In the universe of Asian dedicated hedge funds only the likes of Michael Sofaer and Sloane Robinson have been around longer, and both of those long-tenured managers of hedge funds are based outside of Asia. SPARX Group was founded in Tokyo in 1989 and the SPARX Long/Short Fund was launched in June of 1997. At that time the only local hedge fund operations were those of Tiger and Soros Fund Management, and the offices could only offer 'research services' to the parent companies in New York as decision-making had to be done offshore.

It is a testament to the determination of the SPARX management that they could obtain permission from the Japanese authorities to run their fund from Tokyo. It also reflects that the company pursues its own path, and even now it remains very unusual in the context of the money management industry in Japan. SPARX Group is the only quoted major independent asset management company in the country. But then founder Shuhei Abe is not your typical 'salary man' and his career path shows it.

He must have learned his lessons well and impressed his clients: "I was asked to go to work for one particular client of mine – a wealthy European individual," says Abe. At 30 years of age Abe thought he could afford to take the risk, though he had no track record – in fact he had no experience at all of managing money. "But I had some ideas," he says matter of factly. He was not unprepared – he says that he had read many American books on investing, but practically had not tried the concepts out. He formed Abe Capital Research Inc in 1985. "I enjoyed my first attempt at managing money. I had no skills and no experience but I found that buying hidden asset values in stocks worked for me at that time."

Abe accumulated a track record, and it was sufficient for him to attract other clients. After a few years he could count Soros Fund Management as one of his clients, and he ran Japanese equity positions for the Quantum Fund. The market environment was very different then – the Japanese equity bubble that eventually took the Nikkei to 36,000 was still inflating on the back of zaitech, or financial engineering. Soros predicted the end of the bubble in Japanese equities specifically in an op-ed piece for The Financial Times in 1987. Though other equity marketsexperienced a crash in 1987, the actual peak for Japanese equities came two years later. During this period Soros' attitude to the area where Abe was investing switched overnight. For top-down reasons Soros became a bear and asked Abe to short Japanese stocks.

"Mr Soros has his own ideas – he is a very independent thinker. He likes to invest on the basis of an idea, and verify that hypothesis in the markets first. One day the market just turned and the Quantum Fund was ready for it. I learned a lot about investing at this time," says the SPARX CIO. "Let's face it, George Soros was the founder of the whole hedge fund business as we know it." In particular Abe says he took on board the concept of shorting. This was not as straightforward then as it sounds now. "It was difficult to implement because at that time, the mid-1980's, there was no such thing as prime brokerage. I had to go and find the stocks to borrow myself," he explains.

In thinking about his own next steps around this time, in 1989, Abe took the chance to observe many asset management companies and how they operated. The templates were not Japanese asset management companies because there were just so few of them at that time. Rather, Abe was struck by a couple of American heavyweights. Both of which, coincidentally, were independent and privately owned.

"I was struck by what Fidelity was doing at that time. I knew them quite well because they were a client of mine, and they were a good model for me. Their portfolio managers were supported by a team of analysts and I wanted to bring this structure with me to my own company."

The second American financial company is less obvious as a template for an aspirant Japanese money manager. "I really admired what I saw of Goldman Sachs then. I know it is categorised as a bank or broker/dealer, but really it is an investment company, so it was not Goldman Sachs Asset Management I had in mind. The impressive part of what they do is their system to reproduce the talent; in that they are different from other companies. They are very unusual in making a major commitment to develop their staff, and they put a lot into training structures within the company. It is still the same today. There were no Japanese companies to act as a model for what I wanted to do."

Specialising in small cap at the outset

So Abe founded SPARX in Tokyo 1989, with a determination to do something different in the context of Japan. At the time of its founding SPARX was very unusual in being an asset management company that was not part of a brokerage, bank, or insurance company. The market circumstances were not easy. "At that time I could not be blindly bullish on the markets, given that George Soros was looking to short, but it was sensible to stick to something I knew well in Japanese equities. It turned out that I was to enjoy a stroke of luck."

The good fortune was that Abe had decided to specialise in smaller cap stocks at the outset of his new firm. This was very rational. "There was a huge valuation gap between small cap and the rest of the market," explains the founder of SPARX, "and back then Japanese asset managers did not conduct so much independent research. Plus there was no broker research coverage on these companies." So this was a structural valuation anomaly that the new firm could exploit, and it explains why the acronym SPARX was taken, as it stands for Strategic Portfolio Analysis Research Experts.

Beyond valuation, the opportunity was also enhanced by the stance of the authorities in Japan. At the time there were only a couple of hundred companies listed on the JASDAQ exchange, and the authorities wanted to grow it. This could only mean that there were would be lots of newly listed small companies that had little if any research coverage. This gave very rich pickings for a research-driven investment company.

The first major client of SPARX was the investment agent of a Middle Eastern government. At this time it was a move up from the efficient frontier of an asset allocation model (based on historic data) to add Japanese equity exposures. This particular office had a large exposure to Japanese equities. Abe managed to persuade them over the course of two or three visits that they should switch some large cap to smaller cap exposures in Japan, and that he was the man to manage the mandate.

The peak of the broad Japanese equity market was in 1989, but the peak of the market for small capitalisation issues came in June 1990. This gave the immature SPARX a grace period of a year to garner some profit, as the Nikkei OTC index went from 1600 to as high as 4100 in June of 1990. At the same time large cap stocks went down. Abe is disarmingly honest about the period: "That 13 month period was lucky for us, because it was followed by a prolonged fallow period. Looking back on it, it was the luckiest period of my whole life." In the course of time other clients followed, but slowly. "In 1993 a large Swiss bank became a client," says Abe, "but the whole period from 1990 to 199394 was just tough. Having said that, the company would not have developed in the way it has without going through that difficult time. There was no growth to be had managing Japanese securities of any kind, and we ourselves had no growth in new money at all." Over the next year or so assets under management had reached US$1 billion, but the product was small cap only – and this was a very volatile market to be involved in. 1995 was a peak and from then on small cap was declining again, and with that SPARX's growth prospects.

Abe took a big lesson from this time. "I was on a trip to London, and was waiting in the reception area of a client's offices. There was a pile of IBM computers, all boxed-up, sitting in the reception area with me. I spotted that with each IBM pc was a Microsoft software box, and I asked myself: "How can I get to be needed like the operating system software?" It struck me that the relative performance game was not the answer. The clients just don't want to lose. I began to think seriously about the long/short strategy. The fall in Japanese equities in 1996 really spurred me on to get the hedge fund project off the ground. My thinking was that we could avoid the cyclical nature of asset management business by being in long/short."

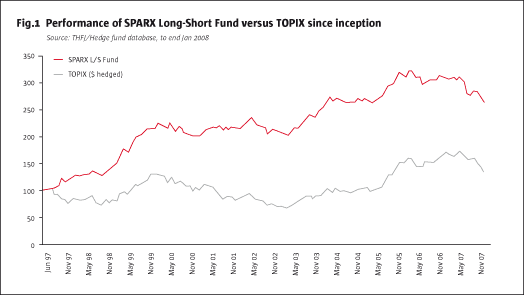

It was not easy getting it off the ground. There was still not a widely available infrastructure for stock borrowing in Japan, and there were only two or three firms running long/short strategies in the fund format in Japanese securities. Into an indifferent market the SPARX Long/Short Fund was launched in June of 1997 with US$5 million of capital, including the manager's own. By the end of that year TOPIX (in $'s) was down 20% and the fund was up 17.3%. A similar gain was achieved the following year against a broad market index in dollars that was flat-to-down. There was some proof of concept in these returns, but the strong showing by Japanese markets in 1999 made international investors take note, and the few hedge funds operating in Japan posted bang-out numbers, including the one managed by SPARX. The 54.3% return drew in investors, and assets managed in the fund grew to several hundred million dollars.

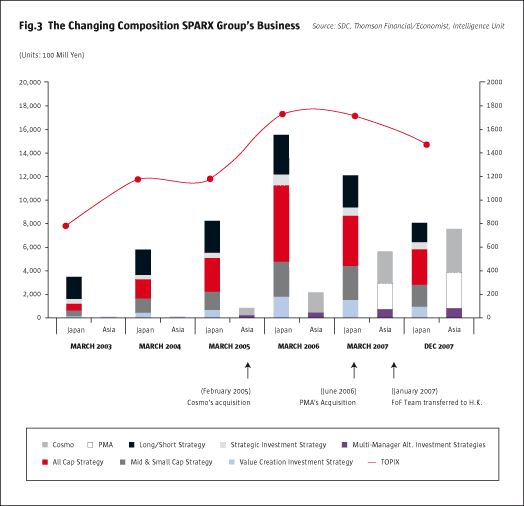

According to Abe, over the period from December 2001 to March 2006 the total assets under management of SPARX Group in all strategies grew from US$2.7 billion to US$20 billion. Whilst he ascribes a luck element to the growth achieved by SPARX in its' first five years, the second phase of growth was from following a business strategy. In particular, he says that as CEO he was always worried historically that the company was dependent on one business stream. "To stay like that would, in my mind, be like Nintendo selling only one game. By this stage we were no longer lonely as hedge fund managers in Japan. Everyone else was doing it, and prime brokers were making it easy to get into the business. So we had to broaden our base of product offering beyond Japan."

Broadening the base beyond Japan

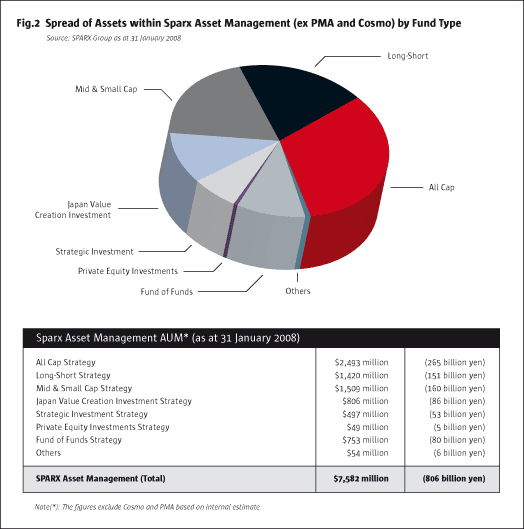

Fig.2 shows that Abe has done a fine job of building a business with a spread of fund types that invest in Japan. As well as the hedge fund (single manager and multi-manager) offerings their products spread across the capitalisation tiers, as well as edge or cross-over strategies in the strategic (long term concentrated), and private equity vehicles. Altogether the funds shown amounted to nearly US$8.5 billion at the end of last November.

From an investment perspective Abe saw some years ago that Asia was presenting great opportunities for SPARX. His intention at the outset of this regional expansion was to build a network of independent asset management firms in Asia. He said at the time, "When the golden era in the US comes to an end, the world's capital will shift over to Asia, and when that time comes, I want to be the first port of call as an Asia asset manager for international investors."

The concept for expansion was to work with like-minded management company leaders in other territories, and make SPARX a portal for investing in the whole of Asia.

Abe had been in contact over a number of years with the entrepreneur that ran Korean firm Cosmo Investment Management. Cosmo was a Seoul-based independent boutique management house whose focus was companies with small market capitalisations. At the time of taking a 51.9% stake Cosmo had assets under management of about ¥76 billion, and it must have looked to Abe something like the SPARX of a few years earlier.

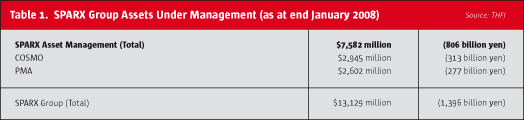

Over the last few years Cosmo's business model has completely changed: it has become very similar to SPARX's model, which is a hybrid of alternatives and long-only traditional funds. They've added a long/short fund to their product range, and it has grown well. Like SPARX, Cosmo has introduced a strategic fund, which is a concentrated, relational-based investment strategy, staying closely in track with companies' top management. The other strategic change has been on fees – there was great potential to improve the profitability of the existing business. Cosmo has brought out long only funds with performance fees. "They were operating with an average fee level of only 15 basis points, and were collecting no performance fees," says Abe. "Their average management fee is now close to 50 basis points, and Cosmo's assets under management are around US$2.945 billion." A lot of this growth has been of benefit to SPARX as through options the Japanese firm controls.

PMA Investment Advisors

Whilst the deal with Cosmo can be seen as a strategic alliance, the takeover in June 2006 of Hong Kong-based PMA Investment Advisors Limited was something else. PMA was founded in 2002 as a multi-strategy platform, specialising in Asia ex-Japan. Today it employs a total of 65 people at offices in Dubai, Hong Kong, London and Sydney and manages assets worth nearly US$3 billion. The purchase of 100% of PMA brought SPARX Asian expertise outside of Japan and Korea. Abe characterises it as giving SPARX an expanded research platform throughout Asia which positions the company as a premium player in the market. "I want to offer to investors of the world a high-quality investment philosophy and deep skill. It was very important that we share a similar investment philosophy, and in a sense I discovered that early on. The guys that run PMA came to see me before their launch in 2002, so we have had a dialogue for a long time before this deal. I know we are working with a high quality operation."

However Abe is keen to draw a distinction between himself as an asset management executive and those running PMA. "Let's be clear on this – I'm an owner/chef in this business, whereas PMA is run by professional managers employing chefs. It really suits their multi-strategy approach, but we are coming at the task of running an investment business from a different perspective," he discloses. "For instance – they started their business planning to meet institutional investor requirements, whereas we at SPARX have learned that as we went along. For us it was our clients who told us about what we should do to comply." It is indicative that PMA was the first hedge fund group in the Asia-Pacific region to be accorded SAS 70 certification.

PMA runs different investment strategies than SPARX (see details at the end of this article), so that it gives SPARX Group diversification beyond that of geographical spread. PMA runs an Asian equity long/short fund, engages in Asian credit strategies, and has an Asian macro/currency fund. Under SPARX ownership PMA has enhanced its' capabilities through several initiatives, so it is still investing in its business for growth.Just after the acquisition PMA brought on board the entire team of Trigon Advisers, a Hong Kong-based asset management firm, to join its own credit investment team. This created one of the best group of credit specialists on the buy-side in Asia. Early in 2007 PMA, led by Farhat Malik, opened an office in Sydney. Initially the office offered analytical input on Australian equities, but is expected to tap into the burgeoning demand of Australian institutions for hedge fund product through a marketing presence.

Then just this year PMA has hired Christy York from Deutsche Bank to be its representative in Europe, based in its' London office. SPARX has its' own office on the edge of London's Mayfair. Such initiatives show PMA is looking to push on to the next level.

PMA and SPARX have no overlap. PMA's strategy is to develop an Asian platform that excludes Japan and Korea. SPARX's platform covers only Japan, and Korean investments are managed by Cosmo. So now SPARX Group has a platform that covers all of Asia. One of the interesting developments recently demonstrates genuine synergy between the parts of SPARX Group. A couple of months ago PMA Investment Advisors successfully launched a US$600 million-plus portfolio focusing on dividend-paying growth stocks in Asia ex-Japan and the Middle East. The PMA Asia Middle East Equity Income Fund comes about as a result of the firm seeing significant opportunities for investing in Asian and Middle Eastern stocks which offer high dividends and growth potential. This new fund raised its capital from a Japanese investor base through SPARX Asset Management. For PMA the project has allowed an initial entry point into Japan as a source of investment capital, and intriguingly the new portfolio is expected to be the first of many joint initiatives between PMA and SPARX.

Funds of funds

A long-established diversification of SPARX Group is the fund of hedge fund business. It is now run out of Hong Kong by a division of SPARX International Ltd, though the pan-Asian remit was once handled from the Tokyo headquarters of SPARX. It has what is believed to be one of the longest track records in the region, with products dating back to 1997.

SPARX International (Hong Kong) Limited manages assets worth about US$787 million (as of November 2007). Abe is candid about the SPARX fund of funds operation. "If I was running this business as a high rankingemployee, rather than an entrepreneur/founder then I would have closed the fund of funds business down some time ago. As it is, patience has been rewarded, but the reality is that the fund of funds has taken nearly 10 years to reach approaching US$1 billion under management. Frankly, I have found it difficult to franchise out to external managers what we do ourselves."

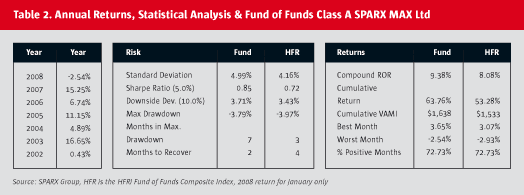

The track record and metrics of the SPARX fund of funds given in Table 2 has attracted some high quality clients, the most notable of which is the US$220 billion California Public Employees' Retirement System (CalPERS). The fund's current international hedge fund exposure is through four international fund of funds (FOF) – Ermitage European FOF, KBC Asian FOF, SPARX FOF, and Vision Asian FOF. Winning a mandate from CalPERS is a difficult and long process, and is seen as a badge of honour amongst money managers, though not necessarily one with top-of-the-scale fees.

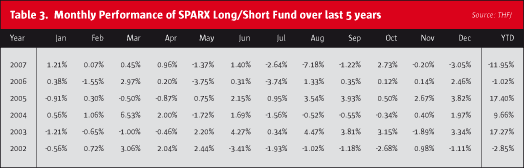

Table 3 shows the returns of the long-running Japanese equity hedge managed by SPARX. The high water mark for the fund was in April 2006, and it stands 22% above the latest NAV. So whilst the management fee continues to be earned there is no prospect of a performance fee contribution to SPARX Group for some time. During the period since the high water mark of the long/short fund fees of both types have been earned by the SPARX Asia Pacific Fund of Funds, the funds of Cosmo Investment Management, and those managed by PMA.

Indeed the assets under management of Cosmo and PMA have continued to grow whilst those run by SPARX Asset Management have suffered from the poor Japanese equity market conditions. This compensation by the acquired businesses for the dull local market vindicates Shuhei Abe's strategic vision for SPARX and how it has been executed over the last three years. As CEO it may be Abe's lot to worry, but recent outcomes mean that he has to worry less than he would have done without the diversification strategy he has successfully followed.

Some of the PMA Range

THE PMA ASIAN OPPORTUNITIES FUND YTD

Fund Assets: 60m

Launch: June 2005

2007 Return: 13.54%

- The Fund is a multi-asset class, multi-strategy, multi-manager fund that intends to have broad pan-Asian, ex-Japan, geographical and wide sector exposures with low correlations to both Asian and Western equity and Fixed Income indices.

- Originally launched in June 2005 with a multi-strategy mandate to include Long/Short Equity, Credit and FX/Rates, the fund is composed of 6 PMA funds (as of 308) and will continue to diversify and incubate new strategie

- Dynamically rebalance portfolio weightings as investment opportunities aris

- Target absolute returns of 15-20% per year

PMA CREDIT OPPORTUNITIES FUND

Fund Assets: 451m

Launch: April 2004

2007 Return: 11.24%

- The Fund seeks to profit from credit migration opportunities across Asia, with low volatility.

- Exposure is taken along the entire credit curve from AAA to distressed creating a unique balance between credit risk, prospectivereturns and fund liquidity.

- The fastest growing space in Asian credit is the leveraged loan market in which PMA has been at the forefront.

PMA HARVESTER FUND

Fund Assets: 119m

Launch: March 2007

2007 Return: 16.73%

- The Harvester fund specialises in the Asian financial markets with an emphasis on FX and interest rate product * The focus is on, but not restricted to, the 12 actively trading Asian markets, which include HKD, SGD, KRW, TWD, CNY, IDR, THB, PHP, INR, MYR, AUD and NZ

- The Harvester Fund is modelled on the Macro strategy within PMA Asian Opportunities Fund * The Fund seeks to exploit local Asian structural inefficiencie

- Locally connected with 'on-the-ground' knowledge provides an edge, broadening trading opportunities and enhancing returns.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical