The Pegasus is a flying horse from Greek mythology, but the soaring performance of the Kairos Pegasus strategy – up 52.99% in its first year, 2014 – is very much real, and has already been recognised with performance awards. If Pegasus was the progeny of water god Poseidon, then the manager of the Pegasus fund, Federico Riggio (pictured, above), is very much a product of Kairos’s culture, as a company that in the last 16 years has evolved into one of the leading alternative asset managers in Europe. Kairos tends to train and develop analysts and PMs organically and Riggio was hired straight from Milan’s Bocconi business school in 2008. After less than two years as a pan-European equity analyst in London, he was rather swiftly thrown in at the deep end, working as a co-portfolio manager of both long-only and long/short Italian strategies: the KIS Risorgimento Fund and the KIS Italia Fund.

Since its birth in 1999, Kairos has become a name to conjure with in the world of alternative equities. After successfully establishing a European long/short business, which today remains a core element of the company, Kairos in 2007 hired a team of specialists to develop Italian funds with the aim of creating synergies with the existing team, and also of extracting alpha from a very inefficient market. After the financial crisis of 2008, Kairos, true to the meaning of its name, took advantage of the opportune moment and added a European fixed income team with a focus on corporate bonds.

Meanwhile Riggio was instrumental in establishing the Italian equity business of the company alongside Massimo Trabattoni, whom he considers his mentor. Trabattoni currently still runs that business. During his tenure as co-PM, the flagship product delivered returns of around 80% between 2008 and 2013, while the Italian market dropped 20% – and the Kairos Italia fund also did this with half the volatility of the wider market. Long-only Kairos funds are generally rated five stars by Morningstar and run with an absolute mandate. Kairos also runs Italian equity mandates for two major European insurance giants and for a leading sovereign wealth fund.

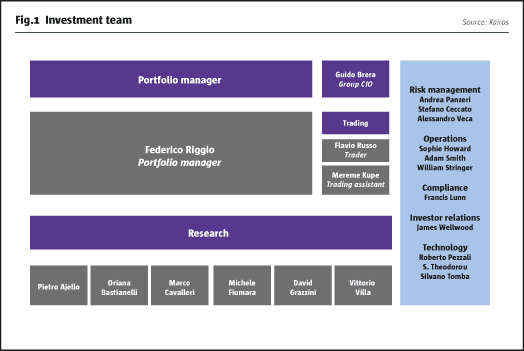

Riggio did very well co-managing two Italian funds, but he was ready for a bigger challenge and a wider mandate. “I am always scouting for ideas all of the time, on a bottom-up basis, talking to management and looking at financial statements. Even during my days managing Italian funds, I never stopped looking at the other European markets, and I kept visiting companies outside of Milan,” enthuses Riggio, who also draws upon research resources including six analysts, based in London and Milan. In particular he has always been keen to explore opportunities in Southern European countries, which he perceives as less exploited by competitors and brokers, and also rich in special situation opportunities, an area where he thinks a sophisticated investor can extract a lot of alpha.

Kairos was also keen to start a special situations fund concentrated primarily on ideas where the team could identify a catalyst, and Riggio was the right candidate to launch it. The partners of Kairos gave him their imprimatur with €40 million of seeding in 2014, and within a few months of opening to outside investors the fund has already raised nearly €100 million, taking assets to €145 million in early 2015. The initial capacity target is €500 million, and Kairos is building a stable and diversified investor base, including family offices and sophisticated institutions. Kairos tends to be cautious on capacity. Already running in excess of €7 billion across a wide range of long-only, absolute return and hedge fund products, the firm wants to grow the AUM of Pegasus gradually and carefully by choosing the right partners.

Alpha driving returns

Unlike many event driven hedge funds, Pegasus does not necessarily have a long bias and Riggio says he could go net short. Net exposure usually ranges from 20-80% but returns have not come from riding equity beta in the few European equity markets that performed well in 2014. Indeed, beta-adjusted exposure was sometimes negative last year, even if the raw figure was not. Intuitively this is not so surprising, as the long book contained plenty of airports and utilities, which are naturally low-beta sectors – and historical beta is not relevant for event driven situations such as stocks subject to takeover offers. The fund’s only negative month in 2014 was September, which was positive for the market, while Pegasus made 7% in October, which was negative for European equities, and again the fund maintained composure in December’s soggy market. Pegasus started 2015 with a loss of 2.18% in January versus the Eurostoxx 600 up 7.16%, but was back into positive territory by the end of February. It seems pretty clear that the fund has been genuinely uncorrelated in both up and down markets, and Riggio has been able to add value both on the long and the short side.

So positioning, such as the fund’s substantial Italian short book in early 2015, is the consequence of stock-specific calls, and does not signify a negative stance on the Italian economy or market. In fact, Riggio thinks that, after years of stagnation, Italy’s economy can begin to grow in 2015. It may not grow at US levels but a few years of growth are possible, and Kairos colleague and Italian specialist Trabbatoni has also opined positively on Italy’s prospects. Yet already Riggio finds that “some stocks discount too much growth while others don’t discount enough of it,” and this throws up opportunities for both longs and shorts.

Trading banks from both sides

For instance, over the years, Europe’s beleaguered banks have provided plenty of opportunities on both the long and the short sides. Riggio recalls 2011 as being special for two reasons. It was the only year when his funds lost money, and it was also the best year of his career to date – because it threw up extraordinary opportunities for bargain basement valuations, laying the foundations for superb performance in 2012 and 2013. With hindsight, Riggio admits that Kairos were a bit too early in buying banks on valuations of between 0.3 and 0.5 times book value, (as some Italian banks troughed out at 0.2 times book!) but those banks now trade on valuations between 0.8 and 1.1 times. So what was a recovery trade (that doubled investors’ money simply from valuation normalisation) would now become a fundamental call on whether banks can cover their cost of capital.

And in early 2015 Riggio has some doubts about that. He is “worried about European banks’ net interest margins, which are squeezed by negative rates and further threatened by the flattening yield curve.” Given these dynamics, Riggio is not comfortable with the degree of multiple expansion seen in the sector, and is finding short ideas particularly in Southern European banks that are highly dependent on net interest income, which is in Riggio’s view really “net interest income on steroids,” given the ephemeral carry trade. Even though Riggio concedes that volume growth might compensate for the disappearing carry trade in some cases, he still finds a strong short case for certain banks, and may use put options to express these trades. In contrast, financial institutions that get more of their revenues from fee income, as opposed to interest income, have more sustainable earnings. These are populating the long book, where Riggio also insists on strong dividend cover.

A core holding for the fund has been a trade in Italian non-life insurers, Unipol Group and UnipolSai; this had several rationales. These insurers are among the few financials that still trade well below tangible book value; the dividend yield could reach 6%, and the preferred stock discount to the common stock was partly crystallised upon conversion.

Greek banks also trade below book value and are on the radar screen as Riggio always searches for value where there is mess and inefficiency. For now though, the fund is not involved, because “macro calls are not our core competence,” he says. “We do not want to bet on politics and prefer to wait for more clarity. When the dust settles we will know fair value and can get a better feel for risk/reward.”

Fiat was a huge winner for the fund in 2014, where, as with Unipol, the investment thesis was multi-layered. Firstly, Fiat offered huge scope for positive earnings surprises because its guidance for 2015 looked too low, and the company has massive operating and financial leverage. There were also imminent catalysts. Migrating the main listing to the US from Europe was expected to engender some multiple expansion, and spinning off Ferrari was expected to unlock the hidden value of this luxury brand, with 90% of the Ferrari shares going to FCA shareholders. Riggio thought Ferrari’s pedigree warranted a valuation around 20 times EBIT, much higher than the Fiat Chrysler multiple.

The multi-pronged buy case proved correct on all counts and Pegasus reaped rewards from both stock and option positions. Fiat has raised capital from floating Ferrari, reduced debt, diversified its investor base, and seen its discount to Ford and GM narrow. Riggio has tactically traded around the position, selling calls around a placing, and by early 2015 profits have been booked with only a tiny slither left. Now that analysts that were negative on Fiat have started turning positive the potential has been recognised – and it is time for Riggio to fly into other opportunities.

Airports and infrastructure

Airports are amongst his favourite sectors. Riggio bought Flughafen Wien (Vienna Airport) as a core long because he liked the total shareholder return (TSR), free cash-flow generation and free cash-flow growth. The fund entered the trade on a €1.3 billion market cap, with free cash flow of €100 million, growing at mid to high single digits. A takeover bid for the stock at a 30% premium, from the IFM Global Infrastructure Fund, came as a welcome surprise, as the asset is very attractive to pension funds.

Pegasus still owns several other airports, including Zurich airport, which also offers attractive TSR versus other Swiss stocks, with the added sweetener of possibly being able to issue bonds at negative interest rates. Normally investors ask management to lever up and increase returns to equity, by reducing the weighted average cost of capital (WACC) because debt costs less than equity. In this case the leverage may even add to free cash flows on top of the lower WACC. The logical conclusion is that airports could see further multiple expansion. Another regulated infrastructure investment is French toll road operator Eiffage, which could benefit from a renegotiation of motorway tariffs that have been frozen. An additional infrastructure holding, Ansaldo, has been boosted by a competitive bidding war.

Telecoms is another industry where Riggio sees plenty of scope for consolidation – both horizontally and vertically. Already plenty of telecoms mergers have been waved through by regulators that want to ensure the industry can adequately invest in upgrading networks. There is also potential for vertical alliances, blending content with telecoms. And telecoms are really beginning to monetise their data traffic, as a growing proportion of web surfing takes places on mobile devices and 4G is increasing data consumption.

Pegasus’s unconstrained mandate allows Riggio to hunt for value in more exotic places. Turkey may get most attention for its political tensions and currency volatility, but the Istanbul stock market is home to some hidden gems. A gold miner abbreviated as Kozal has remarkably low break-even costs of around $500 per ounce, as it mines very high grades of gold. The company trades on a single-digit multiple, even including the cash that makes up over one-third of its 3.3 billion Turkish lira market cap. Pegasus normally hedges currency exposure, but Riggio argues that Kozal is already naturally hedged because it sells gold in US dollars. The lower Turkish lira helps to reduce its local costs, so to hedge the TRL denomination of the shares would in effect be double hedging. Elsewhere in emerging Europe, Riggio might dabble in some Russian or Polish stocks, but he admits that these are marginal positions. Another trade within the theme of collapsing emerging market currencies is an opportunistic short position that seeks to profit from certain companies that are vulnerable to a devaluation of the Venezuelan Bolivar.

Unconstrained but disciplined

The mix sounds very eclectic, but the mainly European fund does have some structure in the form of three books with different objectives. “We box ideas into these categories so we have a structured and repeatable process to analyse performance,” explains Riggio. Special situations trades soft events including spin-offs, restructurings, share buy-backs and changes in capital structure; the core long book looks for value based mainly on dividends, valuation or anticipating earnings surprises; and the opportunistic book could be either short-term trading or portfolio hedging – and this is where indices and options can come in. “Each month starts with a blank page,” explains Riggio, so there are no fixed minimum or maximum weights for any of the books.

Nor is Pegasus subject to the same diversification rules that apply to many Kairos products, including those in a UCITS framework. Pegasus runs a high-conviction, concentrated book that can go above the 10% position size cap applying to UCITS. The fund is unconstrained – it owned no pharmaceuticals stocks in 2014 and had virtually nothing in information technology in early 2015. But there are limits on single-name exposures and a strong risk management framework, which typically limits the gross to around 250% and the average position size is between 5% and 7%. There are also more unusual types of risk limits such as time stops for special situations. If catalysts do not materialise within the expected timeframe, Riggio moves onto the next idea as, he says, “I do not like to be stuck with legacy positions.”

Riggio’s attitude to liquidity seems equally pragmatic. The lower the market capitalisation, the greater the potential upside must be. So he might buy a firm with €200 million market capitalisation if it could be worth €500 million – but maintaining liquidity remains an overriding constraint. Some special situations funds are known for long, multi-year lock-ups, and have a habit of creating side pockets for illiquid investments. Neither of these is expected to be a feature of Pegasus, which offers monthly dealing with a one-month notice period. Kairos was able to meet redemption requests in 2008 and group chief investment officer, Guido Brera, has a role in Pegasus in terms of exposure management and liquidity, while the dedicated risk management unit has further oversight. Says Riggio, ”common-sense limits mean that the fund should not get anywhere near the risk management limits.”

Indeed, Pegasus has not overshot its volatility target of 8-10% in 2014. The targeted net return of 12-15% has been dwarfed in 2014 because many expected catalysts appeared quickly, as did some unexpected ones such as the bid for Vienna airport.

Pegasus is only the latest in a long string of successful product launches from Kairos, which have won a whole clutch of awards over the years. For instance the Kairos International Sicav KEY fund – one of 11 funds in a SICAV wrapper also available in offshore funds – won the UCITS Hedge Award for Best Performing Long/Short Equity Style Specific in 2015, and the Kairos International SICAV Multi Strategy UCITS Fund – one of five Kairos multi-manager funds – was named Best Performing Fund of Funds at the 2013 UCITS Hedge Awards, arranged by The Hedge Fund Journal. Kairos Pegasus arguably synthesises the best elements of Kairos’s absolute return franchise. Pegasus clearly has the potential to continue shooting the lights out in terms of returns, whilst it is staying within the framework of tried and tested risk and liquidity management that has earned Kairos such a strong reputation in alternatives, and has allowed the firm to thrive over the last 16 years.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical