Now that equities are finally on an upward trajectory and economic indicators in the US and in Asia are in a recovery mode investors are increasingly looking for the next big investment idea. The preference is for strategies on listed instruments that bear little correlation to traditional asset classes and can guarantee decent returns. An asset class ticking all of those boxes is dividend futures, an instrument that allows investors to gain exposure on what the price of a company dividend will be at a future date.

Dividend futures have been traded on exchanges only for the last five years but are now available on Eurex and a number of other European and Asian exchanges. It is a small but fast-growing sector and, more importantly, one which is based on a strong underlying market.

UK companies alone paid out a record of £25 billion in dividends in the second quarter of this year – 7.6% more than last year and the largest ever quarterly payment by UK firms. According to estimates by Capita UK Dividend Monitor, the total payout of UK company dividends this year could reach as much as £81 billion. Enter a team of former Societe Generale derivatives specialists who have spotted a gap in the market and Lyxor Asset Management, one of the world’s leading managed account platforms, and you have the first dividend futures strategy.

The benefits provided by the managed account set-up are all the more relevant when investing in early-stage managers or emerging strategies, says Philippe de Beaupuy, head of Managed Account Platform UK at Lyxor Asset Management. It creates the same framework of risk management and transparency that prevails for more established ones. “It is in Lyxor’s culture to constantly innovate and look for ways to bring new types of strategies and sources of alpha to investors”, adds de Beaupuy.

Paris-based alternative investment firm Melanion Capital, set up by former SocGen trader Jad Comair, received their investment management authorisation from the French regulator Autorité des Marchés Financiers in mid-June.

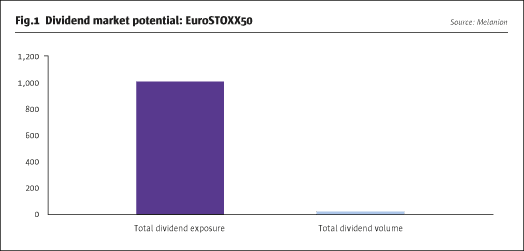

Jad Comair, founder and chief investment officer at Melanion, explains: “This has developed as a fully fledged asset class of its own. Open interest has exponentially increased since 2008 and today it is a $10 billion market with investors like banks, hedge funds, pension funds and family offices.”

The appeal is that the futures allow market participants to get an exposure just on the dividend part of the investment and does not mean that they have to hold a share in the company in question. The changes in the prices of a company’s share will have almost no impact to how the dividend is paid out by the same company.

Comair cites the example of France Telecom (the company has since been renamed Orange SA), which said it would pay a dividend of €0.80 this year. The market is trading at 57 cents discounting the risk that between now and when the dividend is due to be paid, the company might decide to cut its dividend. Investors who are confident about the telecom company’s financial health would buy the dividend at 57 and if they are right, make a profit. Those sceptical about France Telecom would sell at the same price.

Historically, the main use for dividend futures has been as a hedging instrument. Big pension funds, for instance, will be paid dividends on an annual basis by all the companies in their portfolio. If the fund is keen to have a very predictable income and not inclined to carry the risk of the dividend being cut at the last minute it may choose to hedge that particular risk and sell dividend futures while still holding the stock.

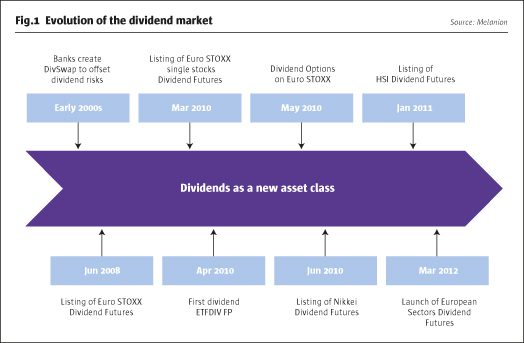

Some form of dividend derivatives has been traded over the counter for over a decade. Dividend swaps were first set up by banks in the early 2000s to offset their dividend risk. The instruments were linked either to single companies or to all the companies in an index, such as the FTSE 100, tracking the dividends paid by all the companies in the index during any given calendar year. Actual dividend futures made it onto the radar screen of a broader range of market participants in 2008 when Eurex launched its first Euro STOXX 50 dividend futures contract. Other exchanges quickly followed suit and now a number of major exchanges list such instruments. Eurex offers dividend futures on over 100 single stocks and on the DAX, SMI and a whole host of Euro STOXX indices.

On NYSE Liffe it is possible to trade futures contracts on the FTSE 100, CAC 40 and the Amsterdam AEX index. London, Madrid, Tokyo, Singapore and Johannesburg have similar offerings and market players can even trade dividend futures based on Russian stocks listed on the LSE.

The market is still nascent but fast-growing, says Philippe Teilhard de Chardin, chief executive at Advisors and Partners LLP, and the former globalhead of prime brokerage at Newedge. Advisors and Partners advised Melanion Capital on the launch.

De Chardin compares the dividend futures market in its present state to what oil futures looked like in the ‘80s. “At the time a lot of physical oil was traded but only a fraction of trading was in futures. If you look at the oil market today futures trading dominates the market. The same will happen with dividend futures,” he says.

Statistics support this view: single-stock dividend futures on Eurex reached a monthly trading record of 278,000 in January. Open interest currently stands at one million contracts, representing a notional value of approximately €750 million, with the five most actively traded dividend derivatives being Banco Santander, AXA, Telefónica, Vodafone Group and Iberdrola.

Listings of new products have heated up this year. In May, IDEM, the derivatives market of Borsa Italiana, started offering dividend futures on European single blue-chip stocks, and in June Singapore Exchange launched the Nikkei Dividend Point Index Futures contract.

The only market where there is relatively little activity is in the US, because there is a regulatory void between the CFTC – which regulates futures – and SEC – which regulates equities – on where these products fit in. However, European exchanges have stepped in and are offering dividend futures on US stocks.

Part of the appeal of dividend futures is that they are centrally cleared and are traded in a liquid market. “There is a general move away from non-cleared to cleared instruments among investors because of Dodd Frank regulation in the US and similar regulation in Europe. This product ticks all the fund management boxes of the new world, liquidity and transparency,” says Comair.

Melanion is certainly well placed to play this market as the whole team has a strong track record in trading this type of instrument. Before setting up Melanion Capital, Comair worked as the managing director of the fundamental trading desk at Societe Generale. At the time, he worked with Erwan Tigreat who was heading the convertible bond trading team in Japan and in Paris before joining Comair for the launch and expansion of SocGen’s dividend futures trading desk. Tigreat is now running the Business Develoment arm of Melanion.

The team is further supported by risk manager Dr Bing Zhou, a former quantitative researcher at SocGen and Mosaic Finance, where he developed algorithmic trading strategies, and Antoine Iskandar who worked at SocGen equity derivatives division and then left to Barclays Capital’s dividend futures desk and is now Melanion’s portfolio manager.

“Our strategy is a long/short dividend future strategy. 70% is fundamental dividend picking: we chose the dividends for our portfolio like a stock picker would chose his stocks. The decision to go long or short is based on our fundamental analysis. The remaining 30% is systematic quantitative arbitrage strategy,” says Comair.

On single stocks it is possible to bet on the dividend up to five years ahead; on the indices it is up to 10 years. The picking process is based on “pure fundamental conviction,” he adds.

Since the company received a green light to launch its dividend derivatives investment management activities, it received a major accolade from the French Ministry of Research and Development which granted Melanion Capital its Innovative Start-up Venture status (JEI Jeune Enterprise Innovante).

The ministry said it awarded the JEI status based on the company’s competence and expertise in a new and challenging asset class, on Melanion’s R&D work in building models for forecasting dividends, dividend volatility and dividend term structure, portfolio management and the development of proprietary risk management tools for dividend futures investment and development of pricing models for other dividend derivatives.

Comair said that the company sees the emphasis on research as one of its essential pillars for growth. When looking at a company’s dividend Melanion will go through a meticulous process.

Melanion carries out a very similar type of research to more conventional stock pickers when choosing shares, except the fund does not focus on the whole financial health of the company as this would have been performed by numerous other brokers already; Melanion focuses on just the dividend factors.

“Using the France Telecom example the questions we would ask are: does the company have enough cash, are they going to cut their dividend, are they leveraged, are they planning any acquisitions, what does their balance sheet look like. They have internal pressure from their unions to cut their dividend, so how strong is the union and will it be able to force that kind of decision?” says Comair.

There are several sectors that are particularly active, such as Spanish banks which pay very high dividends compared to their European peers. Spanish banks have a strong retail shareholder base who will hold on to the bank’s stocks even when shares dip because they are sure that there will be a high dividend paid out by the bank at the end of the year.

Jad Comair

Founder & CIO

Comair is an investment management professional with a strong experience in dividend futures. Prior to founding Melanion Capital, he worked for 10 years at Société Générale’s Equity Derivatives department as a managing director of the fundamental trading desk. For the past five years he set up and developed SocGen’s dividend trading desk which specialized in dividend futures. Comair holds an engineering degree from Ecole Polytechnique and a Masters in finance from Ecole Nationale des Ponts-et-Chaussées.

Antoine Iskandar

Portfolio Manager

Iskandar is a dividend future expert from his work at Société Générale’s equity derivatives engineering department in 2009 and 2010, and his work at Barclays Capital’s dividend future trading desk in 2011. For most of 2012, Iskandar worked with Comair for the launch of Melanion Capital, where he has been actively managing a mock portfolio. Iskandar is a graduate from ESSEC business school and has a Masters in Probability and Finance from Ecole Polytechnique.

Bing Zhou

Risk Manager

Zhou is a finance expert with a PhD in Physics. Prior to joining Melanion Capital, he worked for the past three years as a quant researcher in Société Générale and Mosaic Finance where he developed algorithmic trading strategies. Prior to that he worked for four years in Ecole Polytechnique’s Physics department, data mining and modeling laser physics. Zhou holds a doctorate from Ecole Polytechnique and a Certificate in Management from Ecole Nationale des Ponts-et-Chaussées and has several publications in the Physical Review Letters journal.

Erwan Tigreat

Business Development Manager

Tigreat is an investment management professional with 15 years’ experience in the financial markets, mostly spent at Société Générale as a managing director. He managed the convertible bond trading team in Japan then in Paris, actively managing a global book of CBs. In 2008, he joined the dividend futures trading desk, where he helped set up the launch and expansion of the desk. Tigreat holds an engineering degree from Ecole CentraleLyon.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical