Nickel Digital Asset Management Ltd (“Nickel”) is an FCA-regulated investment manager, dedicated to the digital assets space. Nickel manages two distinct strategies in two separate vehicles namely the Digital Gold Institutional Fund and Digital Assets Arbitrage Fund.

Digital Gold Institutional Fund is a secure, liquid and cost-efficient way to invest in the digital assets market. This recently launched, daily dealing, Bitcoin-tracking fund offers unleveraged exposure to Bitcoin, while providing solutions that address the risks and difficulties associated with the purchase of cryptoassets and storage of private keys.

Digital Assets Arbitrage Fund runs a market-neutral cryptocurrency strategy, which has generated uncorrelated and consistently positive returns since its launch in 2019. Nickel continued its unblemished track record during the turbulent month of March 2020, which offered some good entry points for arbitrage trades – while wiping out some leveraged long-only funds.

The change is coming. In years to come we will see the Internet-of-Information evolving into the Internet-of-Value.

Anatoly Crachilov, Founding Partner & CEO, Nickel Digital

Both strategies are carefully designed to meet institutional investors’ typical requirements: leading service providers include KPMG as auditor; Trident Trust as administrator; third-party custody from Fidelity Digital Assets (FDAS) and Copper, and reputable legal advisers.

A new financial ecosystem

Nickel’s longer-term vision is to broaden and deepen its involvement in the cryptoasset space, and to influence the growth of a disruptive financial ecosystem. A more efficient and lower-cost blockchain-based financial system, removing frictional transaction costs, is a new paradigm that could upend old ways of doing business. Money Over Internet Protocol (MOIP) has been compared to Voice Over Internet Protocol (VOIP), which cut the cost of telephony by over 99% and greatly increased data volumes. Leading veteran hedge fund managers, including systematic trader Jim Simons and discretionary macro trader Paul Tudor Jones, as well as Yale endowment manager David Swensen, have entered the crypto investment space.

“The digital asset space is at the forefront of innovation across industries. The internet has transformed our lives by making transfers of, and access to, information instantaneous and borderless. However, the transfer of value is still stuck in the last century. Indeed, today an international SWIFT bank transfer can still take over 24 hours – how inconceivable it would be for a WhatsApp message to be delivered with a 24 hour delay! And there is no reason why financial assets should not achieve the same level of mobility,” says Nickel co-founder and CEO, Anatoly Crachilov, who was part of the first cohort of the innovative Oxford Blockchain Strategy Programme.

(L-R): Alek Kloda, Founding Partner & Portfolio Manager; Michael Hall, Founding Partner & CIO; and Anatoly Crachilov, Founding Partner & CEO.

“The change is coming,” says Crachilov. “In years to come we will see the Internet-of-Information evolving into the Internet-of-Value. Currently, closing an equity trade between Goldman Sachs and Morgan Stanley takes milliseconds, thanks to modern trading technologies, yet the settlement process, through old infrastructure and legacy intermediaries, takes another 72 hours. This creates operational inefficiencies, introduces credit risk, and ties up banks’ capital for days. On the other hand, blockchain technology, the underlying protocol for all cryptoassets, allows for transfers of value around the world in a matter of seconds without involving multiple intermediaries,” adds Crachilov.

Crachilov has spent most of his career at investment banks, including Goldman Sachs, JPMorgan, HSBC and the EBRD. His interest in digital assets was sparked when working for the investment management division of Goldman Sachs. “There was an emerging interest from our clients to explore this new asset class. We founded Nickel to provide institutional-grade access to this market,” says Crachilov.

The case for institutional allocations to digital assets

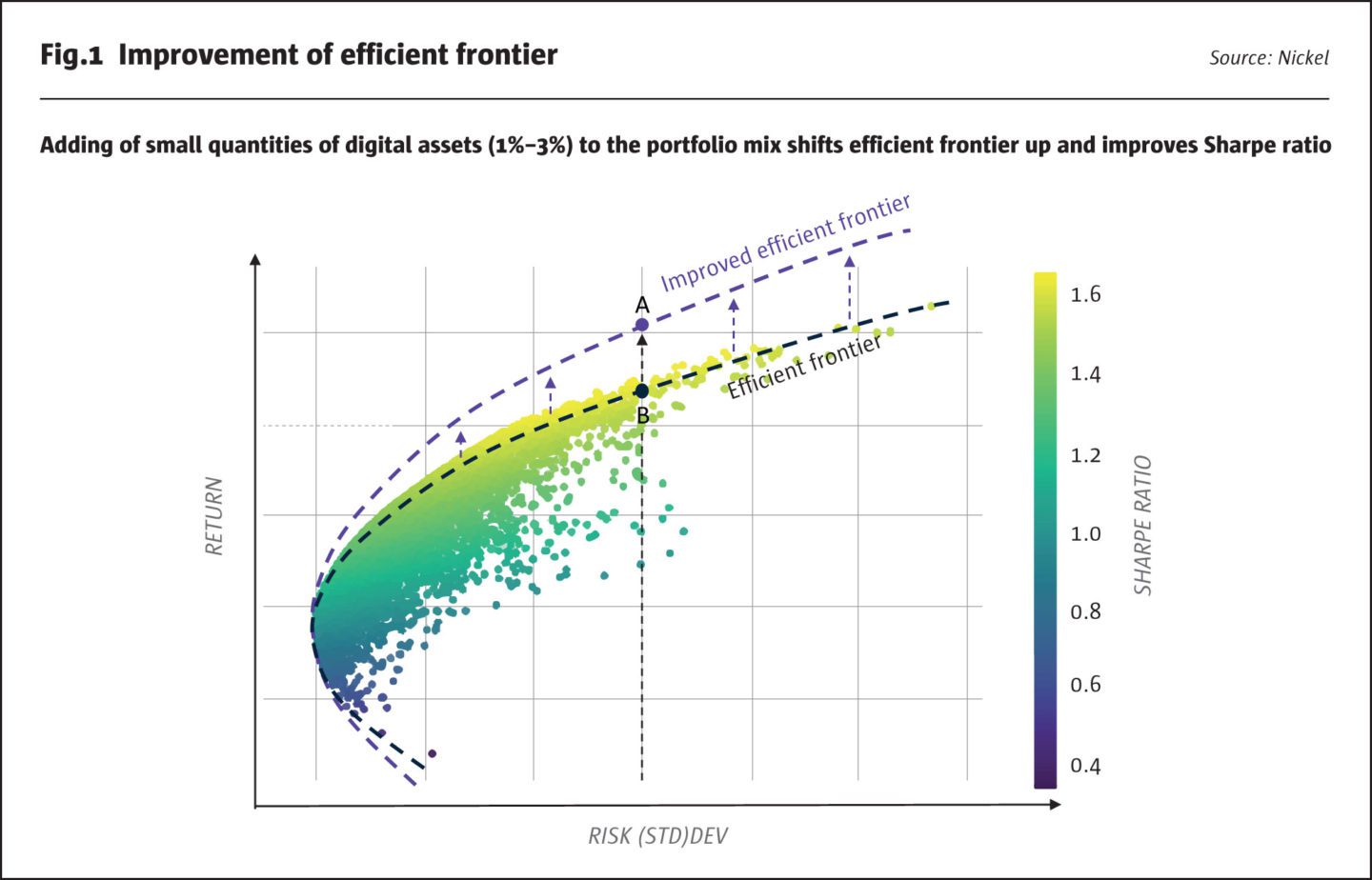

Bitcoin has demonstrated a meaningful diversification effect for institutional portfolios, over a statistically significant seven-year period since reliable crypto trading and pricing data has existed. The addition of an uncorrelated asset, like Bitcoin, to a diversified investment portfolio results in an upward shift of the efficient frontier and an improvement in the Sharpe ratio (see Fig.1). Furthermore, Bitcoin could offer a hedge against inflationary risks, which may be growing due to the extraordinary policy responses to unprecedented economic and financial conditions triggered by the Covid-19 economic downturn.

Portfolio diversification

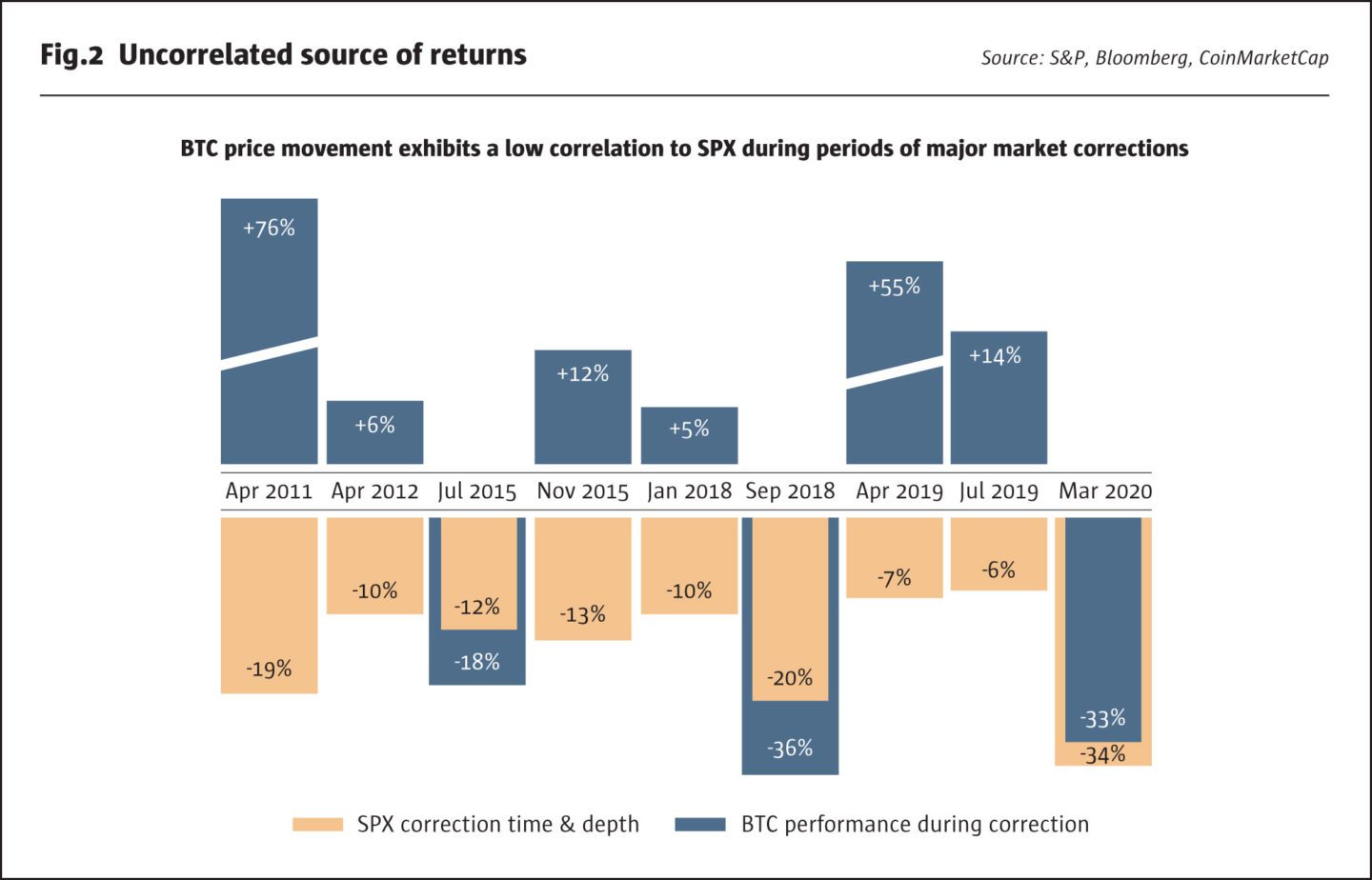

“Since Bitcoin’s creation in 2009, it has exhibited an independent behavioural pattern during several corrections of the S&P 500 and other key financial assets. Bitcoin is certainly not immune to large swings in its price, and its volatility has remained elevated throughout the years. However, its price action rarely coincides with other market events. We have pulled together all the major corrections on SPX Index since 2010, and superimposed movements of Bitcoins over the same timeframes. On many occasions Bitcoin moved in an uncorrelated manner, and often in the opposite direction,” explains Crachilov (see Fig.2).

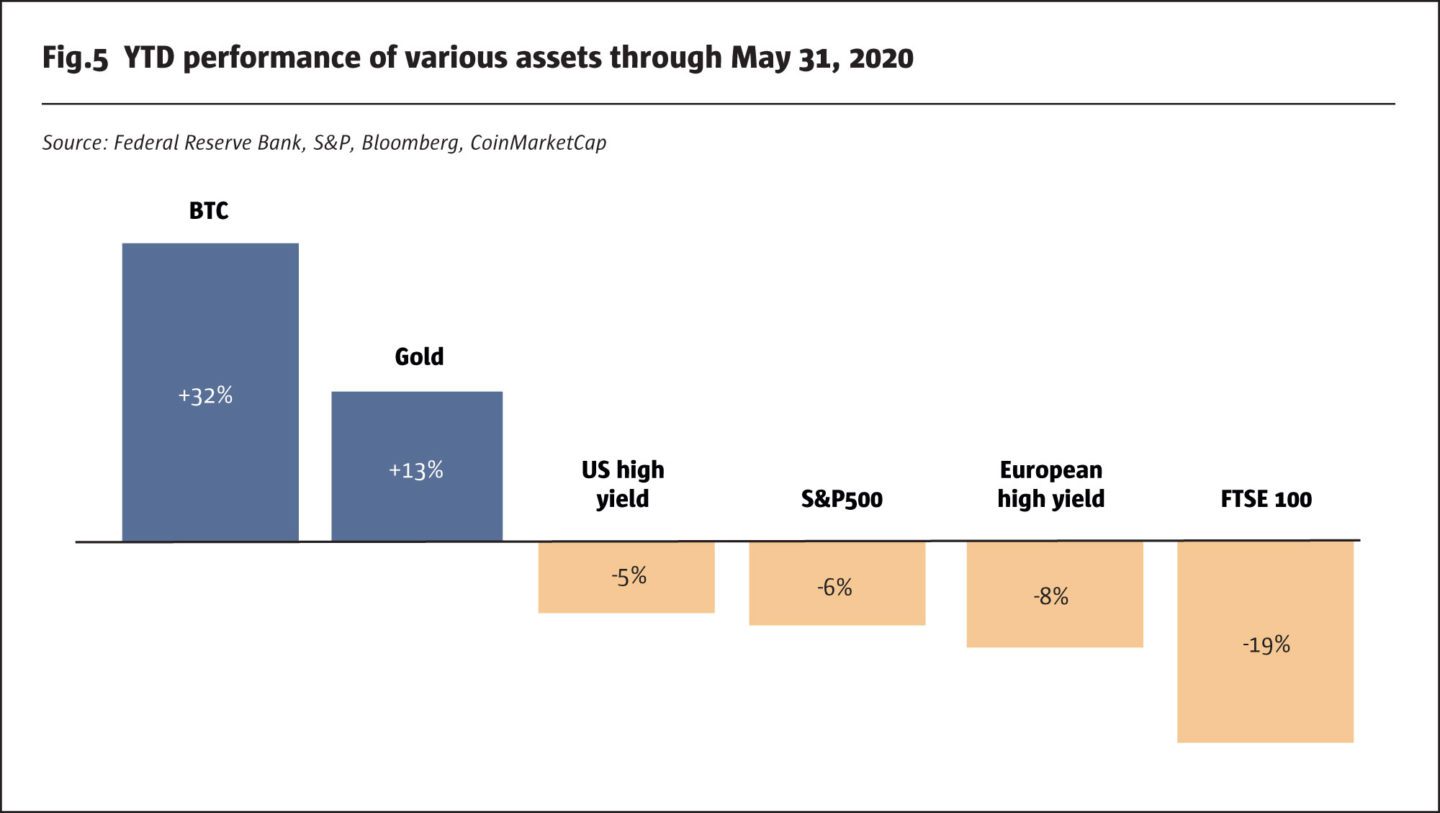

“This does not mean that during exceptional events, such as March 2020, Bitcoin is immune to contagion from other asset classes. High demand for liquidity affects all assets classes, especially those easy to sell, such as exchange-traded Bitcoin. However, once the dust settles, Bitcoin tends to catch up to its low-correlation pattern. Indeed, while the SPX was down as much as 6% YTD through May 31 2020, Bitcoin was up 32% over the same period of time. Historically, exposure to Bitcoin resulted in a significant performance contribution, while also offering a portfolio diversification effect,” says Crachilov.

Bitcoin’s low long-term correlation with equities has historically made it an excellent portfolio diversifier, as shown in Fig 3. “An allocation as low as 1% may have a disproportionately large effect on an investment portfolio. Over the last 7 years, adding 1% of Bitcoin to a standard, moderate risk portfolio consisting of 60% US equities and 40% US Treasuries, would have improved cumulative return from 93% to 109%, while keeping the standard deviation largely unchanged at 7.4%. Replacing 3% of the equity bucket with 3% allocation to Bitcoin would have boosted returns to 145%, while marginally increasing the standard deviation from 7.4% to 7.5%. This would have resulted in the Sharpe ratio improving from 1.2 to 1.7, a material boost for a mere 3% allocation. Finally, the maximum drawdown of such a portfolio would be affected in a limited fashion, increasing from 11.5% to 12.0%,” explains Crachilov.

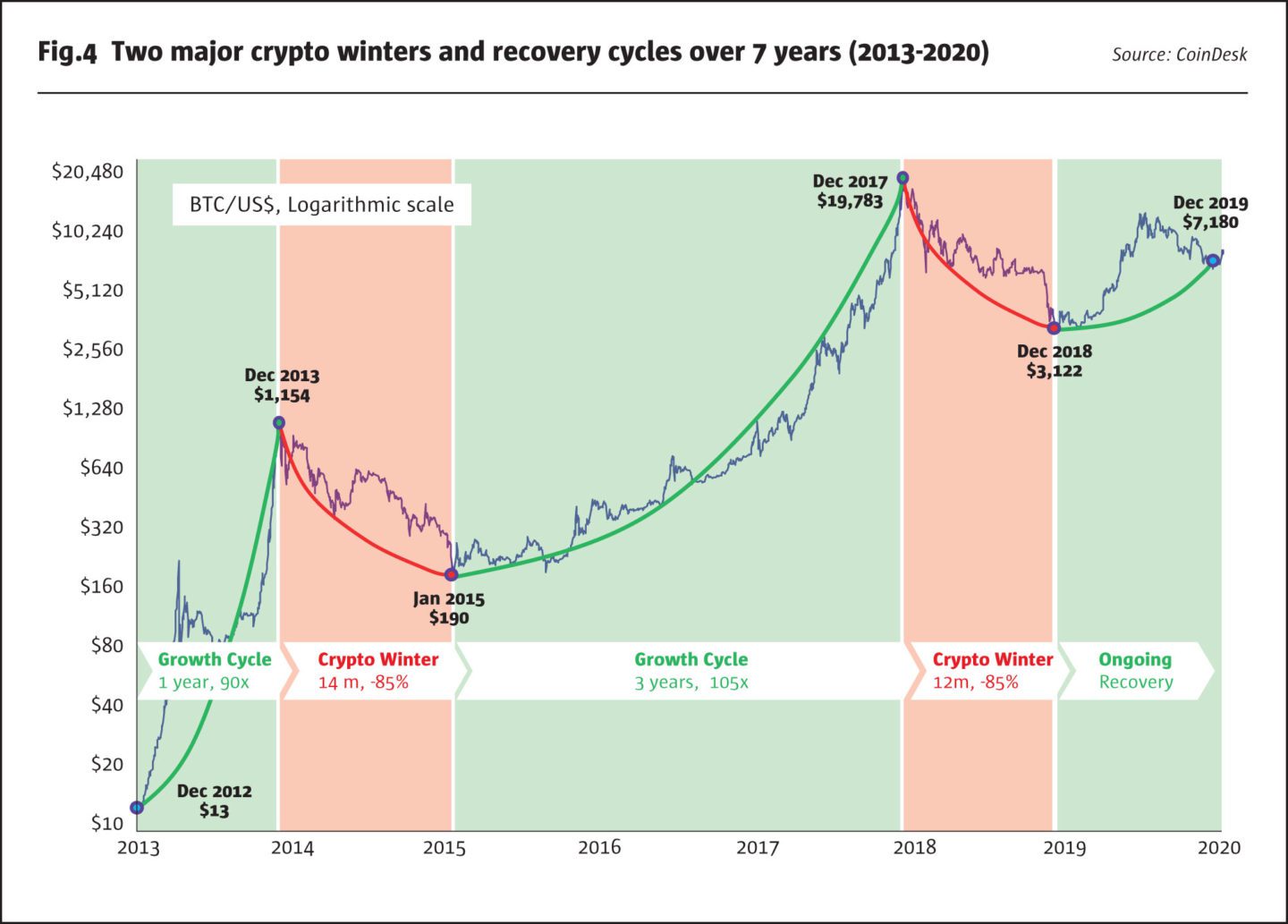

“This seven-year period from December 2012 to December 2019 was deliberately chosen to capture not only periods of extreme price rises, similar to 2017 peaks, but also times of price falls to achieve a more complete picture of Bitcoin’s behaviour,” explains Crachilov. “Indeed, the analysed period encompasses two major ‘crypto winters’: the well-known one of 2018, which attracted wide public attention, and the less known – but no less severe – one of 2014. To examine and analyse the earlier correction, the price graph of BTC must be viewed on a logarithmic scale. This graph reveals certain patterns of price appreciation when the market tends to overrun itself, followed by deep corrections. Indeed, as with any new technology, cryptoassets will remain volatile for the foreseeable future, as the market attempts to pinpoint the intrinsic value of this technology”.

“In both cases, Bitcoin’s price corrected by as much as 85%, and both peak-to-trough falls lasted for 12-14 months. However, both bear markets were followed by multi-year periods during which Bitcoin recovered its losses and, subsequently, multiplied in value. In the final account, despite Bitcoin’s volatile pattern and instances of deep market corrections, the ultimate impact on the simulated portfolio was impressive,” Crachilov explains (see Fig.4).

“A similar pattern continued over the first five months of 2020, which provided further strong evidence of Bitcoin’s independent behavioural pattern during stressed markets. With major equity indices being down between 6% and 19%, Bitcoin delivered over 30%, outperforming other key asset classes,” points out Crachilov (see Fig.5).

A financial asset: hedging currency debasement and inflation risk

“Bitcoin is also attractive as a financial asset in its own right. The fundamental use case for Bitcoin is its store of value function based on the scarcity feature embedded at the protocol level, which cannot be adjusted or manipulated by any given party. Fiat currencies, on the other hand, remain at the mercy of policy makers and the amount of newly issued units of money can increase at whim. The $3.9 trillion of new money created in the world in response to Covid-19 just over the last 3 months is evidence of that. Every paper money project eventually returns to its intrinsic value: zero,” says Crachilov.

In a 2020 macro outlook investor letter The Great Monetary Inflation, Paul Tudor Jones and Lorenzo Giorgianni have set out several arguments for a surge in inflation as economic policy enters uncharted territory: they judge current economic policies to be “the most unorthodox economic policies in modern history”.

One key argument is that central banks are becoming complacent about an uptick of inflation. The Fed has already, officially, shifted its inflation target to a policy of symmetrical fluctuation around the central level, which implies that years of undershooting the target should be balanced out by years of overshooting it. And unofficially, there are fears that central bank independence could suffer, and political appointees might delay monetary tightening.

In any case, fiscal policy – with an expected $3.8 trillion US fiscal deficit in 2020 (around 18% of GDP) as forecasted by the US Congressional budget office – could have an even greater impact than monetary policy. Politicians desperately want to avoid the worst unemployment since the Great Depression, and the trillions of dollars of fiscal stimuli might stoke inflation.

De-globalisation is another inflationary force that predates the Covid-19 crisis, but which could be accelerated by it. The multi-year globalisation trend that has reduced manufacturing costs could reverse course if the crisis heightens trade tensions, and results in production being brought back into higher cost countries. The US administration may be one of the most vocal critics of China, and it has now been joined by EU lawmakers blocking Chinese takeovers, while China and Australia have exchanged rhetoric that may raise the spectre of a trade war.

Paul Tudor Jones identifies ten assets or strategies that have, historically, performed well under inflation: gold; yield curve steepeners; the NASDAQ 100 index; long cyclical stocks versus short defensives; long currency of commodity exporting countries, short the importers; Treasury Inflation Protected Securities; the Goldman Sachs Commodity Index, the JPM Emerging Market Currency Index – and Bitcoin. He concludes: “If I am forced to forecast the fastest horse, it would be Bitcoin. It is the quintessence of scarcity premium. It is literally the only large tradable asset in the world that has a known fixed maximum supply”. Indeed, with nearly 88% of the maximum 21 million supply of Bitcoin having already been released into circulation, the balance will be issued in geometrically decreasing amounts until 2140.

Clearly other coins exist, but the network effect is a very powerful metric in the crypto ecosystem.

If Bitcoin can maintain its status as the leading cryptoasset, it benefits from network externalities and ‘winner takes all’ economics that can lead to exponential value creation. Bitcoin has a 65% market share of digital assets and is the most liquid coin.

“While we expect more advanced protocols to emerge that enable fast transaction processing, Bitcoin, like physical gold, should retain its store of value function,” says Crachilov. As Paul Tudor Jones put in his investor letter: “Bitcoin falls into the category of a store of value and it has the added bonus of being semi-transactional in nature”.

Digital Gold

Nickel Digital Gold Institutional Fund: a competitive offering for liquid, cost effective and secure long only Bitcoin exposure.

Investors can take a long position in Bitcoin through several avenues: futures; some European listed ETFs; a US listed closed end fund that trades OTC (as the SEC has not yet approved any US listed ETF); various private funds, or ‘spread betting’ companies outside the US. All these methods involve various costs including commissions; premiums; bid/offer spreads; management fees; embedded financing charges that can sometimes run into double digits on an annualized basis, and market impact costs for large buyers. Buying spot Bitcoin is also an option – but the trade execution and the following safe storage of private keys can create headaches for institutions.

In contrast, Nickel’s offering is designed to provide transparent and efficient access to the market, offering industry-leading security, execution, liquidity and cost-efficient terms. It offers daily liquidity, no lockups, execution at mid-market price, and charges management fees as low as 0.5% pa.

“Furthermore, it allows for large volume trades with minimum slippage. Indeed, the main cost for institutional investors is market impact. Using Nickel’s arbitrage execution infrastructure can reduce the slippage of a $10 million ticket from over 300bps on the most liquid spot exchange to less than 30bps when executed optimally across several instruments and exchanges,” explains Nickel portfolio manager, Alek Kloda.

Cryptocurrency arbitrage

A range of exchange-traded cryptocurrencies, including Bitcoin, can also provide uncorrelated returns without taking directional market risk.

Though it was not easy to launch Nickel’s arbitrage strategy, it capitalised on the founders’ experience in both conventional and crypto markets. CIO, Michael Hall, has been a fixed income arbitrage trader for much of his career, at Bankers Trust New York and at Vega in Madrid. Nickel’s co-founder and senior portfolio manager, Alek Kloda, started making markets in cryptocurrencies while studying for a PhD at the LSE. He had earlier worked for Martin Hughes’ Toscafund and for Liongate, a fund of hedge funds.

“Cryptocurrency assets have many characteristics that create attractive arbitrage opportunities. Fragmented retail liquidity creates price differences between similar instruments that trade on different venues in multiple geographies and time zones,” says Hall. These factors create inefficiencies dwarfing those seen in traditional markets. “Annualised arbitrage spreads can run into double digits, even on an unleveraged basis,” he adds.

The anomalies also persist due to operational challenges in creating infrastructure allowing for automated sweeping of both fiat and crypto collateral around multiple venues, as digital markets never close.

Exchange selection

“Nickel only trades at the safest exchanges, which have high and verifiable trading volumes and offer secure withdrawals procedures. We perform extensive due diligence on trading venues. We only trade on the most robust ones that have real volumes and deep order books. We also analyse blockchain data and monitor collateral movements between exchange addresses,” explains Hall. Furthermore, Nickel performs due diligence on the exchange withdrawal procedures and technology: top exchanges have segregated APIs for withdrawals and whitelist withdrawal addresses.

It is also vital for the strategy to be able to hedge and to move collateral around on a 24/7 basis, which is why the CME Group, which still closes for weekends, is of limited use for Nickel’s crypto trading operations.

Real time US dollar transfers between leading crypto institutions are facilitated by Silvergate Bank and Signature Bank, via their proprietary networks. “It is possible to move collateral between counterparties in a matter of seconds,” says Hall.

Hacks and heists

While several cryptocurrency exchanges have had assets stolen, crucially Nickel’s clients have not incurred any losses due to a hack. The experience of Binance provides a case study that is one reason why Nickel prefers to stick with larger exchanges. In 2019, Binance was hacked for US$40 million of crypto but made its clients whole on the loss. This made commercial sense because the loss was less than one quarter of the profit. “As exchanges continue to improve their security procedures and implement off-exchange settlement, we believe these issues will disappear over time,” says Kloda.

Arbitrage sub-strategies

The Digital Assets Arbitrage strategy dynamically and opportunistically rotates around arbitrage sub-strategies, including market making; triangular arbitrage; futures basis and swaps. To manage risk, the portfolio maintains diversification by time frame, product, exchange, and trade type. Some of the trade types are, in principle, similar to other hedge fund arbitrage strategies while others are unique to the crypto world.

“Cross-venue arbitrage is an example where textbook arbitrages can be constructed, given low latency technological and operational infrastructure that can handle the complexities of monitoring multiple order books, managing inventories on exchanges, and simultaneously executing trades in a matter of milliseconds,” says Kloda. A “triangular” arbitrage could be based on discrepancies between exchange rates observed for two or more related cryptocurrencies listed on three or more venues. “In theory there is no limit to the number of legs involved, but each leg adds various costs: exchange costs, asset withdrawal fees and FX hedge costs,” adds Kloda. The main risks are price slippage, or when an exchange rejects one leg of a trade after other legs have been executed. In order to mitigate these risks, trades are executed in thousands of small clips.

The immaturity of crypto financing creates potential for trades that revolve around lending and borrowing. Yield and basis trades can involve lending and borrowing digital assets and fiat, for periods of between one day and one month. These can make annualized returns as high as 20%. “Swaps trading exploits anomalies around swap pricing and funding costs for similar instruments. Futures basis trades exploit gaps between cash and futures markets. Leverage of up to 3.5 times can be obtained, though we do not go over 2x,” says Hall. The main risks are being able to weather the mark to market volatility and associated margin calls prior to maturity, as the basis can widen out before it converges to zero at expiry. Another risk is sudden price movements creating collateral imbalances on exchanges and potential liquidations of positions. Hence the need for an automated margin management system with swift collateral transfers.

The amount of leverage used is much lower than on other hedge fund arbitrage trades. The prospectus limits leverage at four times though in practice it is unlikely to exceed two times. “We can get some balance sheet leverage through Master Repo Agreements (MRAs) with custodians, exchanges and marketplaces with access to BTC and USD. The exchange listed futures provide notional leverage,” says Hall.

More leverage and institutional involvement could evolve the arbitrage strategy over time: “Some inefficiencies may be eroded, but new markets will spring up, in terms of new venues and new instruments, and our low latency infrastructure provides an edge,” explains Hall.

7.59%

Over 12 months since inception in June 2019, the Digital Assets Arbitrage Fund has returned 7.59% net of fees, with a Sharpe ratio of 5.1

Risk-adjusted arbitrage returns

“Since inception last year, the Digital Assets Arbitrage Fund has delivered a superior risk-adjusted return, outperforming the benchmarks of the main asset classes,” says Hall.

“The return profile of an ideal asset should be positive on average, have the lowest possible volatility, and be uncorrelated to returns of other assets. While we continuously strive to improve returns by adding new sub-strategies and enhancing the models and the trading base of the fund, we are pleased that we have contained the volatility during turbulent times in what is clearly an uncorrelated strategy,” says Kloda.

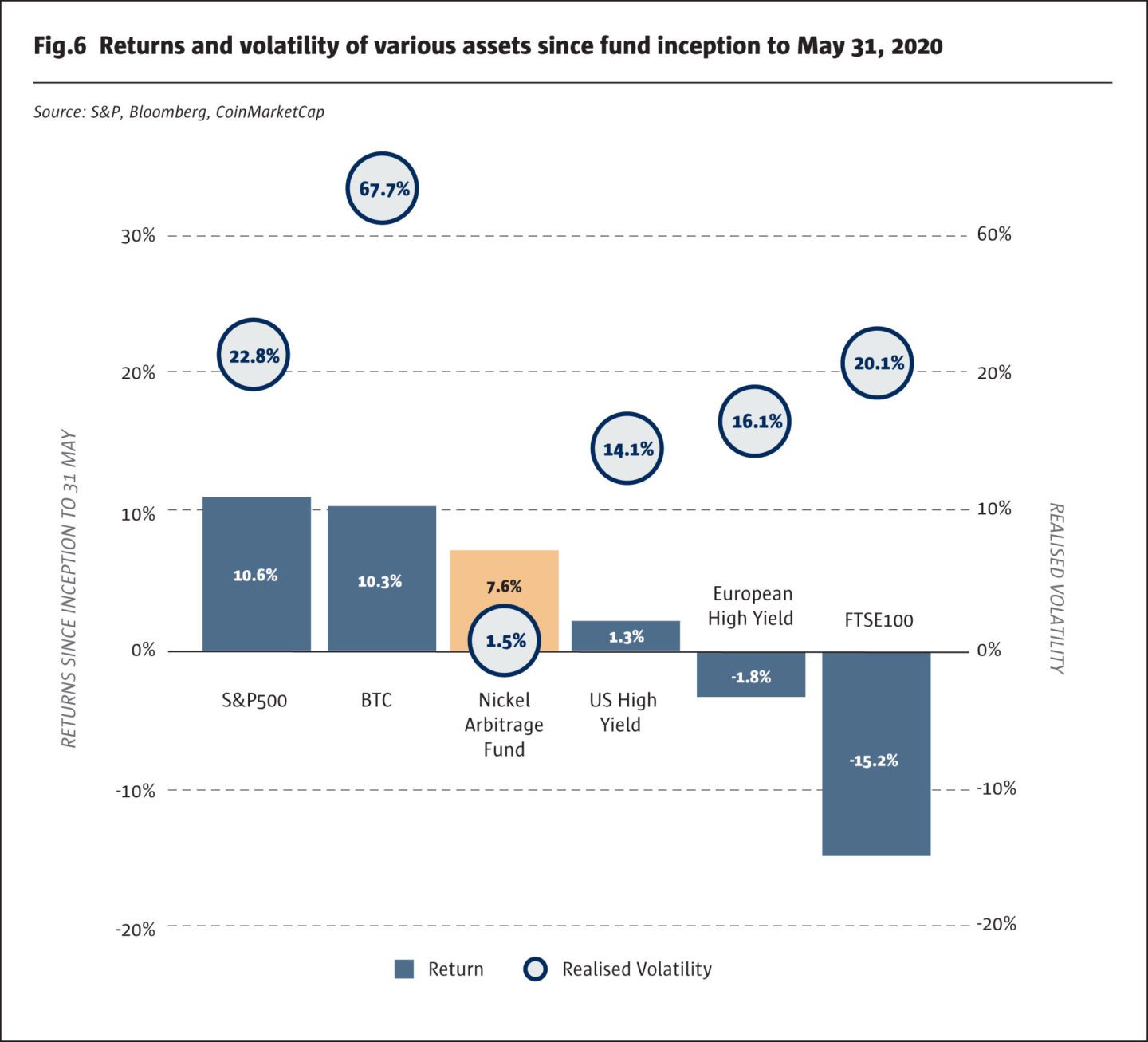

“While the fund has outperformed many risk assets since inception on an absolute basis, it is more relevant to examine the performance on a risk-adjusted basis. This can be done by viewing returns of various assets through the prism of their realised volatility,” explains Crachilov.

Over 12 months since inception in June 2019, the fund has returned 7.59% net of fees, with a Sharpe ratio of 5.1. The fund’s standard deviation stands at 1.5%, as compared to 22.8% for the S&P 500, 14.1% for the US High Yield Index, and as much as 67.7% for Bitcoin. The low volatility of the fund’s return largely reflects the consistency of its monthly gains, with no down months since inception.

Fig. 6 summarizes the returns and annualized volatility of various assets calculated from their performance since the fund’s inception date on June 01, 2019.

Digital assets custody

Both of Nickel’s funds use Copper as a trading custodian to protect the assets during trade execution. Digital Gold also uses Fidelity Digital Assets as a long-term storage custodian. “Fidelity, in addition to having robust operational procedures, offers a multi-million-dollar insurance coverage against potential security breaches, providing peace of mind for the investors,” says Crachilov.

“Custody and settlement in the traditional financial world is taken for granted and are not considered risky. However, due to the immutability of blockchain transactions, digital asset custody for institutional size investments requires robust, well thought-out solutions. We reviewed over 40 custodians including crypto vaults, ex-military storage bunkers, several UK and Swiss custodians and US exchanges. We chose Fidelity and London-based Copper as they offered the most advanced, institutional-grade solution in the market,” Crachilov adds.

The addition of an uncorrelated asset, like Bitcoin, to a diversified investment portfolio results in an upward shift of the efficient frontier and an improvement in the Sharpe ratio.

Michael Hall, Founding Partner & CIO, Nickel Digital

“Some high net worth individuals with a managed account might feel comfortable controlling their own private keys through self-custody, and some funds have used the self-custody model too, but this sort of arrangement is not acceptable from an institutional point of view, and not practical when dealing with multiple investors,” explains Hall. “Self-custody in the crypto world creates a risk of misappropriation of assets by either managers or third parties. Investors do not want to see the investment manager exercising sole control over their cryptoassets. Indeed, the irreversible nature of blockchain may result in irrevocable loss of assets. Hence, in our setup, proven security procedures are required to ensure capital protection. Every asset movement requires multiple approvals across several organisations, making the process safe,” says Kloda.

The latest evolution in crypto custody is off-exchange settlement, which reduces counterparty risk by keeping the assets with the custodian and allowing for rapid exchange transaction settlement. Though this only went live in May 2020, some of the larger exchanges have already become part of the new structure, which could be a game changer. “The whole trading environment is becoming safer and this should ultimately lead to continuous settlement. This should allow for more freedom in choosing the exchanges with whom we trade,” says Hall.

“All of this has brought comfort to our investors, 80% of whom had never invested in crypto before,” adds Crachilov.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical