Japan has the world’s third largest economy, third largest stock-market, and over 3,700 listed companies, with trading volumes of USD 4 trillion per year. The liquidity of the stock-market, relative ease of short selling versus some other Asian markets, and dearth of sell side research coverage should make it attractive for hedge fund managers. Yet there is actually much less hedge fund capital devoted to Japanese long/short equity than to US or European long/short equity, as advisory firms such as Sussex Partners have observed in their commentary. The ratio of hedge fund assets to market capitalisation is estimated at about 0.5% in Japan, compared with 6% in the US and 8% in Europe. The number of hedge funds in Japan, at between 80 and 120, is also very small when there are around 10,000 active hedge funds globally, according to eVestment.

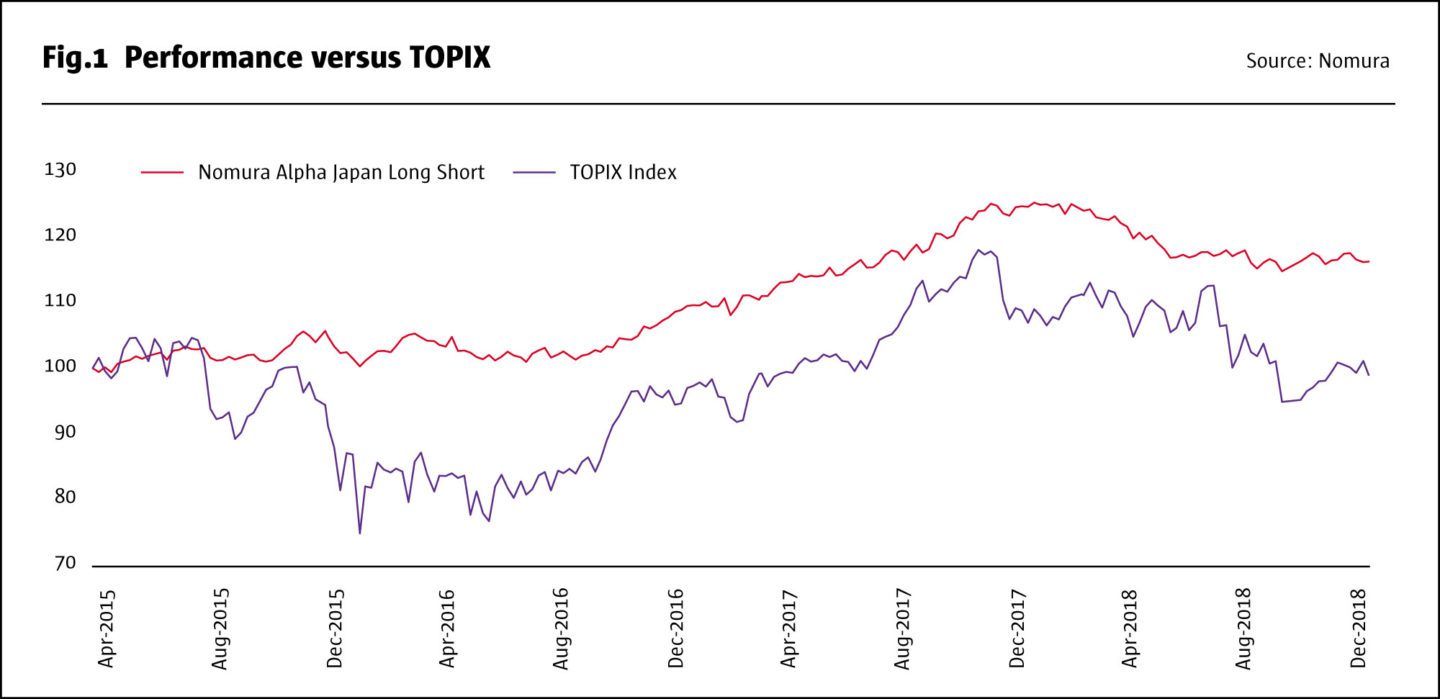

Founded over a decade ago under the initiative of Chairman Michel Amsellem, Alpha Japan Asset Advisors Limited (“Alpha Japan”) is an independent firm exclusively focused on Japanese equities, and licensed as a discretionary Investment Manager by Japan’s Ministry of Finance. It has one of the most experienced and cohesive teams of investment professionals who work together in a relatively flat and non-hierarchical structure. Though Asian hedge funds in general have been relatively slow to adopt UCITS, Alpha Japan were amongst the first to set up a UCITS, and manage both Irish and Luxembourg domiciled UCITS. Nomura Investment Solutions PLC – Nomura Alpha Japan Long/Short Fund received The Hedge Fund Journal’s ‘UCITS Hedge’ award for best performing Equity Long/Short (Japan) strategy over two, three, four and five year periods ending in December 2018. It received the same award for spells ending in December 2017.

0.5%

The ratio of hedge fund assets to market capitalisation is estimated at about 0.5% in Japan, compared with 6% in the US and 8% in Europe.

“As Japan’s largest security house and stock lender, Nomura was the obvious partner for the UCITS, and Nomura Alternative Investment Management also helps with structuring, risk management and currency hedging,” says Alpha Japan President and CEO, Peng Tang. The weekly dealing UCITS hedge fund is currently distributed in the UK, Ireland, France, Italy, Spain and Switzerland and, somewhat unusually for a UCITS hedge fund, has a minimum investment of USD 1,000 or equivalent for class A. Clients include several private banks, institutional investors and funds of hedge funds.

Currently, Alpha Japan only manages UCITS in the Long/Short space and the UCITS rules on liquidity and diversification make no difference to lead portfolio manager and CIO, Masahiro Umeki, who previously ran a Cayman fund at J-Wellness Investment, which he founded. Investors can review the track record between April 2008 and May 2015, which outperformed the Eurekahedge Japan L/S equity HF index every calendar year bar 2010. It also outperformed the TOPIX index by more than 70%, while running maximum net exposure of 30%.

Broadly market neutral

The Alpha Japan fund, which was previously named Nomura Permal Japan Alpha Neutral Fund, started out in 2012 with a market neutral mandate but shifted to a long/short one in April 2015 after Prime Minister Shinzo Abe’s rise to power ignited investor enthusiasm for beta exposure in Japan. In theory, the fund’s net exposure could range from -50% to +80%, but in practice it has not made much use of this flexibility as the focus remained on alpha generation rather than outsized directional bets. To all intents and purposes, the fund has stayed close to broadly market neutral in a range of -10% to +30%. As of April 2019, exposure is approximately 70% long and 65% short and beta-adjusted numbers are more or less identical. Gross exposure is capped at 220%.

Umeki is somewhat constructive on Japanese equities, partly because cash-rich companies can continue increasing dividends and buy backs, and are generally becoming more shareholder-friendly as corporate governance continues to improve under ‘Abenomics’. The strategy’s 2017 performance was much better than in 2018 but this was not due to beta exposure. Rather, “fundamentals were driving the market in 2017 amid strong inflows, whereas in 2018, fundamental stock-picking did not seem to work as well as outflows led to irrational price action,” says Umeki.

He “does not expect policy surprises from Japan, where unemployment is low but inflation continues to fall short of its target. The economy and government are stable and there is no threat of populist politics”. Umeki is also mindful that the global equity market recovery is not backed up by an economic recovery, and could be vulnerable to adverse news-flow around the trade war, Brexit and so on. Therefore, he feels a market neutral stance is currently appropriate.

Mainly bottom-up

Most of Alpha Japan’s stock-picks are based on bottom-up, fundamental valuation analysis, but big picture macro trends can be relevant too in identifying themes. For instance, Japan’s ageing population boosts demand for healthcare, and helps to explain why this sector is the largest net long position. Conversely, consumer staples are a short partly because consumption growth has peaked out.

Of Japan’s 3,700 listed stocks, roughly 1,400 are deemed to be liquid enough for the UCITS, based on average daily trading volumes (ADV) of at least 100 million Yen per day (c. USD 900,000), and consistent with being able to liquidate a minimum of 60% of the portfolio within five days, assuming 20% of ADV.

So long as liquidity criteria are met, Alpha Japan is agnostic on market cap size. The balance amongst large cap, mid cap and small cap names moves around from year to year, and is a consequence of bottom-up stock picks.

We do not expect policy surprises from Japan, where unemployment is low but inflation continues to fall short of its target. The economy and government are stable and there is no threat of populist politics.

Masahiro Umeki, CIO and lead portfolio manager

Sector specialists

Roughly 60% of the universe has no sell side coverage, placing a premium on proprietary financial modelling and meeting companies. Alpha Japan have over 400 company meetings per year (though some of these involve meeting the same company more than once). This leverages their strong network of contacts, from decades following Japanese companies and a Porter’s five forces approach that involves analysing companies, competitors, customers, and suppliers, to whittle down the universe to a shortlist of 125 leaders and laggards. Between 60 and 100 of these find their way into the portfolio at any time.

Umeki is the lead portfolio manager, who takes the final decision. “I always wanted to run an all-cap, all-sector fund, and now have the luxury of a team of analysts who provide research for both the long-only and the long/short managers and strategies,” he says.

Alpha Japan’s investment team, who boast an average of 27 years’ experience, cover the full spectrum of Japanese industry sectors and market caps through sector specialists and idea sharing between the teams helps to inform understanding of the interaction between sectors. For instance, Umeki, who won a Lipper award two years in a row for the healthcare fund he ran at Nikko Asset Management, is an expert in the healthcare and biotech sector, and has followed many companies from an early stage, including start-ups. “The sell side is only starting to catch up and realise their potential,” he says.

Portfolio Manager, Kunio Tomiyama, focuses on services, materials and growth companies. He also received a Lipper award, for a Japanese small and mid-cap fund as CIO of Credit Suisse Asset Management. His former colleague, Hiroshi Ikeda, specialises in manufacturers and industrials. Meanwhile, Senior Analyst, Kazuki Tagami, who has spent 30 years analysing Japanese companies including at Nippon Life and Sparx, covers electronics. The female senior analyst, Mikako Ishibashi, was managing money in small caps also at Sparx, and monitors pre-IPOs, retail and food. Yosuke Hirai, who has overlapped with Umeki at Nikko Asset Management, looks at machinery, autos and real estate.

Stock picks

Over 90% of the fund is in single stocks. Indices can occasionally be used to fine tune exposures; sector futures are not deemed to be liquid enough.

Hogy Medical is one top five holding in the healthcare sector where smaller holdings also include JEOL and Takara Biotech Inc. The latter is a cell and gene therapist specialist which Umeki believes could also be an attractive takeover target, thanks to its market cap of only USD 2.8 billion, promising gene medicine product, C-Reve and many other technologies in its pipeline. He points to a pattern of consolidation in gene and cell therapies, saying, “In 2017, Gilead bought Kite Pharmaceuticals for $11.9 billion, and in 2018, Cellgene bought Juno Therapeutics, Inc, for $9 billion.”

Another top five long position seen as vulnerable to predators in early 2019 was Heiwa Real Estate, Inc, which owns Tokyo offices including the trophy asset housing the Tokyo Stock exchange. “Heiwa could also be an attractive acquisition for any firm looking for prime office space in Tokyo, which is in scarce supply,” Umeki suggests. “The valuation is low and rents are also well below market rates, so a renegotiation of rents could be one short term catalyst for the stock, particularly since the office market is quite buoyant,” he adds. Further to this Alpha Japan owns Mitsubishi Estate Co Ltd, and to balance out sector exposure, Alpha Japan also has some shorts in real estate companies, including some that have a residential focus and others that are seeing threats to business models based on leasing and construction. Another holding, consumer electronics retailer, Nojima Corp, is profiting from strong demand including replacement demand for consumer electronics, and has done well from outlets in petrol stations. Nojima has opened new stores as the number one player, Yamada Denki, has shut down dozens of stores. “Nojima’s valuation of around seven times PE is lower than peers at 11-12 times,” says Umeki.

How to play electric vehicles?

EVs illustrate how Alpha Japan drills down into supply chain analysis. “Hybrid and electric cars have potential to redefine the landscape among big global automakers,” says Umeki. “We have analysed the supply chain to identify the companies best positioned to profit. We think that barriers to entry for manufacturing EVs are actually quite low, but what really defines the power and autonomy of the car is its battery. The number one maker of the lithium-ion battery, which was invented by Sony and still remains the most suitable technology, is Panasonic, which is why Tesla has a joint venture with Panasonic,” adds Umeki. “We further break down electric batteries into four components: cathode, anode, film separator, and electrolyte, some of which have more valued-added than others,” he goes on. “We then look for leading makers of these components, where Japan has a strong reputation dating back to the 1980s and 1990s. We believe that a number of component makers (such as W-Scope Corporation, Ube Industries and Hitachi Chemical) are the purest and best play on EVs.”

Within the auto-related space, the fund has also been short of a firm involved in making hydrogen fuel cells that reached a PE ratio of 25.

Active trading

Alpha Japan take an active trading approach. “The abolition of earnings preview reports since 2016 has increased volatility around earnings announcements, but not really changed our style,” says Umeki. Most of the trading is fundamentally driven, but some technical analysis can help with very short-term entry and exit levels and decisions.

Pharmaceuticals firm Sosei illustrates how Alpha Japan trades some names from both the long and the short side. Between June 2015 and September 2015, Alpha Japan anticipated that Sosei would need to raise capital and was short of the stock, before switching to a long stance from October 2015, after which the stock almost quintupled in value. Some managers with a growth or momentum style are likely to have been consistently long of “glamour” growth stocks such as Fast Retailing, Nintendo and Softbank. Alpha Japan is more opportunistic. “We have been long of these names in some phases, but tended to short them when they thought valuations had become overstretched and the names started to look overcrowded,” recalls Umeki.

The active trading approach is also seen in an opportunistic approach to structural change on exchanges. Currently, there are companies listed on multiple sections of exchanges based in locations including Tokyo, Osaka and Sapporo. The Tokyo exchange is reviewing equity market structure, and proposing a reclassification of Japan’s stock-market categorisation, which will raise the bar for membership of the TSE’s first section, possibly to a market capitalisation of 100 billion Yen (c. USD 900 million). Umeki expects that the changes could lead to some small cap and micro-cap stocks being ejected from the first section of the Tokyo exchange, and is short of a basket of stocks that could see forced selling from index-trackers and other benchmark-conscious investors.

Alpha Japan is not itself activist in style or approach, but has sometimes, coincidentally, held stocks that have been targeted by activists. That said, Umeki recognises that activism can sometimes provide a further catalyst, in stocks such as Yamada Denki, Daiichi Life and Sony.

Umeki sees strong opportunities for stock-picking on the long and short sides, and could easily manage larger volumes of assets in the strategy.

Long-only strategy

Alpha Japan’s long-only strategy manages c USD 200 million, including the daily dealing Luxembourg UCITS, Lombard Odier Investment Managers’ LO Funds – Alpha Japan. The strategy has delivered top decile or top quartile performance over ten years, and has earned a five-star rating from Morningstar for its five-year performance. The long book of Alpha Japan’s hedge fund strategy actually has very limited overlap with the long-only strategy. For instance, in March 2019, the long-only strategy’s top five positions – Softbank, Mitsubishi Corp, MUFG, Suzuki and Tokyu Corp – had no overlap with the hedge fund’s top five, though they can have some common positions. The commonality is relatively low in part because the long-only is managed to a limited tracking error tolerance of around 8% (ex-ante) versus its benchmark and has an active share of around 70%. This means that the long-only mandate might sometimes be underweight of stocks of which the hedge fund is short.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical