifest benefits of MAPs, Datson and Keith are surprised that MAPs still make up what is probably a single-digit percentage of overall hedge fund industry assets, of $3 trillion and counting. In fact headline figures for hedge fund MAP assets may even overstate the total. Keith accepts that league tables of managed account assets contain some element of ‘double counting’ because some MAPs, including InfraHedge, are providing ‘white label’ infrastructure for other MAPs – and both sets of MAPs include the same assets in their headline figures. Keith suggests that it would be useful for a survey to distinguish between dedicated, and sponsored, platform assets.

But InfraHedge does expect MAPs to grow market share over time, enthuses Datson, who was hired in May 2015 to ramp up InfraHedge’s institutional marketing drive. She expects the market will gradually be drawn to the bespoke MAP model and views it as superior to either sponsored or DIY platforms – and also better than comingled vehicles, where there are still concerns over governance issues.

MAP asset growth may have historically been subdued, as InfraHedge’s business model is in its infancy. Datson claims the option of a bespoke managed account, with full transparency and control, simply did not exist before. “Five years ago large allocators had two options. Go onto another platform where somebody else picks the funds, or go down the DIY route.” But building your own MAP is a big exercise: “We assembled a team of experts and spent years on preparation, and even then the launch took about nine months of graft entailing a double-digit number of man-years,” recalls Keith.

The process of building fresh MAPs for new clients is, however, getting easier. Datson is pleased to report that lead times are falling off as “we learn as we go along and develop the expertize. An asset owner lacking our five years’ of expertize would not be able to replicate it at a good price as tasks such as harmonizing and reconciling the data are a challenge for newcomers,” in her opinion.

Keith recognizes that not everyone can go down the bespoke route, as only large and sophisticated investors can realistically meet the ticket sizes. Still, asset management industry consolidation is showing no signs of abating, and this increases average ticket sizes, bringing dedicated MAPs within the size budget of more allocators. InfraHedge has a strong pipeline of clients coming on-board over 2015 and 2016.

The expansion might not come from the most obvious places. Asia makes up a much smaller percentage of global hedge fund industry assets than do the US or Europe, but for InfraHedge’s business, Asia has been a key driver of growth. In contrast to the UK’s very fragmented pension fund market, Asia is a good fit for the InfraHedge offering due to its smaller number of heavyweight investors. Asia houses many large and sophisticated asset owners. “Some of them have been in hedge funds for many years and some are new to the game, but all are looking at best practices,” says Keith.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical