The Athena UI UCITS Fund run by LeanVal Asset Management (previously called Conservative Concept Portfolio Management AG (CCPM AG)) has received The Hedge Fund Journal’s CTA and Discretionary Trader award for Best Performing Fund in 2022 and over 4 and 5 years ending in December 2022, in the Equity Volatility Arbitrage (Hybrid Systematic and Discretionary) category.

The market-neutral strategy, launched in 2008 and seeded by several German pension funds with a preference for UCITS funds, was one of the first volatility strategies wrapped in a UCITS. Fifteen years ago, the GFC spurred a strong interest in liquid alternatives volatility strategies, especially in Germany, Austria and Switzerland. In times of zero and negative interest rates the option strategies were kind of a “bond substitute” but nowadays offer rather an extra source of potential return and/or equity risk hedging, on top of positive bond yields currently exceeding 3%.

The fund offers a profile comparable to 80/20 multi asset funds but with an embedded option overlay which improves stability of the bond and equity components and is the main source of alpha.

Steffen Kern, Head of Volatility Portfolio Management

Since inception, the strategy has combined investment grade bond collateral with a staggered option spread corridor strategy that aims to monetise equity market corrections, while controlling option premium costs and tail risks.

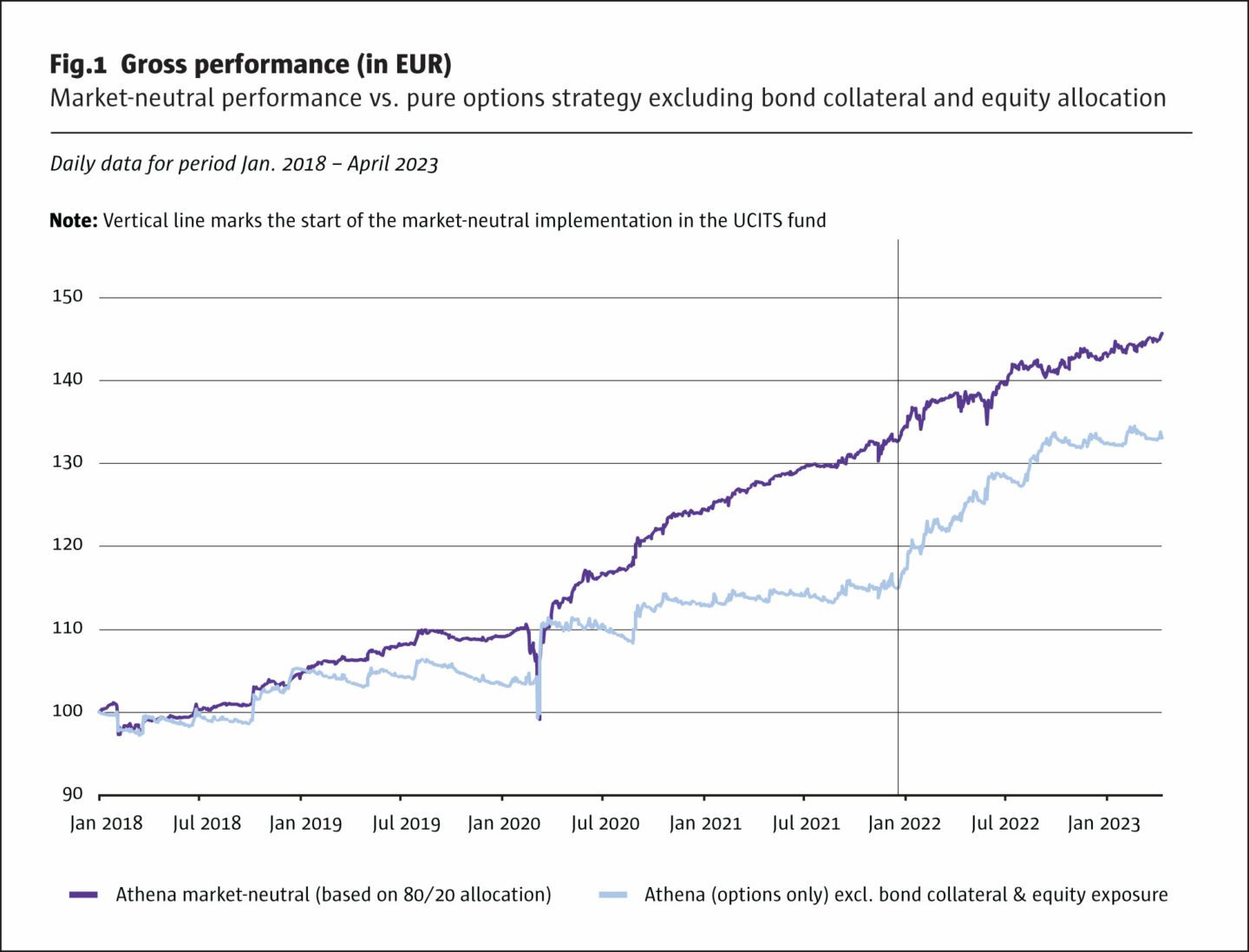

The strategy and fund have evolved over the past 15 years. In 2018, it moved from monthly options to a more active approach utilising weekly options, which had become sufficiently liquid. In 2022, the UCITS fund objective moved from equity market defensive to market neutral by adding a small passive US equity exposure, matching the strategy run in institutional managed accounts since 2018. “This is more convenient for multi-asset investors and more capital efficient since the options work like an overlay,” says Steffen Kern, Head of Volatility Portfolio Management, who has final responsibility for trading the Athena strategy. He works with Axel Gauss, Head of Portfolio Management, and they are assisted by a third portfolio manager, Marin Arapovic, who joined the company in 2021 and is being trained up.

The pure options strategy continues to operate through managed accounts, and both track records are shown above.

Volatility relative value strategy

The option strategy is by far the main engine of alpha and equity risk mitigation; returns from the conservatively managed bond collateral or the passive equity allocations are a pleasant side-benefit. The option strategy is roughly 80% systematic and 20% discretionary – with discretion mainly exercised over structuring the payout profiles and determining position sizes.

Fluctuations around beta neutrality

The put option spreads average long term negative beta of 0.2 due to their negative deltas, and in contrast to some other volatility strategies, no assumption is made about the equity market correlation of any net vega, or any other “greeks”. This also determines the target 20% passive US equity exposure given the market neutral objective. Most of the time, the portfolio beta is near zero, though it could occasionally and briefly go net short or net long.

“Generally, trading 6 weekly option tenors allows for rapid adjustment of the deltas back to market neutrality,” explains Kern.

Managing vega for negative delta & positive gamma

The option strategy is not designed to earn an implied versus realized volatility premium and is not structurally long or short of implied volatility but is solely devoted to monetizing negative deltas while controlling vega risk and costs. Each option structure involves three strike legs of put options using ratio spreads, with typical ratios 1×2 or 1×3. Long puts, and usually a larger number of short puts further out of the money, define the potential profit corridor at expiry. The distance between the short puts and a long tail risk hedge of puts further below defines the potential loss corridor at expiry, which has never been touched since inception of the strategy in 2008 through various market cycles as well as equity market corrections. Notional exposure for the options is typically 200%% and overall fund exposure is capped at 480%.

The actual strikes defining profit and loss corridors are a moving target and a weighted average of up to six staggered weekly maturities, typically built using several different strike levels, all of which are also regularly rebalanced in response to market moves and expiries on a revolving weekly basis. “As the front week matures, new tenors are added with maturities up to 5 weeks, using CME weeklies, which go out to 6 weeks,” says Kern.

2008

The market-neutral strategy, launched in 2008 and seeded by several German pension funds with a preference for UCITS funds, was one of the first volatility strategies wrapped in a UCITS.

Exercise and rebalancing

“In total the fund offers a profile comparable to 80/20 multi asset funds but with an embedded option overlay which improves stability of the bond and equity components and is the main source of alpha, especially during volatile market environments,” says Kern. The ratios and strikes can move around, and the ratio spreads could be credit, debit or neutral at different times, though they are usually debit i.e. paying a small net premium. Put spreads with net premium income can occasionally be created partly through raising the ratio of short to long puts. “We do this if our delta as well as other sensitivities “allows” us to add such a credit spread. These kinds of spreads usually hold higher negative vega, but are used to fine steer the portfolio,” says Kern.

The ratio adjustments consider a range of factors, which can include skewness risk premiums that are influenced by structural hedging flows. A conservative and defensive approach is taken. “We add robustness by spending some premium in times of unfavorable risk premium (e.g. by widening the corridor or adjusting/improving integrated tail hedge). If the VIX is low we spend some premium to maintain a minimum range for the corridor. And in March 2020, the increase in implied volatility allowed for a widening of the profit corridor to roughly 30% for options with just a few days remaining until expiry,” explains Kern.

Because the strategy is always active in relative volatility trades, entering the positions with long and short options at the same time, the positions can be implemented in every environment. A structurally higher volatility and skewness environment improves risk/return somewhat, as the corridor width expands by pushing down the short leg.

With this approach the strategy can adapt to quickly changing market regimes and is using the volatility risk premiums continuously to open potentially profitable corridors on the downside of the S&P 500.

Benefits of weekly options

The strategy has always used CME Group exchange listed options on the S&P 500 index. Since inception, for the first ten years monthly options were utilised, before moving to weeklies in 2018, which are much more well suited to the objective of monetizing deltas from equity market corrections. “With monthly options we sometimes had problems monetizing deltas because the deltas had declined when we wanted to monetise. Now we have 52 chances per year to lock in maximum profits from the equity market moving into the corridor,” says Kern.

Equity and bond collateral strategy

The target 20% long S&P 500 exposure is usually rebalanced quarterly but can be reset more often in response to asset flows or large market moves. The bond strategy is based on a range of conservative rules and guidelines for credit ratings, position sizes and diversification. It has a target duration of 1-2 years with credit quality ranging between BBB+ and AAA and averaging around AA. “Until 2022, these guidelines meant that the strategy inevitably ended up with some negative yields. The highest level of negative yields was around minus 0.35%, though they were still less negative than the negative interest rates that would have been received on deposits,” says Kern.

It can allocate to government, municipal, corporate, financials, SSAs and covered bonds and seeks some yield pickup within the risk limits. “German Bundeslaender (municipalities or local governments) such as Bavaria, Baden Wurttemberg, and Hessen can now pay as much as 30-40 basis points over Bunds in 2-3 year bonds, up from some 10 basis points a few years ago. Some Euro denominated corporate and financial bonds are owned, with issuers including top tier global corporations.

Though the interest rate duration of the portfolio was only 1.5 in 2022, this was still enough to generate mark to market losses from the impact of increasing interest rates. The yield on the fixed income collateral rose from 12 to over 300 basis points as of mid-2023. These losses should be recovered upon maturity. Bonds are normally held to maturity, though might occasionally be sold due to credit ratings downgrade (or for ESG reasons).

Overall profile of the strategy

The three elements taken together are expected to produce positive returns during several different scenarios.

In a falling market, option strategy profits could outweigh equity market losses while in a rising market equity market gains could outweigh option strategy expenses. For instance, in 2022, profits from the options strategy outweighed losses from the equity exposure by a wide margin.

An adverse scenario could however be a flat or very slightly negative S&P 500 performance, which does not entail any (or enough) large enough corrections to monetize any (or enough) profits from the option structure, which is generally positioned for corrections of between 3% and 10%. In a flat or rangebound sort of market where the strategy has not monetized any negative deltas, flat equity performance will not be able to offset some small premium expenses on the options (on average about 25 bp per month).

In total the fund offers a profile comparable to 80/20 multi asset funds but with an embedded option overlay which improves stability of the bond and equity components and is the main source of alpha, especially during volatile market environments.

ESG

An ESG specialist in-house manages the ESG screening. For example, Volkswagen bonds were sold for ESG reasons based on a UN Global Compact violation.

The fund is currently making disclosures under SFDR 6. “Disclosures under SFDR category 8 await some clarifications on the treatment of derivatives from German regulator BaFin,” says Kern.

He would not currently contemplate trading ESG equity indices or derivatives thereof since they are less liquid than the S&P 500 index products used.

Customisation

The firm is however open to customizing any of the three components: the option strategy, equity exposure and bond collateral, which can be seen as distinct modules. This is already happening within the broader LeanVal Asset Management product suite. The Athena Volatility Relative Value strategy can be bolted on to all sorts of other strategies, including different sorts of multi-asset strategies and actively managed quantitative equity strategies.

Overlay to other strategies

The Volatility Relative Value strategy also acts as a building block for some other strategies: LeanVal Equity Protect, following a multi-factor stock selection model and employing a systematic protective put hedging program uses the Athena Volatility Relative Value strategy to finance the long-term costs of the protective put.

UCITS and managed account distribution

The UCITS fund, currently mainly distributed in Germany, has EUR 42 million in AUM and is part of the more than EUR 700 million managed in the Athena strategy. Main assets are managed pari passu in managed accounts. Other accounts implement variations of the strategy as an overlay. LeanVal Asset Management is open to passport the UCITS to other countries and is offering managed accounts and overlay solutions in countries where the UCITS is not passported. The manager is also seeking European distribution solutions.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical