The M&G Episode Macro strategy has delivered a return to risk ratio near one since 2001, outperforming world equities and bonds, and unlike some other macro approaches it has performed similarly before and after the GFC. The UCITS version of the strategy has periodically received The Hedge Fund Journal’s UCITS Hedge award for best risk-adjusted returns in the global macro category. The strategy, which runs over $4 billion, can also be accessed through a Cayman fund or managed accounts.

Dave Fishwick, Portfolio Manager, Episode Fund, M&G Investments

Over three decades of macro trading, including a stint in Australia, lead manager Dave Fishwick has been long and short of everything at different times, and even had a three-month spell with no exposure at all in 2002. His opportunistic approach does not target constant volatility nor any structurally negative correlation to conventional asset classes. Trades are intended to be standalone profit centres rather than hedges for other parts of the Episode portfolio or clients’ portfolios.

Episode’s core positioning over the past 10 years has been mainly in the direction of trends as has its performance attribution, with long equities and bonds making the bulk of returns. Taken together, developed market, emerging market and sector equities, have generated roughly half of returns; long government bonds nearly one third, currencies around one tenth, and corporate credit a sliver.

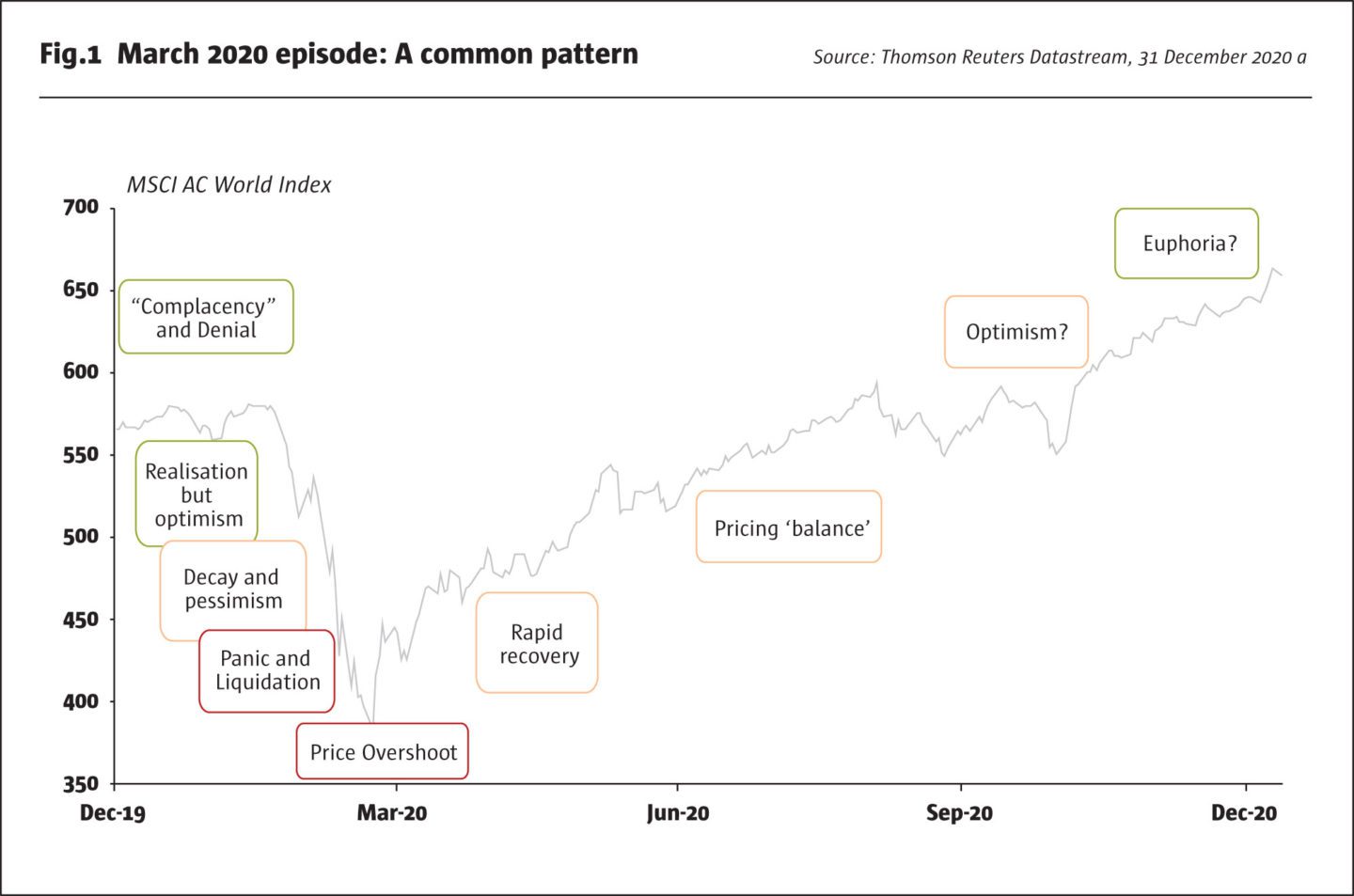

Yet the strategy has been contrarian with respect to short term rapid price moves that have sometimes overshot into euphoria or panic, where price action has engendered self-fulfilling feedback loops. It has also been at variance with trends in terms of tactical trading around core holdings, scaling in and out of positions, buying more on setbacks and top slicing on rallies. Intermittent short government bonds wagers have been the largest detractor from returns, in contrast to some trend following and other strategies that have been mainly long of bonds for decades.

A tale of two bear markets

Long bonds contributed positively for Episode in 2008, but not by enough to outweigh equity losses. The emphasis on valuation mainly explains why performance has varied in risk asset bear markets. “I profited from the TMT bubble bursting in 2001-2002 but 2008 was my worst phase, both personally in terms of human stress and for a valuation driven strategy,” says Fishwick. The reasons for the disconnect between the two bear markets are insightful and disarmingly simple. “In 2000, valuations signaled that 30-year bond yields of 7% in nominal and 5% in real terms were great value relative to equity earnings yields, and the most elevated equity valuations were also running into negative news-flow. We saw the risk of a permanent multi-year loss from tech stocks as very high. We shorted equities and might do so again if we thought they were sustainably overpriced. The 2008 crisis was more difficult to navigate because valuations were compelling and indeed assets such as credit, equity and EM FX did rally by 50% subsequently,” recalls Fishwick. “Whereas sustained losses after the TMT bubble were based on wildly elevated valuations, temporary losses in 2008 were based on reasonably valued assets caught in the maelstrom of extremely bad crisis news-flow, and the mark to market losses were recovered,” explains co-fund manager, Eric Lonergan.

We maintain humility about what is possible and play the odds in a structured way while varying our exposure, observing rather than forecasting.

Dave Fishwick, Portfolio Manager, Episode Fund, M&G Investments

Eschewing stops and tactical trading

Stop losses were not relevant in 2008 nor later, and have never been part of the strategy, which could cut a losing position if the investment thesis had changed – or may well average down by adding to some losing positions, as has been the case with cyclical equities in 2020. “Stop losses do not make sense philosophically as we want to exploit price action, and fixed correlations do not make sense because we want to respond to changing patterns of correlation. We might target positive correlation with risk assets if we judge the odds are in favour of it or could be negative at other times,” says Lonergan. The strategy is prepared to embrace volatility and tolerate losses that are expected to be temporary.

Thus, Fishwick was quickly vindicated by a banner year in 2009, but nonetheless the 2008 performance drawdown has contributed to more cautious position sizing in keeping with the variable volatility approach. “We went into the 2015-2016 and 2020 downdrafts with less capital, and split the capital allocation budgets between medium term value themes and episode themes. Since we were not fully loaded, we could add risk in March 2020,” says Fishwick.

In late 2020, gross exposure of 60-80% was well below the average of 200% for the strategy, which has never exceeded 400% even when it had heavy weightings in short dated interest rates, and does not leverage equity exposure. In October 2020 Fishwick admitted that, “In 2020 it is difficult to build a diversified portfolio, that exploits inefficiencies and also provides protection, and we see very little absolute value outside cyclical equities. Cash is lousy, government debt offers poor buy and hold returns, credit spreads have compressed, and equities overall are rich to neutral. The only standout is the relative value of cyclical equities, which is more of a value point than an episodic point. We now have fewer long equities than in 2019, and also a smaller long Treasuries position because we do not expect 30-year bonds yielding 160 will provide as much diversification benefit as those yielding 350. We are being well paid in absolute and relative terms to own equity risk, but cannot size it too big given the volatility”. Notwithstanding the downsized exposure, positioning in equities and US Treasuries has paid off in November 2020, which was the fund’s best month since inception: up 10.5% for the USD share class.

The strategy held onto cyclical and value equities through some months of volatility – and added to positions on the September 2020 pullback – before they rallied in November, prompting some top slicing. This tactical trading around core positions is typical: “We scaled equity exposure down from 60% to 20% in late 2019 and added Treasuries. This meant we were able to re-size equity exposure in late March 2020, when it felt very uncomfortable to do so. We were conscious of our emotional bias caused by brokers warning that markets might re-test the lows. We were terrified to increase risk but fought this and doubled our exposure in late March. Nonetheless, our bias probably resulted in smaller sizing,” says Fishwick.

The post-GFC macro climate

Some macro and CTA investors who have not met their return targets in recent years lament that central bank manipulation, low volatility and limited dispersion have cramped their style post-GFC. Yet Fishwick argued in his July 2017 article for The Hedge Fund Journal titled, “The Wrong Type of Macro?” that some macro managers could be falling short of return targets because they had prioritized low volatility and negative correlation over return generation, and perhaps even become bond proxies in some cases.

Fishwick in contrast has maintained high single digit average annualized returns and a Sharpe ratio near one since 2008. The fund’s best year since 2009 has been 2019, which should be seen in the context of 2017-2018 setting up the opportunity. Fishwick recalls: “The rise in Fed Funds interest rates helped two-year rates to increase from 1.2% to 3%, while 30-year yields peaked at 3.5%. This pressured all asset valuations, and fears were compounded by the trade war and recession fears. This climaxed in December 2018 with equities down 15%. We then added to equity exposure and long 30-year Treasury exposure. We tactically scaled up equity exposure during the year and also shorted UK and German bonds. We profited from a big equity rally but did not lose much on shorts. This was a classic valuation driven episode for us, with scaling of capital”. There were also signs of behavioural biases such as pessimistic sell side analysts and strategists, which strengthened his conviction.

Eric Lonergan, Fund Manager, M&G Investments

Myopia

Extreme pessimism in late 2018 threw up opportunities, just as it did in the spring of 2020, and there have been other phases of excessive negativity over the past decade. “There have been plenty of false alarms and perfect storms based on other investors’ myopia, volatility aversion and volatility targeting,” says Lonergan. “Big shifts in asset prices and mispricing of risk by investors are as prevalent as ever. There is a fundamental inconsistency between volatility targeting and being an active manager,” he contends. Lonergan views myopia as a very powerful force influencing investor behaviour: “Myopia is an evolved instinct and philosopher David Hume observed the human bias, describing it as narrowness of soul. Myopia is hard wired because humans had to survive from moment to moment, so we tend to react when prices are moving rapidly as if an emergency is imminent. Myopia has been supercharged by technology. Quant analysis reinforces myopia as investors think they need more and higher frequency data to improve predictive power and try to forecast even on an intraday basis,” he finds. The use of high frequency data, including alternative data, for forecasting has become increasingly fashionable, in both discretionary and systematic macro investing, but Fishwick more or less retired from prognostication over 20 years ago.

Forecasting and behavioural finance

Determining that economic variables were non-forecastable marked a major shift in Fishwick’s approach in the late 1990s: “It is really hard to cyclically forecast, and even harder to work out what the market response will be. So, the valuation of risk premia can matter more in helping investors to gauge odds than economics. For instance, Italy and Greece face economic challenges but their bond yields are near all-time lows. It has always been the case that perceptions of risk and the starting point of value are periodically far more important than changes in the underlying fundamentals”.

He switched the focus to grappling with his own and other investors’ behavioral biases, though he acknowledges that, “the early behavioural finance literature was not very helpful in providing practical guidance about how to cope with the biases. The practical applications have only recently been developed. For instance, when scaling into trades, we wait until we no longer want to do them”. Indeed, Fishwick has found that when he felt comfortable with positioning, he was usually wrong, so he would rather be “deeply uncomfortable” as he was in October 2020: “There were many days when we felt uncomfortable with 30% of NAV in the South African Rand, Mexican Peso, Brazilian Real and Indian Rupee. Owning cyclical equities that have gone nowhere for 3-5 years is also pretty uncomfortable. And the portfolio hedge of 30-year Treasuries yielding 1.5% is also tough mentally, when I grew up with yields of 18% in the 1980s,” he reflects. This mental anchoring and referencing can also explain slow market adjustments. “This is probably why it took so long for markets to flatten yield curves. Even in Europe, 30-year bunds continued yielding 2.5% to 3% for years when rates had dropped to zero,” he points out.

There have been plenty of false alarms and perfect storms based on other investors’ myopia, volatility aversion and volatility targeting.

Eric Lonergan

In his June 2016 article for The Hedge Fund Journal titled, “A Pivotal Moment? Assessing the emotional make up of investors”, Fishwick highlighted how euphoria can lead to overconfidence and risk taking, while losses can be very traumatic, and either of these can lead valuations to overshoot or undershoot. His sweet spot trade is a genuine episode, where the stars are aligned amongst compelling valuations, irrational price moves driven by behavioural biases, and a good unique story, all of which can lead to larger position sizes in the more liquid markets. In 2016, investors were accepting negative yields on sovereign debt and had become pessimistic about economic growth, which led to a high equity risk premium for cyclical equities as in late 2018 and 2020.

Liquid linear instruments

Emotional human biases may well also lead to mis-pricings in exotic and complex derivatives, which are critical for trade structuring in some macro strategies, but the choice of instruments has historically been relatively plain vanilla for Episode. “We are looking for the closest exposure to our view, with highest liquidity at the lowest cost. We also have to consider what is tax efficient and eligible for investment via a Cayman vehicle,” says Fishwick. Most of the portfolio is in futures or FX forwards, but ETFs can occasionally be used. For instance, in emerging market local currencies, the team judged that there were not enough liquid futures with long enough duration, so selected a reasonably large and liquid ETF with a multi-billion-dollar market capitalisation.

Historically, the Episode strategy has always used linear, delta one instruments, and tended to view options as relatively expensive at times of heightened risk aversion when it typically wanted to ramp up exposure. The managers could contemplate using options however, in areas such as selling complacency. “Our trade structuring could change in future. We are always open to using options, particularly if we want to drill into more granular industries with stretched valuations and bet against complacency. We might buy index puts if the time is right,” says Fishwick. The managers contemplated shorting technology equities in 2020, but determined that zero interest rates had resulted in a valuation conundrum, while earnings momentum has been positive in contrast to the downgrades seen around 2001-2002.

Within equity markets, Episode has drilled down to the level of industrial sectors, such as mining, banks or technology, but will not trade single names (that are traded elsewhere in M&G and in some of the multi-asset strategies that can feed off similar macro views).

Big Picture Thinking – Inflation, Dual Rates and Politics

Though there is plenty of shorter- and medium-term tactical trading during the year, there is also longer-term thinking bubbling away. Lonergan is an economic commentator and author of books, blogs and articles. Fishwick also has big picture longer term views, and both of them contribute to the Episode Macro blog, along with a dozen or so colleagues within M&G’s Multi Asset team. Lonergan also has his own website, philosophyofmoney.net, including a blog. These writings cover a huge spectrum of areas and we highlight three topical ones here.

Some commentators have suggested that the Federal Reserve’s greater tolerance of inflation is a paradigm shift, the biggest change in monetary policy in 40 years, and might lead to a resurgence of inflation. Lonergan is for the time being rather sceptical: “Central banks have persistently failed to hit their inflation targets. Japan’s central bank shifted its targets and did not manage to arrest persistent deflation. Central banks are still anchored to the challenges of 1970s inflation”.

Lonergan views the advent of dual rates in Europe as potentially far more momentous for monetary policy than tweaking inflation targets: “For the first time since its inception the ECB has not cut official rates despite a deep recession. It has only been engaged in asset purchases, which are not so new – central banks did them in the 1700s. But the ECB has introduced a targeted interest rate for lending that differs from the money market rate, and this could be a real game changer. If funding rates dropped to minus 4 or 5%, the ECB could really cross a Rubicon into the idea of infinite monetary policy, as China had in the 1980s”. Lonergan recently flagged up that the Bank of England has also been discussing dual rates.

On politics, Lonergan has observed that the Covid crisis has amplified both ESG and neo-nationalism, increasing the scope for extremist politics in either direction. New Zealand’s landslide win for Jacinda Ardern could be an example of a relatively left-wing agenda, that also caught Fishwick’s attention: “The New Zealand election manifesto was quite left wing, but ESG could also be very pro-capital,” he says. Fishwick thinks that concern over diversity and inclusion could heighten the focus on rising inequality and tensions between capital and labour, but he remains open minded about how this pans out politically. “We are humble in being more reactive than pre-emptive on politics,” he admits. They did not position the portfolio for any particular US Presidential election outcome last year.

Fishwick has suggested that the unprecedented use of the word ‘unprecedented’ in 2020 is not justified because he is not sure that market outcomes are any less predictable than in other years, and he is confident about dislocations opening up opportunities in future: “The strategy is as valid and reasonable today as ever. Myopia, hindsight bias and commercial pressures such as calendar year bias are chronic. We maintain humility about what is possible and play the odds in a structured way while varying our exposure, observing rather than forecasting. We have an advantage in having seen many surprising things over 30 years, and the ever-present feature of markets is that people remain surprised”.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical