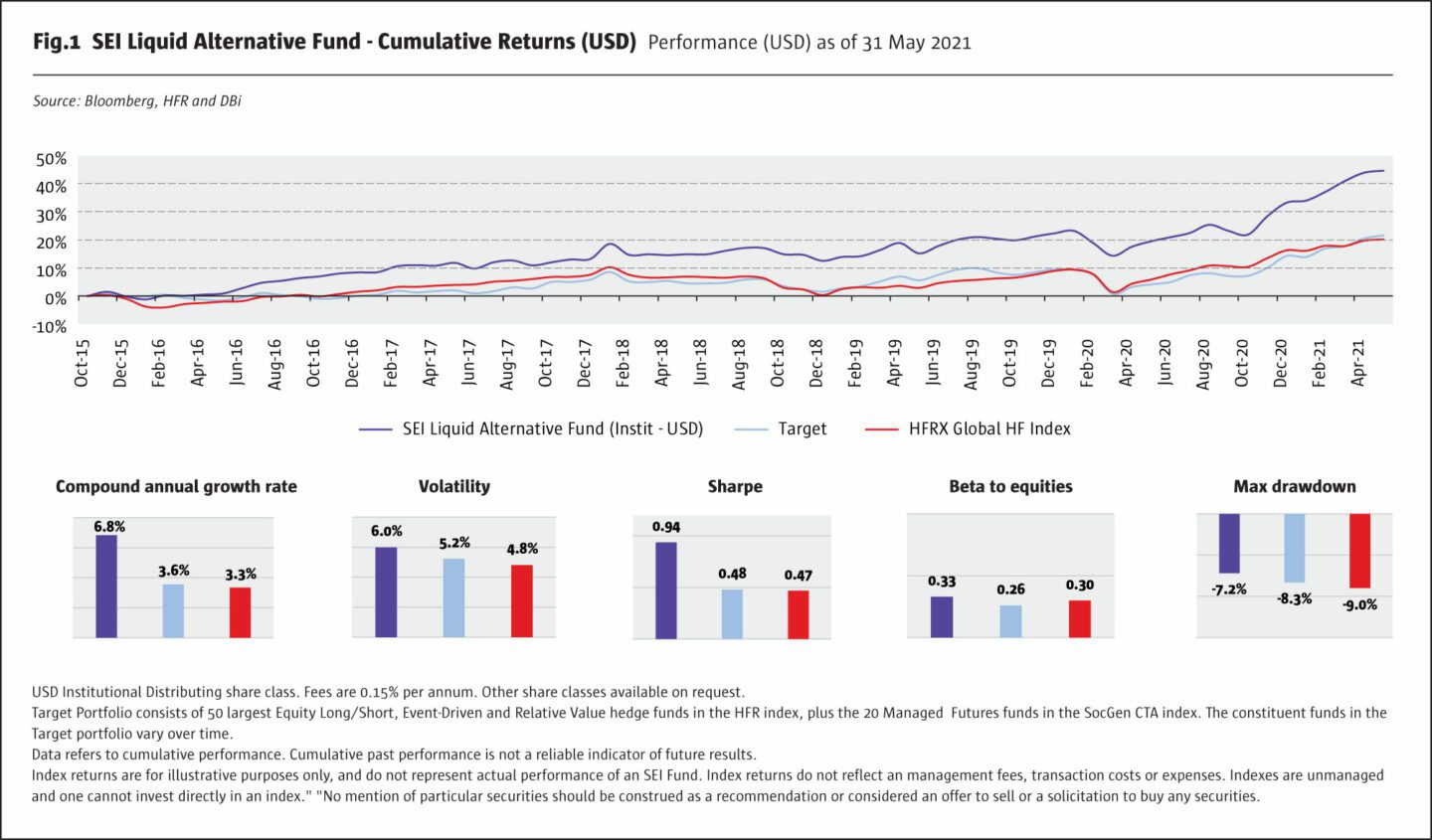

The SEI Liquid Alternative UCITS Fund received The Hedge Fund Journal’s UCITS Hedge award for Best Performing Fund in 2020 and over 2-, 3- and 5-Year Periods, in the Hedge Fund Index Replication strategy category. The product, and predecessor strategies dating back to 2007, have outperformed broad asset-weighted hedge fund indices, but have multiple return objectives and risk constraints.

Objectives and mandate

The UCITS is based on what was originally a customized hedge fund diversifier solution for SEI’s in-house multi asset portfolios, with several objectives: delivering returns of cash +5%; matching or outperforming the larger hedge funds that typically populate pension fund portfolios; replicating returns from a defined range of hedge fund strategies; doing so while maintaining a much lower equity market correlation than broad hedge fund indices; capping all in fees and expenses at less than 1%; and avoiding risks including left tail, trade crowding and illiquidity. “The aim was to build a liquid one stop shop for hedge fund exposure,” says SEI Managing Director of Alternative Investments, Radoslav Koitchev. Though it started with a very “institutional” aim, it is also now offered on various private banking and wealth management platforms that cater for retail investors.

The aim was to build a liquid one stop shop for hedge fund exposure

Radoslav Koitchev, Managing Director of Alternative Investments, SEI

Based on these criteria – and concerns about other replication offerings – SEI selected Andrew Beer’s Dynamic Beta Investments (DBI) to run this strategy. Koitchev, who has been at SEI since 2009, overseeing both hedge funds and liquid alternatives, explains the selection process: “We spent a year on a project before choosing DBI. We did not pursue big banks’ liquid alternative and replication products because they were trying to emulate risk premia such as those from merger arbitrage and selling volatility, were too static in their exposures and had too much left tail risks, whereas DBI was more flexible and dynamic. The banks’ implementation using hundreds, or thousands of securities also defeated the object of seeking a simple solution. Some products were also based on swaps from the bank itself, and the pricing of the swaps defeated the purpose of transparency and low cost. The banks also had a one size fits all approach, but we wanted to avoid the typical equity correlation of 0.8 to 0.9 seen in broad hedge fund indices, and DBI was willing to customize the portfolio to bring down the correlation”.

A different perspective

Beer has approached replication from a different perspective: “We are not pure quants. I am an intrinsic value investor by background”. His career began in 1994 at Seth Klarman’s Baupost and he then founded commodity focused Pinnacle and one of the first Greater China focused managers, Apex Capital Management. “In 2007 my focus shifted to achieving the diversification benefits of hedge funds, but with lower fees, lower correlation, less downside risk and more transparency, and daily liquidity.”

Lower fees

DBI’s objective is to replicate most or all of the pre-fee performance of hedge funds, and then generate outperformance mainly by reducing the cost of fees, in two ways. Most simply the level of fees – with an all-in cost ratio below 1% – is lower. “The most reliable way to outperform is by disintermediating fees. Sovereign wealth funds have done so for years, but most investors have no pricing power. In the 2010s hedge funds had more of a fee issue than an alpha issue, with the typical investor paying away half of gross returns in fees,” says Beer.

The magnitude of the fee difference is something of a moving target since the EY Global Alternative Fund survey (formerly called the EY Hedge Fund Survey) shows fees coming down every year, and they vary with any performance fees, but the gap could average between 300 and 500 basis points for many larger managers.

Less obviously, the product – which has no performance fees – also avoids performance fee netting risk between managers. “Netting risks are as significant as the level of fees,” says Koitchev. Whether investors allocate directly to two managers or do so via a fund of funds or multi-manager product, the weighted average performance fee can be much higher than the headline of 15-20%. For example, if two managers generate equal and opposite returns, resulting in zero overall return, performance fees are payable to the profitable one, so the investor is paying a performance fee on zero gross return.

33%

Bottom-up, Andrew Beer’s analysis suggests that hedge fund longs beat shorts by 33% in 2020, which may mark a return to stock-picking alpha.

A lower equity market correlation

DBI’s fees arguments also applies to most alternative risk premia (ARP) products, which also charge flat fees, but many ARP strategies have also exhibited high equity market correlation, particularly on the downside. The SEI product is designed to have a lower equity market correlation than the 0.8 to 0.9 seen in some broad hedge fund indices, through its choice and weightings of strategy returns that it seeks to replicate.

The process seeks to replicate the returns of two types of hedge funds: multi-strategy and managed futures. Most broad hedge fund indices although diversified across the main hedge fund strategies such as equity hedge, event driven and relative value, still exhibit high equity market correlations around 0.8-0.9 limiting their diversification benefits. This is also the case for the multi-strategy sleeve which consists of 50 large funds across these strategies.

The UCITS reduces its equity market correlation through the size of its managed futures allocation. It has a 60% weighting in the multi-strategy product and a weighting of 40% in a managed futures replication strategy, which is expected to have zero equity correlation over time. The addition of the managed futures sleeve is intended to reduce the long-term equity correlation of the overall strategy to around 0.5-0.6, through a full cycle, which translates into equity beta of 0.2 to 0.3. Beer believes that the size of the synthetic managed futures weighting is DBI’s most striking differentiator from other hedge fund replication products. The managed futures weighting is intended to provide “crisis protection” for those periods, such as 2008, when hedge fund managers lacked resilience.

Avoiding risk factors

The DBI approach also aims to avoid a range of risk factors that can contribute to negative performance for hedge funds. Beer argues that hedge fund performance reversals have been exacerbated by single stock crowding; investment illiquidity risk; fund liquidity risk and asset/liability mismatches that give rise to gating, suspension, and swing pricing; and single manager blow-ups including those related to frauds and OTC counterparty risk. Most of these problems more often emerge during financial market crises such as 2008 or other setbacks. DBI avoids these risks by only trading liquid exchange traded futures, which also align with the products’ daily liquidity.

Methodology: market factor-based replication

Beer argues that for the average hedge fund top-down market factor weights determine 80% or more of pre-fee returns, with up to 20% coming from security selection and illiquidity premia, for equity hedge, event driven and relative value. For managed futures, he reckons 100% of pre-fee returns come from market factors. Consequently, in the Fund the multi-strategy sleeve aims to generate 90% of the pre-fee returns of 50 of the largest equity hedge, relative value and event driven funds, while the managed futures sleeve, more ambitiously, targets 100% of the returns of the largest 20 CTAs – before both fees and costs.

Monitoring of managers

For the multi-strategy sleeve, the largest 50 funds that report performance to databases are tracked, with the aim to be representative of large pension fund portfolios. This ranking is done in a fairly mechanical way: “We do not want to introduce discretion into the selection of funds to replicate because we want to eliminate single manager risk, including our own,” says Beer. He is not sure if non-reporting bias makes much difference; he argues that if they are closed to new investment, their best returns were often historical. They are categorized into the three broad strategies according to managers’ self-reported definitions. The categories are broad, so equity long short could include discretionary and quantitative strategies, and geographic and sector specialists. Turnover amongst the top 50 ranking can be as high as 25% per year and the universe contains a growing number of UCITS funds.

The managed futures managers monitored are the 20 constituents of the SG CTA index, which is split roughly evenly between trend and non-trend managers, including some multi-strategy quant, quantitative macro and machine learning approaches.

Hedge funds change what they do over time. In the early 2000s they bought small cap value and shorted large cap tech. A few years later they bought the BRIC emerging markets. Alpha is dynamic.

Andrew Beer, Dynamic Beta Investments (DBI)

Market factors versus style factors

Market factor exposures are statistically inferred from historical performance, rather than being aggregated from positions. It is worth distinguishing between market factors and style factors. Whereas many ARP strategies would start with either static or dynamic exposures to style factors such as value, growth, momentum, carry etc. and apply them to positions in macro futures markets (and sometimes single securities), DBI is just inferring managers’ market factor exposures to macro markets, and directly replicating those. These inferred exposures could of course be the function of multiple and changing style factors such as value, growth, momentum, carry etc. (as well as bottom-up security selection) and DBI is not making presumptions about which style factors are driving managers’ returns. This reflects Beer’s confidence in hedge funds’ dynamic and adaptive investment processes: “Looking at ARP in 2014 as an investor I had serious unanswered questions. Back-tested numbers were not based on actual experience of investing in hedge funds and were created in a vacuum based on the idea of a static source of alpha since the 1990s. In fact, hedge funds change what they do over time. In the early 2000s they bought small cap value and shorted large cap tech. A few years later they bought the BRIC emerging markets. Alpha is dynamic”.

Inferring market factor exposures

Whereas ARP approaches are often based on back testing factors over decades, in the multi-strategy sleeve, DBI infers managers’ factor returns over a look back period of 14 months, with a higher weighting on more recent returns. However, the approach is also robust to changes in the parameters and would work with a 24 month or 36 month look back period.

It uses five equity indices (Nasdaq; Russell 2000; S&P 400; Eurostoxx 50; MSCI EM) three bond instruments (2-year US Treasury; 30-year US Treasury and EAFE index) and one currency index (USD Index). Until December 2020, it also used EUR and USD corporate bond indices.

In the managed futures sleeve, a 20-to-40-day look back is used, which has worked well so far. Beer might become concerned if the broad SG CTA index became too short term however: “If they all use three-day windows, we will not be able to replicate them over 20-to-40-day lookbacks”.

The managed futures sleeve uses a larger number of partly overlapping but also sometimes different factors: five equity indices (Nasdaq; Russell 2000; S&P 400; S&P 500; MSCI EM); four bond instruments (2-year, 10-year, and 30-year Treasuries, and EAFE index); and four currency pairs (AUD, GBP, CAD and EUR, all against USD).

A consistent approach

The methodology has been remarkably consistent over 13 years. “We are very conservative about making changes to the approach. Our first change in factors was implemented at year end 2020, partly in response to the first quarter of 2020. Two credit ETFs had been used to track exposures of credit heavy mangers but in March 2020 we noticed the ETFs diverging from NAV and becoming less liquid, which could create an asset/liability mismatch with the fund’s daily dealing. Apart from this the pool of factors has hardly changed in 13 years. We get asked about adding the VIX or Bitcoin but are not planning to do so as our analysis does not suggest they are important drivers.”

The approach is partly informed by DBI’s academic adviser, Matt Grayson. “He brings to bear not only quant skills but also real-world experience. He was sceptical of unproven ARP products, and generally wary of complexity and fat tails. He also rejected Kalman filters,” says Beer, who sums up, “the methodology is based on simplicity rather than selling complexity”.

Performance review and attribution: UCITS

The UCITS has shown greatest outperformance of HFRX, of about 6%, in 2016 and 2018. For instance, “when hedge funds are de-risking at the same time in overlapping securities, the stress effect ripples through the industry. We were negative in 2018 but we outperformed the industry by avoiding this risk,” says Koitchev.

The largest performance contributors for the multi-strategy sleeve between November 2015 and January 2021 have been the Nasdaq, MSCI EM and S&P 400.

Two of the top three contributors for the managed futures sleeve have been the same as for the multi strategy sleeve: Nasdaq and MSCI EM while EUR/USD and 10-year Treasuries are the next biggest.

The managed futures sleeve by itself has generated higher risk-adjusted returns than most of the largest 20 CTAs. It not only charges lower fees but also has lower trading costs. “DBI’s managed futures sleeve has transaction costs below 10 basis points per year, whereas we estimate that funds could be spending 100 to 200 basis points, partly from trading more expensive contracts,” says Beer.

Variable equity market correlation

The only criterion that the UCITS product has slightly missed, so far, has been its equity market beta. “Our beta since 2015 of 0.3 is at the top of the expected range, because in a period of consistently rising equities, managed futures funds were net long most of the time. There is no perfect hedge and in January 2018 we were up more than expected – since managed futures and multi strategy were both long of equities – and in February 2018 we were down more than expected. Nonetheless, in late 2015 to early 2016, and in mid-2019, our managed futures sleeve has been net short equities. In early 2016, the net short on the managed futures side was enough to offset the net long on the multi strategy side and resulted in overall neutral equities exposure, which helped the strategy to hold steady when the HFRX Global index was down,” points out Beer. “Over time we would expect the managed futures to have zero correlation to equities.”

Scope of the strategy

The strategy has done a good job of replicating larger hedge fund returns in aggregate, but it is also worth being clear about what it is not trying to replicate – in terms of its approach, funds, strategies, asset classes, and instruments.

Funds of funds and multi-manager products are aiming to outperform through active strategy rebalancing decisions and manager selection, both of which are ruled out of the DBI approach, though the turnover of managers tracked means that DBI is implicitly following performance of managers who grow assets.

Smaller funds

The emphasis on the largest funds makes the DBI approach closer to an asset weighted index, than an equal weighted index, though in fact since 2015 it has kept pace with indices of equal weighted indices of funds, which have somewhat outperformed asset-weighted indices. Beer cautions that there are data quality issues with equal weighted indices.

Idiosyncratic and non-linear instruments

DBI is not trying to replicate single stock alpha, illiquidity premia, or non-linear returns. Several ETFs and funds aim to replicate hedge funds’ long stock picks. Beer did explore the possibility of using a bottom-up approach based on position level data, as reported in regulatory filings, but determined that, “this would run into trade crowding and downside skew problems. We also found that 13F regulatory filings are very US centric, and so would miss out on those periods when hedge funds have profited from emerging market exposures”.

Some strategies are explicitly seeking illiquidity premia. “If funds have a high percentage of illiquid assets, we could not infer their factor exposures from their returns, because the returns are smoothed.”

Hedge fund managers use many non-linear instruments, including CDS, options and other derivatives. “These cannot be replicated so we would not have captured short sub-prime in 2007-2008,” says Beer.

Strategies

The strategy does not attempt to replicate discretionary macro managers. “On a standalone basis they are not easy to replicate,” says Beer. Though the strategy is aiming for low equity beta, “it would try to avoid monitoring funds that structurally hedge all types of beta, since their factor exposures could then be difficult to infer,” says Beer.

Asset classes

No commodities are traded, though Beer argues that the Australian dollar could act as a proxy for some commodity exposures to some degree. The strategy will clearly not capture more exotic return streams from new asset classes including the growing universe of Chinese commodities, as well as insurance linked securities, catastrophe bonds, music royalties etc.

Outlook for hedge funds

Beer has a constructive outlook from top-down and bottom-up perspectives. Top-down, in early 2021 he identifies a big picture theme as being an inflationary trade pivoting into value stocks, and emerging markets, as fiscal stimulus creates a risk of overheating. Bottom-up, his analysis suggests that hedge fund longs beat shorts by 33% in 2020, which may mark a return to stock-picking alpha, though DBI will only attempt to replicate this to the extent that it is reflected in market factors.

Important Information

The SEI Liquid Alternative Fund is structured as an open-ended collective investment scheme and is authorised in Ireland by the Central Bank as a UCITS pursuant to the UCITS Regulations. The fund is managed by SEI Investments, Global Ltd (“SIGL”). SIGL has appointed SEI Investments (Europe) Ltd (“SIEL”), an affiliate of SIGL, to provide general distribution services in relation to the fund. The SEI Liquid Alternative Fund may not be marketed to the general public except in jurisdictions where the funds have been registered by the relevant regulator. The matrix of the SEI fund registrations can be found here.

This information herein has been provided by the Hedge Fund Journal only and SEI has no liability towards its accuracy or completeness.

Application for shares in SEI Funds (the “Shares”) will be considered on the basis of the relevant SEI Fund’s Prospectus (and any relevant supplement) and the latest published audited annual report and accounts and, if published after such report, a copy of the latest unaudited semi-annual report.

If you enter a distribution agreement with SIEL, you, as a sub-distributor, would be responsible for, amongst other things, ensuring that the Shares are only offered, and any literature relating to the SEI Funds are only distributed, in jurisdictions where such offer and/or distribution would be lawful. The SEI Funds referenced in this document are only registered for distribution as indicated in the SEI Fund’s Prospectus.

The Shares have not been and will not be registered for sale to the public in the United States of America (“US”) under the Securities Act of 1933 of the US (or the securities laws of any of the US states).

Past performance is not a reliable indicator of future results. Investments in SEI Funds are generally medium to long-term investments. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. SEI Funds may use derivative instruments which may be used for hedging purposes and/or investment purposes. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice.

The SEI Funds are registered for public distribution in the United Kingdom (UK). For the purposes of distribution in the UK, this information is shared by SIEL located at 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR, UK. SIEL is authorised and regulated by the Financial Conduct Authority.

This document does not constitute investment advice or an offer to sell, buy or recommendation for securities nor does it constitute legal, tax or other advice

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical