Millburn, the USD 6bn+ AuM quantitative manager based in New York, is moving quickly towards the launch of a new long/short commodity/resource thematic strategy, which carries the moniker “Resource Opportunities Program”. This new strategy builds on the firm’s more than 50 years of experience in trading commodities, capitalizing in particular on the application of its proprietary machine learning technology to new markets in China (where the firm has been active since 2013) and to a diverse range of global commodity, FX and equity themes.

There are several key theses for maintaining a strategic weighting in commodities – and some recent developments may strengthen the case for increasing tactical allocations.

Some of the world’s largest pension funds, including those in the Netherlands, have been using commodities to diversify their conventional asset class exposures since the 1970s when “stagflation” was harsh for equities and bonds – but a boon for commodities.

Today’s commodity asset class can be thought of differently than the traditional hard and soft commodity sectors.

Barry Goodman, co-CEO and Executive Director of Trading, Millburn

In 2021, some investors argue that gargantuan money printing and fiscal stimulus associated with the COVID-19 crisis must ultimately percolate into faster inflation, and central banks in regions like the US and Eurozone are now willing to tolerate inflation overshooting their central targets, at least to some degree, partly to compensate for historical under-shoots. If vaccine rollouts allow economic activity to normalize, consumer savings could be unleashed and trigger price inflation, which could also entail a cyclical upswing in commodity prices.

Yet some forecasters, such as Goldman Sachs’ Head of Commodities Research and other bank research desks, go further and have suggested that the appetite for commodities could be longer lasting. The asset class could be on the cusp of a multi-year super cycle, or structural bull market, comparable to the first decade of the new millennium or indeed the 1970s (as a side note, Millburn is probably one of the few managers today that can say it traded through both).

Potential differences this time, however, include the green industrial revolution, which could be a powerful driver and that is seeing over 100 countries and many hundreds of companies commit to net zero carbon emissions by 2050. Further, a social policy shift to “stakeholder capitalism” redistributing income to lower income groups, such as recent graduates whose student debt has been forgiven, could also boost consumer spending and stoke inflation.

1.2

Since September 2013, when Millburn completed the first stage of phasing in its machine learning platform, Sharpe ratios for the Commodity Program, net of fees, have been above 1.2

It is worth keeping in mind that Goldman’s economic growth forecasts are well above consensus levels, but even some investors with a more circumspect economic outlook, who are more agnostic on the overall direction of commodity markets, still envisage alpha generation opportunities (as well as the chance for diversification) through investments in commodity markets. Disruptive trends such as electrification of vehicles and the shift to renewable power generation could generate long term winners and losers in commodity markets, as well as short term volatility caused by the transition of economic and business models and changes in consumption patterns, both of which could create trading opportunities.

As a long/short vehicle, Millburn’s Resource Opportunities strategy may be well-placed to exploit both broad directional and idiosyncratic market action in commodities, over short- and long-term windows. The Resource Opportunities strategy builds explicitly on the success of Millburn’s storied Commodity Program, which launched in 2005 but has been closed to new capital since early 2018 (and which posted another strong result in 2020’s COVID-stressed year). Since September 2013, when Millburn completed the first stage of phasing in its machine learning platform, Sharpe ratios for the Commodity Program, net of fees, have been above 1.2, and the strategy has exhibited negative correlation to global equities and bonds. For instance, March 2020 was the strategy’s second-best month in history, returning +10.92%, helping investors mitigate losses that most would have experienced elsewhere in their portfolios over that turbulent period. The program is off to another good start so far in 2021, up +5.10% through February.

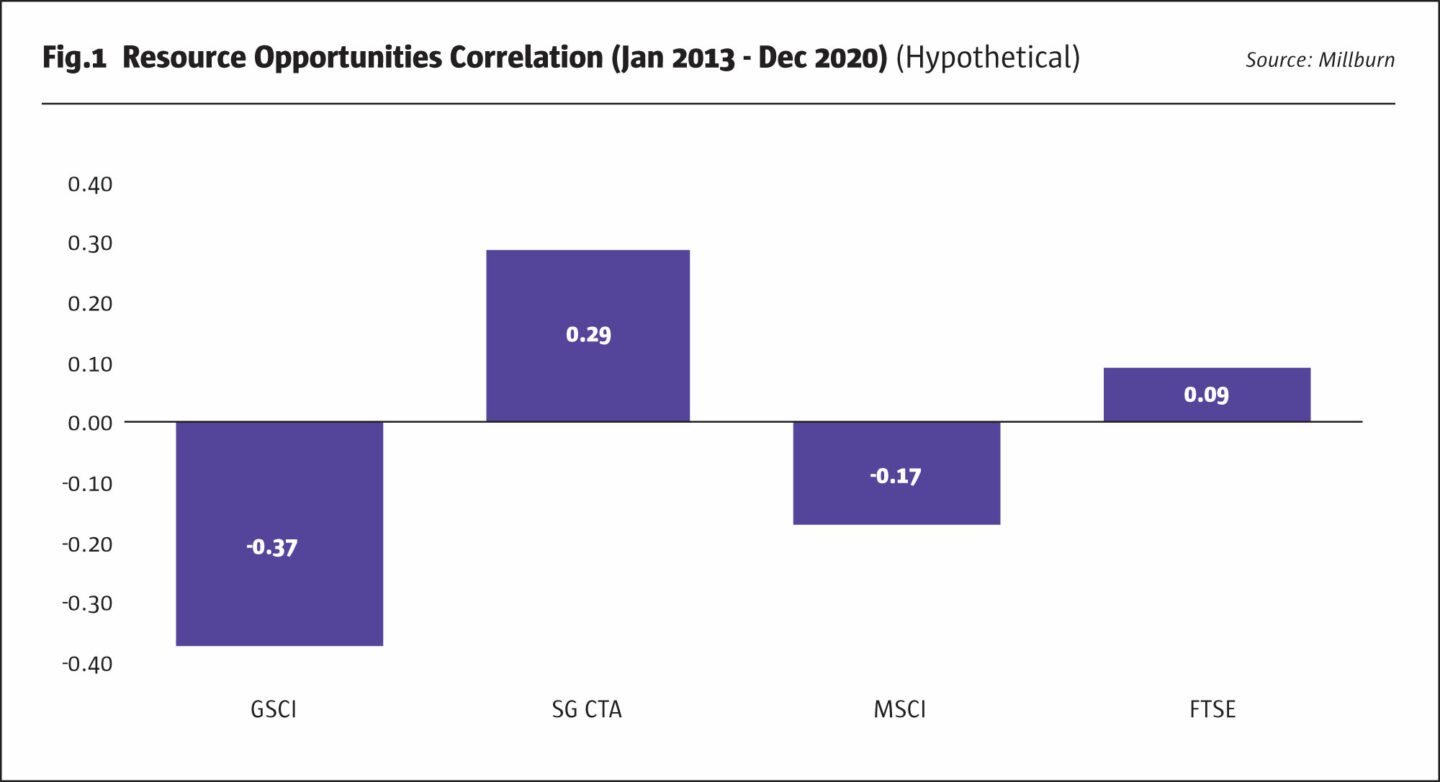

The Resource Opportunities Program research indicates the strategy would have been lowly correlated not only to equities, but also to commodities and CTAs, as shown in Fig.1, based on hypothetical returns.

While the Resource Opportunities Program has significant overlap with the Commodity Program in its strategies and models, which trade mainly directionally – opportunistically shifting between momentum and mean-reversion signals – and trade calendar spreads, the new program applies the directional strategies to a wider range of individual markets as well as thematic baskets of multiple markets. It expands the investment universe by assets and geographies, adding exposures and strategies that the firm believes will place it in the vanguard of “next generation” approaches to disruptive commodities and resources, including the flexibility to continue evolving and incorporating future innovations.

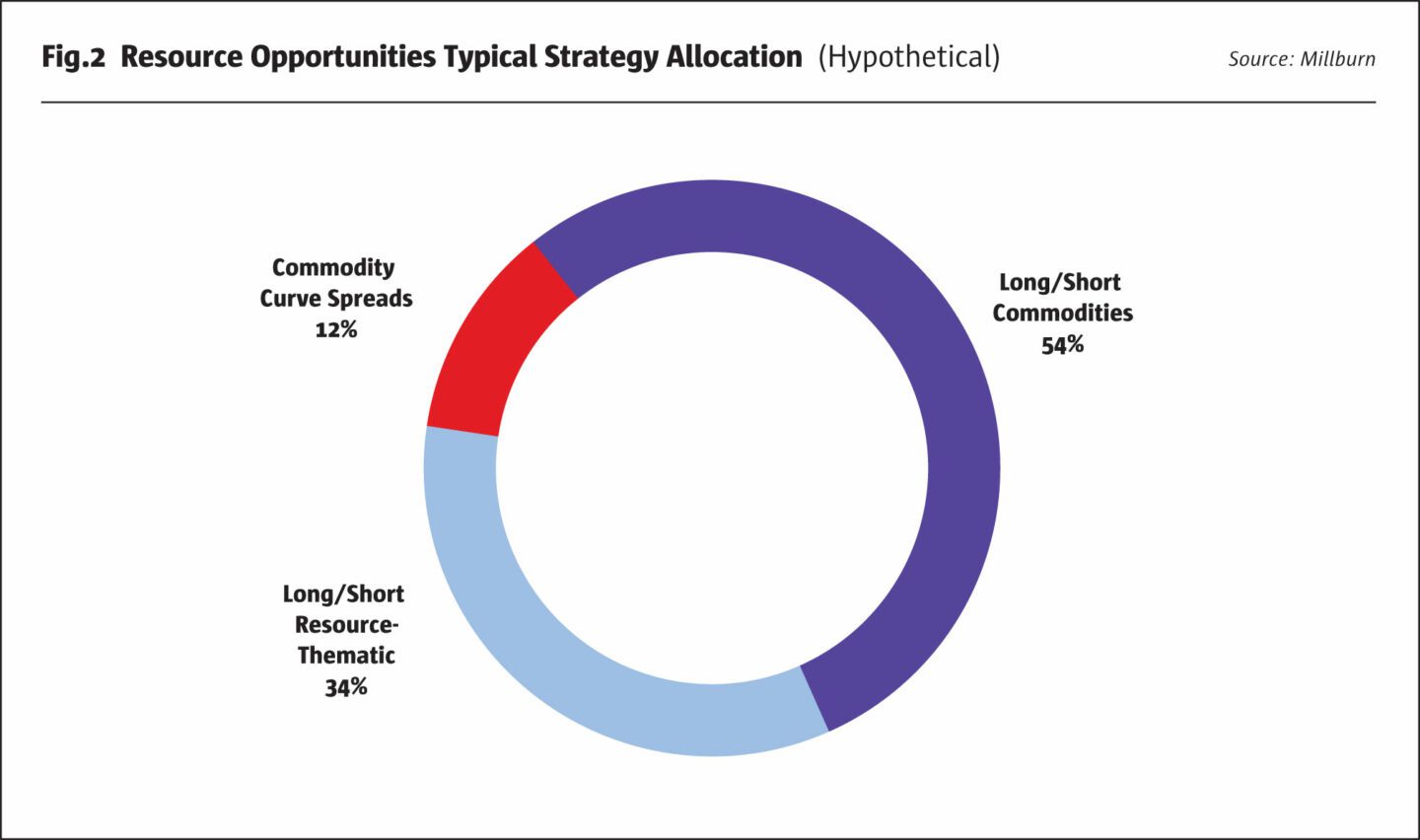

Risk allocations within Resource Opportunities will start with a little more than 50% allocation to directional commodity futures markets, another 1/3 to long/short thematic resource trading, and the remainder in relative value spread trading (see Fig.2). But these allocations would be expected to evolve as more markets become available to trade, or as additional opportunities in the thematic space emerge.

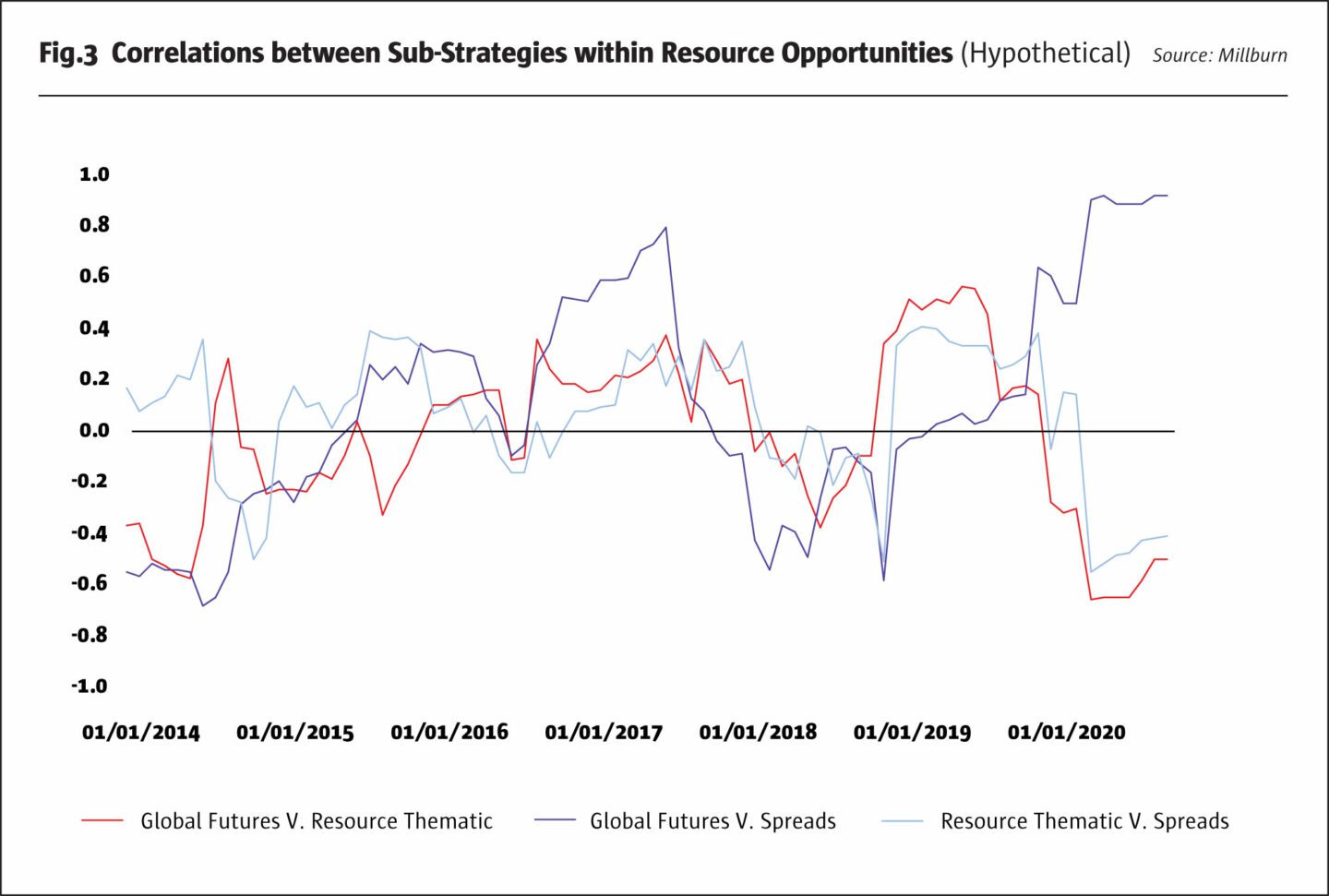

Regardless, the strategy buckets are independent and are expected to typically be lowly correlated to one another – helping improve the consistency of returns – though the correlations will fluctuate over time as opportunities rise or recede, as shown in Fig.3.

Barry Goodman, Millburn’s co-CEO and Executive Director of Trading, believes that the time is opportune for such a strategy: “Resource Opportunities is founded on the recognition that today’s commodity asset class can be thought of differently than the traditional hard and soft commodity sectors. Those sectors will continue to be important, and should continue to provide solid opportunities to trade, as indicated by our continued belief in the prospects of our Commodity Program. But we see the chance here to provide investors with something different: access to a developing set of unique and disruptive new opportunities,” says Goodman.

Chinese commodities

One such opportunity is in China, where futures markets are dominated by commodities and include esoteric instruments such as Glass, PVC, Apple, Wood Pulp, Steel Rebar, Methanol and scores of others, traded on five exchanges that rank amongst the largest commodity trading venues in the world, according to a 2018 report issued by the Futures Industry Association. These markets unique to China can provide portfolios with new and powerful sources of diversification, not to mention potential informational value. China has for years been the largest consumer of some commodities, and in 2020 it has made a much stronger economic recovery than other regions.

Until recently, investment in these instruments has been restricted to on-shore Chinese entities and individuals. But reforms by the Chinese regulators to open up such markets, internationalising some futures markets, will allow a subset of these markets to be included in the Resource Opportunities program, and traded in USD. Imminent approval for internationalising several more Chinese commodities is expected, and the regulatory policy agenda includes a long list of others in the pipeline.

“China is a market that has been developing at quite a rapid pace and has been of interest to us for years. In some ways, we are seeing these Chinese commodity futures markets develop similarly to the development of the commodity futures markets here in the US – which we at Millburn were witness to in the 1970s and 1980s – but it is happening in China at what is clearly a much more rapid pace,” said Goodman. “We have been applying our machine learning research with notable success,” he adds.

Disruptive themes

In addition to commodity futures in China and globally, Millburn has broadened out the universe in the Resource Opportunities Program to selected commodity-centric equity indices and currency forwards in developed and emerging markets, as well as to sector and other ETFs (exchange traded funds) that can access industrial sectors and sub-sectors or other resource- or commodity-related instruments, looking to capture movements in evolving or disruptive themes.

These themes will include things like clean and alternative energy such as wind and solar, and related areas such as lithium and batteries used in EVs, as a few examples. The focus will be on providing access to opportunities within the changing landscape of commodities, including a range of resource-focused themes, many of which have been thrown into sharp relief by the COVID-19 pandemic: “the strategy will provide the chance to capitalize on disruptive themes, existing and evolving, around decarbonization, structural underinvestment, social policy-driven demand, climate change and the potential for inflation. It is really an exciting ‘new frontier’ that we believe will provide some very unique exposures as some of these themes accelerate,” Goodman states.

In our process, the power comes in the ability of the machines to find complex tendencies in large datasets that humans would be hard-pressed to uncover.

Barry Goodman, co-CEO and Executive Director of Trading, Millburn

In all, the Resource Opportunities strategy is expected to begin trading with more than 100 global futures, currency and security markets that fit the mandate. They will all be directly or indirectly related to commodity or resource markets or related themes in some way.

The selection of themes and markets is where discretionary judgement, informed by decades of experience, enters the process. In Millburn’s process, humans rather than machines select which markets are traded, informed by the firm’s 50-years of experience trading commodities, as well as by quantitative variables such as diversification, correlation, liquidity and more.

The range of markets is expected to grow over time, within certain criteria. For instance, while the Resource Opportunities Program will begin by trading securities in the form of ETFs, Millburn has for some years been contemplating trading single corporate securities, and this new program would be a natural fit as research is finalized. In futures markets, cryptocurrency Bitcoin is one example of a relatively new futures market that some may think of as a potential store of value akin to gold, or “digital gold”. And China, as mentioned previously, is expected to make more markets available to non-RMB investors over time – markets that the firm is in most cases already trading on the Mainland with well-developed models, data sources and execution expertise – which should make for easy integration into Resource Opportunities as soon as it is possible.

New themes could be added faster in the thematic universe than in futures markets however, as more specific and targeted themes, for instance around commodity and related product supply chains, can be pinpointed.

But Millburn retains a cautious view on liquidity and is not at the moment pushing the frontiers out into the most exotic or esoteric OTC (over-the-counter) commodity markets, which are sometimes described as “alternative markets”. The aim for the Resource Opportunities program is to use combinations of liquid markets to arrive at unusual themes without directly trading the more niche commodity markets. ETFs can be one way to access such themes, but the firm is also researching swaps on equity baskets and potentially other types of derivatives to provide desired exposures. Recent expansion in the research team has brought additional expertise in equities to bear that should soon be evident in the Resource Opportunities strategy.

Multi-model machine learning

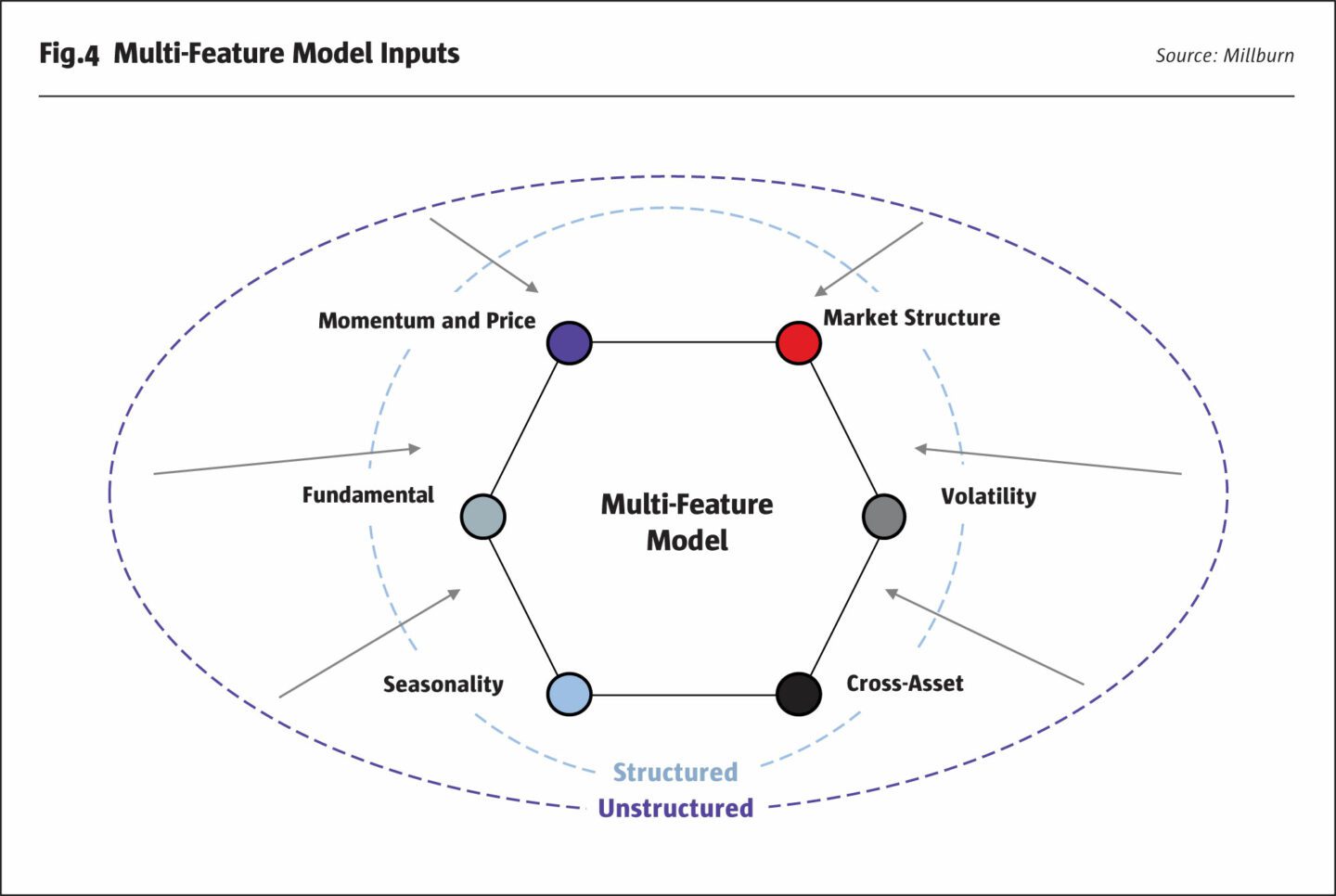

While the Resource Opportunities program maintains a high degree of overlap with the markets in the firm’s Commodity and China programs, it also expands the scope of commodities and resources. What has not changed is the overarching multi-model machine learning philosophy, which will be directly ported for those markets already traded, and which will be tailored to the new markets. As with Millburn’s other systematic strategies, positions in each instrument are determined using the firm’s robust multi-model, multi-feature approach. Models use powerful machine learning technology to find patterns or tendencies in often multiple decades of historical data – including price, fundamental, event, market structure and other quantitative time-series data. And through the learning process – models are rebuilt on an ongoing basis to incorporate the most recent experience – the models are not just recognising old patterns but rather searching for new ones (Fig.4).

Pattern recognition could technically be an accurate description, but it perhaps implies too much precision in identifying recurring patterns for what is a more fluid process: “these markets are noisy, and there are significant uncertainties around movements. We combine a multi-model approach with different features, inputs, machine learning techniques and learning windows in an attempt to build a signal that is as robust as possible, accepting a certain amount of fuzziness around the forecasts,” says Grant Smith, Millburn’s co-CEO and Chief Investment Officer.

Because the process is data-driven rather than hypothesis-based, there is also no predetermined rule delineating how to utilize a particular set of data. What results is a flexible approach that opportunistically moves between momentum and mean-reverting trades, or takes risk off altogether, reacting based on specific market conditions in relation to historical tendencies, and based on how the data interact in a contextual way.

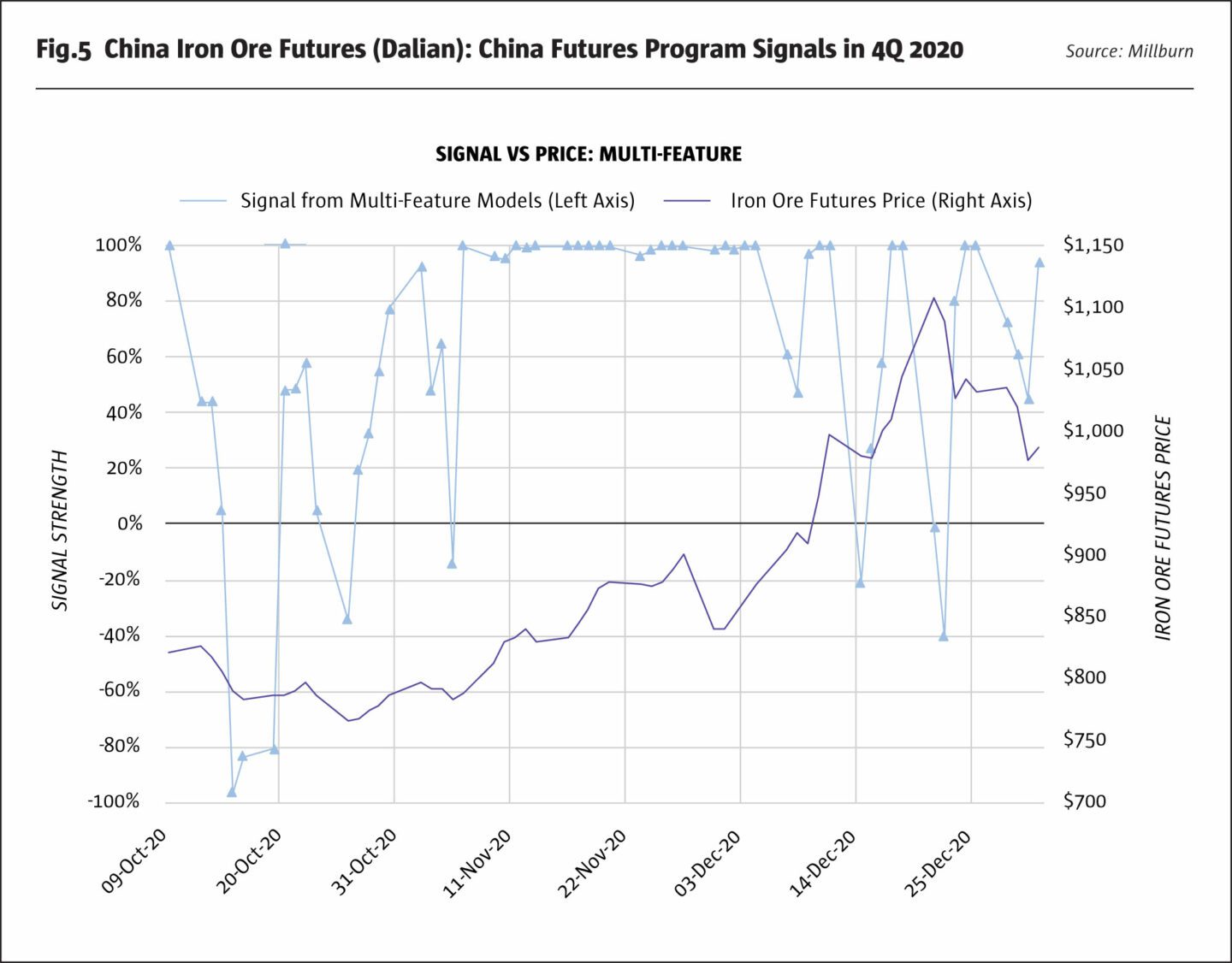

Fig.5 shows how signalling in iron ore, a market traded in China on the Dalian Commodity Exchange, fluctuated between maximum long and maximum short, capturing short term down moves and a large chunk of the upwards trend whilst also participating in some reversals. This example is intended only as an illustration, and shows just a single market of the many included in the portfolio.

Holding periods for positions in the Resource Opportunities Program are expected to be similarly opportunistic and context-dependent; while a position in an average market may be held long or short for 10-15 days on average, in the meantime, generally many times a day, small adjustments will be taking place with the goal of keeping a position finely tuned.

A synchronized bull market in commodities?

The strategy is intended to be an all-weather approach, in the sense of at least having opportunities in a range of different market environments. Smith sees the ability for the models to be nimble while still considering multi-year influences like bear or bull markets as one of the key advantages to the approach in Resource Opportunities. And the long/short approach of the Resource Opportunities strategy should, he believes, provide the ability to profit from both up and down market moves, such that investors need not be forced to “time” the strategy: “Millburn has always been a believer in commodities, and had the benefits of trading through a series of secular bull markets in commodities over the last five decades. But our approach has never been to treat the asset class as a single, uniform thing, or even to treat such secular cycles as unwavering. Instead, we look at individual instruments, and individual return drivers. Clearly in the case of a commodity super cycle, one of those drivers will be the overall tailwind of such environments. That will be important, and will be revealed in the analysis of the data. But that won’t tell the whole story, especially in today’s complex markets,” said Smith.

Smith continues: “this means that even within a secular bull market, our systems would be expected to scan the data and compare it against history – including against prior commodity super cycles – looking for opportunities to profit from shorter-term moves, if and when they present themselves. We think that is an intelligent way to trade today’s markets.”

Thus in choppy markets or during reversals within a major trend, the models would also aim to profit. Millburn’s other strategies are distinguished by having profited in trending and rangebound markets alike, but the trend/non-trend performance attribution dichotomy is too narrow a prism for this multi-faceted approach, which is not about defining regimes, but rather is focused on evaluating in real-time how to best be positioned given how current market conditions compare with those seen historically. The goal is to gain a statistical edge in understanding how markets may move over the next several minutes, several hours and several days. With thousands of potential evaluations per day, these edges can accumulate. There is no need for every model within the array used to determine positioning in a particular market to be changing direction every few minutes, but if just a few models do so, this tilts the balance of probabilities in favour of tweaking a trade or even cutting and reversing into the opposite direction. There is more trading around core positions than wholesale cutting and reversing. Return forecasts also need to be sufficient to cover transactions costs (which are also forecast using machine learning), so some signals are not actioned.

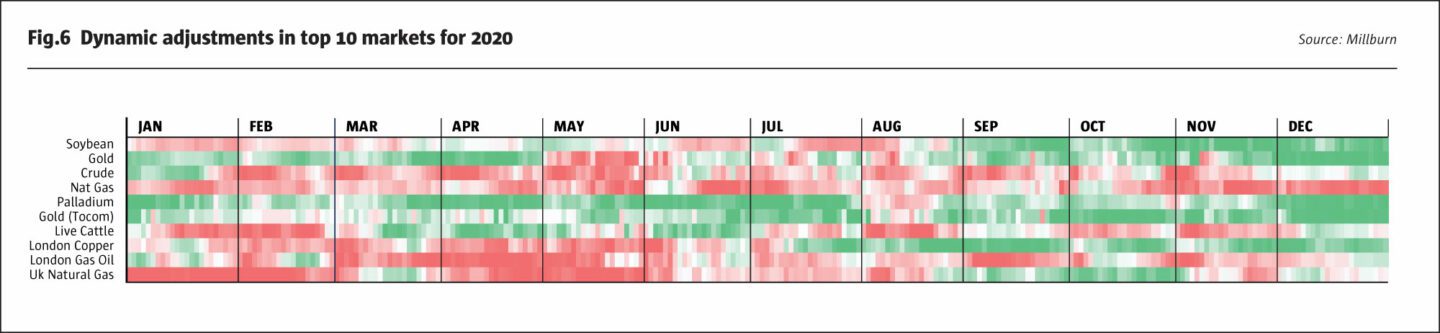

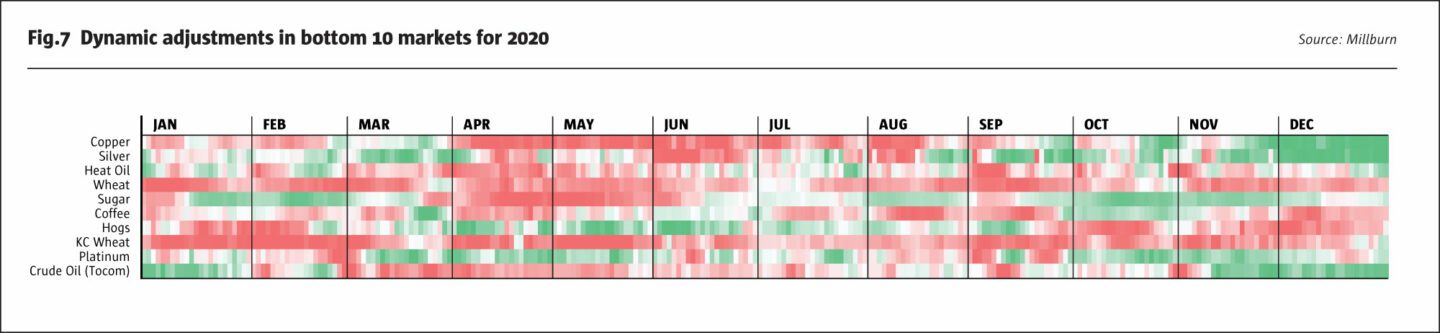

Fig.6 and Fig.7 highlight how often position directions and sizes have changed on a daily basis (but not intraday), for the top and bottom 10 markets in 2020 in Millburn’s Commodity Program. Long positions are in green, and shorts in red, with darker shades of colour denoting larger positions, and white indicating a very small exposure was held at that time.

Data inputs, evolution and alpha decay

Data inputs are roughly 50% price and 50% non-price in number (but not necessarily influence), and can be thought of as mainly traditional in nature, though Millburn is continuously evaluating many so-called “alternative” datasets like satellite imagery, newsfeed closed-captioning, and other developing ideas. The recipe matters more than the ingredients however. “In our process, the power comes in the ability of the machines to find complex tendencies in large datasets that humans would be hard-pressed to uncover, or to even know to look for. We provide the machine learning engine with access to a wide range of inputs, but we use our market knowledge and other tools to avoid inputs that don’t have the potential for at least some basic correlation with price moves. It is a low bar for inclusion, but having this filter helps us trust the outputs,” says Goodman.

And Smith characterizes the models as “lifelong learners”, adapting regularly as they evaluate the growing set of historical data, reinventing themselves to deal with alpha decay, which is a constant battle that many quants contend with.

“We know that markets change. The prices of crude oil in the 1980s and beyond were not influenced by fracking, because fracking simply didn’t exist. So perhaps at that time OPEC inventory releases carried a very high weight in terms of the influence on crude oil prices. But then along came fracking. A model that ‘learns’ periodically would be able to pick up on the decreasing influence of OPEC inventory releases on price moves, and would automatically reduce the weight of the OPEC numbers when making a forecast. In this way the models are self-adapting and, we believe, will have a better chance of providing accurate forecasts on an ongoing basis,” said Smith.

For example, despite the fact that negative oil prices in May 2020 were a non-event for the Millburn portfolios because they had rolled contracts well ahead of expiry dates when prices went below zero – the models can nonetheless learn from the phenomenon of negative prices, and not be surprised when they see it again.

Expectations

Overall, the firm’s research indicates the Resource Opportunities strategy should provide good potential for diversification, and near-zero correlation to traditional asset classes and to other hedge fund strategies over the long run. And it may well be a good consideration for investors seeking to mitigate the effects of inflation, or profit from a super cycle in commodities if indeed it does emerge. Millburn remains humble and certainly reminds investors that there can be no guarantee of success, but will indeed be invested alongside others at launch.

Regarding capacity, Millburn has historically not been shy to close a program to preserve alpha, as they did with the existing Commodity Program in early 2018. The new Resource Opportunities strategy has capacity partly because it is not exposed to certain types of relative value spread trades that constrain the existing Commodity Program. Instead, the research team has developed a new spread strategy for the Resource Opportunities program, trading at different times, and in a different manner.

Despite this innovation, capacity in Resource Opportunities will be limited to start, but it will be a continued process of evaluation as the strategy evolves and as new themes develop, and new markets are added. “We’re excited to bring this strategy to the market after a long period of research. We think it has the chance to provide immediate value to our investors’ portfolios,” said Goodman. “But an even more exciting part is the path of opportunities we see going forward.”

The firm is currently gathering interest for founders’ opportunities (which will come with a reduction in standard fees), with the expectation that trading will begin early in 2021.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical