In 2014 and 2015 Russia was given a substantial economic blow following a new oil price shock and the implementation of economic sanctions for its annexation of Crimea and its active role in destabilising Eastern Ukraine. This triggered its first significant devaluation crisis in December 2014. Following a series of emergency rate hikes, which were instrumental in supporting the rouble, the currency renewed its weakness to reach an all-time low of 80 versus the US dollar in January 2016, as oil fell below USD 30 per barrel. Since then a period of exceptional stability has prevailed globally and Russian assets are among the top performers this year. At this juncture, we deem it useful to look again at the current economic environment, corporate performance, and market factors to draw a reasonable near term outlook. We have identified the following catalysts:

- Policy response: a shift away from currency stabilisation policies. Authorities will likely support a weaker rouble after the 18th of September parliamentary elections through gradual reduction in real interest rates from their current abnormal high levels.

- Corporate results: Russian companies and the main index constituents in particular have not been able to turn around profitability and growth.

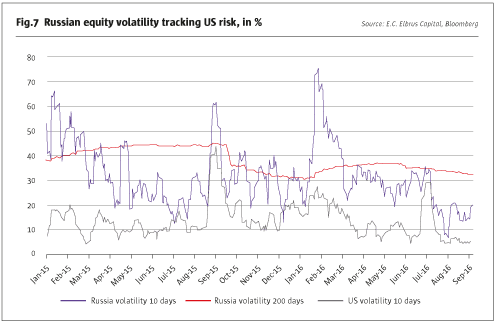

- Market factors: Russian equity volatility is extraordinarily low compared to historical levels. A reversal to the mean following an exceptional period of ultra-low US yields will potentially trigger a 15 to 25% correction in Russian equities, in line with its historical pattern.

Russia’s economic performance continued to be weak with GDP contracting an estimated -0.9% in the first half of 2016 year-on-year, as consumption recovery failed to rebound together with investments. Proposed privatisations were not completed while the fiscal deficit remains high at an expected 3.9% of GDP for 2016. The Central Bank of Russia continued to run a tight monetarypolicy hampering a growth recovery.

In economic terms and despite the government’s impulse and desire to diversify its economy away from energy, Russia has been unable to benefit from import substitution for structural reasons. Loan growth remained weak as banks preferred to gobble up new bond issuances rather than increase lending. Maintaining adequate capital ratios proved particularly constraining for the big banks and assets’ quality continued to deteriorate as measured by the rising size of renegotiated loans on their books.

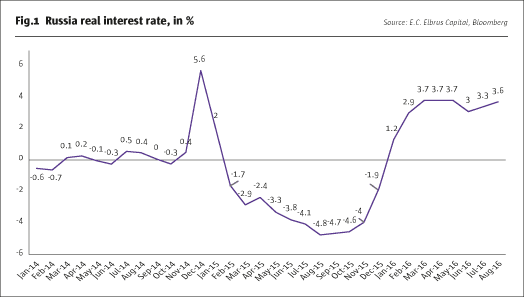

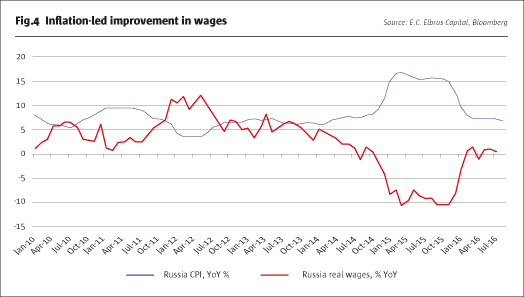

At the same time, the Russian economy witnessed a strong disinflation process (Fig.4), which allowed the country to lower its interest rates from a peak of 17% in December 2014 to 10.5% so far in 2016. For the record, interest rates were cut by a cumulative 6% during the year 2015 and a small 50 basis points to 10.5% so far in 2016. Nevertheless, real interest rates remained stubbornly high as shown in Fig.1.

Finally, the continued abrupt fall in US yields throughout 2016 provided the Russian currency with additional support this year, as a profitable carry trade flourished.

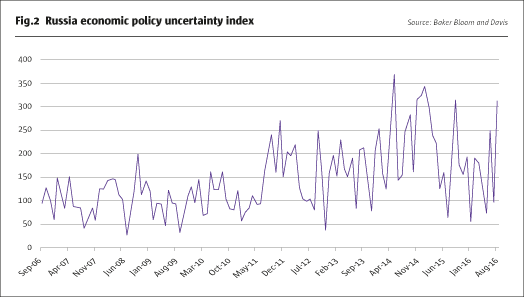

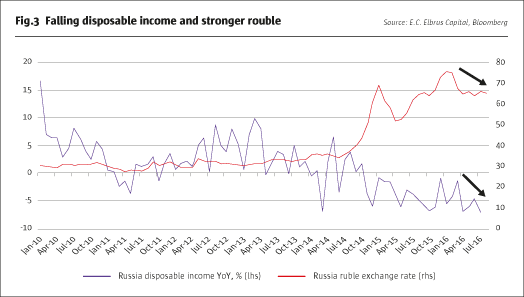

Further to that, overall business uncertainty reached new highs (Fig.2). Consumer spending continued to retrench failing to respond positively to this year’s currency strength and rising real wages. Finally, disposable income plummeted further (Fig.3), and auto sales contracted by a 18% in August on an annual basis.

One explanation is that a bigger share of other households’ complementary income sources, including, but not limited to, rent from real estate and interest revenues continued to contract. The analysis of wages alone does not capture the full picture on households’ sentiment and behaviour as many Russians have secured several alternate sources of often non-official revenues and jobs to complement customary low wage levels. As pressure by the government to reduce so called grey salaries increased, this continues to result in lower net income for households.

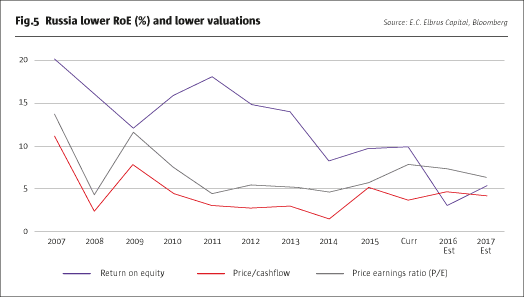

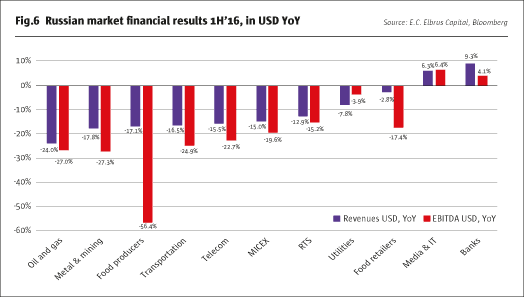

On the corporate front, the situation deteriorated. This year’s first half results have witnessed lower corporate earnings and operational performance (Fig.4). In our view, the second half of 2016 will display a similar picture of weak top line and little or no EBITDA growth. The standout performers remained the “new economy stocks”, which proved outperformers with positive aggregated results reflecting continued change in consumption habits such as on-line shopping, money transfers, gaming, taxi services, advertisements as well as financial on-line supermarkets. Finally, banks exhibited better results, but at the expense of asset quality. The increasing volume of renegotiated loans must not be ignored. Their number has reached RUR 4trln (approximately USD 61bn) for the biggest bank or 20% of its assets. Low capital ratios closer to minimum regulatory requirements also continued to be a burdensome constraint. These factors put at risk the type of multiples that investors have to pay after the recent rally if profitability and growth don’t return soon. As the chart in Fig.5 shows, valuations have bounced off the lows in the past 2 years but the return on equity performance of Russian companies continues to fall.

This sentiment and analysis seems to be largely ignored by international investors and tangible negative evidence seems to be widely overlooked due to abundant and rising global liquidity.

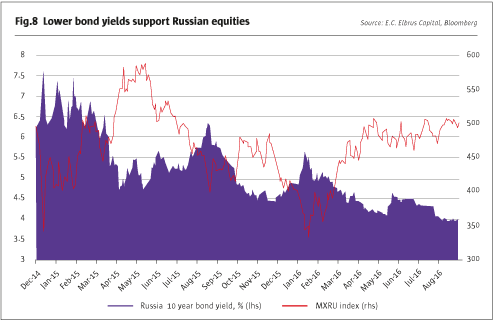

A final element is global equity volatility level. The Russian market volatility is sitting at the bottom of its 2016 range and 50% below its long-term reading (Fig.7). Over the last 4 months, global markets’ volatility has literally vanished dragging down Russian volatility with it. A phenomenal US yield compression also benefitted Russian bonds, providing the Russian financial market with additional support (Fig.8).

Stabilising the currency before the September parliamentary elections or preventing it to fall to politically unacceptable levels were key objectives in 2016. Similarly, we believe that the numerous rumours and speculations of a possible oil output freeze were essentially spread to dampen oil price volatility or, to the very least, to put a floor on it. At this juncture and with WTI oil prices stabilising within the USD 40-50 range, we can assert that Russia moved out from a potentially serious solvency issue when prices were below USD 30 per barrel. However, considering a wider fiscal deficit, current tight monetary and fiscal policies are proving inadequate to stimulate growth. Therefore, we believe that growth issues will soon return to the top of the Russian administration’s agenda. Nevertheless, in absence of significant investments, a period of weaker currency environment will be necessary to balance the budget.

In summary, Russia has stabilised mainly on the back of external factors but it appears to us that current gains seem to be built on excessive economic optimism. Even a meagre 1% positive rate of GDP growth is putting at risk many economic assumptions. Future corporate performance is also a hostage to the rouble movement. Finally, a normalisation of global volatility level will trigger more pronounced market movements going forward. Among the negative catalysts, these include a widening of GEM spread, rising US yields as well as oil prices volatility. We therefore view the current risk reward in Russia as unattractive and expect lower price levels in the market to materialise in the near term. However, the long term economic and solvency picture remains balanced.

Elbrus Capital is an independent specialist in Eastern European Equity investments with over 15 years’ experience. info@elbrus-capital.com.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 116

Russia

Economic analysis update

E.C. ELBRUS CAPITAL INVESTMENTS

Originally published in the September 2016 issue