Gennaro Pucci’s PVE Capital has a recurring pattern of exploiting something akin to a “first-mover advantage”, and the PVE Credit Value Fund won The Hedge Fund Journal’s 2015 UCITS Performance Award for “Best Performing Credit Fund”, based on its Sharpe ratio and performance relative to other credit funds in the Alix Capital UCITS database. Enumerates Pucci, “We were one of the first to launch a credit UCITS, develop a Japanisation thesis for Europe, profit from banks shedding assets, and pull off an Italian non-performing loan deal,” and PVE also stands ready to pounce on selected European asset-backed securities (ABS) – when and if ECB QE can revitalise this market.

PVE’s ability to swiftly take advantage of these diverse opportunities comes from several attributes. With assets approaching $1 billion, “We are a niche player and do not have to compete with the biggest funds for opportunities,” explains Pucci, who traded structured credit for Commerzbank, and the world’s oldest bank, Monte dei Paschi de Siena, before becoming head of trading at Credaris. Pucci’s structured credit strategies have annualised at 28% over 10 years through bull and bear markets. PVE maintains a panoramic view of credit and also operates a versatile range of investment vehicles and structures, which range from UCITS to Irish funds, managed account platforms, funds of one, and private equity-style structures with multi-year investment horizons.

PVE’s compact, versatile and un-bureaucratic team also facilitates faster decision making. Pucci is CIO. Portfolio manager Loren Remetta joined PVE very soon after launch, and is responsible for liquid hedging, bonds, rates, FX and business development. Remetta has worked at Ambac, West LB, Dresdner, Bank of America and UBS, trading credit including single-name CDS and index CDS, as well as crossover names. Remetta’s remit at PVE includes risk management around interest rates and foreign exchange, but the main risk manager and research analyst is David Yuen, who worked with Pucci at Credaris.

Quantitative PhD Yuen is “incredibly useful,” says Pucci. PVE does not directly trade correlation in the way that Credaris did, but clearly correlation is a critical input for pricing structured credit and trades such as mezzanine risk sharing. Yuen builds his own pricing and valuation models, but he is not just a quant – he also runs risk across all of the portfolios and manages daily risk reporting, and he takes a portfolio management role on some of PVE’s structured credit investments.

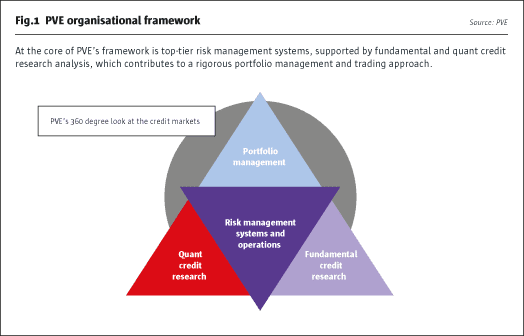

Research analyst Galina Goryacheva was at Eiger and Elgin before, where she researched both loans and bonds. Goryacheva has been instrumental on selecting key bond investments for the UCITS strategy. The analysts do quantitative and fundamental research which feeds into the weekly investment meetings that are attended by everyone, including COO Sohil Shah, who was head of operations overseeing multiple funds at Finisterre Capital, operations analyst Sumit Ahuja, and head of marketing, Noelle Tevis. PVE starts with a top-down approach and then asks analysts to seek opportunities in specific areas. Pucci draws on the whole team’s experience, saying, “Everyone has a different skill-set, so we are able to look at the market from 360 degrees.” (See Fig.1).

“Our perspective on credit gives us the chance to spot opportunities,” Pucci goes on, but the opportunity set is shifting as the liquidity backdrop changes. “I do not feel too comfortable over liquidity,” admits Pucci, observing how banks cannot easily provide liquidity and now the extreme emotions of fear and greed are important, with one comment from Yellen triggering outflows.

Retail investors, in the form of mutual funds and ETFs, have in effect become the biggest absorbers of the lack of liquidity. He therefore thinks that some funds of multi-billion size could have difficulty managing concentrated positions, but PVE’s UCITS has substantial capacity of billions because the investment-grade universe is the largest.

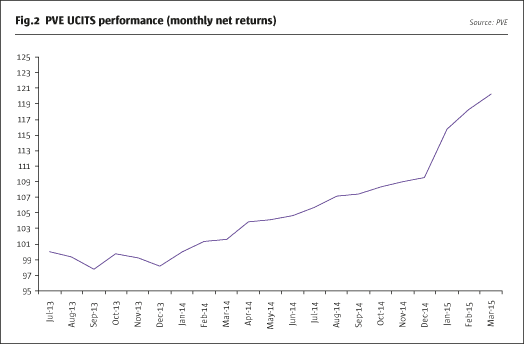

Despite the scalability of the UCITS, “A pure long/short credit fund does not offer the same opportunities as before, partly because the short side is technically driven by central bank interventions.” Faced with this new paradigm, Pucci launched the UCITS to test his thesis that Europe was undergoing “Japanisation” with abundant liquidity supporting ultra-low default rates and helping fixed income to outperform other asset classes. Although the fund has made as much as over 11% in the first three months of 2015, on top of its strong 2014, “there is plenty of money still to be made,” opines Pucci.

Is Italy the sweet spot in Southern Europe?

Meanwhile, Italian non-performing loans (NPLs) are now one of the three big bets of Pucci’s career, which has spanned investment banking, structured credit and high-yield. His first big bet was shorting structured credit in 2008 while at Credaris, and it was a Credaris investor that provided the €50 million capital to seed PVE mid-crisis in July 2009. Just as Rothschild famously relished blood in the streets as signifying an opportune moment to invest, Pucci loves nothing better than a crisis, so in 2012 Southern European crisis-stricken longs provided the second big bet. Now that peripheral Europe has seen a broad-based and synchronised recovery in risk assets, the opportunity for making such macro calls has diminished, so Pucci has to narrow down his search for much more specific, bottom-up opportunities. “Italy is very different from Spain, Portugal and Greece, as the collateral underlying loans is of higher quality,” he argues, pointing out that Italian property has held its value much better than have Spanish condominiums.

As well, conservative loan to value ratios of around 70% in Italy mean that buying NPLs at 30-40% on the dollar includes a huge comfort cushion, or margin of safety in the language of Benjamin Graham. “We can afford a 60-70% drop in house prices before losing money,” Pucci estimates. PVE are projecting an internal rate of return (IRR) above 30% after fees, based on what Pucci claims are “very conservative stress tests”. Nevertheless, he will admit that risks to the base case could include “prolonged deflation that might make the assumptions too high.” Yet what makes the trade even more extraordinary is that Pucci actually sees potential for property prices in Italy to appreciate, as his home country is “rich in terms of savings while negative rates on government paper will push private wealth into housing again,” with rental yields of around 3-4% very attractive.

Sourcing and servicing barriers to entry

“Given equity valuations, there are very few opportunities that can return 30% and still have protected downside which this collateral offers you,” argues Pucci, and the reason, he thinks, is that the Asset Quality Review (AQR) is “forcing banks to accept purchase prices that funds are willing to pay.” Prices may also be more compelling in Italy due to the barriers to entry entailed in sourcing and servicing the loans.

“The problem is in sourcing portfolios, and in Spain too many funds are chasing the space as everyone piled in as soon as housing started to level off,” observes Pucci, who has an extensive rolodex from his 20 years of experience in the NPL space. PVE is punching above its weight in Italian NPLs – the half a billion dollar portfolio acquired was one of the largest deals of the past eight months, and PVE has a strong pipeline of future deals in the space.

PVE has chosen its loans carefully. Rather than buying a whole block of loans and starting the servicing process from scratch, PVE has found a carefully selected book of seasoned loans comprised mainly of prime residential property. “We bought the book from someone who had already cherry picked it, and it is being sold after three of four years of servicing, so we only have four more years to go,” foresees Pucci.

To service the loans PVE has had to create an SPV that is compliant with Bank of Italy Law 130. Legal and servicing costs over several years can add up to 10% of the amounts recovered, but the deep discounts are more than enough to accommodate this, Pucci estimates. PVE has partnered with Ubaldo Palmidoro of Centaurus, who used to be part of the fourth largest servicing company in Italy and has many years of experience. Partnering with this newly created servicing company, Centaurus, may also allow PVE to do future acquisitions much more efficiently.

PVE has negotiated servicing fees “below average for Italy and closer to typical UK ABS levels,” says Pucci. The fees that PVE could earn are typical for a multi-year fund structure, and naturally PVE will only receive performance fees after capital is returned to investors.

Investor structure

Investors in the deal, which is not offered to retail investors, are institutions including pension funds, insurance companies and foundations. Most investors were existing PVE clients, with a mix of European and US investors. The US investors have a special type of currency hedge structure in place. Given uncertainties over recoveries, the hedge amount is the initial investment plus a percentage of estimated recoveries. “It is structured as a cross-currency swap with variable notional, so the amount can be reset as we get a clearer picture over likely levels of recoveries, which we expect to have within six months,” says Pucci.

Although PVE set up their UCITS fund independently, on the NPLs PVE chose to partner with Sciens Group Risk Services Limited for multiple reasons. Sciens co-invested in the deal, as did PVE staff. PVE already has a good experience of working with Sciens in other vehicles. And Sciens, unusually for a managed account platform, has experience of hosting private equity vehicles. The combination of Sciens’ own reporting and the Bank of Italy Law 130 regulations for securitisation vehicles, mean that “investors get as much transparency as possible,” promises Pucci. Investors will get quarterly reports, and annual audits from one of the big four firms.

Credit UCITS can produce double-digit returns

PVE is not targeting returns of 30% for its UCITS strategy, but is still aiming for and attaining far higher returns than some investors think are achievable within a UCITS framework, as shown in Fig.2.

Few credit hedge funds exist in a UCITS format, and many investors are sceptical about the ability of a credit UCITS to generate high returns, as a UCITS structure cannot play illiquidity premiums and cannot trade the full range of credit instruments. PVE of course has other vehicles for more esoteric and less liquid asset classes, but has demonstrated how a credit strategy in a UCITS framework can generate strong returns and allow for high-conviction views to be expressed. It is true that the UCITS 5/10/40 rule does set minimum levels of portfolio diversification, but PVE has still been able to maintain a relatively concentrated book of 20-25 bonds, choosing sectors carefully and using its fundamental research capabilities. PVE would never want to buy a broad high-yield index that in the US, for instance, has been hurt by heavy energy exposure, and UCITS certainly do not force anyone into buying indices or even hugging benchmarks closely; UCITS does not impose any tracking error constraint versus indices. The UCITS concentration rules have, however, forced the fund to regularly top slice its winners, which would otherwise have appreciated beyond UCITS concentration limits, and Pucci argues that this cautious approach of locking in some profits on winning trades is “not a bad strategy.”

The UCITS fund has been aggressively playing the deflationary theme with long exposure to corporate bonds, including those of 20 to 30-year duration and even some perpetuals. Pucci’s conviction that interest rates would follow a Japanese path seemed very contrarian in 2012, but has now been vindicated, with longer-duration positions benefiting disproportionately from the collapse in European interest rates. This is all part of Pucci’s bigger-picture macro view, which also implies that the euro should mimic the yen in depreciating against currencies of countries with stronger economies. Consequently the PVE fund has been long of US dollar and pound sterling.

In addition to these macro calls, bottom-up security selection has helped returns in several areas. Covered bonds have benefited particularly from the ECB asset purchases. There have also been event driven kickers. PVE bought bonds of Friends Life becausethey expected consolidation amongst life insurers, so Aviva’s takeover bestowed a windfall. This was not the only tender offer that the fund has benefited from, but PVE always assess offers on a case-by-case basis. The fund accepted one tender offer at an attractive premium, but in another case held out for a better offer which was soon forthcoming. One special market anomaly PVE has identified is that so-called “Yankee bonds”, or US dollar-denominated bonds from European issuers, offer a significant yield pick-up over euro-denominated bonds from the same issuers.

Going forward Pucci thinks that negative yields on sovereign paper will push more investors into investment-grade corporates, and “national champions” will become a core theme. PVE observes how the ECB purchases are a huge boon for credit investors because the ECB is a big fish making ripples in a small pool. “The quantum of ECB QE is as big as Fed QE in absolute terms but the impact is much bigger as Europe’s fixed income markets are so much smaller, at 40% of the size of the US market,” explains Loren Remetta. Government deficits are also much smaller than they were in the US, so PVE thinks the Bank of Italy could buy more than the total sum of issuance. Pucci contends that negative rates on short-term government debt are perfectly rational in the context of negative short-term interest rates. He thinks that the mentality of investors buying Bunds at a negative yield is that they can at least be assured that their losses will be limited to a fixed level.

But PVE does trade around core strategic views. In mid-March Pucci was tactically taking some profits on the US dollar exposure and also scaling back duration, as he thought the trade was perhaps becoming a little crowded. PVE has started putting on tail risk hedges, mindful that the 30-year US bond lost 9% of its value in just three weeks. Pucci will admit that there is some political risk to the QE trade – a change in the ECB consensus or in Mario Draghi’s mood could derail it, but for now it seems to be full steam ahead. Pucci argues, “The technicals are much stronger than the fundamentals, with incredible inflows as there are not enough bonds to meet demand.”

It is possible that PVE’s UCITS is demonstrating more concentration and conviction than many others because PVE opted not to partner with any platforms, which can sometimes impose extra restrictions on top of the UCITS rules. Says ex investment banker Tevis, “We did all the prep work in-house, which proved to be a great learning experience.” PVE started exploring UCITS back in 2010 and ran up against investor resistance about whether such a liquid product could provide returns. So at first the weekly dealing Irish UCITS, which launched in August 2013, had quite a low level of assets. PVE covered some costs for a while and service providers also offered competitive deals. But once the UCITS had enough size behind the strategy, it began to exhibit strong performance.

Somewhat more flexible than the UCITS, PVE’s MAP6 fund on a platform established by Goldman Sachs is a “fund of one” that was set up for a specific client. It does mainly high-yield debt and hedges credit risk as well as doing single-name shorts, whereas “UCITS credit risk is managed through substitution of bonds.” The MAP6 product also takes exposure to tranches of structured credit, typically in the crossover category.

ABS on the horizon

Notwithstanding all of these successes, Pucci is never resting on his laurels. Always at the back of his mind is where the next opportunity may lie – and this might be in European ABS. Right now, Pucci thinks, “It is too early to tell if the ECB will succeed in revamping the ABS market,” and the triple A tranche still yields too much relative to junior tranches. “If triple A yields 140 basis points then single B at 300 and CLO equity at 800 are too low.” However, there are early signs that expectations of ECB purchases are starting to compress AAA spreads, which opens up headroom for higher yields on the more junior slices – and could also inject new life into the primary market. As well, “Investment banks are beginning to extend leverage to super senior but not enough to allow for large-scale securitisation,” observes Pucci. When and if the deal flow and yields become appealing, the right vehicle is already in place, like a coiled spring standing ready to take advantage of the situation.

Asset-backed securities could be taken advantage of by PVE’s Pearl Vega vehicle, on the Sciens platform, which currently pursues special situations including structured credit and bank capital. PVE now has as much as $600 million of assets in special situations, which have found value in bespoke CLO tranches that have performed strongly this year. Trades have also included selling Jump to Default (JTD) protection on Russian mezzanine exposure where PVE is getting paid 8% for one-year protection. “Three of the underlying names would need to default before we lost any money, and we think this is very unlikely as they are firms like Gazprom and VTB.”

Pucci has over his career been very selective about choosing opportunities in credit, but today he is upbeat about all of the funds. “We see market opportunities in all funds and we are very opportunistic in using our experience and relationships to take advantage of ECB purchases, distressed assets, and special situations plays.” Historically PVE identified investment opportunities before raising assets. In future, Pucci may move towards a more flexible model of seeking pre-commitments from investors that are drawn down as and when opportunities arise. Investors should watch this space to find out where Pucci is next hunting for extraordinary opportunity.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical