The event, held on 2 October 2019 in Amsterdam, raised money for Alternatives4Children (A4C), which is an independent charitable foundation established in 2011 in the Netherlands by professionals from the alternatives financial industry. “With active chapters in the Netherlands and London, we find that organising the Legends4Legends event is a great way to combine a content driven conference, bringing in legends from the investment industry that you don’t always see presenting, while at the same time raising money for charity,” says co-founder, Marc de Kloe. Readers should save the date for the 5th event, scheduled for Thursday 24 September 2020.

Credit: Carolyn Seeger // Photography

Recession risk and equity long/short

“Bond markets are discounting a 63% probability of recession and equity markets a 22% probability,” observes Effie Datson, till recently Senior MD and Head of Hedge Funds at Union Bancaire Privee (UBP). Datson – who has featured in The Hedge Fund Journal’s “50 Leading Women in Hedge Funds” report in association with EY – continues, “Within the equity market, there is extreme divergence between momentum and value. A good equity long/short manager should lose less, and might even make money, when the market collapses.”

Japanese equities: short regional banks, long retailers

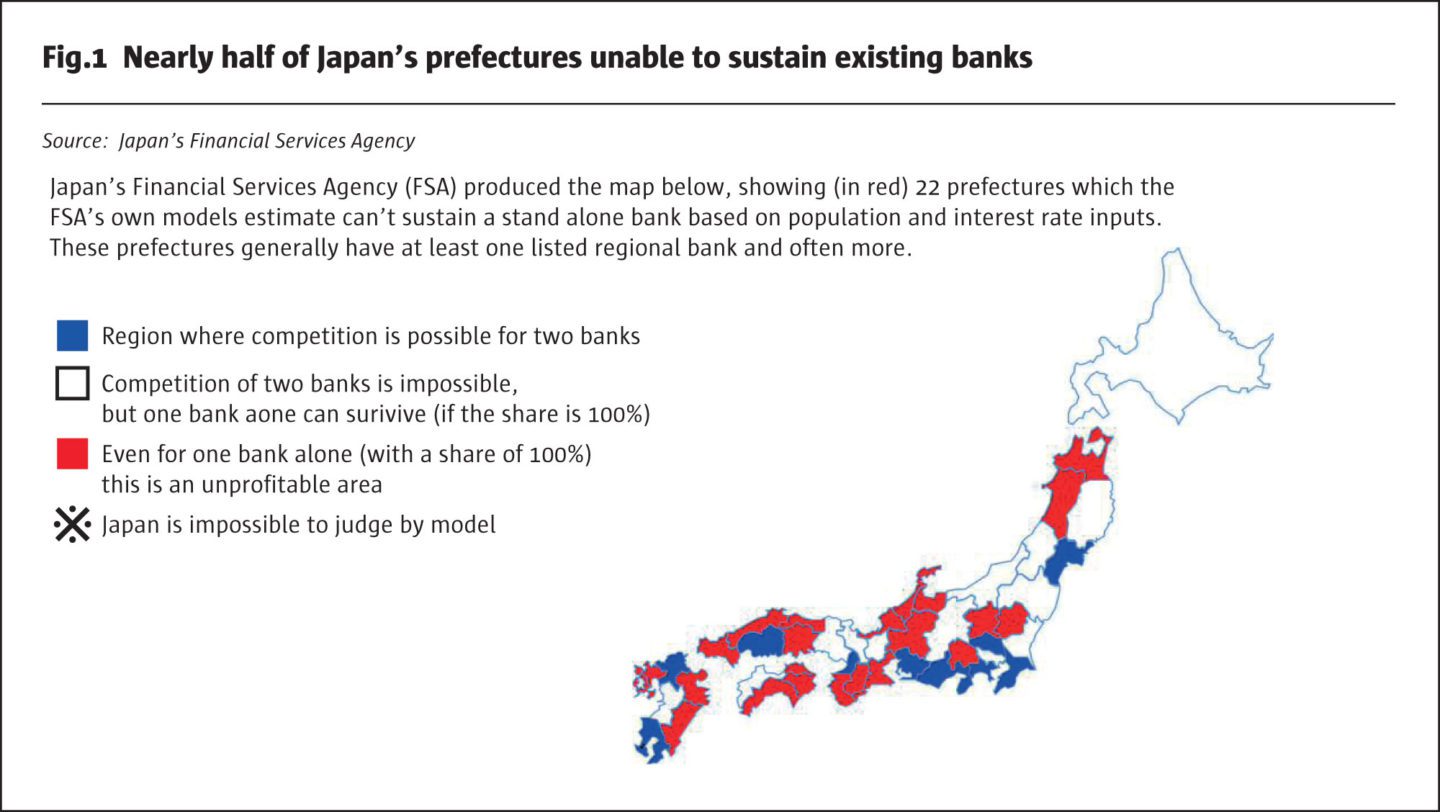

Shannon McConaghy of Horseman Capital Management argues that, “In general Japan’s regional banks are the weakest link amid the climate of low growth, low rates and yield suppression. Japan’s financial regulator has identified more than 20 prefectures, or regions, where banking is not profitable, even if a sole bank has a regional monopoly. There are ten other prefectures that can only support one profitable bank.”

Japan’s regional banks appear to face more acute structural headwinds than other banks globally, even the much-maligned European banks. “To some extent, Japan’s low interest rates and ageing demographics foreshadow problems for Europe, but European banks do at least recognize Non-Performing Loans (“NPLs”) that some Japanese banks disguise with accounting tricks. Japan’s demographic decline is hollowing out their customer base at a more rapid pace, while interest rate suppression is pushing new loan interest rates to 0.8%, according to the most recent data from the Bank of Japan. This is below the roughly 1% asset yield the banks require to break-even. Many of the loans are “zombie loans” related to “zombie businesses” and the owners of these businesses can now renege on their debts while still keeping their personal assets including their houses, savings and cars. The regional banks would currently appear to be the new zombies. Some of them may prove to be terminally unviable, as toxic assets likely rule out white knight takeovers.”

“As Japan remains the world’s largest net foreign creditor, according to International Monetary Fund data, there could even be global repercussions if banks are forced to sell overseas assets. Ultimately, the problems of Japanese banks should prompt central banks to re-assess yield suppression, which is destroying the banking system.”

While McConaghy would agree that convenience stores have a better outlook than other retailers, he feels there is significant decline to come in some other retail formats. These are suffering from a declining customer base at the same time as seeing cost pressures due to labour shortages.

According to Quaero Capital’s Rupert Kimber, “Certain Japanese convenience and drug stores offer dual attractions of consolidation and operational leverage. The 7-Eleven chain owned by Seven & I Holdings, gets 22 million customers per day spending an average of US$6, and incremental spend boosts the bottom line. The consolidation stage in this sector has run its course, the second stage ahead, is a secular, multi-year trend of improved shareholder returns from operational leverage which is ignored by the majority of market participants. Hence the convenience store valuations are too low.”

Illiquid versus liquid alternatives

Over the past 18 months, liquid alternatives have seen small net outflows, while illiquid alternatives have continued to raise assets. Datson says, “Private equity is equity risk with illiquidity and leverage on top. The trillions of dollars reallocated into private equity risk permanent impairment of capital, which matters more than day to day volatility.” Odi Lahav, CEO of MJ Hudson Allenbridge, points out that, “running money in closed end funds has a structural advantage and allows good private equity managers to add some alpha, for instance through riding out cycles and timing exits. It has a place in institutional portfolios, but using mean variance optimization on its own to determine the optimal allocation size is flawed and might result in excessive position sizes, given the artificially subdued volatility. The value of having liquidity within a portfolio allowing for some optionality should not be forgotten.”

Illiquid alternatives may not appear to have mark to market risk now, but they will do eventually when assets are sold. Lahav says, “Although there’s an active secondaries market in private markets funds today, you may give back all the illiquidity premium and more if you try to exit during times of stress in the markets. Extra haircut, spreads and fees on illiquids are not uncommon, it all comes down to supply and demand dynamics”. Some pension funds may be almost forgetting about the benefits of liquid alternatives.

Lahav, who advises pension funds, charities and family offices, perceives that, “Negative cashflows and low rates are driving pension funds into credit and in particular private debt, which is showing some signs of a bubble. We favour a multi-asset approach to generating yields, and in today’s markets we particularly look for some counter-cyclical exposures with that portfolio.”

Direct lending

Waterfall Asset Management Managing Partner and Co-Founder, Tom Capasse, is cautious on direct lending, finding value in more esoteric sectors, such as litigation finance, aircraft parts, medical tourism, or US taxi medallions. “Waterfall has cut its direct lending allocation from 20% to 0.5% and may even look at shorting it. Direct lending is becoming overcrowded and much riskier. Leverage multiples for bank loans and mid-market loans are near all-time highs at around six times. Meanwhile the denominator of the equation – EBITDA – is being manipulated by adjustments including proforma adjustments that, for example, anticipate profits for drugs not yet approved by the FDA. This means EBITDA multiples could be understated by 1.5 turns and also means debt service coverage ratios are overstated. Additionally, covenants have been eviscerated and unitranche loan to value ratios have increased from 60% to 80%, leaving a smaller cushion to absorb declines in collateral values. Thus, financial leverage is layered on top of structural leverage.”

Credit liquidity mismatch

At least six speakers flagged up a liquidity mismatch in corporate credit, and most of them cited similar statistics. Mutual fund and ETF ownership of corporate bonds has jumped from 12 to 30% of the market, which has itself doubled in size, while leveraged loans have also grown to match the size of the high yield market. Meanwhile, thanks partly to the Volcker Rule, banks’ and dealers’ inventory of corporate bonds is down 85-90%, from US$413bn pre-crisis to US$63bn more recently. The net impact is that the ratio of mutual fund to dealer holdings of bond inventory has increased from two in 2007 to 43 in 2018. Downgrades could be a cliff edge event for pricing as passive investors become forced sellers.

Structured credit is preferred partly because its low ownership by daily dealing vehicles sidesteps the liquidity mismatch, but also because household credit fundamentals may be stronger than those of corporates.

US consumers versus corporates

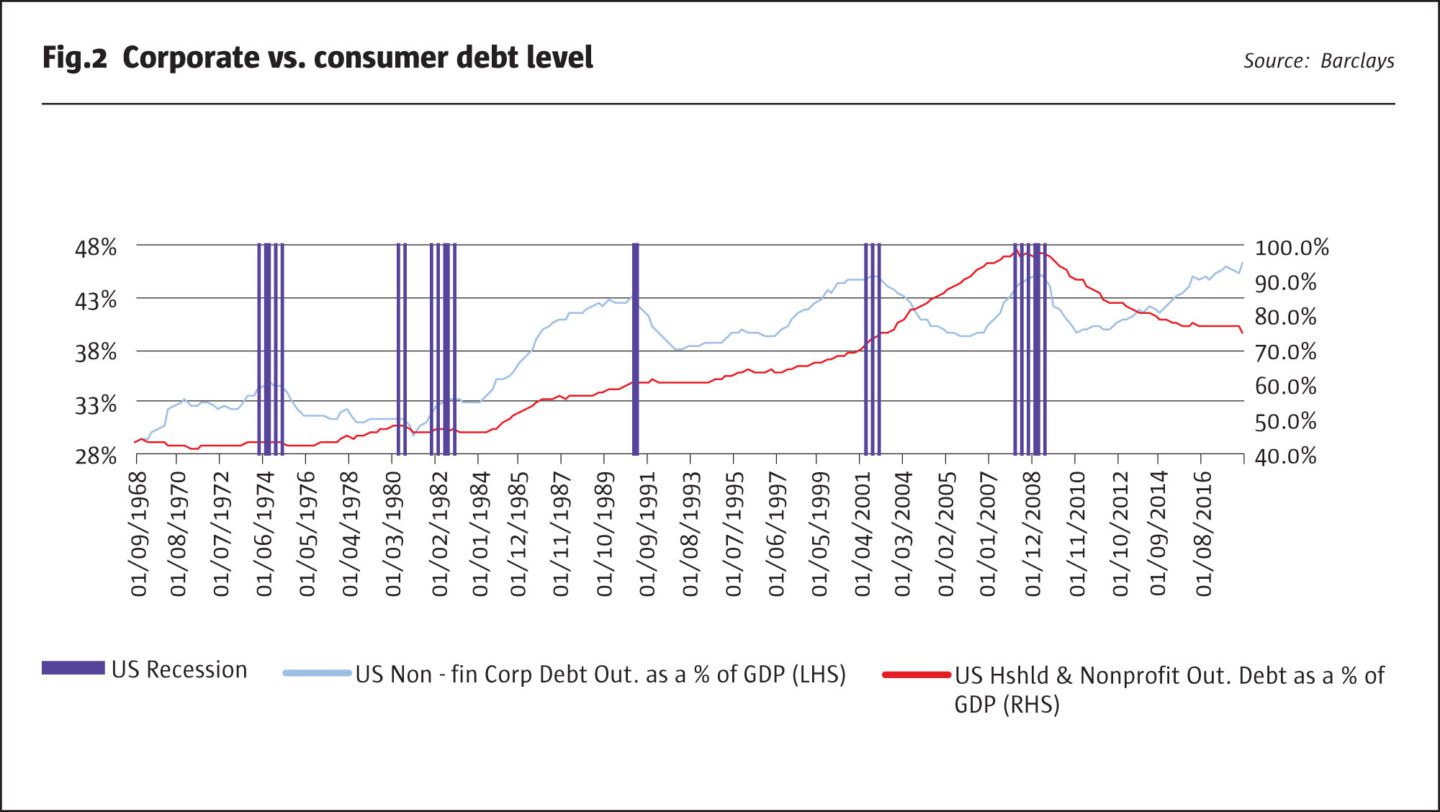

Thomas (T.J.) Durkin, Co-Head of Structured Credit and Head of Residential & Consumer Debt at Angelo Gordon, is broadly constructive on US households. “Aggregate US debt has risen to US$70trn, including banks, companies, households and the government, but the story is different for corporates and consumers. In corporate credit, the US high yield market – including high yield bonds and leveraged loans – has almost doubled to over US$2trn since 2008, growing faster than US GDP, which has risen 33% since the crisis. Covenant lite issuance has reached 80% of total issuance, while covenant protection has dropped by 50%, and everyone is trying to arbitrage the credit ratings agency rules for CLOs in terms of buckets, industry diversification scores, and enhancement levels. Investment grade credit has tripled from US$2trn to US$6trn and declined in quality, as the BBB segment has grown from 35% to 50%.”

“US household fundamentals are more robust. US household debt may be at a record in nominal terms, but this is a very crude measure. Once the debt is adjusted for inflation, population growth, and incomes, debt to income ratios are well below crisis peaks and consumers can easily service the debt. Household debt has come down from a peak of near 100% of GDP in 2008 to around 75% in 2018. Additionally, consumer savings are up. Job vacancies exceeding unemployment suggests that there are labour shortages, and wage growth is accelerating.”

Waterfall’s Capasse is also enthused about parts of the asset class. He has been dubbed as a father and founder of the asset backed securities (ABS) market, having done the first subprime deal bought by HSBC, and seeks out relative value in primary and secondary ABS in 60 sectors as defined by Moodys. Waterfall particularly seeks opportunities where returns can be enhanced by credit and regulatory complexity or barriers to entry, in terms of origination licenses, loan servicing capabilities or technological expertise, where the firm has proprietary technology: WAMCAM, Waterfall Controlled Asset Management, which automates loans.

US housing

Capasse has a constructive outlook on US housing. “Supply is constrained by limited new build and inventory,” he says. “Housing starts are down from two million per year pre-crisis to 500-800,000 now. Meanwhile, demand is picking up as more millennials shift from renting to buying houses. US house price growth could revert to more typical historical levels. In general, the mortgage market is hampered by conservative lending criteria post-crisis, but there are interesting niches. Equity extraction products, known as reverse mortgages or equity release, are a relatively neglected area partly for historical reasons. A US Government program became overextended as sub-prime seniors had taken on extra debt to pay off first mortgages. But there is clearly a market for home-rich, cash-poor older people and tappable home equity could be over US$5.7trn, according to the Black Knight Mortgage Monitor. The typical borrower is an 84-year old woman. Waterfall is one of only two non-agency jumbo reverse mortgage lenders in the US, in what is a public/private partnership with the US Government”.

He continues that, “these mortgages command premium interest rates of 6.5% versus 4% for the average US mortgage. Home Equity Line of Credit (HELOC) and home improvement loans can pay even higher yields of 8%. Securitising the paper can increase loss-adjusted returns to the mid or high teens. The barriers to entry include the wherewithal to originate, securitise, and sell the deals.”

Small balance commercial loans

Beyond this Capasse explains that, “small balance US commercial loans (SBCs) are another niche where there is limited competition, partly because only 14 non-bank licenses were issued. SBCs are first lien loans on smaller owner-occupied commercial properties on average worth $2m. They make up 15% of commercial mortgage debt in the US. It is possible to make a loan at prime rate plus a 1% spread, for a 60% to 80% loan to value ratio, securitise 75% of it in a government-guaranteed security, and immediately see the paper rise to a 10% premium, while continuing to receive servicing income.”

Spanish NPLs

Capasse compares the NPL climate in Spain in 2019 to that of the US in 2014, in that NPLs are declining, but are not yet back down to the pre-crisis levels seen around 2006. “European non-performing loans in general have seen IRRs drop from 10-13% to 5-8% on an unlevered basis, as the cycle matures and capital has flowed into the space,” he says. “But there are segments of the market where returns remain more interesting. Spanish banks are generally wary of the construction sector and particularly avoid deals that have complications such as previous foreclosures or uncertainty over title. They prefer to stick to cleaner, plain vanilla situations with yields of 2-3%. Hence commercial and consumer real estate have continued to deleverage even as the Spanish economy has recovered. Reticent banks open up the opportunity to make direct loans, including bridge loans, to property developers and buyers. Coupons can be as high as 10%, 12% or even 15% for loan to value ratios as low as 60%. Waterfall is also taking a close look at buying the tail ends of earlier NPL funds.”

Student loans

Speakers were not positive on all subsectors within ABS. Capasse flags up that, “Student loans are now twice the size of credit card balances in the US. Some 11% of student loans are at least 90 days delinquent, and 20% are in deferral. There have been two million defaults over the past six years. Capasse points out that the problems may get worse as college tuition costs continue to rise faster than inflation, while many university graduates are in jobs that do not require their education.

Angelo Gordon’s Durkin concurs on the macro but believes there are pockets of niche opportunities within the space. “Student loan debt has reached US$1.5trn, and delinquency rates are up, but the majority of that debt resides on the Treasury’s balance sheet and is not accessible to the market today. Delinquencies on seasoned private student loans have burned out to below 5%, and bondholders today are enjoying recoveries from loans that had charged-off during the global financial crisis.”

China peer to peer lending

Capasse highlights how, “over 4,000 peer to peer lending platforms have failed in China, as half of borrowers miss payments. Generally young borrowers use multiple platforms, sometimes taking out new loans to refinance other loans.”

Shorting the Hong Kong dollar

Kyle Bass, CIO and founder of global event-driven fund, Hayman Capital, argues that his short Hong Kong Dollar position, which looked rather contrarian when it was established, should move towards mainstream thinking.

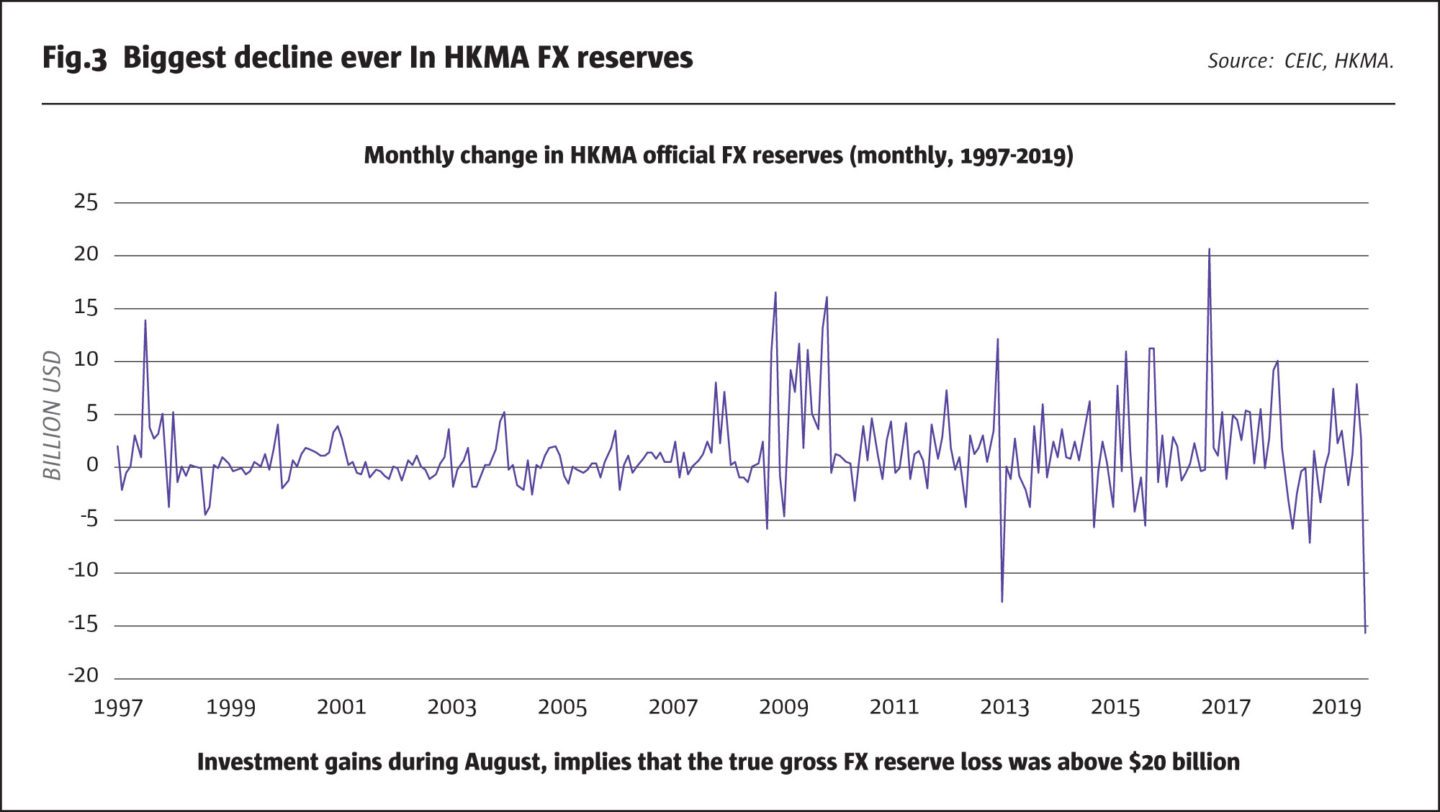

Multiple factors are coalescing and intensifying to threaten the HKD’s 36-year-old peg to the US$. As China’s southern port, Hong Kong was once a huge exporter and re-exporter, but has now become a huge net goods importer. The mirror image is that it has moved from being a services importer to exporter. Even before the recent protests, liquidity was draining away from Hong Kong. The HKMA (Hong Kong Monetary Authority) has used up 80% of its available reserves of HKD260bn since June 2017 and its FX reserve loss in August 2018 was the largest ever.

When reserves run out, interest rates could spike and cause a banking crisis. Hong Kong has the world’s most leveraged banking system, at 900% of GDP, which is comparable to Iceland, Ireland and Cyprus before their banking crises. Lending worth some 280% of Hong Kong GDP is exposed to mainland China, which is slowing: China is printing the worst industrial production and GDP numbers since the crisis. Retail sales in Hong Kong dropped 25% in August. It could get worse. China is overreaching its authority, pushing through extraditions, and threatening Hong Kong’s autonomy. This behaviour might force the US to rescind its free trade agreement with Hong Kong (the United States Hong Kong policy act). The currency peg does not suit Hong Kong’s economy as it has decoupled from the US economy: in 2008 Hong Kong interbank interest rates moved to zero even as China was growing banking assets by 50% per year. Soon, capital, investment and people will flee Hong Kong, and there will be demand to convert HKD to USD, which also offers a higher yield. Between 1978 and 1984 (when the HKD was pegged), it depreciated by 47% against the USD around fears related to the handover. Bass believes regulators in 2019 are behind the curve, just as they were in 2008 when he shorted sub-prime mortgage debt in the GFC, and in 2011 when he traded the European sovereign debt crisis.

Cryptocurrency and Blockchain

At the alpha stage

Pantera Capital Management Co-Chief Investment Officer, Joey Krug, developed his strong interest in Bitcoin in 2011 after reading a white paper. Krug says:

“Bitcoin appeals to millennials, with 20% of those aged under 30 saying they would buy Bitcoin, and some surveys suggesting that more millennials have a coinbase account than a brokerage account. There is scope for new highs in Bitcoin as supply is set to halve this year.”

“The open source nature of cryptocurrencies lets anyone read software and code, and means that bugs are easily visible. In contrast SWIFT’s US$1bn heist came as a surprise.”

“Cryptocurrency take-up should be accelerated by greater scalability, as lower latency allows for more transactions per second. Better fiat on-ramps for getting money into crypto are also important. And more use cases will develop.”

“For instance, the Augur cryptocurrency, a no-limit betting protocol, is promising, but will need more infrastructure and a few years to build out.”

“Tokens and equity are being used to fund crypto start-ups. The ICO boom has created a huge flow of capital into the space that at times seemed like the dot com boom. Now the market climate is much healthier, and crypto startups are attracting talent from giants such as Netflix or Google who are lured by equity in the form of tokens.”

“A sustainability weakness of Bitcoin is clearly the vast amounts of electricity it uses: Bitcoin alone uses 0.29% of world electricity, which is more than some entire countries. An alternative approach is to make proof of stake (PoS) rather than proof of work (PoW) the dominant consensus protocol. A wide variety of PoS models exist.”

“The vision is of a financial world transformed in 10 or 20 years. Just as the internet democratised access to and creation of new information, so too cryptos can democratise financial markets, disintermediate and lower transaction costs. This will take time as drastic shifts in regulation are needed.”

“Cryptocurrencies are in the alpha phase, analogous to when the internet was called arpanet. For now, Bitcoin is more like digital gold, with most usage based on speculation and the desire for uncorrelated hedges rather than utility. But this will change: lower fees for payments are a key use case for cryptocurrencies. In terms of payment scalability, Bitcoin and Ethereum have issues. They can process 10-15 transactions per second, against 2,000 for visa.”

Cryptocurrency payments

Other applications are more suitable for payments. Tyler Spalding’s Flexa application already allows for meaningful and secure transactions. “Currently, credit card payments involve card associations, card processors, payment processors, and US card fraud losses run into the billions while data is being stolen all the time. The social cost of payments could be as high as 2% of GDP, and this is on top of retailers’ payment costs, which can be their second highest costs. Fee-based finance is rent-seeking and exploitative whereas decentralised finance is more efficient. Flexa lets any crypto be spent in a store, immediately and at zero fees. This cuts out the middleman, the fees, and the risk of sensitive data being abused. This new payment network can bypass the infrastructure of Mastercard, Visa and debit cards,” says Spalding.

“Scans at the point of sale can be as fast as 200 milliseconds. All kinds of digital assets can be used, not only cryptocurrencies. Retailers such as Baskin Robbins, Bed Bath & Beyond, GameStop and Nordstrom are already signed up. Flexa is licensed in all US states and Canada. And McKinsey has just opened a tech store in Mall of America, the largest US mall, which accepts crypto for payments.”

Pantera Capital Management Co-Chief Investment Officer, Joey Krug, developed his strong interest in Bitcoin in 2011 after reading a white paper. Krug says:

Other applications are more suitable for payments. Tyler Spalding’s Flexa application already allows for meaningful and secure transactions. “Currently, credit card payments involve card associations, card processors, payment processors, and US card fraud losses run into the billions while data is being stolen all the time. The social cost of payments could be as high as 2% of GDP, and this is on top of retailers’ payment costs, which can be their second highest costs. Fee-based finance is rent-seeking and exploitative whereas decentralised finance is more efficient. Flexa lets any crypto be spent in a store, immediately and at zero fees. This cuts out the middleman, the fees, and the risk of sensitive data being abused. This new payment network can bypass the infrastructure of Mastercard, Visa and debit cards,” says Spalding.

Hidden risks in clearing houses?

Horseman’s Russell Clark sees multiple bearish signals: yield curve inversion; a lower copper price; a stronger Yen; the Swiss Franc outperforming the Euro; bank stocks lagging broader markets. He is therefore surprised to see equities moving higher and volatility staying low.

Regulation may be temporarily calming financial markets but cannot do so indefinitely. Central bank activity will prove to be a disaster long term, as it bankrupts banks and pension funds. Earlier government mistakes that ultimately precipitated crises were branding MBS as less risky than corporate loans and deeming Greek government bonds equivalent to German bunds. Now the latest regulatory time bomb could be lurking in centralised clearing.

Banks face higher capital charges if they do not use centralised clearing houses. Regulators take comfort from a shrinking headline total for notional outstanding derivatives, but this may be illusory due to trade compression, which uses an algorithm to close circular trades and free up margin based partly on discounting margin for correlated assets. But correlation patterns can break down. One clearing house nearly went bust after a sole trader of European power was wrong footed by a long Nordic, short German power trade. The correlation discount suggests that the clearing house understated the risk of the trade. Spread trades such as West Texas versus Brent oil also attract big correlation discounts.

The ratio of gross margin to initial margin is now higher than before the GFC, so it is possible that there will not be enough margin in the system if volatility steps up. That could lead to a reach for high quality collateral. The spike in overnight repo rates seen in September 2019 may already be symptomatic of collateral shortages.

Nowcasting

The aforementioned forecasts are more likely than not to prove wrong, according to Ineichen Research and Management founder, Alexander Ineichen, who argues that, “The guru accuracy histogram from CXO Advisory Group suggests that over 50% of forecasts are wrong. For instance, meteorologists in the 1960s did not beat naïve forecasting and increased computer power in the 1980s did not help them. It was a change of approach from pseudo precision to ensemble forecasting that improved their accuracy.”

But nowcasting is to forecasting what astronomy is to astrology. It is an objective, fact-based approach which focuses on known, real time data and therefore is not forecasting. It can increase the robustness and conviction of investment decision making, and improve risk management. It can determine if markets are in trends or trend reversals, decide on directional positioning, and help to identify outliers, such as sharp declines in asset prices, which occur mainly in bear markets. This in turn can contribute to more asymmetric investment returns.

Off the Record Speakers

Anchorage Capital, Bridgewater Associates, Pershing Square Capital, PAAMCO Prisma and BlackRock addressed the conference off the record.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical