To rename the single strategy asset management offerings of Old Mutual Global Investors (OMGI) as Merian Global Investors (MGI) – after spinning it out of Old Mutual – is more than a mere cosmetic exercise. The new name is inspired by the extraordinary German-born polymath Maria Sibylla Merian, whose ethos epitomises the culture of the firm. Merian, who lived between 1647 and 1717, advanced science by studying insects, as well as creating exquisitely beautiful botanical art. Just as Merian was a scientist and an artist, MGI views investment as both a science and an art, and offers systematic and quantitative strategies, alongside judgmental and discretionary approaches.

Merian was also a pioneer who documented metamorphosis, and an adventurer who funded her own expedition to Surinam to study nature first hand. Correspondingly, MGI gives fund managers the freedom to execute and evolve their proven investment strategies independently. “There is no CIO, and no house view is imposed on individual teams, who may hold opposite positions in the same markets or instruments,” says CEO, Richard Buxton.

(L-R): Leif Cussen, Portfolio Manager; Mark Greenwood, Portfolio Manager; Ian Heslop, Head of Global Equities; Richard Buxton, CEO and Head of UK Equities

Innovation

MGI also champions innovation, not least in being one of the first managers to launch a fund that trades the new asset class of contingent convertibles (Cocos). “We have a long history of igniting and educating client interest in new strategy types,” says Head of Global Equities, Ian Heslop. The firm has managed equity market-neutral strategies since 2001.

Bureaucracy can stifle innovation and MGI retains an entrepreneurial ethos whereby managers live or die by the success of their strategies. “We are unashamedly a boutique. We have 240 staff and would not want more than 300,” says Buxton. Though the emphasis on entrepreneurialism means that equally one could argue that MGI is a collection of boutiques that just happen to sit in one open plan office.

The TA Deal: Long term vision and incentives

The right owner is vital for preserving the culture of the firm. Merian persevered through different types of adversity, not least being initially ignored by the scientific community because she was publishing her works in German rather than Latin. Similarly, MGI and its new part owner, global growth private equity firm, TA Associates, have the long-term vision to stick with some unfashionable strategies – such as equity market-neutral, or precious metals, in 2018 – that may undergo periods of underperformance or losses. Merian was the first scientist to document every aspect from start to finish of how insects developed in their natural environment; correspondingly TA and MGI appreciate the benefits of strategies that are expected to provide powerful diversification benefits through a full market cycle.

Investment teams have always been involved in decision making, for example in determining maximum asset capacity for their strategies. Therefore, it is natural that the buyout from Old Mutual was led by six MGI portfolio managers (Amadeo Alentorn, Richard Buxton, Ian Heslop, Dan Nickols, Mike Servent and Richard Watts). Buxton wanted to partner with TA Associates because, “they have decades of experience in the asset management vertical and understand the cyclicality of the space. They play a long game. They supported Jupiter throughout the financial crisis, and increased their stake when Jupiter went public. We want an owner committed to growing revenues not cutting costs.

We have a long history of igniting and educating client interest in new strategy types.

Ian Heslop

“Despite the corporate changes, it’s been very much business as usual,” he continues. “The recent discontinuation of two strategies – the absolute return government bond team in Edinburgh, and a Hong-Kong based Asian equity desk – was part of the regular fund review process.” To help grow its presence in Asia, Merian has just signed a Memorandum of Understanding (MOU) with Ping An of China Asset Management (Hong Kong) Company Limited, which has been managing the Merian China Equity Fund since March 2018.

TA can help MGI develop other relationships that may accelerate its growth. The most obvious synergy between the two is TA’s connections in asset management. In addition, if MGI ever decides to start distributing onshore in the US, TA will be well positioned to offer some guidance, based on its extensive North American network. By way of contrast, Buxton points out, “there were no synergies amongst Old Mutual’s asset management businesses,” (which had included US asset management – now BrightSphere Investment Group; South African asset management – Nedbank; and UK wealth management – now Quilter Investments).

The Old Mutual ownership structure did not encourage direct ownership for MGI employees. “The new structure creates a new currency for rewarding teams, who can buy or be given equity in the business,” says Buxton. “All MGI staff now have direct or indirect economic exposure,” he adds.

The MGI Limited Board composition symbolises MGI and TA’s aligned interests, being equally balanced amongst TA, MGI and independents. It will contain nine directors, with three from MGI (Richard Buxton, Richard Watts, Ian Heslop); three from TA Associates (Chris Parkin, Richard I Morris Jr, Patrick Sader; and three independents, including Sarah Bates – who has over 38 years’ financial services experience – as independent non-executive chair, and Mark Gregory – who has more than 34 years’ experience – as independent non-executive director and chair of the audit and risk committee, demonstrating independent oversight.

Active management

MGI, like all TA’s portfolio firms, pursues active investment management but is not dogmatic about it. “We respect passive, index investing and ETFs, and expect both will continue to grow. We also think there is still a market for high active share alpha, and alternatives,” says Buxton.

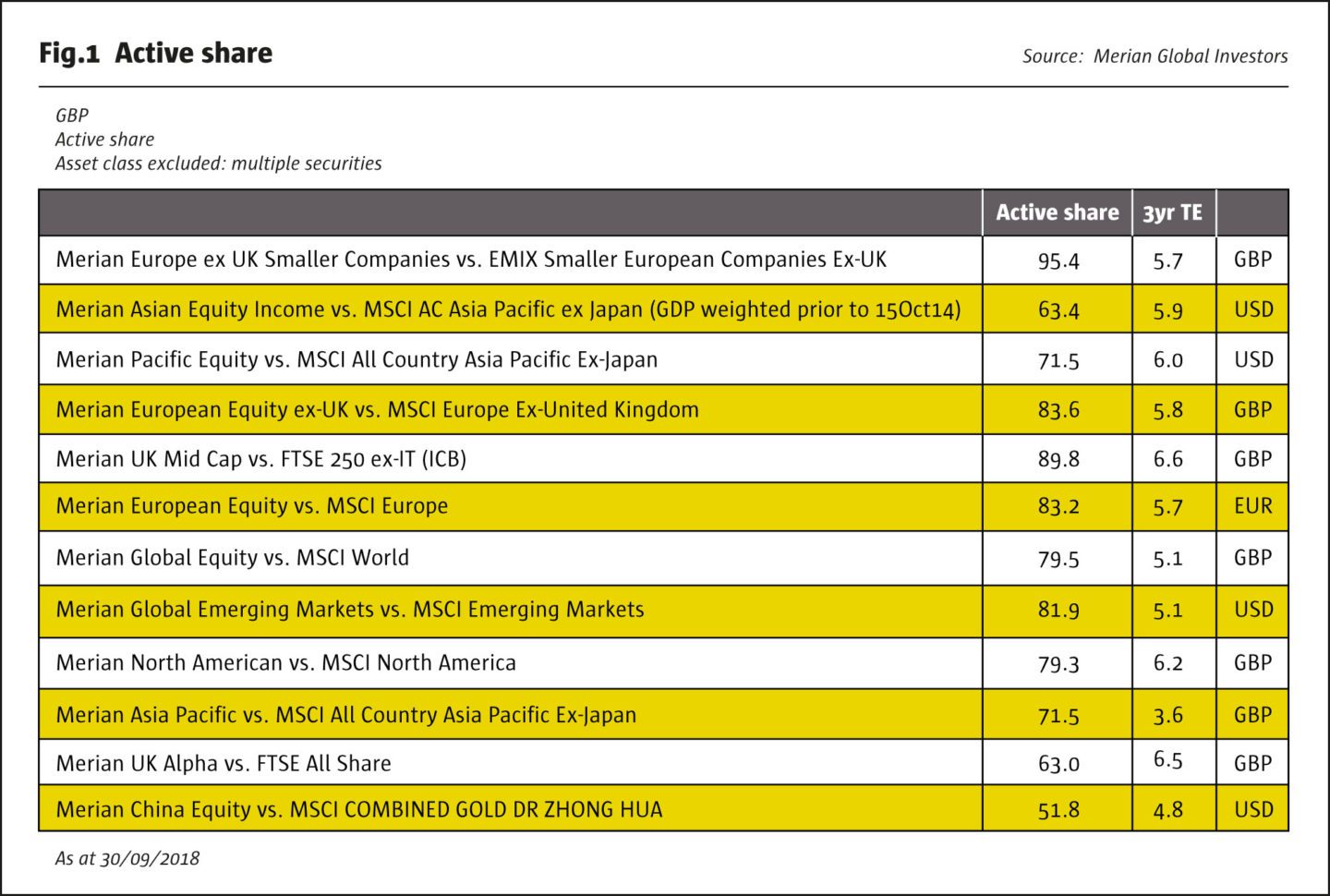

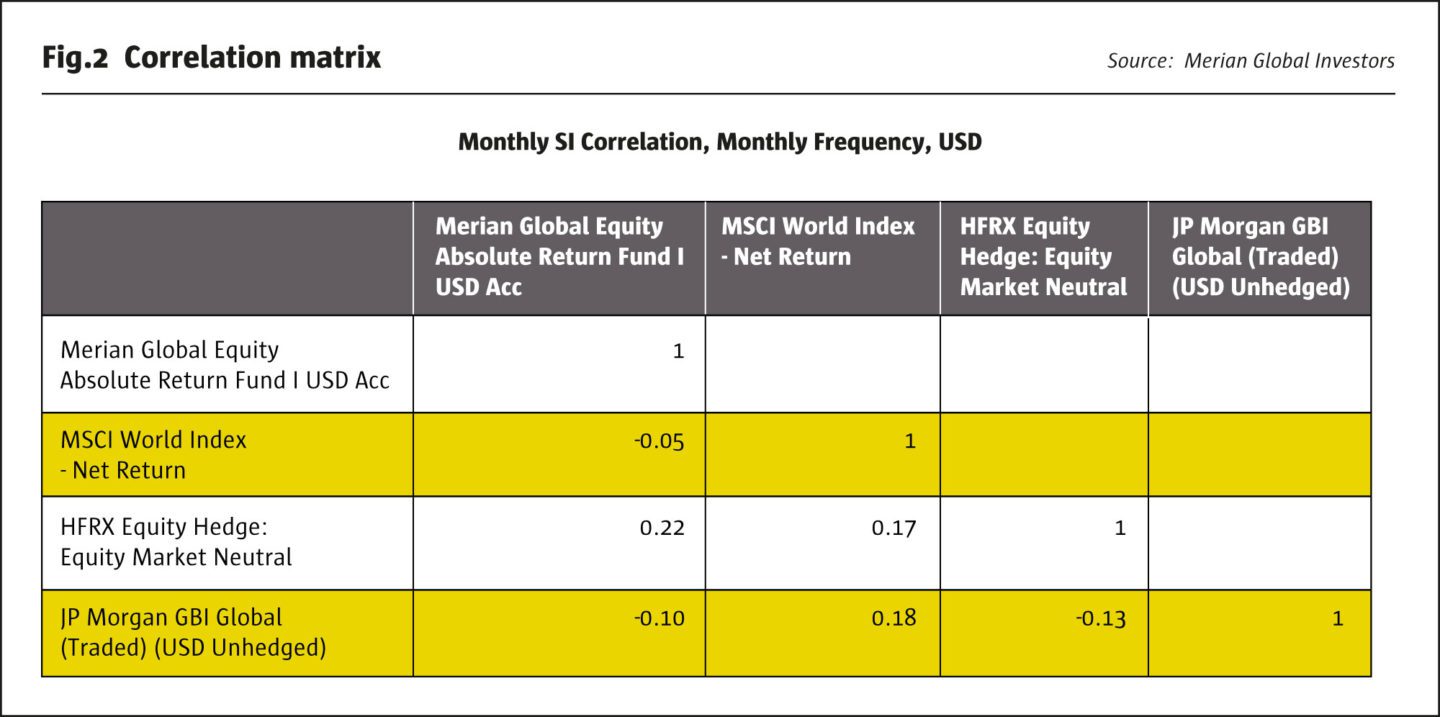

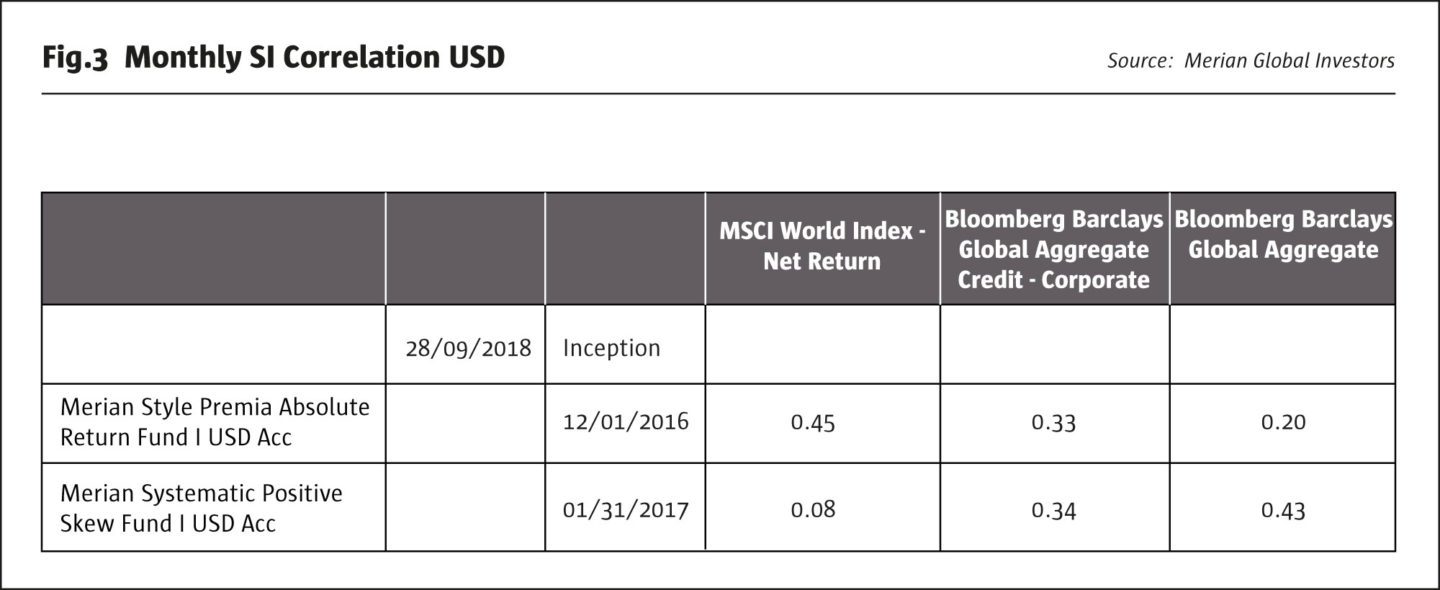

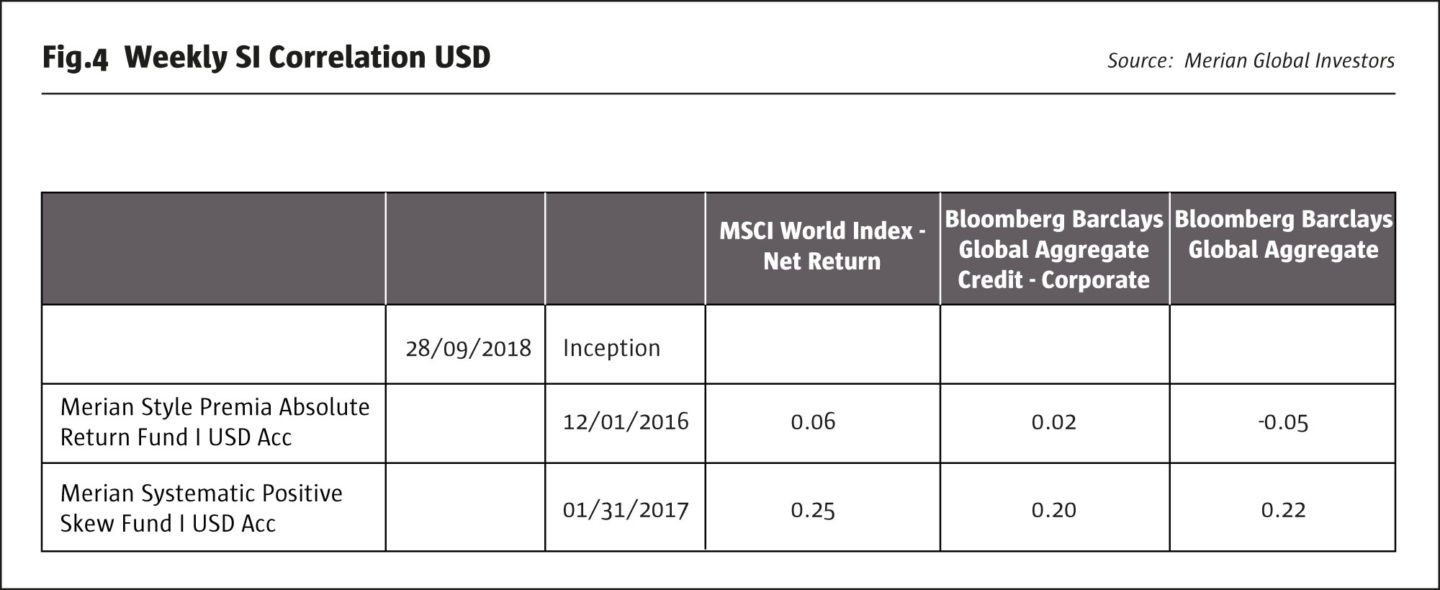

Doing something different is the common strand running through MGI’s strategies, both on the long-only and the alternatives side, where assets are $27.1 billion and $17.7 billion respectively, as of 31 August 2018. The active share metrics for long-only funds, and a correlation matrix for the alternatives flagship GEAR are shown below. MGI’s hedge fund strategies are not benchmarked against any hedge fund indices, but they show little or no correlation to hedge fund indices, and importantly also have low correlation to equity, bond and credit markets.

The MGI philosophy accommodates diverse approaches as there are multiple routes to the common goal of delivering a differentiated return profile. For instance, Buxton’s concentrated discretionary portfolio of around 30 large cap stocks, and Heslop’s global portfolio of 450 stocks, each have high active shares, showing how superficially very different strategies can both have low position overlap with the benchmark.

Though MGI’s managers pursue a highly individualistic style of investment, they still need to fit in on a personal level. Intellectual mavericks are welcome but they should not be sociopaths. “You have to be a bit of an oddball to be an active fund manager, but there is a tipping point between self-confidence and over-confidence. We weed out egos and politics when interviewing fund managers. They need to fit into our collegiate, collaborative and friendly culture. Candidates should expect to have at least 12 interviews,” says Buxton.

Cognitive diversity

Cognitive diversity is sought in another hat-tip to Merian, who as a polymath truly deserves the seldom-used epithet, “Renaissance woman”. MGI also believes in recruiting across the spectrum of academic disciplines: Buxton read English; Heslop studied chemistry; and the Chief Risk Officer is a lawyer, and not a quant as is common.

Quant engine

Most quants at MGI have a background in science and maths. In hiring quants, MGI is not specifically seeking those with PhDs in “buzzword” disciplines such as Artificial Intelligence, Big Data and Machine Learning, though some staff do have expertise in these areas. Buxton suggests, “some other asset managers are paying top dollar for these skills because they are starting from ground zero. We already have a good quant engine”. Additionally, Heslop is not a fan of some Machine Learning approaches. MGI only uses the technique on a “supervised” basis, in conjunction with a fundamental hypothesis explaining mispricing or predictive power. Heslop is wary of some “unsupervised” back-testing approaches that might be prone to over-fitting, and identify patterns that prove to be spurious.

“Quantamental” aspiration

Historically, MGI’s quantitative and discretionary strategies have been quite separate, though the teams do, unusually, sit next to each other in the office. “It is really quite rare to have different abilities in the same room. We can recognise the strengths and weakness of both approaches and want to build something more powerful,” says Heslop. Buxton sees scope for fostering a fusion between the two, which could result in hybrid products in particular markets or thematic areas. “We are good at fundamental analysis and meeting management. We also have a great quantitative toolbox for analysing data, style, factors, portfolio construction, risk controls and so on,” says Buxton. A “quantamental” approach might blend judgmental investing with more use of data with while maintaining controls over factor exposures and style risks. This ambition is very early stage for now but investors should watch this space.

Merian Global Investors’ Alternative Strategies

Below is a whistle-stop tour of MGI’s alternative strategies, briefly highlighting some of their distinguishing features. Readers can refer to our interview “OMGI’s Global Equity Market Neutral Strategy” in issue 130 for a deeper dive into the GEAR strategy (though the below does also give a taste of some more recent GEAR research projects).

GEAR (Global Equity Absolute Return)

GEAR, managed by Ian Heslop, Mike Servent, and Amadeo Alentorn, has since 2009 generated some of the best risk-adjusted returns in the equity market neutral space, and consequently has won The Hedge Fund Journal’s “UCITS Hedge” awards. GEAR has consistently demonstrated returns that are not only uncorrelated to equities, bonds and credit, but also to the return stream of peers as measured by equity market neutral hedge fund indices. GEAR uses proprietary factors – for instance its value factor has greatly outperformed generic measures of value. Assets in GEAR have stabilised around $17 billion (the team also manages around $10 billion in long only).

As of October, 2018 has been a somewhat challenging year, for two main reasons. “The best performing styles – low volatility and beta – do not form part of GEAR. While GEAR to some degree attempts to time factors, 2018 has seen some violent episodes of style rotation that have occurred too fast for GEAR to adjust. The strategy does dynamically rotate around factors, and aims to shift exposures at inflection points – but does not want to get whipsawed by doing so more often,” explains Heslop. He expects that, “a normalisation of equity market volatility towards historically typical levels of 15-20% annualised will increase the appeal of GEAR’s low volatility: it is managed to a 6% volatility target (the Cayman ARBEA version of the strategy, launched in 2013, targets volatility closer to 9%)”. He also expects that choppier markets will make GEAR’s uncorrelated return profile more attractive.

Several research projects are underway in GEAR. “Multiple portfolio optimisation will apply liquidity constraints across multiple portfolios, capping the aggregated exposure to individual stocks. It may also allow different portfolios to use different stocks to target similar levels of alpha,” says Heslop.

GEAR can have net exposure to sectors and industries, but has historically been broadly country neutral. This constraint is being reviewed, which may allow for some degree of country directionality.

The dynamic weighting schemes are also under review. “As well as rotating around existing live series, the models may reintroduce new ones such as macroeconomic factors and factor mean reversion,” says Heslop. “But we will change only incrementally, because we have confidence that the models provide good downside risk control”.

Merian Style Premia Absolute Return Fund (STAR)

STAR is a market neutral strategy managed by Leif Cussen and John Dow, who have been with the firm since 2005 and 2006 respectively, previously co-managing statistical arbitrage (stat arb) strategies that were offered on a standalone basis. STAR could, to some extent, be categorised as an Alternative Risk Premia (ARP)/ Alternative Style Premia/Alternative Beta offering. Four of the factors it trades – value, momentum, carry, quality – though defined in house, are fairly generic in principle. Its fifth strategy is a proprietary stat arb strategy that seeks to capture the liquidity premium investors pay to enter or exit positions at times of imbalances between supply and demand. Though style weights do not vary a great deal, STAR aims to add value through its risk-weighted optimisation of individual factors, and by systematically recycling unused style risk allocations. “Periods of extreme market stress and the unwinding of crowded trades can both increase demand for liquidity and therefore often provide rich opportunities for the Statistical Arbitrage style,” says Cussen. STAR has exposure to stat arb, which applies only to equities and not to fixed income or foreign exchange; whereas the carry strategy does not apply to equities. Value and momentum apply to all three asset classes; commodities are not traded. STAR also aims to enhance returns through maximising the efficiency of implementation of all five core styles for example through leveraging MGI’s systematic heritage and minimising associated implementation costs.

Merian Systematic Positive Skew Fund (SPS)

SPS is perhaps the MGI alternative strategy that is most difficult to fit into any established strategy bucket. SPS invests in a similar investment universe to most CTAs: mainly liquid futures in energies, agriculturals, precious metals, equity indices, FX, bonds, and short-term interest rates. But SPS shows near-zero correlation with traditional trend-following managed futures indices, as measured by the SG CTA index. Manager Mark Greenwood says, “SPS is theory-led whereas many CTAs are data-driven, using quants to mine data for signals”.

Greenwood was, between 2000 and 2014, a discretionary trader of inflation and exotic currency options and derivatives at investment banks Barclays and RBS, but has now codified his process into a set of systematic rules. “These rules follow a theory on how options markets exert influence on futures markets,” he says. The objective is to use options markets to gauge the likelihood of extreme moves in markets.

SPS aims to generate a positively skewed return profile (which some broader CTA indices have not exhibited over the past couple of years) but without the drag from option premiums paid for not an option-like payoff profile. The return pattern is expected to be less directional than CTAs and more geared towards profiting from phases of higher market volatility, and from crowding in markets. “The more crowded markets become, ie the more the rules-based investors use the same rules, the greater the potential for positively skewed returns according to the theory underlying the strategy. This is because crowding can result in disorderly markets if positions are simultaneously unwound and we believe the SPS theory can identify when these situations are more likely to occur,” explains Greenwood. From inception to October 2018, SPS has outperformed the SG CTA index.

Merian UK Specialist Equity Fund (UK SEF)

The UK small and mid-caps long/short strategy is run by fund manager Tim Service, who has been with the firm since 2007, and deputy fund manager Luke Kerr, who joined in 2001.

The strategy is about $800 million in a Dublin-domiciled UCITS vehicle, having originally started life as a Cayman–domiciled fund in 2003. UK SEF’s sterling share class annualised at just under 8% with low volatility and low correlation to equity markets including the UK’s mid-cap FTSE 250 index. Unlike many UK long/short equity funds, it is broadly market-neutral. Net exposure is low, but not zero, and returns come predominantly from stock-picking alpha on the long and short books. “The long book of the fund benefits strong stock-picking pedigree of Merian’s UK Mid and Small Cap team, who manage around £7 billion AUM, and a range of mid and small cap funds with very strong long-term records. Our standing gives us exceptional access to management teams, and a well-resourced and experienced team of eight, all of whom contribute to idea-generation on UK Specialist,” says Service. “We use the desk’s scale to our advantage in the IPO market, and believe our track record here has been supportive of performance in recent years,” he adds. “The short book benefits from a large universe of under researched stocks, where the scope to anticipate profit warnings or identify structurally challenged businesses, we think, is higher than in the large cap universe. Most small and mid-cap investors are long-only, and most sell-side small-cap analysts have little interest in looking for short ideas”.

This desk is also managing the recently launched UK-listed investment company, the Merian Chrysalis Investment Company Limited, that invests in the unquoted sector. For many years, the team have met pre-IPO companies but not been able to make substantial allocations to them within the confines of liquid products. “Chrysalis opens up a huge field of opportunity to invest in the UK’s abundance of vibrant, creative and disruptive new business formation,” says Buxton. It also provides the team with market intelligence, particularly since many innovative smaller firms are staying private for longer. The fee structure is innovative in that no fees will be charged on uninvested cash until the vehicle is 90% invested.

Merian Strategic Absolute Return Bond Fund (SARB)

SARB is managed by Head of Fixed Income, Mark Nash, and portfolio manager, Nicholas Wall, who both joined from Invesco in 2016. The desk includes eleven other investment professionals, specialising in areas such as emerging market debt, credit and Cocos, and sovereign debt. Nash argues that, “larger teams suffer from inertia and bureaucratic processes that result in market consensual trades, and also suffer from a slow decision-making process to alter positions in a fast changing environment”. SARB takes both long and short positions in entire fixed income and currency universe: government bonds; foreign exchange; credit; emerging market debt and volatility. It can be seen as a macro fund, plus credit, and minus commodities and equities. Says Nash, “we focus on price movement more than yield. Carry analysis is always a part of the process, but should not be the primary driver of trades. Many strategies fall foul of this”. SARB is subject to a strong risk management framework: “headline volatility levels always adjusted for market risk, best ideas are scaled for conviction, volatility and correlation,” he adds.

Merian Contingent Convertibles (Cocos)

Cocos has been managed by Lead Financials Research, Lloyd Harris, and Rob James, since August 2017. Few other Coco funds exist, and most of them benchmark cash, whereas Merian’s fund uses a Cocos benchmark. The managers are of the opinion that, “the asset class is extremely cheap, offering high yields but very low realised volatility for that yield level,” says Harris. Additionally, “the asset class has low correlation to other corporate bond asset classes and negative correlation to US Treasuries”. Their general view is that banks are now significantly better capitalised in the past, but they take care to, “exclude the marginal banks that are challenged on distributable reserves and projected capital ratios,” he continues.

Merian Gold and Silver Fund

The precious metals strategy is run by Ned Naylor-Leyland, who previously ran a precious metals fund at Cheviot Asset Management, and Joe Lunn, who was a mining engineer in South Africa. It owns physical bullion, which may mitigate counterparty and other risks that can be entailed in ETFs. The strategy also has long exposure to gold and silver equities. It aims to profit by dynamically varying weights between bullion and equities, and between gold and silver. Historically, silver has shown higher volatility than gold, and equities should in theory be a leveraged, higher volatility/beta play on the underlying.

“We focus on mid cap companies which are historically cheap and include likely acquisition targets for the large cap “majors” which are faced with declining reserves. The dearth of actively managed strategies and fundamental equity research relating to mid-cap gold & silver miners results in mispricings and opportunities for the funds,” says Naylor-Leyland.

It also includes proprietary financial modelling. “We maintain models of the companies which are based on our own work and analysis of mining operations (rather than relying on the equity research of third parties),” he says.

“Companies are evaluated based on the location of their assets (certain jurisdictions are no-gos), management capability, the equipment and processes that they utilise, and their approach to ESG,” he continues.

“With gold under-owned, there could be potential for a major trend reversal,” concludes Heslop.

Diversity and ESG

Merian was a woman, and MGI is taking diversity seriously. Four out of seven members of its executive committee are women: Head of HR, Karen Barnett; CFO, Terri Borain; CRO, Jessica Brescia; and COO, Nicola Stronach. MGI’s Independent non-executive Chair, Sarah Bates, promotes diversity within the investment management industry and is a co-founder of the Diversity Project and chair of the Diversity Project Charity. Well aware that women remain under-represented in investment management functions, Buxton points out that, “the industry has failed to recruit and retain women. We are determined to do something about it, and fully support the Investment Association’s merger with Investment 20/20 and the related diversity initiative. We are asking head-hunters to send blind CVs, so we do not see names, genders, or schools, to avoid any unconscious bias. Three recent investment recruits across three desks have been women. But we cannot suddenly fire half of our investment staff, as it is an industry-wide problem”.

Diversity is one facet of the ‘S’ in ESG policies, which apply internally and are part of the process for analysing external investments. MGI has for many years had policies around Governance, the ‘G’ in ESG, such as proxy voting and engagement, an area in which Buxton has taken a close interest. Inundated with RFPs for ESG mandates, the firm is now building out the E and S, Environmental and Social, with two recent hires including Head of Responsible Investment and Stewardship, Freddie Woolfe and Lydia Harvey as ESG Risk Manager. One focuses on integrating ESG data into existing processes and the other is actually a member of the risk team, which speaks to how MGI perceives ESG. Heslop argues that, “we have done a lot of work internally and the jury is out on whether ESG tilts in portfolios are alpha-generative. But ESG could reduce left tail risk in portfolios – and also corporate reputational risk for MGI itself”. Heslop continues, “we have developed quantitative ESG screens, but still have some reservations about some data, so there is no perfect screen. Hence an ESG analyst is needed to exercise judgment”. On supply chain analysis (which might involve millions of firms at various stages of supply chains), Buxton agrees that it is difficult to decide where to draw the line, and recalls having conversations about this with environmentalist, Jonathon Porrit, 25 years ago.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical