Preqin conducted a series of interviews with over 100 hedge fund managers in November 2013 in order to find out about the pressures they are currently under as a manager and their outlook for 2014. Hedge fund managers were asked to give their opinion on a variety of topics, including their experience of changing assets under management in 2013, future growth potential for the industry, and current challenges for fund managers.

Changes in industry AUM

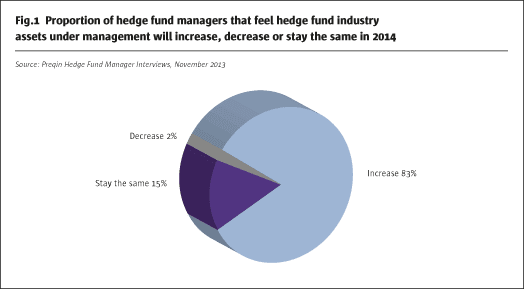

At the end of 2012, 62% of fund managers predicted that hedge fund assets under management would increase over the course of 2013. These fund managers were proved right, with the industry adding approximately $255 billion over the course of 2013. The managers that participated in the latest study in 2013 are even more positive about the outlook for growth in 2014; 83% feel the industry will grow as a result of inflows and performance, and just 2% feel the industry will suffer net outflows (see Fig.1). This is in contrast to the 11% of fund managers surveyed at the end of 2012 that reported that they felt the industry would decline in terms of assets under management in 2013.

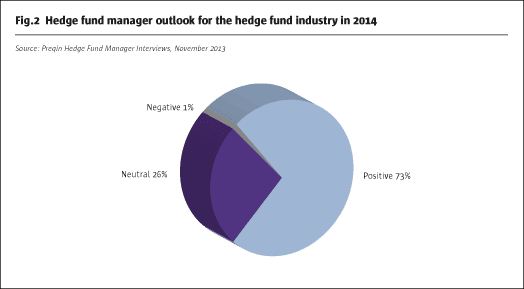

Although there are concerns surrounding regulation, the strong performance and solid growth of the industry in 2013 has led to an improvement in the outlook among fund managers on the global hedge fund industry for 2014. The overwhelming majority of fund managers are optimistic for the year ahead: 73% reported they are positive, with just 1% reporting to Preqin that they are negative about the outlook for the industry in 2014 (see Fig.2).

This is a significant improvement in the level of optimism from the industry compared to last year, when 55% of fund managers reported they felt 2013 would be positive, and 44% were negative about the opportunities in the industry over the year.

Institutional assets

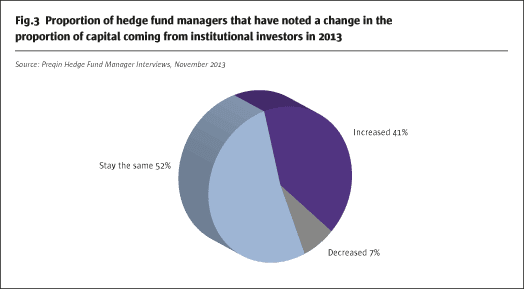

An increase in the proportion of assets coming from institutional pockets over the past year has been reported by 41% of fund managers who have reported to Preqin. In fact, the proportion of total industry capital coming from institutional investors is the highest it has ever been, at 65% of the total industry assets under management.Although more than half of fund managers surveyed reported they have not had any changes to the proportion of their capital coming from institutional investors, just 7% of fund managers reported a decline in the proportion of their assets coming from institutional investors; therefore, the net movement has been in favour of more managers picking up larger amounts of institutional capital (see Fig.3).

Institutional assets by investor type

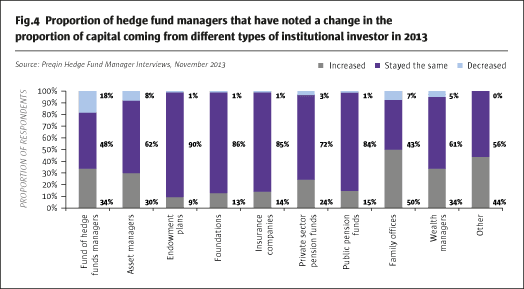

With industry assets under management increasing and managers reporting that they are seeing an overall higher percentage of capital coming from institutional investors, it is interesting to evaluate where this money is coming from. Fund managers were asked if they had noticed any change in the proportion of capital coming from various institutional groups in 2013, with the results presented in Fig.4.

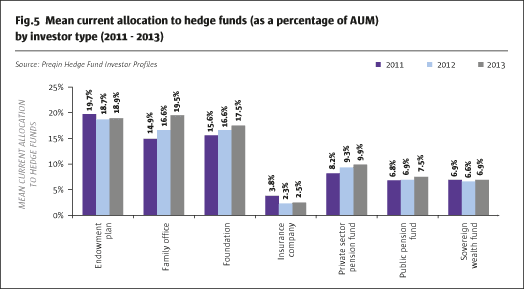

There has been resurgence in the amount of capital being committed to hedge funds by private wealth firms in 2013, with 50% and 34% of managers indicating that they had seen a higher proportion of assets coming from family offices and wealth managers respectively. This increased activity from family offices in 2013 is supported by data from Preqin’s Hedge Fund Investor Profiles, which show that the average current hedge fund allocation among family offices increased from 16.6% in December 2012 to 19.5% in December 2013 (see Fig.5).

An increased proportion of assets coming from fund of hedge funds managers in 2013 was reported by 34% of managers; however, a noticeable 18% of managers reported a lesser percentage of their assets coming from these firms, highlighting the fact that many fund of hedge funds managers have struggled to raise assets over the past few years. As funds become more established, managers often prefer inflows from institutional investors rather than fund of hedge funds managers, as investments from institutions tend to be longer-term in nature and ticket sizes can often be larger. However, funds of hedge funds are likely to remain a key source of capital for smaller hedge funds due to their ability to focus on emerging managers and niche strategies.

Public and private sector pension funds are continuing to allocate to hedge funds, and 15% and 24% of hedge fund managers reported an increased proportion of assets from these groups respectively. Both of these investor groups increased their mean hedge fund allocation by 0.6 percentage points in 2013 and pensions are expected to continue to be active in seeking new hedge fund investments over the coming year. Endowment plans are established investors in hedge funds and many of these firms are already operating at their optimum hedge fund allocation; 90% of managers noted that the proportion of capital coming from these investors in 2013 had not changed and the mean current allocation to hedge funds from endowments has fluctuated only slightly from 18.7% in 2012 to 18.9% in 2013.

New fund launches

A quarter of all fund managers that participated in the study stated that they plan to launch a new hedge fund over the course of 2014. There are some regional differences within this group of fund managers; 30% of Asia-Pacific-based fund managers have plans for a new launch in 2014, compared to 24% of North America-based fund managers and 21% of Europe-based fund managers. The Alternative Investment Fund Managers Directive (AIFMD) has had a negative impact on the number of fund launches within Europe, and with fewer fund managers in the region planning to launch funds in 2014 than in other regions, this trend looks set to continue over the year ahead, and we may see a reduced number of fund launches from the region until the full effects of the AIFMD become clear.

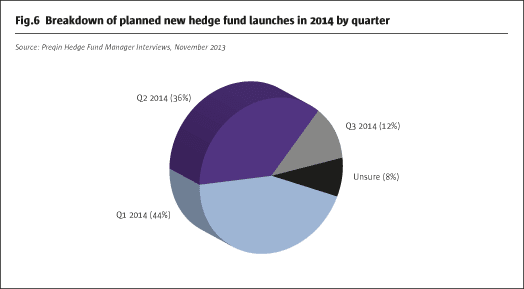

Four-fifths of fund managers with plans to launch new vehicles intend to do this in the first half of the year (see Fig.6); therefore we could witness an influx of new fund vehicles in the early part of 2014. 54% of fund managers that plan to launch new funds in 2014 stated that their fund will pursue a strategy that is new for the firm. This is a significant decrease from the proportion of fund managers that gave this response to this question in Preqin’s survey at the end of 2012. In this study, 89% of respondents stated they will be looking to launch a new strategy for the firm, indicating that more fund managers are focusing on the strategies and sectors they know best in 2014 compared to 2013, when more fund managers were looking to exploit previously untapped strategies.

Challenges for fund managers

Fundraising has been a significant challenge for fund managers over the past several years, as investors have become more selective following the fallout of 2008 and much of the fresh capital has flowed predominantly to just a handful of the most established names.

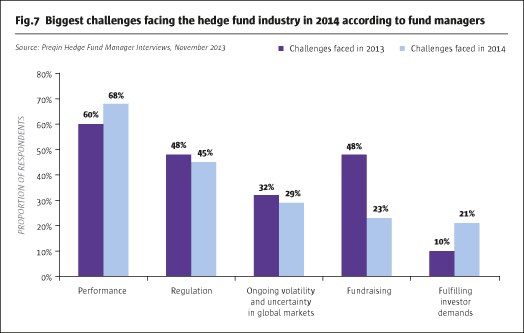

However, many fund managers are seeing a lightening of the fundraising burden in 2014, and there has been a significant drop in fund managers naming fundraising as a significant challenge, from 48% in 2012 to 23% in 2013 (see Fig. 7).

More fund managers have reported that generating strong performance is the key challenge for 2014, compared to the managers that participated in Preqin’s survey at the end of 2012, although in both studies this was the leading challenge the participating managers faced.

A Preqin survey of institutional investors in December 2013 showed that investors view the returns of hedge funds as the most important factor they assess when selecting new fund opportunities and also that the primary objective of their hedge fund portfolios is to generate strong absolute returns; therefore, it is vital to post good returns in order to attract, as well as to retain, investors.

More fund managers reported fulfilling investor demands as a significant challenge for 2014 than in our previous study at the end of 2012. With fundraising becoming less of a significant concern, and performance and fulfilling demands becoming more prominent challenges for fund managers, it is clear that these fund groups believe posting solid return figures, as well as listening to their investors, is a sound strategy to ensure that fundraising stays on track.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical