Pundits will always differ on the identification of market stages and especially on when a reversal of a sustained bull run for an individual asset class or multiple asset classes will occur. Despite this timing question, many investors are looking carefully at current market levels against a backdrop of the unwinding of global quantitative easing and increasing geo-political tensions. The result of this examination has been that investors are beginning to seek to create a basket of protective strategies with the goal of producing positive returns which are necessarily uncorrelated from major asset classes as markets begin to move sideways and the threat of a sustained downward correction increases. As the summer slows down the markets (hopefully) and vacations dominate, it may be a nice respite to consider making some protective portfolio shifts/additions.

Inflection point alpha (“IPA”) is meant to be a modified version of the concept of full blown crisis alpha, as first introduced by Dr. Kathryn M. Kaminski, now Chief Research Strategist at AlphaSimplex, the firm founded by the esteemed Andrew Lo of MIT. This modification does not contradict the idea that when multiple assets are in “crisis” mode certain strategies (trend following was highlighted) perform well. Putting forth IPA is, however, an attempt to proactively deal with where the markets are currently, their probable path, and what that means for institutional investors trying to successfully navigate the period. Crisis alpha looks for periods in which two or more assets are in crisis, each with a crisis barometer. IPA does not rely upon assets being in a defined crisis but addresses the fact that that there are periods of inflection for global economies and their underlying assets. This approach will focus on the use of alternative investments in combination with existing traditional or alternative portfolios.

Alternative investments, as the name suggests, are those which provide some seemingly different means of generating returns relative to traditional fixed income, equity and cash investments. Included under the current alternative investment umbrella are private equity, hedge funds, managed futures, real estate, and derivatives. The aim is to provide some intelligent investing diversification versus the old standard 60% equities/40% bonds portfolio. Here, the focus will be upon hedge funds, managed futures, and commodities (with derivatives being a way to achieve exposure and imbedded in certain strategies).

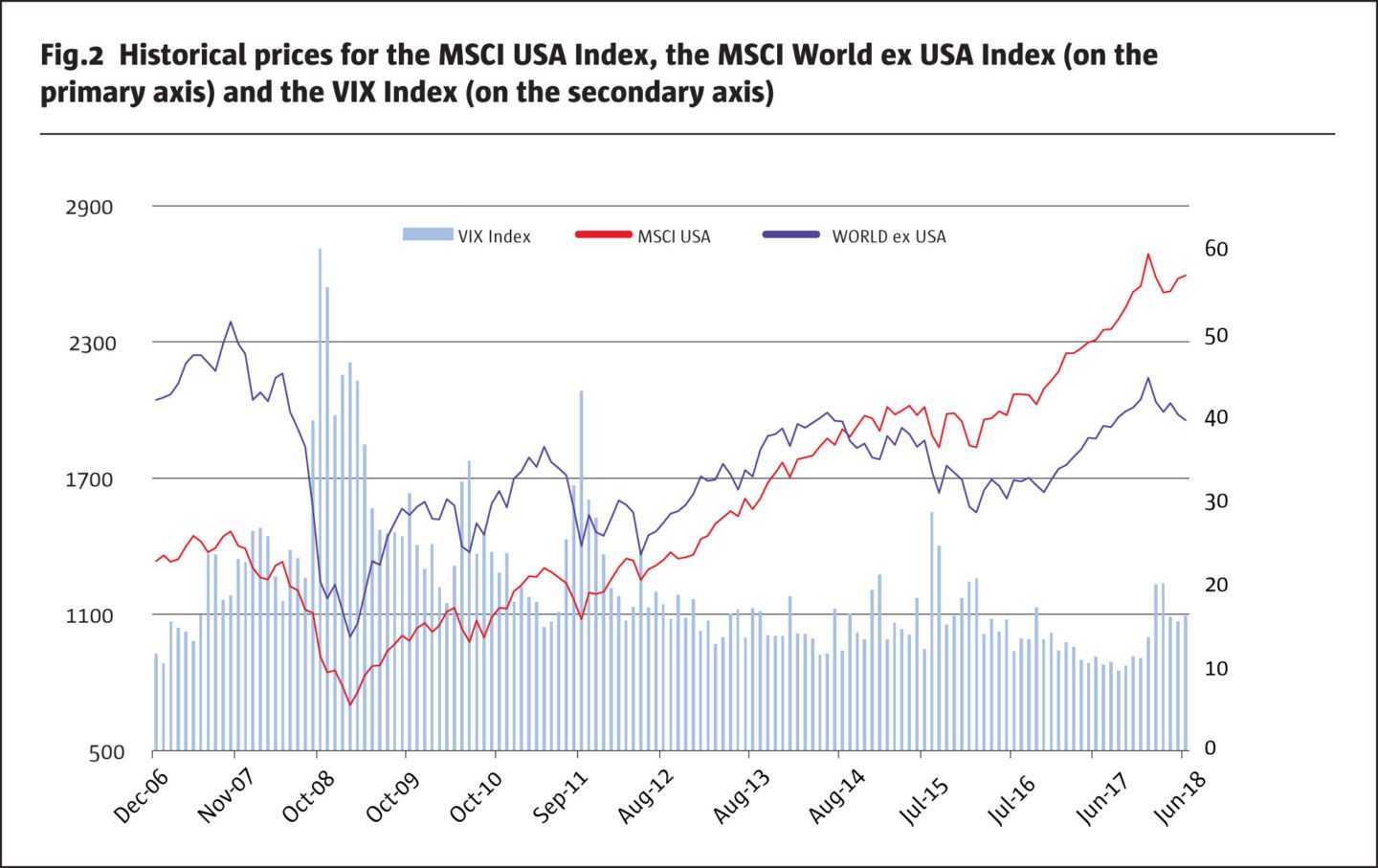

It is essential to establish the current state of major markets and where they are relative to the bull run since the global financial crisis, now the second longest on record for equities.

For simplicity, the representative assets are global rates, corporate credit, and, most closely watched, global equities.

Interest rates

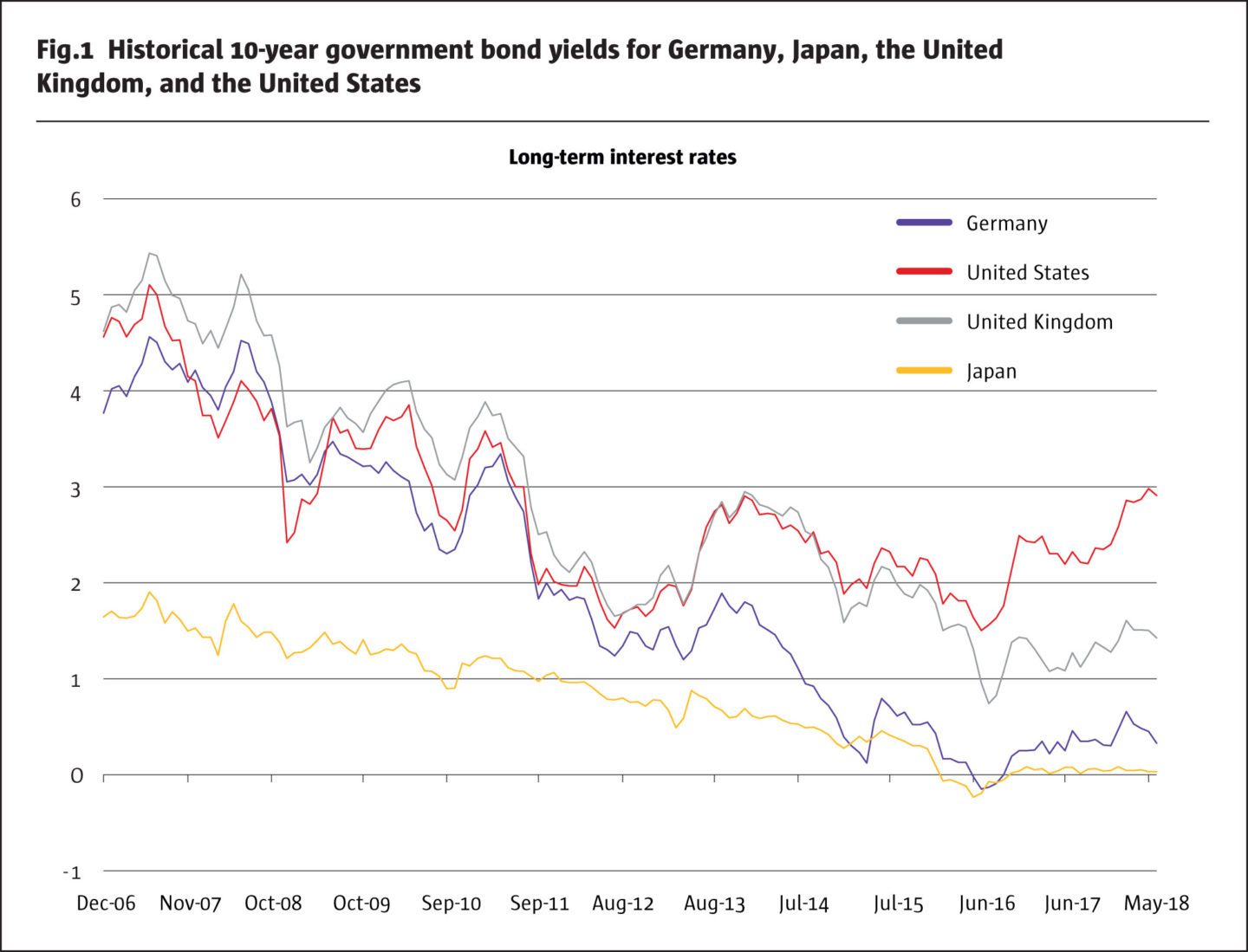

While interest rates have frustrated many a macro trader with their slow rise, punctuated with more than a few flight-to-quality rallies, the zero-rate environment is likely on some path towards normalization. The rise in rates is reflective of the end of QE, accompanied by central bank rate increases towards a neutral position.

Credit spreads

The global search for yield combined with the ballooning Central Bank balance sheets of quantitative easing has resulted in arguably overly narrow spreads for the risks assumed with bonds. This includes floating rate bonds and asset-backed securities. Investor protection has also declined with covenant-lite bonds becoming prevalent across issuance types.

Global equities

There is likely no single trend or valuation commonality across global equity markets, however global PE ratios need to be supported going forward. There is a case to be made that pockets of over, or at least full, valuation already exist. Some equity markets, the US in particular, may have been the beneficiaries of safe-haven flows away from other jurisdictions for both economic and non-economic reasons.

The conclusion is that as quantitative easing mechanisms are unwound, and we see a reduction in on-going central bank accommodation, the markets find themselves at an inflection point. Just the sheer size of the balance sheets being run-off would suggest that it is unlikely to happen without at least a bump or two. The outcome will ultimately be determined by global economies, geo-politics, and a raft of other factors than can propel markets or derail them. Building an IPA portfolio involves a bit of science and more art, using a palette of investment products which can be varied by each artist’s/investor’s needs.

Suggested sources of uncorrelated alpha for IPA

Global macro: Global macro investing in its purest involves taking positions in rates, currencies, equity indices, and commodities based upon a top-down assessment of global economies and asset classes.

Systematic global macro: Many have attempted to systematize the position-taking and risk management acumen of the premier global macro portfolio manager. These models often work quite well when a trend/trade is established and there are not frequent reversals (as has been the case lately).

Discretionary global macro: At the core of the successful global macro fund is the risk management skills of the portfolio manager(s) and it is this ability to manage the risk, especially during volatile periods, that separates the great from the good. It can be argued that inflection periods favor the human mind, and thus discretion, over the algorithms.

Managed futures: Managed futures is the most widely known example of a strategy which has historically performed well during crisis periods. Kaminsky looked at periods in which three or more assets were in crisis and this is when managed futures strategies performed best. The simplified conclusion is that multi-asset crises favor managed futures.

A wider range of assets during a crisis leads to more crisis alpha

Trend and counter-trend: Trend following is the most mentioned of the strategies that function well in crisis periods. It should be noted that the older, generally less sophisticated trend programs focused around entry/exit and risk management aren’t as desirable as the recent breed of more highly engineered (version 2.0+) strategies. Similarly, there can be advantages to a portfolio that incorporates differing speeds/holding periods/time horizons. Higher speed models, which often incorporate some mean reverting components are also to be considered for incorporation.

Non-trend AI/machine learning: Machine learning and its alternative moniker artificial intelligence have become buzz words in the systematic investing community, with accompanying claims of usage. Firms that do use some of the more advanced techniques on both the investment/model as well as the trade execution are certainly deserving of consideration when choosing managers.

Commodities: Commodities have long been a focus of those trying to construct an uncorrelated portfolio. From precious metals to agricultural products to oil, there are many cases of movements unaffiliated with any major market. Access in the past, via index or fund has been less sophisticated and often disappointing as products have floundered. The newer 2.0 versions including AI/machine learning, spread trading and non-index exposures have solved some of those issues and made access more complementary to uncorrelated portfolios.

Volatility-centric: The benefits of being long volatility at inflection points and during crises are well known. The trick has been finding the right vehicle so as to not pay away too much while waiting and/or being able to hold the position through the performance period. Here, those funds with a convex payout profile and some type of RV component to defray the cost are favored.

The belief is that combining some or all of the aforementioned elements in a cohesive portfolio will result in a robust, protective portfolio that will endure during inflection periods and excel into crisis periods.

A distinction needs to be made between crisis alpha, IPA, and tail-risk strategies. The key takeaway is that tail-risk strategies are designed to protect when severe shocks and accompanying market moves hit the market unexpectedly, which really by definition is how these moves occur. These strategies generally have a very convex payout, with options almost always a part, for which the investor pays away some level of premium.

This premium may be partially off-set by complementary strategies, but the profile is generally a consistent return drag, until one or more events cause a paradigm shift in market prices. While perhaps a topic for another time, these strategies have and have not paid off as advertised and face survivorship challenges in benign market periods i.e. the insurance company must still exist when one goes to collect. IPA differs in that it strives to produce consistent absolute returns which endure through the inflection period and into multi-asset crisis periods. It is at the inflection period and into crises that the non-correlated absolute returns really make a difference to the risk/return profile of the larger portfolio.

Portfolio construction

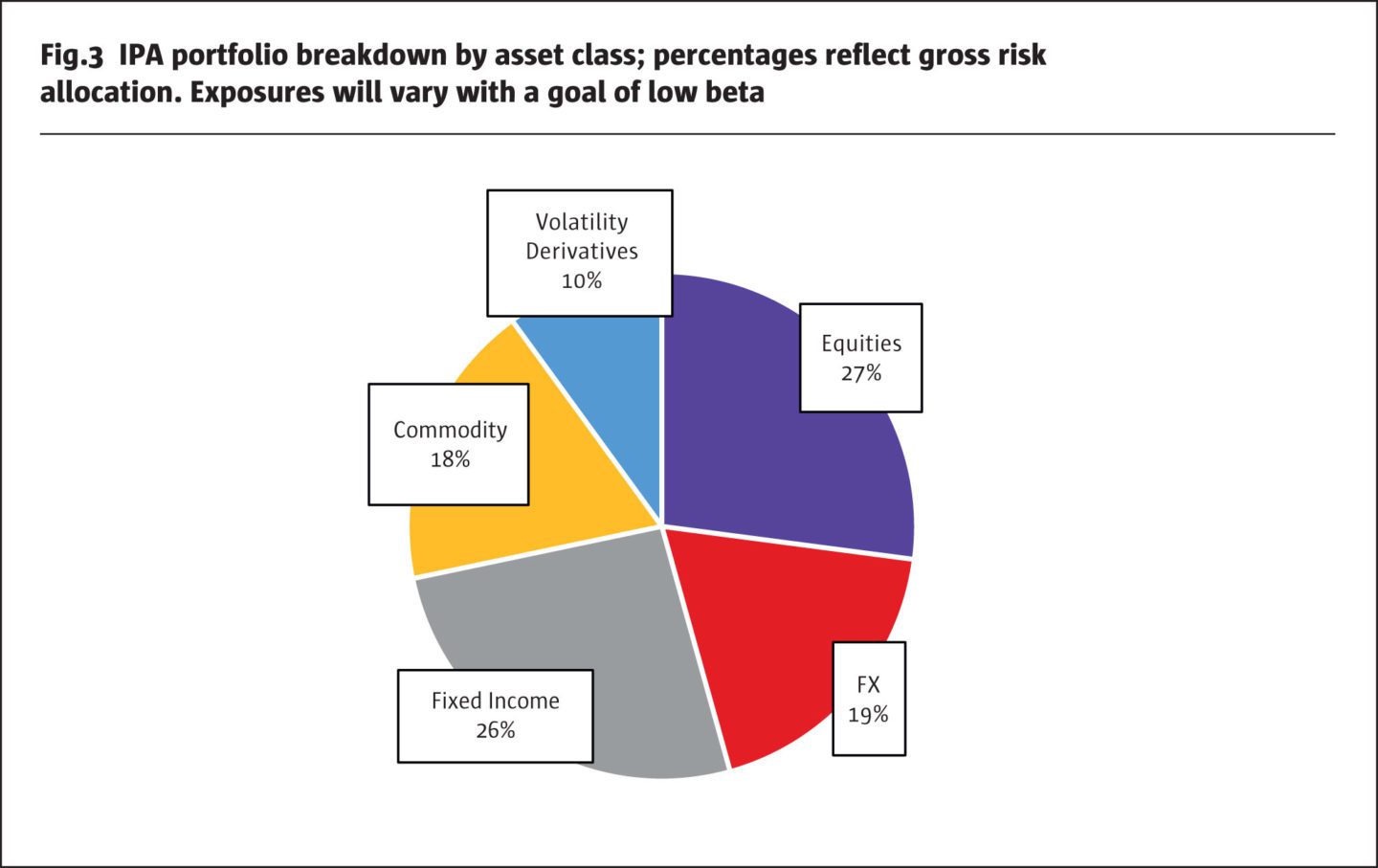

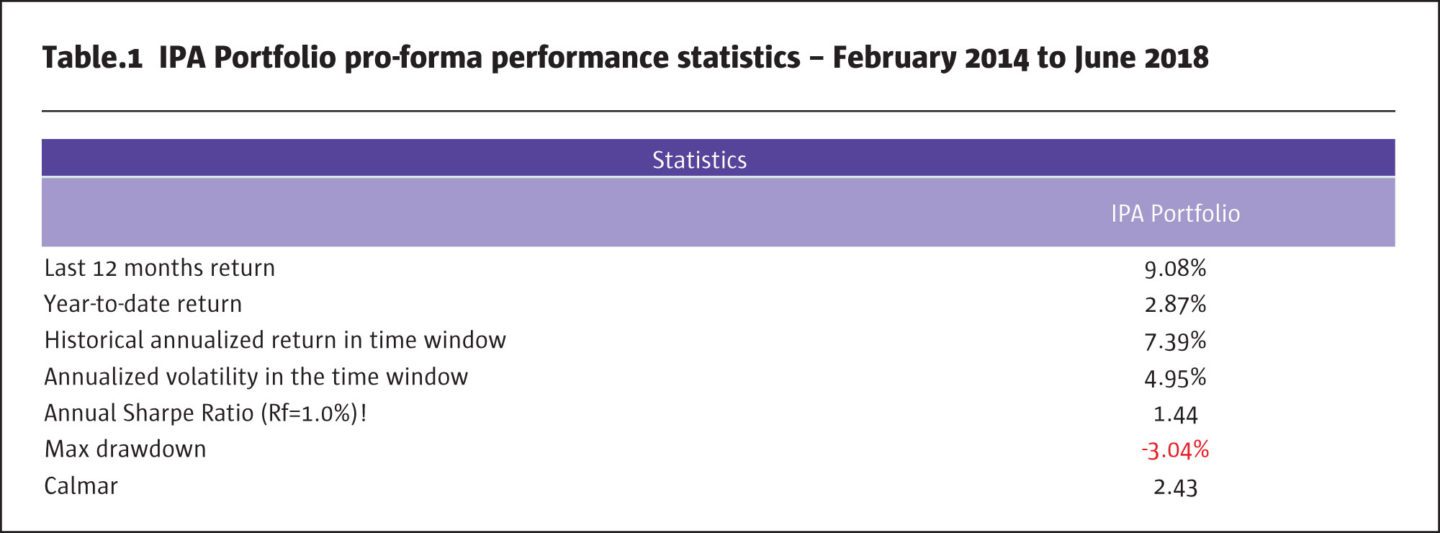

Here is where the art comes in, as the back-tests will never look bad, even through multi-asset crisis periods. Using a forward looking, albeit qualitative, view coupled with some quantitative measurement/adjustment yields a range of portfolio options from which to choose. Here is one example (see Fig.3).

Critical to the IPA portfolio is the ability to adjust the portfolio based upon outlook and specific client requirements without succumbing to the desire to over-manage the book during transitions which are bound to include sideways or counter-markets.

Applications/structuring

There are many ways to invest in such an IPA portfolio. One can simply add the components individually, co-mingle the components in a fund, or employ more sophisticated, cost and capital efficient methods. In the end it is the effect on the broader portfolio that will prove the value of the package, regardless of access method.

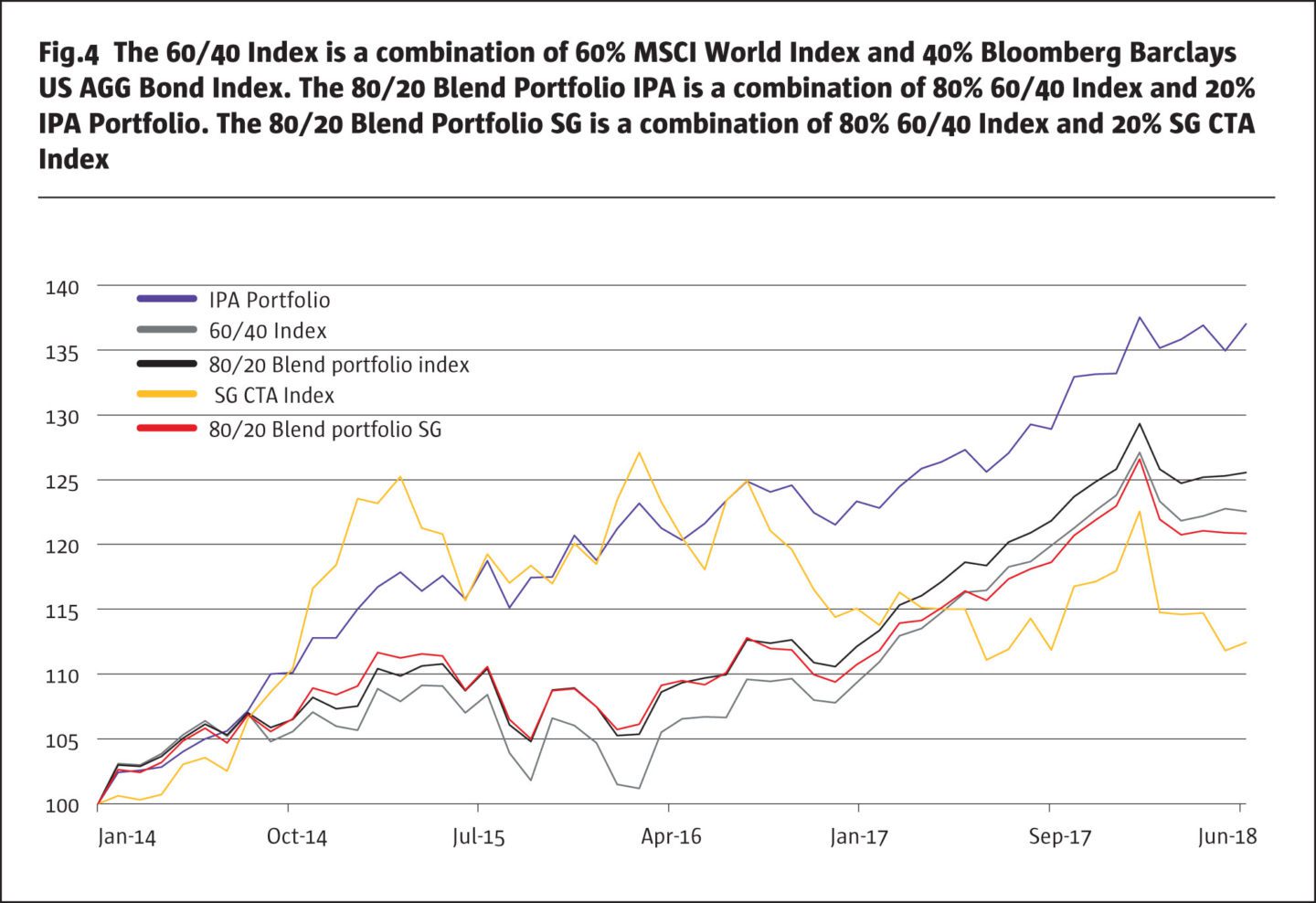

The starting point for many investors is the effect of a non-correlated portfolio on a standard 60/40 portfolio. Here the objective is to reduce risk, while improving performance during difficult periods, particularly for equities. Other investors are adding an IPA portfolio to their existing alternatives portfolio, again with the objective of smoothing out the return stream while staying invested.

Full or partially funded

One added benefit of building a liquid, diversely constituted portfolio is that it can be accessed as a fully funded multi-manager package or, for those with acceptable credit-worthiness, on a less or even unfunded basis. Low funding levels are a major benefit to those balance sheet constrained investors like under-funded pensions, for added leverage, and in some cases overlay functionality. A swap, which can be funded and margined in different ways, is the method most chosen by institutions and has the added advantage of eliminating manager counter-party risk (substituting a bank). Other access methods include a structured note, which fits platforms such as private banks wishing to provide an IPA product to its HNW clients, and option strategies.

Reading the tea leaves to discern the approach of the next significant market turn is quite difficult. Recognizing that many assets may be fairly to fully priced and beginning to face potential headwinds would seem to be more certain. The proposal here is to begin to prepare portfolios that have benefitted from the bull run, particularly in equities and credit, for sideways markets, and some potential for meaningful reversals (gasp! bear market/recession) to follow. Worrying about the production of crisis alpha may be premature, but why not begin to build a portfolio which will do well at this inflection point and beyond? Happy Summer IPA.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical