Nick Vasserman, who featured in The Hedge Fund Journal’s 2021 “Tomorrow’s Titans” report, founded Integrated Portfolio Intelligence (IPI) in 2019. IPI is currently offering the IPI global strategy (previously described as a cross asset macro and commodities program) as well as two standalone investment programs that form part of the global strategy. The first is the G10 Quant Macro strategy which is essentially a carve out of the global program and has been running in parallel since the firm started. “This is now available as a standalone following discussion with investors and investment consultants as there are fewer such dedicated investment alternatives in the marketplace after the exit of high-profile European names in the space (such as IPM and ADG). The strategy is not correlated to common trend following, it focuses on liquid macro markets and does not contain commodities that are typically a separate allocation,” says Vasserman. The second is the new Carbon Alpha strategy that is discussed here and has been included in IPI global since April 2022.

The carbon strategy trades various carbon markets, and builds on Vasserman’s more than 25 years of experience managing systematic fundamental macro and commodity strategies, mainly at UBS Investment Bank and JP Morgan Americas.

The long/short carbon strategy is returns-oriented and not intended to be a pure ESG or impact strategy per se, though it can make a positive contribution by adding structure, liquidity and transparency to existing and emerging carbon markets – and by educating the wider investment community about measuring, mitigating and adapting to carbon transition. Institutional investors are paying more attention not only to their own carbon footprints, but also to how carbon and decarbonization affects financial markets in general, and commodities in particular. Longer-term it seems reasonable to predict bearish trends for fossil fuels and more bullish moves for the metals that will power electrification. But these megatrends are far too long term to inform a tactical strategy that is aiming to deliver consistent risk-adjusted returns in a climate like 2022 when many fossil fuels are surging ahead.

The primary attraction of carbon is its alpha potential in emerging and relatively inefficient markets. Analysing and trading carbon markets can employ some concepts that are somewhat analogous to traditional commodity and macro markets, but it also requires a considerable amount of novel and lateral insights and models. The IPI edge in carbon is derived from building on an existing investment process, technology and models integrated with new carbon intensity and other environmental models that have been developed internally and in conjunction with industry partners such as JPMCC (JP Morgan Centre for Commodifies) and data providers such as S&P Global.

Russian invasion reaction

The carbon market reaction to Russia’s invasion of Ukraine shows how different it is. “Whereas energy and other commodities rallied, carbon emissions had a pullback, which was partly down to the political backlash against energy transition, and partly due to elevated investor positioning after the 2021 price rises. Our models identified key trigger levels for long liquidations, and moved into a neutral to bearish stance,” says Vasserman.

“Demand does have a direct correlation with economic growth, but it is also influenced by the carbon intensity of that growth... analysis needs to be granular enough to drill down to industries and jurisdictions.”

Nick Vasserman, Founder, Integrated Portfolio Intelligence (IPI)

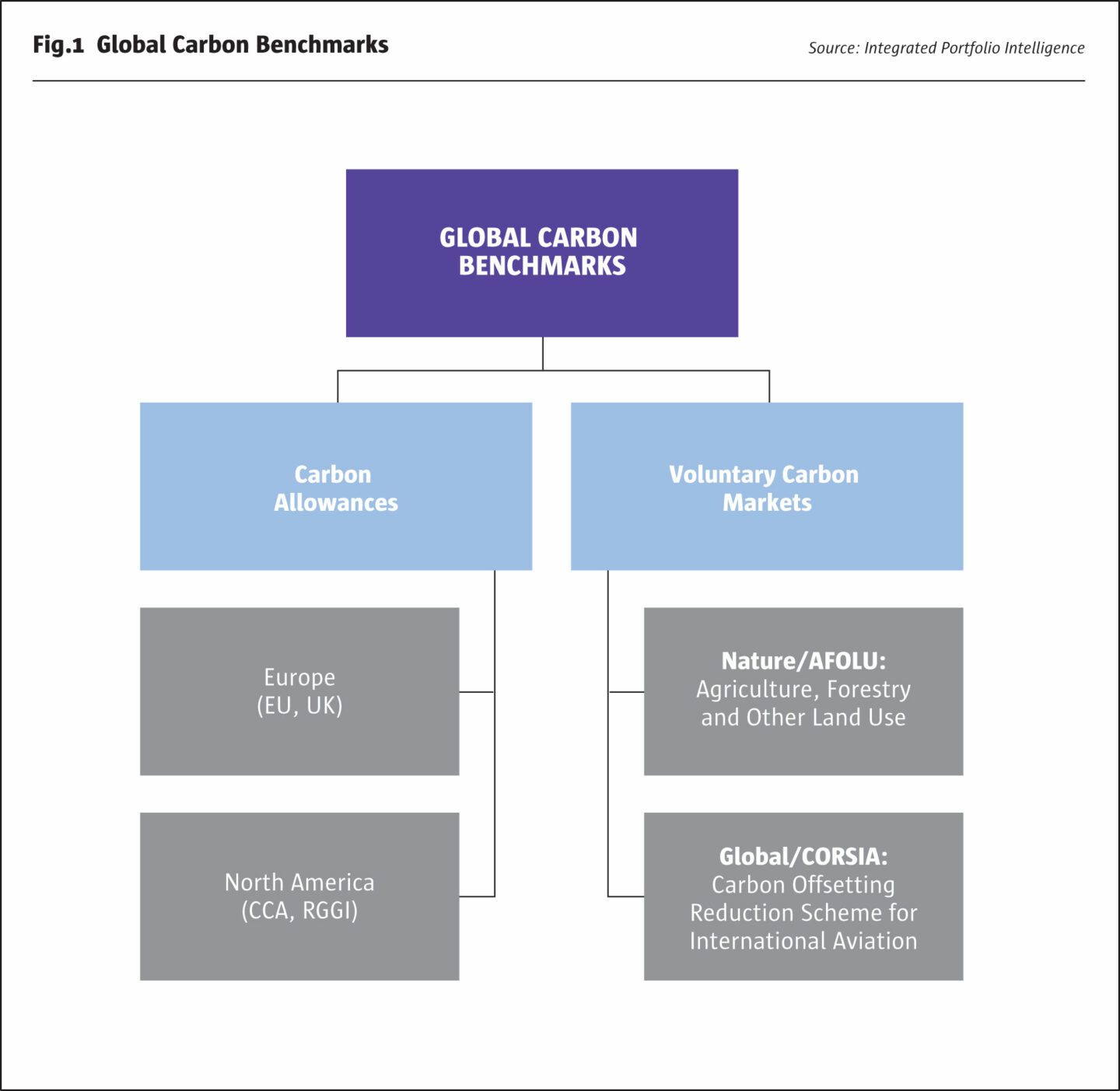

Local and global, mature and nascent, markets

Carbon markets are an intricate tapestry of compulsory public compliance markets, voluntary private markets (voluntary carbon markets or VCMs) and associated offset technology and projects. Some of them are local or regional markets covering the UK, EU, US or US states, while others can be globally fungible, but only to the extent that various offsets or projects satisfy the relevant criteria. Markets vary in their degree of maturity and sophistication: “The oldest compliance markets – EEA in Europe and CCA in California – now have a mature term structure including options and volatility. In contrast, the UK and REGGI US markets are less widely traded while VCMs are undergoing the most material transformations in liquidity and pricing,” says Vasserman.

Data quality and fundamental analysis are early stage

Carbon instruments are disparate. More broadly, carbon market analysis within wider financial markets is inconsistent or incomplete because the measurement of carbon emissions intensities and understating of fundamental carbon valuations is still in its infancy. “Most companies report only “Scope 1” emissions from their direct manufacturing and “Scope 2” from their energy use, even though “Scope 3” from their supplier and buyer chains are orders of magnitude greater for nearly all industries bar utilities and airlines. Further, very little attention is paid to broader macro emissions dynamics across entire industries and geographies,” points out Vasserman.

The Carbon Alpha investment approach cannot completely transplant models from systematic macro. Data automation is a work in progress, which is internationally less advanced than in traditional systematic macro, because there is not a long enough data history for back-testing. “Many institutions have not yet developed analytics, and the carbon supply/demand balances involve different analytics to mature commodity markets. We are tactically navigating a unique energy and technology transition with no comparable historical precedent in modern financial markets. Hence, we rely on a disciplined investment process, incremental model deployment framework and technological infrastructure,” says Vasserman.

Dynamic opportunities

Though Vasserman is constructive on long run appreciation for carbon, he expects that, “The market will exhibit persistent volatility in a multi-speed world presenting IPI with attractive tactical opportunities. As different countries are at different economic development stages, they are expected to tactically manage sovereign energy security and geopolitical priorities alongside decarbonization objectives causing a great deal of regulatory uncertainty that will be further compounded by unforeseen political considerations and technological developments. Therefore, a dynamic medium frequency (typically to 3 months) investment approach is preferred”.

Directional and relative value

Carbon Alpha trade types blend directional and various relative value approaches. “The strategy is unbiased and could be market neutral, net long or even net short although this is not anticipated to be very common. We expect to most often be broadly neutral or mildly long of carbon,” says Vasserman. “Relative value (RV) trades include geographic cross-market spreads, spreads between different types of offsets and calendar spreads within a single market. These new markets can be less efficient potentially resulting in material pricing dislocations, especially for term structure. Seasonality factors are important for term structure analysis, along with a range of other proprietary models and attributes, such as the underlying pool of deliverable projects.”

Variable patterns of correlations

RV trades heed the fact that dynamic patterns of correlations within carbon markets, and between them and financial markets, have not been stable. “Investor behaviour and calendar effects can lead to spikes in correlation,” says Vasserman.

Correlations vary between the specific markets. “The California contract, covering power generation and industry, can be lowly correlated with the North East US contract, which only covers power generation. In the short term these are very different markets, with different participants and liquidity profiles, and different fundamental drivers,” says Vasserman.

The different allowance and offset programs have multi-faceted features, including their trading or credit mechanisms; targeted emissions reduction; method of allocation; coverage; offset criteria, and compliance routines – and all these elements can be updated at regular intervals. For instance, the EU has accelerated reduction targets, increased the proportion of credits auctioned, allowed for some intervention, and proposed expanding market coverage, among many other mooted changes.

The Carbon Alpha strategy could express views on both convergence and divergence between the various markets: “We expect that growing liquidity should reduce correlations, and we are already seeing lower correlations between categories of offset projects such as nature and technology,” notes Vasserman.

Markets to trade and markets to monitor

The strategy trades across six liquid exchange listed markets for now, in the US, EU and UK, which also make up its proprietary index published on Bloomberg (ticker C02INDX). The six are: EUA, EUK, CCA and RGGI emissions listed on ICE, and S&P GSCI N-GEO and GEO VCMs listed on CME.

Physical markets, and new environmental markets, such as Renewable Energy Credits in various US regions, Methane Performance Certificates, and various OTC markets, feed into the analysis of fundamental supply and demand linkages in different markets, but are not currently traded.

In broad brush terms, IPI estimate that the overall carbon market could grow as large as the global industrial metals market.

Fuzzy forecasting of technology and regulation

A wide range of long-term forecasts for carbon prices is apparent, because they depend on a range of assumptions and scenarios for governments and industry. “They are sensitive to the balances struck between energy security and transition. There is also political uncertainty about which political parties might accelerate or decelerate carbon transition,” says Vasserman.

Vasserman does feel confident in predicting that, “The transition will be non-linear and path dependent, with spikes, regimes, and shifts as regulatory policies are redesigned”. He judges that regulation and technology overall are more important than the debates around discount rates.

Technological advance, and its interplay with regulation, is an important uncertainty because a sudden breakthrough, such as commercially viable hydrogen powered steel or technologically feasible

hydrogen fuelled aviation, could materially impact demand for certain carbon allowances and offsets, as could advances in carbon capture: “The progress of carbon storage and suppression technology, and renewables, are key assumptions underlying forecasts. We expect that the term structure may not be efficient at factoring in technological advances, and this could provide consistent opportunities for the Carbon Alpha strategy,” says Vasserman.

IPI has built its own energy transition scenarios out to 2050, which reflect the wide range of potential outcomes by including conservative, intermediate and aggressive scenarios: “They are based on multiple different data sources and benchmarks, rather than any single dimensional view,” says Vasserman.

Demand side analytics factors

There is some commonality with commodity markets on the demand side: “Electricity prices and weather are important observations for compliance markets. Demand side factors include global economic activity, emissions intensities, availability of renewables, increased investor participation and importantly regulation,” says Vasserman.

It could be dangerous to oversimplify carbon to a GDP proxy: “Demand does have a direct correlation with economic growth, but it is also influenced by the carbon intensity of that growth, which varies between geographies, supply chains and life cycles. Freak events such as Covid lockdowns can clearly reduce industrial and transport related demand. Analysis needs to be granular enough to drill down to industries and jurisdictions,” says Vasserman.

Analytical themes on the demand side include power generation transition, transport transition, agriculture and forestry, and manufacturing trends. “Weather analysis is more about avoiding a disadvantage than obtaining a real advantage,” says Vasserman.

Diverse investment groups and strategies contribute market liquidity and tactical opportunities

The first buyers of carbon products were industrial end users who actually need to buy the allowances or offsets. Now the non-compliance investor base is broadening out. The proliferation of investor categories adds complexity to the demand analysis as well as new trading opportunities: “It has included mainly trend following CTAs and some discretionary funds for some years. It now includes congestion and ESG impact investors and passive investors into ETFs. We have noticed some crowding of trend following investors in the compliance markets, where investors became a large part of volumes by February and March. We have also observed investors pursuing congestion strategies,” says Vasserman. He reckons that investors trading congestion in commodities are likely to increasingly do the same in carbon markets, though with some tweaks and quirks: “Rolls tend to be annual and over multiple days rather than monthly over a short window. A more stable contango means that traditional carry trading does not work well”.

Supply side regulation, nowcasting and regulation

The supply side is uniquely determined by regulation, which can be completely redesigned and modified changing the supply-demand balances of compliance markets. Vasserman’s team is closely monitoring developments in multiple jurisdictions. “Regulations cannot be systematically modelled in a quantamental framework, but given the transparency of the regulatory, political and legal process and associated timelines, they can be nowcasted, or contemporaneously forecasted. The IPI process closely monitors scheduled regulatory events, tracks key individuals, and takes a broad macro view across sectors. Supply diminishes by design, which creates unique implications for the term structure, which we expect will remain upward sloping – in contango,” says Vasserman.

Equally, politicians in general, and populists in particular, could be a source of volatility. Vasserman expects that other groups of investors are likely to over-react or under-react to regulatory and political changes, which can spark off substantial short-term volatility and relative market dislocations.

Carbon related global macro

The strategy could at some stage spawn carbon-inspired macro. There is already enough data to make some tentative predictions about how commodity markets may evolve. Many commodity markets are traditionally characterized as globally homogeneous, but carbon analysis, as well as wars, sanctions and counter-sanctions, could start to change this. “The same commodity has very different carbon intensity depending on its geography. US onshore fracking versus the Gulf of Mexico, or US soybeans versus Brazilian production that requires deforestation, have different carbon footprints that are not reflected in pricing differentials today. Global macro valuations are evolving and will soon incorporate and properly capture carbon factors in addition to conventional economic variables,” says Vasserman. Possible trade ideas might include shorting certain livestock markets, which are a significant source of global emissions.

The costs of any carbon allowances could also vary between geographies, which means that the global trade rules need to allow for tariffs to eliminate potential regulatory arbitrage – and the EU already has such rules in the pipeline. In this respect, carbon regulation could be another force for deglobalization.

VCM growth potential

In broad brush terms, IPI estimate that the overall carbon market could grow as large as the global industrial metals market, even though it might not grow as big as the energy market is today. IPI determined a hard Carbon Alpha strategy capacity limit that is based on market liquidity parameters for IPI’s dynamic investment framework.

Over the next 5 years Vasserman sees most market growth potential in the VCM market, which now includes at least three broad categories, and will be listed on at least three exchanges: CME, ICE and NODAL/EEX, as well as off-exchange liquidity from OTC lookalikes and new venues coming on stream. “We expect to see new VCM liquidity venues launched in North America, Canada, South Korea, Australia, and possibly also Japan and China. Meanwhile, eligible offsets could come from anywhere, including popular emerging and frontier markets such as Kenya and Indonesia,” says Vasserman.

Forecasts for offset prices range between increases of factor 3 to factor 5 out to 2040, implying a nominal compound annual growth rate between 7% and 9%, which is not far from equity returns. “Our approach is to probability-adjust different scenarios but we do expect that carbon could outperform many projections, though there are big uncertainties over technology, regulation and the importance given to decarbonization vs. energy security risks,” says Vasserman.

Voluntary carbon market opportunities

Some segments of the carbon market are highly heterogeneous: “In voluntary carbon markets there is no standard set of accounting rules, as for finance. The quality and transparency of individual projects will vary, and would require very careful due diligence. We invest in derivatives-based benchmarks and not individual physical projects for fear of write offs, which could be caused by fraud or simply failing to meet the evolving criteria for a desirable offset vehicle. This is no different from equities, where a single firm value can go to zero, but an entire index is unlikely to,” explains Vasserman.

Though offsets and projects are not directly traded, they are analytically very important for VCM market analysis. Analytically, Carbon Alpha is drawing an analogy with the cheapest to deliver (CTD) analytics in futures markets and expects that benchmarks should converge towards the CTD deliverable project prices, though Vasserman sees different opinions on what constitutes the CTD: “At this stage there is substantial market inefficiency due to lack of standardization and consensus on how to evaluate projects and quantify different attributes and features”. Extensive due diligence data rooms – online libraries of documents and files – containing dozens of verification and monitoring statements and reports, are used to help ascertain if a project is eligible. It is not straightforward to gauge whether a project will meet the deliverable criteria for a futures contract and if so in what quantity (measured in CO2 metric ton equivalents per year). In the short term this is another source of investment opportunities for the Carbon Alpha strategy though Vasserman expects that improving global standards should make this more predictable and transparent over time.

Credits can be for reduction/avoidance, or removal of carbon, and each type can be nature-based or technology-based. Vasserman expects that removal credits should command a premium over reduction credits under normal market conditions.

Analysis of offsets and projects is also germane to term structure and associated calendar spread trading.

Balancing beta and alpha to achieve a long carbon bias

The default option is to just invest in the dynamic long/short strategy, but IPI’s global carbon beta index, weighted by open interest, could be used for a pure beta product or a hybrid alpha and beta mix. Investors can tailor their own blend of beta, alpha, and associated tracking error. This is most relevant for investors who wish to introduce a long bias in their carbon portfolio rather than a pure absolute return long/short profile. The beta index also defines an objective performance benchmark, which IPI aims to outperform though its tactical trading.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical