Old Mutual Group, the FTSE 100 company which bought Skandia Investment Group and for a period of time ran it alongside its Old Mutual Asset Managers unit, has overhauled its alternatives investment business in recent months, breathing new life into an existing enterprise.

Firstly the company combined the two businesses – Skandia’s very successful multi-manager business with OM Asset Managers’ expertise in direct investment. The new entity is Old Mutual Global Investors, and the closer tie-up between the two is providing economies of scale in distribution, compliance and operational efficiency.

In anticipation of this, in the summer of 2012 Old Mutual Global Investors also started looking for a new head of sales to boost its alternative investments division, which consists of two hedge funds – the UK Specialist Equity Fund and the Global Statistical Arbitrage Fund – and one alternative UCITS fund, the Global Equity Absolute Return (“GEAR”) Fund. What started off as a discussion about sales ended with the company creating the new position of Managing Director of Alternatives to engineer a bigger rethink of its strategic approach to hedge funds and alternative investments. The person attracted to fill the position was Donald Pepper, formerly managing director of Merrill Lynch’s prime brokerage business in EMEA, who had also worked as the head of alternatives at New Star and later as head of hedge funds at Henderson.

Initially, Pepper did not think he would be interested in joining Old Mutual, but what changed his view were new management hires in the company which signaled a renewed focus on hedge funds within the business.

“What interested me is that the company hired Paul Feeney [chief executive of OM Wealth Management] and Julian Ide [chief executive of Old Mutual Global Investors]. I knew Paul Feeney from his time at Gartmore as some of the AlphaGen hedge funds had been prime brokerage clients at Goldman Sachs and Merrill Lynch. Both Paul and Julian realised the potential opportunity in hedge funds and alternative UCITS, acknowledged that the firm had been under-punching its weight in this area, and were receptive to change”, said Pepper.

“I had got to know Old Mutual from the days when I was managing the client side of the prime brokerage business for Merrill Lynch in Europe and Old Mutual became a very important client for us,” says Pepper.

“I already knew Paul Simpson, manager of the Global Statistical Arbitrage Fund, Ian Heslop, manager of the Global Equity (market neutral) UCITS strategy and Ashton Bradbury [manager of the UK Specialist Equity Fund]. Their reputations are very good in the market and I was very impressed with their investment style,” says Pepper. Another point of appeal was the fact that the company had seed capital available for alternative investment – “a huge thing in this environment,” says Pepper.

At the time OM Global Investors did not have a hedge fund specialist so when Pepper started in his new position he undertook a review of the alternatives business. This brought up the fact that the asset base was relatively small and that the business had attracted less in-flows then it could have done.

“Reviewing the basic features of the funds it became very clear that there were some quick wins we could make by changing some fund terms which were putting investors off,” says Pepper.

Pepper moved the crystallisation of performance fees to an annual, rather than quarterly, basis. Previously investors had been charged performance fees every three months which could mean that if the fund had a flat performance on the year, investors could still end up paying significant “performance” fees. Now, as is more typical in the hedge fund industry, the administrator gauges the fund’s performance on 31 December, and investors only pay fees on performance over the full year. Pepper has also introduced a cash hurdle rate in the fee structure, which means that the company only charges a performance fee on returns in excess of the cash interest rate. “Investors are paying performance fees for the alpha we generate, not for the return from prevailing cash rates”, said Pepper.

Pepper also initiated the removal of gates which could be used to prevent investors from pulling their money out when they wanted to. “Highly liquid funds don’t need to have a gate,” says Pepper. He also reduced the redemption notice period from 20 to five days on these funds.

Old Mutual is also moving from a single prime broker to a multi-prime broker operating model at Pepper’s instigation.

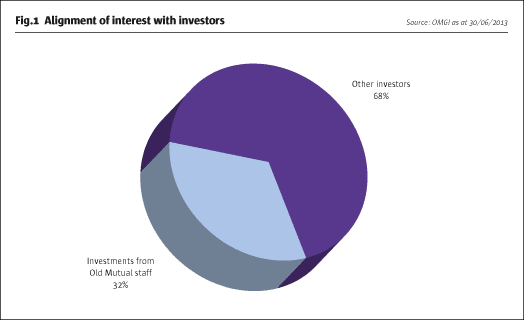

A number of investors, particularly in the US, made it clear that after 2008 they were no longer interested in investing with managers who did not have any “skin in the game”. To address this, Old Mutual has invested $50 million into the newly launched OM Arbea fund and is planning to put $15 million of acceleration capital into the UK Specialist Equity Fund. The hedge fund managers, and Pepper himself, are significant investors in OM’s hedge funds. Over 30% of the AUM in the UK Specialist Equity Fund is from OM employees (see Fig.1), while in the UCITS fund, where minimum investment is much lower than the $100,000 entry for offshore funds, there is a larger pool of OM staff also invested in the fund.

In parallel with the fund structure changes Pepper analysed the investment strategies themselves. “The investment processes were excellent but what Old Mutual had not done is talk with investors and realise that the calibration of risk target and return target was no longer giving investors what they wanted,” he says.

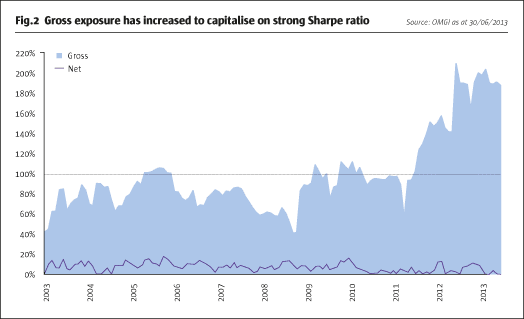

The funds had attractive Sharpe ratios but returns in the previous years had only been in the low to mid-single digits. This may have been enough during the crisis period of 2008 but as the markets started recovering from the financial crisis investors became less interested in low-volatility, low-return funds and became willing to take on more risk in pursuit of more return. OM Global Investors responded by upping gross leverage on its UK equity long/short fund from 100% to 200% (see Fig.2), and gross leverage from 300% to 400% on the Global Statistical Arbitrage Fund, bringing it closer in line with the industry average for this strategy. The response was almost instant and interest in the strategies spiked, with new in-flows in August and more expected in September. On 1 July an offshore version of the Global Equity Market Neutral strategy was launched with a higher volatility target achieved by increasing leverage to a range of 300%-400% versus 200% gross leverage in the UCITS version. For those investors who don’t want the higher risk profile, Old Mutual has kept the UCITS fund running as a more conservative option.

These changes, and strong performance, have resulted in significant new in-flows in 2013. Assets under management in the UCITS fund have gone from $60 million late last year to $391 million by the end of July, and most of the rise happened since April. The bulk of investors already on board are European although there has been interest across the globe, particularly in Latin America where Old Mutual has a strong distribution network. Interest in the fund spiked after the markets turned volatile in the second quarter of this year. The fund is structured in such a way that it is uncorrelated to other markets and can generate returns independent of market direction.

“It is harder to argue in favour of our funds when there is a situation like in the early part of this year when markets were moving up in a straight line,” says Pepper. “In the first three months we had a very benign market underwritten by central bank strategies. In that kind of situation investors ask themselves why they should hold funds like ours which are low or zero beta hedge funds, because in that situation they prefer a fund that will provide some participation in the beta,” he says.

However, that approach changes when the market turns volatile because investors realise that they may need a safer, smoother return stream, exactly the kind of fund that Old Mutual now provides.

The three funds in the alternatives range have a very good track record; they have been running for a combined 20 years and have generated positive returns in 19 of those years.

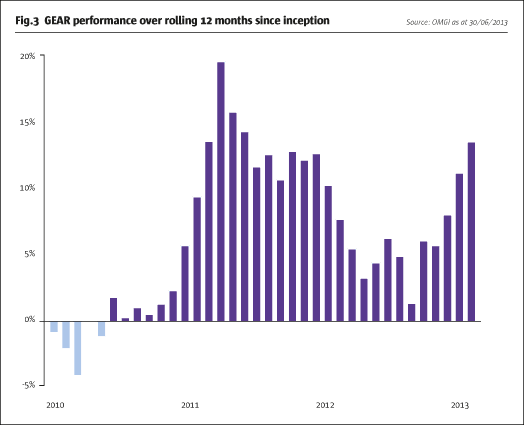

During the blackest year for the industry, 2008, the Global Statistical Arbitrage Fund managed by Paul Simpson and John Dow boasted a return of 18.3%. In 2011, when the average hedge fund lost 8.9%, Old Mutual’s Global Equity Absolute Return Fund (GEAR), an alternative UCITS structure, rose 12.6%, and its other two funds were up a respectable 5% and 5.5% respectively. GEAR has been running for four years and has had annualised returns of 7.8%. Of the three funds, only one had a single down year and even then it was off only 2.4%.

“This really is a place for widows and orphans to put their money,” says Pepper. “This is, in my opinion, what a hedge fund ought to do”, he adds.

The funds have also managed to avoid the harshest of drawdowns. The UK Specialist Equity fund, a UK mid and small-cap equity long/short fund, managed by Ashton Bradbury, with very limited net exposure/beta, has had only two cumulative drawdowns of over 2% since its inception in 2003. The biggest drawdown was 4.1% in over a decade of managing money, including the 2008 crisis, something Pepper calls “truly heroic”.

With the changes that have been brought in, the fund has moved from having returns of between 4% and 5.5% in 2010, 2011 and 2012, to being on target for an annualised return of above 10% this year.

In July Old Mutual Global Investors launched a new offshore Cayman hedge fund, the OM Arbea Fund, based on its Global Equity Absolute Return Fund. GEAR started off in 2009 as a global equity strategy fund in a UCITS format at a time when investors looked for a regulatory wrapper that would provide more security. Its volatility target was between 5% and 6% and it was expected to deliver returns of between cash plus 5% and 6%, explains Pepper. The fund exceeded these targets, delivering annualised returns of 7.8% in the four years from inception to end-June 2013, and with a volatility of 5.4%, but the world around it changed – those returns were no longer good enough for some investors. Talking to large pension funds, the OM team found out that the schemes were setting themselves targets of around 8% or higher, and OM could not afford to ignore this given that the biggest allocations into hedge funds globally come from large pension funds.

“We decided to recalibrate and add a bit more volatility in pursuit of commensurately higher return in the offshore version while keeping this very sensibly calibrated version for other investors like high-net-worth individuals and family offices who wanted a more stable core part of their portfolio,” says Pepper.

Also, looking at the size and growth of the UCITS market, it was becoming clear that the growth of the UCITS market was lower than what was initially expected. Assets under management in alternative UCITS are now around $116 billion, or only about 5% of the total hedge fund and alternative investment market which is worth around $2.6 trillion.

“We had a very good product which was very well managed but it was talking to only about 5% of the total market. By launching the new product we can now talk to the other 95% of the hedge fund market,” says Pepper.

Old Mutual invested $50 million of seed capital into the fund, aiming at volatility levels of between 8% and 9%. Given a Sharpe ratio of above 1, it targets returns of between cash plus 9% and 10%.

The Arbea team is headed by Ian Heslop, who has been with Old Mutual for 13 years and previously worked for BGI. The fund is co-managed by Amadeo Alentorn, previously with the Bank of England, and Mike Servent who had worked with Barra International and COR Risk Systems. The team has been working together on their investment processes since January 2005. They are managing around $1.2 billion of assets both onshore and offshore in hedge funds and long-only global and regional equity funds. Research for the investment process is done both in-house by Yuangao Liu and Lawrence Clark and externally by the Academic Advisory Board, a team of external economic experts specialising in macroeconomics, statistics, in how markets work and how portfolios are built.

The company also outsources research to a Virtual Laboratory, postgraduate researchers who are sponsored to work on short-term projects that overlap with the projects of interest to Old Mutual, typically to do some preliminary research before additional research is done in-house. The research is crucial for fundamental stock selection and handling the potential downside of the portfolio.

“No matter how you invest there is a cyclicality in investment and you need to manage the cyclicality in the portfolio,” says OM Arbea’s head of team, Ian Heslop. The two main reasons behind it are downside risk and the correlation between the different types of assets that are chosen. Market neutrality is not sufficient to ensure uncorrelated returns, says Heslop.

“If you don’t deal with correlation in the stock selection process, even if you have a very good market-neutral portfolio construction you will correlate with other markets,” says Heslop.

He adds that while sophisticated investors understand the idea behind uncorrelated returns, less sophisticated investors will ask for uncorrelated returns in falling markets and fully correlated returns in rising markets.

“We can’t achieve that but what we can do is deliver 60% to 65% positive returns,” says Heslop. Looking at the fund’s track record, the MSCI World Index has been down for 19 out of 48 months from when the fund was launched in July 2009, and in that period the Old Mutual Global Equity Absolute Return Fund was up 13 of these 19 down months, moving almost completely independently of the rest of the market. The company goes through a painstaking process of meticulously picking stocks that have a mispricing in place which will result in good returns and also builds its own risk models which give the team a diversified portfolio which works.

The fund is invested in the broadest set of equities. The universe is the most liquid 3,500 stocks from the 10,000 stocks comprising MSCI World coverage. In the portfolio, one-third of the stocks are European, one-third North American and the last third is equally divided between Japanese and Asian stocks. Institutional investors have access to the fund via I-shares, which charge fees of 75 basis points management fee and 20% performance fee, over the cash hurdle rate.

Planning ahead

Going forward the team is firstly aiming to build up its current hedge fund assets to capacity. Capacity of the global statistical arbitrage strategy is $700 million to $750 million and it is currently at $370 million; the capacity on Arbea is between $1.5 billion and $2 billion depending on whether it is all UCITS or hedge fund or a combination of the two. The UK equity long/short Specialist Equity strategy’s capacity is £250 million and AUM is currently at £35 million.

Old Mutual is also already starting to consider what complementary strategies might be run alongside existing ones in the alternative investments group. “We are in discussions with an investment team outside of Old Mutual who could be interesting. This may come to fruition in late 2013,” says Pepper.

“I firmly believe we are very well placed to attract additional first-class investment talent. The barrier to entry has risen significantly with heightened regulation and compliance requirements. Hedge fund managers at standalone boutiques are finding themselves getting increasingly drawn into non-investment matters. That is not what hedge fund investors want to see”, says Pepper.

At OMGI the portfolio managers can focus on delivering alpha and managing risk while the support functions take care of these and other non-investment areas of the business. “The old myth that ‘the best hedge fund managers are to be found only in boutiques’ is plain wrong. Managers who are specifically motivated by generating returns for their investors, rather than being more interested in asset-gathering in their ‘own’ (often eponymous) firms, like the fact these non-investment distractions are taken away in large, well-resourced firms like Old Mutual,” he added.

OMGI is also looking at some of their long-only investment teams and considering launching an alternative UCITS or hedge fund version, leveraging on their existing investment expertise.

The changes which the company has spent the last six months putting in place should serve it well to build the alternatives business to full capacity by some point in 2014. The intense focus on building uncorrelated portfolios means it will be prepared for the markets irrespective of how volatile they are.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical