Event-driven and merger arbitrage strategies often have a long equity bias, but Helium’s strategy is distinguished by being “mainly market neutral” says Syquant Capital's CIO Henri Jeantet, who adds that “the art of being boring is a key asset in our investment style especially when markets get to be turbulent or investors are alerted by a major deal break in the M&A spectrum”. The firm’s Helium Opportunities fund received three awards for best performance in the Merger Arbitrage category, based on risk-adjusted returns over one, two and three years to 2015, in THFJ’s 2016 UCITS Hedge awards. The flagship fund has printed a Sharpe of around three.

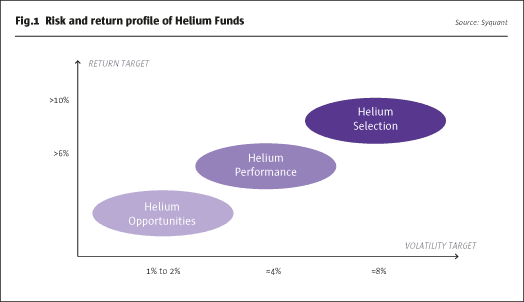

Syquant Capital was founded in 2005 and started out running its strategy as a very low volatility, cash or bond substitute, in a Cayman structure. The firm later re-domiciled to UCITS and decided to offer investors amenu of three volatility targets. The highest risk funds have been making high single digit returns in 2015 and 2016 with a respective Sharpe of 2 and 1.5. Having originally been seeded by the CEO of Exane, most of the $2bn asset base now comes from institutional investors (including pension funds, insurers, asset managers, endowments and family offices).

Deal selection – and avoiding deal breaks – have contributed positively and the managers have also been very flexible and opportunistic in varying their exposure to the core merger arbitrage strategy: it has ranged from 12% to 100% between 2012 and 2015. Syquant estimates that discretionary selection of deals has accounted for around 50% of alpha, while tactical allocation to strategies and positions has made up the other half.

Dynamic strategy allocation

Allocations between the main two strategies – merger arbitrage and event driven “hard catalysts” – are a function of the bottom-up opportunity set in terms of convictions on individual deals. The bottom-up approach, with careful attention to detail and news flow, has enabled the funds to avoid the major pitfalls and blow ups.

One strategy, stock selection, combines both a discretionary and a systematic approach. This strategy tries to create alpha by selecting stocks with a higher probability of a forthcoming event – hence an event driven “soft catalyst”. Alpha generation comes only from single stocks on the long side while index shorts manage risk.

Risk management is complemented by a “Risk On”/“Risk Off” feature. Over the last nine years, there have been five “Risk Off” triggers (2007, 2008, 2011, 2014 and 2015). “Avoiding the black swans” says co-CIO Xavier Morin “helps the overall volatility and significantly boosts the Sharpe over a long period”.

The merger arbitrage allocation touched its nadir in 2012, when gross exposure fell to 12%. The opportunity set for the strategy was poor as Europe was quiet due to sovereign debt and Greek crises, while North America saw three deals in Canada fail in one week. Fast forward three years to 2015 and Helium had its highest ever exposure to merger arbitrage, at 100% (in the extra low volatility funds and over 100% for both Helium Performance and Helium Selection), as there were a record number of deals in the US, Canada and Europe – and spreads were attractive. The spectacular Shire deal break in October 2014, to which Syquant Capital had no exposure, sent shockwaves throughout the sector and led to an indiscriminate blow out in spreads. Syquant assessed each deal on a case by case basis, and doubled the overall exposure to the strategy. Again deal by deal focus meant that certain positions that had absolutely no tax inversion risk were trebled whilst other positions that may have been more sensitive were not increased or even decreased. The event driven strategy exposures have ranged between 20% and 35%, while the systematic bucket has generally been in a range of 0 to 15%; its 30% weight in 2008 was exceptional.

Merger arbitrage deal criteria

Helium’s investment universe for the core merger arbitrage strategy is comprised of announced deals, in the US, Canada and Europe (pre-announced deals may find a small space in the event driven sleeve both in the “hard catalyst” and “soft catalyst”). But within this universe Syquant strikes a balance between North America and Europe. The portfolio is diversified into 40-70 deals.

Syquant has a bias towards strategic and agreed deals, and is more reluctant on private equity, LBO and/or hostile deals. Explains Morin “private equity deals are mainly financial deals and private equity companies are more likely to change their mind than strategic buyers focused on long term rationales and less dependent on market conditions”. He adds “even in very adverse situations strategic deals can be completed but we apply a higher risk premium to private equity deals”.

Tax, regulation and crowding

Syquant has steadfastly eschewed tax inversion related deals and had no exposure to the Pfizer/Allergan deal break in 2016. Explains Investor Relations Head, Carl Dunning-Gribble, “political uncertainty is too binary and does not follow normal, economic rationales. We cannot rely on any legal precedents from judgments or rulings as there is no consistency in political reasoning – but the spreads do not reflect this risk”.

Syquant tries to avoid over-crowded positions in its pre-merger, event book, particularly where many brokers are enthusiastic, because “the downside can be painful if there is no official confirmation” but Morin pragmatically takes the view that “all merger deals are in some sense crowded because in any deal 90% of the investors will be arbitrageurs”. So Syquant did not hesitate to build a significant position in the Shell/BG deal despite this deal being “crowded”. And in the Shire/Abbvie deal, US tax inversion risk, rather than crowdedness, was the reason Syquant avoided it.

Regulatory risk is something that Syquant will contemplate however. The fund has been exposed to some deals where regulators have withheld approvals, sought a second hearing, or faced legal issues. These positions tend to be sized smaller. For the lowest volatility funds, the position size is designed to limit losses to 0.10−0.15%; for Helium Performance roughly double that, and even for the highest volatility fund, Helium Selection, such positions are sized to cap anticipated loss at 0.50-0.70%. The lowest volatility strategy is likely to make a clean exit if spreads widen, but the other two strategies have more latitude to trade around positions and take a longer term view.

Syquant can in theory own targets with a market capitalisation as low as $100 million. In practice with firm level assets of $2bn a meaningful position in such a small company could be very small as a percentage of Syquant’s own assets. Targets with market cap around $400mm are more frequently seen. Then if Syquant owns 5% of the target, or $20mm, that translates into 1% of its firm level assets.

Sizing and Brexit

The greatest risk of merger arbitrage is one that many investors are least aware of and arises in a “stock for stock” deal where the arbitrage fund goes long the target company (like in a “cash” deal) and goes short the acquirer. When the acquirer is bid for by a third party, causing a deal break, this can result in double losses – on both the short position on the predator, and the long position on the initial target company. Syquant has experienced this once when Chiquita’s bid for banana distributor Fyffe was scuppered by a Brazilian conglomerate’s bid for Chiquita itself. The Fyffe share dropped about 25% (losing the bid premium) and the Chiquita shares shot up by about 35% on the news of the bid, resulting in overall losses of 60%. Fortunately the position had been sized small, and losses were limited to around 0.30% at the fund level. Syquant generally runs a very diversified book.

But avoiding deal breaks is key. When recently the Syngenta/Monsanto merger deal failed and Syquant called investors to inform them that the Helium funds had no exposure to the deal, one investor replied: “when something bad happens in the merger arb space you guys are the last on my list to call…”

Syquant are not invested in any deals where Brexit would trigger a ‘force majeure’ or‘material adverse change’ (MAC) clause and allow bidders to renege. But the second order impacts of Brexit do have implications for some deals: SAB Miller shareholders successfully argued that the lower sterling exchange rate should prompt Anheuser Busch to increase its offer. Syquant is not invested in the Deutsche Boerse/LSE deal but does not view Brexit as the only risk factor.

Despite all of these criteria, Syquant will not necessarily go for the very lowest risk deals with the tightest spreads. The manager typically looks for annualised spreads in a range of 4-8%, but the 8% is not an upper bound. Recently a number of Syquant’s largest positions have, at certain points during 2016, offered double digit annualised spreads. SAB Miller did at one stage this year. The Home Retail deal has widened after Brexit, but Morin views that as irrational because both the acquirer and the target are UK companies. Softbank’s bid for ARM Holdings “offered a surprisingly high annualised spread of 12% given that it is likely to swiftly complete in September” argues Morin. More recently (August) the funds took a position on the Syngenta/ChemChina deal. If the PMs were very cautious on the deal (no position) prior to the Cfius approval in the US, now that the largest obstacle is lifted and the deal still offers an attractive spread, Henri Jeantet and Xavier Morin have built positions in that deal across all the Helium funds.

Syquant can be opportunistic about increasing its weightings as spreads widen – and as the deal nears maturity, and goes unconditional or quasi-unconditional, Syquant will sometimes max out at a 10% position size – the highest permitted by the UCITS diversification criteria. Morin cannot recall any unconditional deals that broke. “The risk is just counterparty risk, there is no regulatory, financial or political risk” observes Morin.

Process

Syquant are early risers, assessing deals after the announcement and before markets open, with two analysts reviewing documents, potential anti-trust issues, or shareholder objections, to form a view on whether the deal has a high or low probability of completing. After an initial and internal investment team discussion, the principal PMs Jeantet (Helium Opportunities and Helium Fund) and Morin (Helium Performance & Helium Selection) will make the final call including on the weighting of the position. Initial position sizes tend to be cautiously small, as Syquant knows from experience that spreads will often widen out in response to anti-trust related delays or if an obstinate activist takes a stake in the target company.

Syquant maintain a regular dialogue with companies, investment bankers and regulators to get colour on deals. Of course this is all public information but it can still help to gauge sentiment. The whole team feed inputs into the analysis but the final decision rests with Jeantet and/or Morin for the low volatility strategy, and with Morin for the higher volatility one.

The process has been developed over decades when the team worked as proprietary traders at Credit Agricole (and some of its corporate forerunners). Investors can review their proprietary trading track records in equity derivatives, which had no losing years.

Event driven – hard catalysts

If announced M&A deals offer a finite and public universe of deals, Syquant’s event book requires more labour-intensive work to identify “hard” and “soft” events. Hard catalysts include rights issues, Index reshuffles, post M&A situations, IPOs and secondary offerings, “Stubs” and holding company trades and spinoffs. The positions are hedged with peers or sector indices to isolate the stock specific alpha.

Examples include the Alcatel minority squeeze out. Nokia has bought 90% of Alcatel but some shareholders are holding out for a higher offer. Morin thinks that Alcatel has been unfairly sold off in sympathy with Nokia’s fall on a Samsung litigation issue. In the post M&A sleeve, Shire bought Baxalta with its own stock, which has created some overhang, and Morin sees scope for a recovery. Another post M&A trade was Office Depot, bought after it crashed 50% on a deal break. An example of a spinoff is that Merlin Properties is in the process of an asset exchange with Metrovesa to diversify its property assets in return for its shares, and Syquant do not think that the mutual benefits are reflected in the price.

Event driven – soft catalysts

The soft catalyst strategy uses both a discretionary and systematic screening method. The ‘Eligible Universe’ (step one) is 100% discretionary and employs valuation metrics and a special focus on ownership structures, to identify candidates for potential future corporate events and catalysts. These could include an activist entering the fray. Over the years, Morin had identified a certain number of fundamental factors which, when combined with ownership-specific factors, are reliable leading indicators to certain corporate events. “The DNA is to have a higher proportion of stocks with a strong “corporate identity” and/or a propensity for a “corporate event” says Morin. A highly diversified long portfolio is drawn from a universe of 300 stocks in Europe and 300 in the US. The second step selects amongst the ‘Eligible Universe’ the 100 “best” stocks each with an equal weighting – this second screening is 100% systematic. Morin adds: “We co-mingled our quantitative know-how with our corporate event expertise!”. The beta exposure of this sub-strategy is hedged by 50% or 100% (though the overall fund’s beta exposure is of course still capped at 20%).

A further risk management feature is a “Risk On”/ “RIsk Off” feature, whereby this sub-strategy will be “risked off”(0% exposure) under certain market/ strategy environments. As it is vulnerable to hyper volatility and/or market dislocation, the PM prefers to “switch off” the strategy pre-emptively. “We wouldn’t want one sub-strategy to “overshadow” the other two sub-strategies in terms of volatility and/or performance impact” says Morin. The idea of capital preservation remains paramount.

Dividend arbitrage

Dividend futures arbitrage is another sub-strategy that Syquant can play from long or short sides, but in practice it is more likely to be a long trade. Dividend futures can trade at deep discounts to expected levels of dividends, and Syquant thinks that realised dividends on the EuroSTOXX 50 could turn out to be higher than discounted by the futures.

Systematic mean reversion strategy

The systematic mean reversion strategy is a type of short term statistical arbitrage approach. It only really works in very dislocated and volatile markets. It trades the 600 most liquid stocks in Europe, which when segmented by sectors (GICS Level II) are normally highly correlated. When there is a negative correlation shock and stocks diverge by two or more standard deviations, the model identifies dispersion and throws up signals to trade reversion. The underperformers are bought and the outperformers are sold, on a cash, beta and sector neutral basis (with corporate events filtered out). The model operates on a 12, or 24, hour cycle. It worked very well in 2008 and contributed 85% of the positive performance.

But for now, the merger arbitrage strategy is front and centre and Morin is fairly confident that “the current environment offers the chance for the strategies to match their respective return targets”. Still, circumspect Morinis well aware that the first two quarters of 2016 ran ahead of target so he realizes that the later quarters might not be as good. But the basic ingredients are in place: large volumes of M&A dealflow continue, and acquirers can leverage at very low costs. Morin sees “lots of deal flow in the US and Europe, with or without Brexit”.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical