In 1999 “the idea was to create an independent and global asset management firm,” recalls partner and general manager Fabio Bariletti – “a company without any conflict of interests, completely aligned with investors”. Hence Kairos only focuses on absolute return, whether mandates are long/short or long only. The Kairos ethos is to generate active alpha – there is no place at the firm for passive investment or benchmark hugging, says partner and portfolio manager Michele Gesualdi. The owner-managed company has always been a partnership with ownership widely distributed among its managers. And the focus of staff and resources is on managing money and not on distribution, as Kairos always felt confident that assets would naturally follow performance. The priority from the very start was developing an institutional-quality platform in every way, rather than building another distribution powerhouse. Kairos raised its current $7 billion of assets thanks to its performance, reputation and mostly from word of mouth, while developing an institutional profile over the last 14 years.

Of course Kairos has not hesitated to invest in hiring and retaining great analysts. The founders are proud that they are not the only people who have been there since inception – analysts have also been happy to grow with the company, helping to keep staff turnover low. Kairos is also running very successful single-manager funds, but the growth and outstanding reputation of its multi-manager business is what this feature investigates. Its three founders all came from Citco, where “we were a key part of the team that ran multi-manager business,” says partner and portfolio manager Stefano Prosperi. The trio have worked together with Kairos since the start in 1999. Although they may technically have different titles, in practice their roles have often been interchangeable, as all three have been immersed in the business. Citco’s fund of funds was in New York, where Kairos retains a core presence, because it is crucial to be close to the pulse of manager talent. A hectic schedule of manager meetings has always been vital for Kairos to keep pace with hedge funds.

Research, then, is the lifeblood of the multi-manager business, just as it is for the single-manager range. Kairos invests primarily in portfoliomanager and analyst talent – “then the distribution looks after itself,” says Prosperi. Analysts who were junior once are now senior and the flat, non-hierarchical structure lets everyone make a real contribution from the start. “The biggest mistake is to compromise on people,” says Bariletti, who values the strong culture of mutual trust within the firm. The incentive structure of this business model is simple: rewards are driven by performance as opposed to asset gathering. Therefore, Kairos has no desire to hire a large team of marketers, and would prefer to tie up with other firms that need quality products to put meat onto their distribution skeletons. “The research emphasis is also a function of the client base,” explains Gesualdi, who points out that most Kairos investors are high-net-worth individuals, pension funds, endowments, and now also sovereign wealth funds. Although Kairos has been a great trail-blazer in the UCITS space, the retail mass market is not where assets come from. The UCITS venture for Kairos is just a way to express their research in a regulated format, which is very important for a certain set of clients. Having been the first company to launch an absolute return multi-manager UCITS business, this has then created an advantage in terms of visibility for the firm.

“Glocal” globetrotters

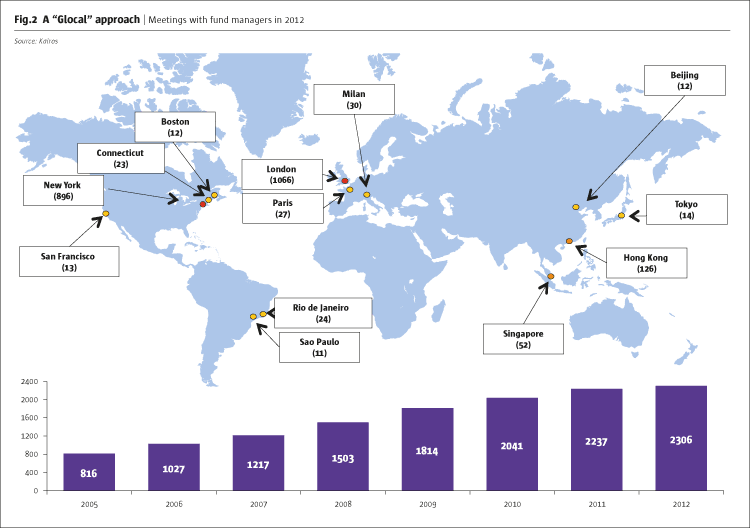

Face to face meetings, at managers’ offices, are an indispensable part of the talent-scouting and monitoring processes: Kairos is global but also very local when it comes to due diligence. “The ones with grey hair get in front of the most important managers,” says Prosperi. The team are constantly travelling with their analysts to New York, London and Asia. The advent of teleconferencing and videoconferencing is no substitute for meetings in person. “You don’t see the body language and reactions of people,” says Prosperi, who also adds that office visits are essential to check out operational routines, day-to-day interaction between key people, soundness of the infrastracture and long-term sustainability of the set-up. “So many things cannot be captured on a conference call,” Bariletti adds, and Kairos is particularly wary of over-confident managers. The firm clocks up as many as 2,300 meetings in a year which, according to a recent survey prepared by a leading prime broker, is about 10 times the average of its competitors. Kairos staffers spend plenty of time traipsing through airports, and by recalling the famous HSBC series of airport advertisements, Prosperi highlights how an image or a word can have completely different meanings in different countries and cultures. “We go to Hong Kong, Sao Paolo, Beijing, San Francisco and Tokyo,” says Bariletti, “because we want to get the full picture and uncover managers not known by peers, and because we think that local managers always have a strong advantage compared to global funds that are managed out of, say, London or New York.”

CLICK IMAGE TO ENLARGE

Small is beautiful – for funds and fees

Kairos seeks out emerging talent and thinks its portfolios have very little overlap with those of larger funds of funds or the majority of the large institutions. Whereas many allocators focus on the big, easy and perceived-to-be safer bets, Kairos will go for smaller funds with an institutional infrastructure. Smaller funds need not imply smaller firms; the median fund size in Kairos fund of funds is $400 million but the median firm size is between $5 billion and $10 billion. The majority of Kairos performance has been generated from funds below $500 million of assets or less than three years old.

The sweet spot can often be a new fund housed by a larger group. This provides the best of both worlds – the infrastructure of a larger organisation with the entrepreneurial hunger, nimbleness and flexibility of an emerging fund. Kairos does not take pure start-up risk and is not investing in ventures with two people, a dog and a Bloomberg terminal in somebody’s attic. The vast amount of contacts and experience accumulated by the team over the last 20 years comes in handy here: their collective Rolodex of knowledge makes it much easier to remember who the real key risk-takers were at other funds, and CVs can be easily validated through a populated list of proprietary references. This corporate memory must be gargantuan when Kairos aims to see each and every new hedge fund launched. Proprietary trading records, however, are seldom seen as a sound basis for investment, unless Kairos feels they have some informational edge in ascertaining who produced the performance. Even then, Kairos is concerned that “the numbers might have come from advantages that cannot be exploited outside the bank, such as sight of order flow,” says Gesualdi. Generally the early-stage managers sought by Kairos need to have a publicly available performance record.

As an early investor in new funds, Kairos is often in a strong position to negotiate fee discounts: currently in their funds they pay an average aggregated fee of 1.1% management and 11.8% performance for hedge fund portfolios, and an even more impressive 0.9% and 9.5% for the UCITS absolute return-focused mandates. Kairos frequently also secures Most Favoured Nation (MFN) clauses, which ensure that managers cannot offer anyone else lower fees without extending the same terms to Kairos. Capacity agreements are another benefit that Kairos seeks out from smaller funds.

Liquidity and transparency paramount

Yet verifiable performance is only the beginning of due diligence, which also entails background checks. Material and ongoing co-investment from managers is non-negotiable, and managers must also promise not to divest their own investments before Kairos does so: the philosophy of alignment of interests permeates the way Kairos selects funds. In all areas Kairos holds managers to the same high standards that apply within Kairos itself. The firm has always spent significant amounts of time on operational due diligence and never compromised strict rules, which naturally include independent valuation of funds. These criteria have allowed them not only to avoid frauds such as Madoff – which immediately failed their ODD process – but also to avoid liquidity bottlenecks. Kairos takes pride in its zero fraud record, and in never having side-pocketed, suspended dealing or suspended NAV calculation in any of its funds. Redemption requests were promptly met in 2008. Kairos have always respected liquidity and stood aside from some of the most fashionable strategies in 2006 and 2007 which involved less liquid credit and equity-related investments. Regulation D, or private investments in public equity (PIPEs) are off limits. “Accepting any degree of illiquidity is not in our DNA,” says Michele Gesualdi. Risk management teams of managers need to be every bit as independent as Kairos’s own risk team are.

The risk team of five have always had a power of veto, even if this has never had to be exercised, and two of them are fully devoted to the fund of funds. The risk gatekeepers thoroughly review liquidity of funds, using holdings data obtained from independent sources such as the administrator. The risk team can at any time alert Kairos to red flags on exposures, breaches of mandates and so on. All of the standard analytics on gross and net exposure, correlation, value at risk, and so on are calculated.

Kairos’s funds have been primarily invested in liquid equity long/short, credit long/short, and event-driven strategies, with opportunistic excursions into CTAs and macro. The team need full transparency to crunch the numbers and monitor constantly risk exposure at an aggregate level. Heavily leveraged strategies are also echewed; Kairos would not allocate to funds using substantial leverage, which is likely to rule out some funds in the mortgage and fixed income arbitrage space. “Kairos prefers to avoid the types of negatively skewed strategies that make a steady 1% per month followed by a 30% sudden and unexpected fall,” says Prosperi.

Performance

Kairos always tried to be innovative, having offered managed accounts and bespoke solutions to pension funds for many years. Kairos also launched the first fund of UCITS absolute funds. Not only does the flagship multi-strategy boast one of the longest track records, it is also one of the strongest. The fund made more in 2009 than it lost in 2008. “Not many funds of funds can say that investors who came on board in early 2008 were above the high-water mark by the end of 2009 – and even fewer rivals can say that they had not imposed gates or issued side pockets,” Bariletti stresses. Moreover, in the transient fund of funds subculture, few competitors display the continuity in terms of team people and style.

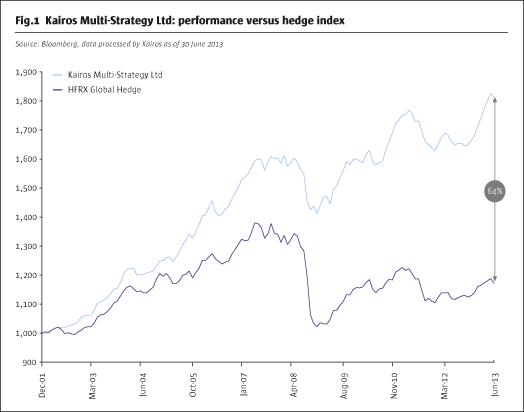

Kairos highlights that most of their returns have been driven by alpha generation. Since January 2002 the flagship Kairos Multi-Strategy Ltd fund has returned approximately 85%, some 64% ahead of the HFRX Global hedge fund index. This result has been achieved with a contained net exposure and a low volatility of around 4%. The correlation characteristics are also interesting in light of the 2013 bond sell-off: correlations have been negative to bonds, and positive to equities. “We are often considered a call option on equity or to put it in more simple terms the optimal way to gain exposure to the equity markets, maintaining the volatility profile of a fixed income instrument,” adds Prosperi.

Active asset allocation

That Kairos actively manage the portfolio does not mean that they trade funds. Where Kairos may be much faster than some competitors is the due diligence process: typically taking between six and 12 weeks, Kairos can swiftly allocate to new funds and strategies. Each month they review the portfolio to ensure it is what would be constructed afresh today. This process of re-examining the rationale for choices “is designed to reduce the chances of falling in love with funds,” reflects Prosperi.

Kairos are dynamic in their approach to asset allocation, and constantly re-adjust positions as their views on the market change. “We started 2013 with some net long exposure to US equities as the firm had a constructive view on the US economy,” Bariletti explains.

In contrast, the less efficient European equity markets were seen as a richer source of alpha, so in these markets Kairos preferred to emphasise more gross exposure but a limited net stance. ”We form our top-down views speaking with managers globally and also discussing our opinions with our strategist, but the bottom-up process, and therefore the ability to find interesting unexploited managers, ultimately drives our asset allocation,” summarises Prosperi.

Lately Kairos has made some sound asset allocation calls. The team was early in starting to scale back credit exposure in 2012 and this caution helped to limit the effect of the correction of mid-2013. By the end of last year Kairos only had credit exposure in one very specific area: bank loans. Analysis suggested that bank loans were anomalously priced: offering the same yield as high-yield debt, even though loans sit above bonds in the capital structure. On top of the superior seniority, loans pay coupons based on floating interest rates, avoiding the vulnerability to rising rates that has hurt high-yield bonds.

That said, Kairos has no aversion to high-yield debt at the right price. The retracement of credit spreads is now encouraging Kairos to start slowly scaling back into selected high-yield and emerging debt. At the beginning of the spring of this year the exposure to CTAs was brought down to zero as the team anticipated a less favourable environment for these strategies, thus avoiding the negative contribution that many portfolios suffered in the last few months.

Japan is another area that may be increased. Recently the team revisited Tokyo, an inefficient equity market they have followed since 2000. “The explosion of both liquidity and volatility in Japanese equities improves the opportunity set,” Prosperi argues. The dominance of retail investors creates extra opportunities as the Japanese love trading. This market is a haven for the few active mangers remaining. When we spoke, Kairos was in the process of deciding which Japan long/short managers to increase.

Premier league partners

The word Kairos in Greek means “an opportune moment” and that would seem to encapsulate the views of two top-tier institutions that have recently made different types of commitment to Kairos. The joint venture with Julius Baer bears witness to the pedigree of partner that Kairos is able to attract. Julius Baer is Switzerland’s third-largest bank and took a 19.9% stake in Kairos, which in turn took over 100% of Julius Baer’s Italian private clients operations. The conservatively run banking group is financially very sound with a tier one capital ratio of 23%, at the top of the Basel league tables. That Kairos satisfied Julius Baer’s demanding due diligence marks a strong stamp of approval. The Kairos Julius Baer venture involves the development of the wealth management business at Kairos – a leading player in this field in Italy.

Meanwhile on the investment side, Kairos won a mandate from one of the biggest sovereign wealth funds (SWFs) in the world, once again passing through a rigorous due diligence process. So, in just over 10 years, Kairos has overtaken many longer established businesses – and the omens are that the Kairos star is rising.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical