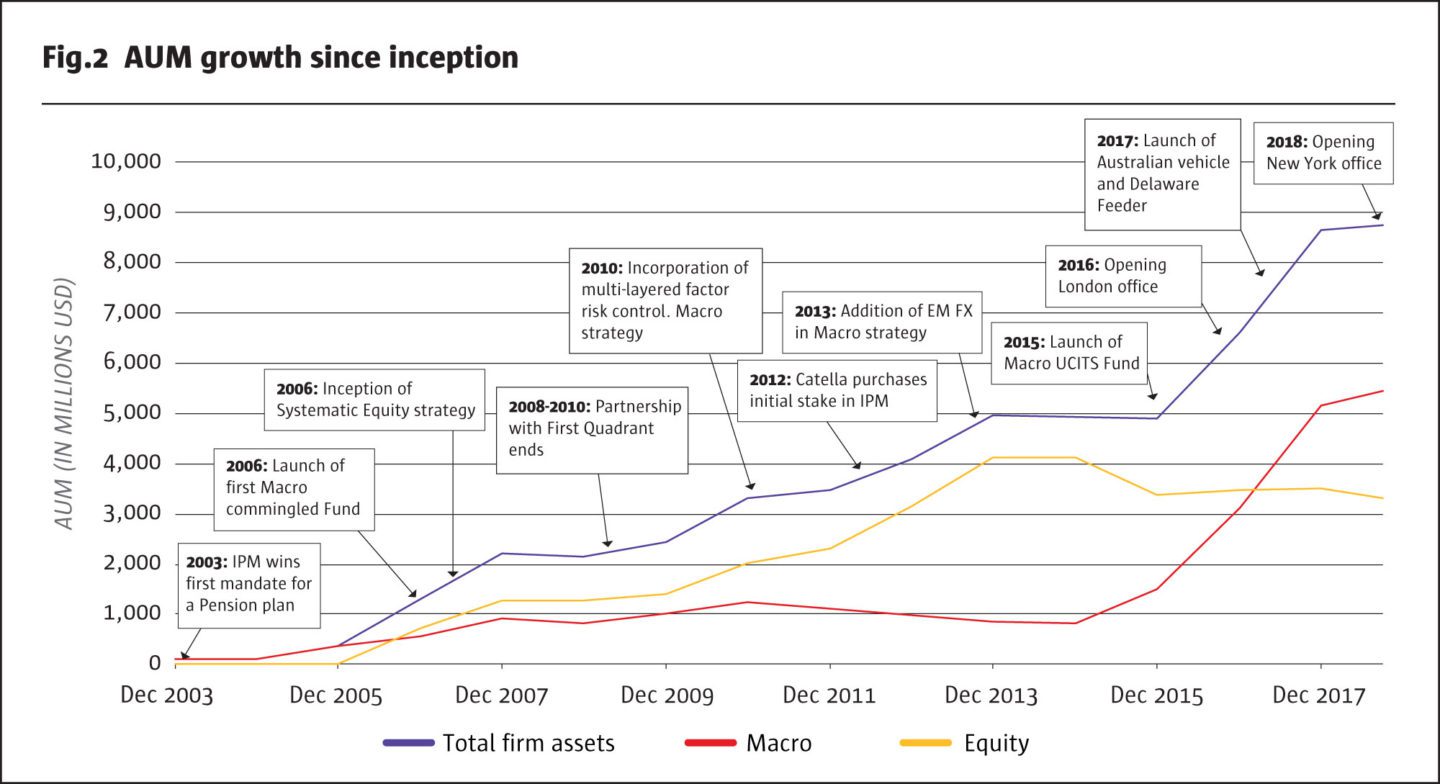

IPM – Informed Portfolio Management AB (IPM) runs just two strategies. The firm – one of The Hedge Fund Journal’s ‘Europe 50’ managers – has flagship systematic macro strategy assets of $5.7bn1. This means they have now overtaken Brummer’s Lynx as the largest single liquid hedge fund strategy assets in Sweden and the Nordics; Brummer still runs more assets overall, across all strategies. Sweden in turn is ranked as having the third largest hedge fund assets in Europe, according to 2017 Preqin data. Beyond this IPM runs one other strategy: a value-oriented systematic equity strategy integrating ESG factors that is currently offered on a long only basis (but could in theory be structured as a market neutral strategy).

This feature focuses on the flagship strategy: a systematic, fundamental, predominantly relative value macro approach, which has considerably outperformed most peers in other tactical trading strategies in discretionary macro and managed futures/CTAs. IPM will often get grouped into a broad macro or CTA index, instead of, or in addition to, a systematic macro one. In common with most tactical trading strategies, IPM’s best year of the past decade was 2008, but IPM has shown low or no correlation to these strategy averages or their constituent managers.

IPM Index memberships

Daily

BTOP 50 (CONFIRMED) (Daily)

SG CTA Index (Previously Newedge CTA index (BB: NEIXCTA)) (Daily)

SG Macro Trading Index (Quantitative)

Monthly

HFRI Fund Weighted Composite Index

HFRI Asset Weighted Composite Index

HFRI Macro (Total) Index

HFRI Macro (Total) Index – Asset Weighted

HFRI Macro: Systematic Diversified Index

HFRI World Index

HedgeNordic – NHX CTA

BTOP 50 (CONFIRMED) (Daily)

SG CTA Index (Previously Newedge CTA index (BB: NEIXCTA)) (Daily)

SG Macro Trading Index (Quantitative)

HFRI Fund Weighted Composite Index

HFRI Asset Weighted Composite Index

HFRI Macro (Total) Index

HFRI Macro (Total) Index – Asset Weighted

HFRI Macro: Systematic Diversified Index

HFRI World Index

HedgeNordic – NHX CTA

“IPM has stayed true to the original vision of providing investors with a source of diversifying returns, based on a wholly systematic and fundamental framework,” says Serge Houles, Head of Client Portfolio Management at IPM. The concept of quant macro is now well understood, but IPM is also very different from other systematic macro managers – in its return profile, philosophy and process.

IPM is ploughing its own furrow in one of the most diverse hedge fund sub-strategy spaces. Alongside IPM, a manager search for systematic macro might include firms such as: ADG, AQR, Aspect Capital, Bridgewater, First Quadrant, GCI Systematic Macro, Grantham, Mayo, Van Otterloo (GMO), GAM Systematic|Cantab, Quantedge, Quest Partners, Theam and Wadhwani Asset Management. These managers’ systematic macro strategies can sound superficially similar to the extent that they use similar or identical names for some factors, styles, models and signals, but they tend to define, implement, weight, and time their signals differently. In our opinion, nearly all of them are very different. Pairwise correlations between them are generally pretty low, and there is substantial performance dispersion, including in 2018.

Unlike IPM, some of them use technical as well as fundamental inputs. IPM uses an array of fundamental data, including macroeconomic releases, prices, news, sentiment, estimates, and forecasts. Nearly all of this is “structured” data that can fit into a spreadsheet.

Philosophy

The central plank of IPM’s philosophy is that, “markets underestimate the value of trading on fundamentals, but overestimate the importance of events such as politics and geopolitics which generally are harder to predict. This tends to distort prices away from what fundamentals imply, which we aim to profit from later on,” explains CIO and Head of Research, Björn Österberg. “Support for this can for instance be found in behavioural finance,” he adds.

Idea generation

IPM’s idea generation is grounded in fundamental analysis, and signals are not found by “data mining”. IPM has research projects looking at advanced statistical techniques, and big data inputs, but all of its models are based on intuitively sensible hypotheses. “We always go from the idea to testing, never from testing to the idea. Underlying dependencies should be stated rather than discovered,” says Deputy CIO, Mattias Jansson. “Our edge is not to develop sophisticated machine learning algorithms, but we could theoretically use techniques such as natural language processing if we were to interpret datasets such as central bank statements,” he adds.

IPM’s models combine academic and proprietary influences, and some are thought to be unique. Österberg reckons, “around 25% of them could be really unique concepts not spotted elsewhere but most ideas blend proprietary and academic research, and it is sometimes hard to define if the original inspiration came in house or from a research paper”. He is confident in declaring that, “we hardly ever transplant anything directly from academia”.

Although implementation is 100% systematic, discretion is exercised in choosing what to include in models. “Our conviction is very important in deciding on inputs, and the investment committee makes the final decision to validate model philosophy,” says Österberg.

Markets underestimate the value of trading on fundamentals, but overestimate the importance of events such as politics and geopolitics which generally are harder to predict.

Björn Österberg, CIO and Head of Research, IPM

Model growth and evolution

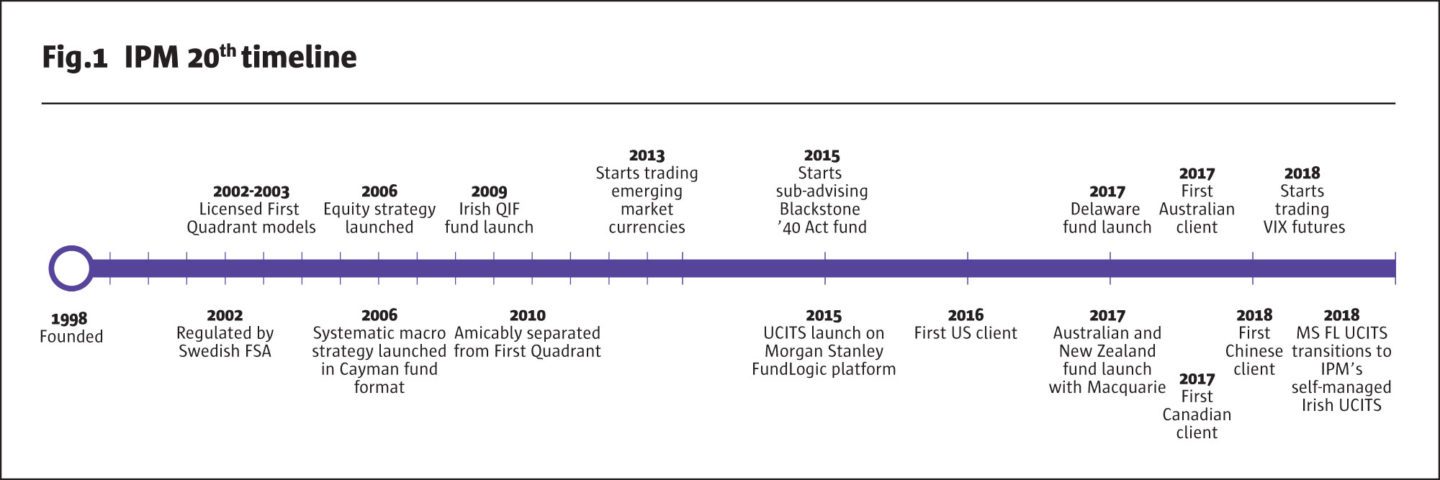

The number of models, or “investment ideas” as IPM calls them, has steadily grown to 85, with the latest additions partly arising from expanding the investment universe to include emerging market currencies and most recently VIX futures. Introducing EM FX in 2013 has since then added about 15 ideas, and another 10 are used to trade the VIX futures.

“The current ideas have very low and stable correlations to one another,” says Österberg. The hurdle for introducing a new idea includes that it should have a low correlation with existing ones, and it should also lack correlation to generic risk factors found in alternative risk premia (ARP) strategies, with a few exceptions. IPM’s carry model is intentionally correlated to generic carry, (but viewed as a whole, IPM’s strategy has never had a bias to being long carry and has often been net short of carry). “Historically, roughly half of the ideas which we research more in depth have gone live; though the proportion has fallen over time as it gets more difficult to find new ideas,” says Österberg.

Models are rarely discontinued, and IPM is more likely to adapt and refine them if they are not performing as expected. “We look for intuitive ideas. Discontinuing signals would mean that we would also have to be ready to reject their underlying concepts,” says Jansson.

Investment universe

EMFX and the VIX apart, the investment universe has hardly changed, sticking with liquid and major macro markets. The only deletion has been the local Swedish government bonds market, which IPM stopped trading in 2016 after changes in market structure meant liquidity deteriorated. That said, IPM’s Risk Management Committee has temporarily removed markets, e.g. the Swiss franc during the time it was pegged to the EUR. IPM has not ruled out bonds or currencies with negative interest rates; the strategy profits mainly from price action rather than yield and is mainly relative value. IPM’s models are cognisant of how commodities can impact certain currencies, but IPM does not directly trade commodities.

Taking the VIX as a case study in instrument selection, IPM spent about two years researching potential drivers of the VIX contract before adding it to the universe, and the ten models evaluating it, in 2018, after approval from the investment committee. The team explored the possibility of using variance swaps but decided that it would be operationally more straightforward to stick with futures and avoid the extra work entailed in trading the OTC swaps market. (IPM has so far ruled out bond and currency volatility products for the same reason). IPM also quantified the liquidity of the contract, looking at open interest and volumes relative to expected trading frequency and transaction cost parameters. IPM concluded that the US VIX future was liquid enough, but that the VSTOXX traded on Eurex and the Japanese volatility future, would not be liquid enough.

While some investment managers have increased the frequency of their signals, trades and holding periods, IPM continues to have multi-month holding periods, with an average holding period of around one year, but with continuous gradual shifts in positioning. These longer time frames mean that execution is not particularly time sensitive. “Once a signal to trade is generated, even executing it a week later will result in low alpha decay. As trading over longer time horizons is not so sensitive to timing, we have the luxury of primarily focusing on lowering transaction costs,” says Österberg. Execution makes extensive use of algorithms, but they are applied by a manual trading desk team of four.

85

The number of models, or “investment ideas” as IPM calls them, has steadily grown to 85, with the latest additions partly arising from expanding the investment universe to include emerging market currencies and most recently VIX futures.

Performance attribution

IPM’s performance attribution has been broad based, with four of the five sub-portfolios positive since inception.

Relative value trading in developed market currencies and bonds, has generated the larger part of profits. Relative value trading of emerging market currencies, introduced in 2013, has contributed less partly because it has a typical risk weighting of 10% versus 30% for developed market currencies. Only relative value trading of equity indices has incurred a slight loss since inception. A sleeve averaging around 15% of risk, devoted to directional trading of the four asset classes evaluated, has also contributed profits.

Investment ideas are categorised by themes or families and the macro and market dynamics families of models have made the biggest contributions, followed by risk premia, with value near break-even when viewed in isolation. It is worth noting that the value family of models does not necessarily imply any value bias at the portfolio level. IPM has been short of popular “value” trades such as the fundamentally cheap Swedish Krona in recent years, because the sell signals from the other models outweighed buy-signals from the value models. This is also one example of contrarian positioning.

Dynamic rebalancing has also added value, according to a study IPM carried out. Allocations to asset classes and models have not been fixed; IPM times both, to some degree. “Based on the perceived opportunity, the strategy automatically varies allocations to the majority of its models, with some adjusted on a gradual basis and others switched on and off in a more binary way,” says Österberg.

Because volatility is only implicitly targeted, IPM is given ample flexibility around exposures both when models generate more, and stronger signals, but also when by contrast signals are weaker, in each case not directly linked to the market’s volatility. Though the expectation is that volatility should average around 15% through a full cycle, it can overshoot when there is more opportunity, and undershoot when there are fewer or weaker signals – or when the Risk Management Committee judges the market environment to be hazardous; for example the RMC has dialled down risk in October 2008 and during the European sovereign debt crisis in 2011, which was also IPM’s only losing calendar year.

Utterly uncorrelated

Thus IPM’s performance can be explained in the context of its own models, but seems impossible to explain by using a conventional principal component analysis (PCA) approach. IPM’s sensitivity analysis presentation shows correlations to equities, bonds, hedge funds in general, macro funds and managed futures funds, of between +0.2 and -0.2. When returns for these asset classes and strategies are ranked by quintiles, IPM’s own returns seem to show no sensitivity to them. (By way of contrast, principal component analysis suggests that global equities have had explanatory power for 70-80% of broad index hedge fund returns over recent multi-year periods).

Given the explosion of interest in alternative risk premia strategies, it is always worth investigating whether, and to what extent, a hedge fund strategy might be replicable through lower cost premia. IPM’s return profile has, on average, shown correlations near zero to eight generic equity factors: (global value, global momentum, global size, global volatility, global quality, global multi-factor, global equity carry, and dividend month); four generic FX factors (global FX value, global FX carry, global FX momentum and global FX trend); six generic bond premia (global rates value, global carry, global momentum, global trend, global volatility and global curve); and, not surprisingly given the absence of the asset class in the portfolios, five generic commodity premia (value, carry, momentum, trend, volatility).

What is perhaps more interesting is how IPM has arrived at average correlations near zero. Over time, correlations have ranged between as high as +0.8 and as low as -0.8 for some of the above factors, underscoring the dynamic nature of IPM’s process.

Research and culture

Research uses mainly in-house software, but IPM draws on a library of mathematical third-party software for tasks such as optimisations. Analysts need maths and coding skills. They code in the language of their choice leading to a wide range of programming languages used in aggregate and can be drawn from a broad spectrum of numerate academic disciplines, including economics, econometrics, engineering/physics and biometrics. Some researchers are more theoretical and others more market-oriented. The research team of almost 20 are all expected to be generalists, involved in driving forward the research process, for both the systematic macro strategy and the single equity-picking one, but some of them also have more specific responsibilities for areas such as data management and cleaning, production and coding.

“The environment is an open plan, flat, inclusive and collaborative Swedish engineering culture,” says Lars Ericsson, acting CEO. Everyone is encouraged to contribute and get involved. “It is a combination of an international hedge fund and a Swedish engineering environment – people have a lot of freedom but still adhere to a scientific approach within a strict academic framework,” he continues.

This is the antithesis of the perceived egotistical “star manager” culture that prevails at some firms. Personalities at IPM tend to be low key rather than alpha males; almost 40% of staff are women, (including: Head of Human Resources, Sara Lundvall; Chief Risk Officer, Elisabeth Frayon; Head of Business Development, Tara Skinner; and Chief Technology Officer, Anna Hallerdal). The percentage of women is currently higher in non-investment roles, in line with the rest of the financial industry. “We have respect for diversity in backgrounds and personalities. The staff come from many nationalities,” says Ericsson.

Remuneration is competitive for the Swedish market, and the overall work/life balance can be attractive compared with London or New York. Recent research hires have previously worked at large local quantitative, fixed income arbitrage, and discretionary macro funds, including Lynx, Nektar, Brummer, SEB and Ambrosia.

Ownership includes key staff. Catella AB, which is listed on the Stockholm stock exchange, bought a stake in IPM in 2012 and has been a stable and passive owner; for them IPM is a diversifying financial investment. In addition, Catella’s wealth management arm is invested in IPM products and naturally went through the standard due diligence process.

Staff turnover has also been low because, “we look after staff well, and lose very few involuntarily. We protect our intellectual property, and few staff have sight of all models,” says Ericsson. Of the leavers, many have gone to work in banks. The only two departures known to have set up a hedge fund strategy have been Alex Gioulekas and Igor Yelnik.

Gioulekas had started two different strategies at IPM in CTAs and commodities, in response to a reverse enquiry from a client who was seeking a diversified systematic “one stop shop” for tactical trading allocations. “They were discontinued as client interest turned out to be low, because larger institutional clients have the resources to select best of breed managers in each strategy, and our CTA strategy could not claim to be a best of breed CTA,” says Ericsson. Gioulekas left IPM by mutual agreement and now works at Coeli AB, managing a strategy called Prognosis Machines, based on Artificial Intelligence that is quite different from IPM’s. Yelnik launched ADG, which is running a systematic fundamental macro strategy.

Fin International branding project

“To be front-of-mind, a brand needs a clear articulation. Whilst Volvo means safety, IPM means openness. IPM should be perceived as being open to new ideas, innovative and inclusive,” according to Marek Warno of integrated design and PR agency, Fin International, which has been working on a branding strategy project with IPM since 2017. “Though IPM is very much global, being Swedish is also an important part of the DNA,” he adds.

Warno has found this remit to be “the most extensive, integrated and satisfying branding project we have done. We conducted a comprehensive fact-finding mission, interviewing key staff, and also clients and intermediaries, including those who were not investors”.

“Openness is a massive differentiator versus their competitors, manifested in the flat internal structure, and active client involvement in what is a glass box not a black box. Factsheets contain performance attribution by asset class and model family,” he continues.

But IPM’s self-perception did not always match the outside world perception in all areas, according to Fin’s interviews with IPM staff, stakeholders and journalists. They somewhat modestly did not view themselves to be as innovative as they are considered to be by those outside the company. Warno adds, “This is where a new brand can act as a confidence-building catalyst inside the organisation.”

The branding project has resulted in a new brand image, designed to convey these values. The letter ‘I’ now denotes more than IPM being informed: it’s also idea-driven, innovative, inclusive and integrated. This has subsequently been rolled out with IPM’s new website, videos and investor documents. Fin International’s other mandates in the hedge fund industry have included design work for emerging markets fund Emso, consultancy for Aspect Capital and coining the name Brevan Howard.

Institutional investors worldwide

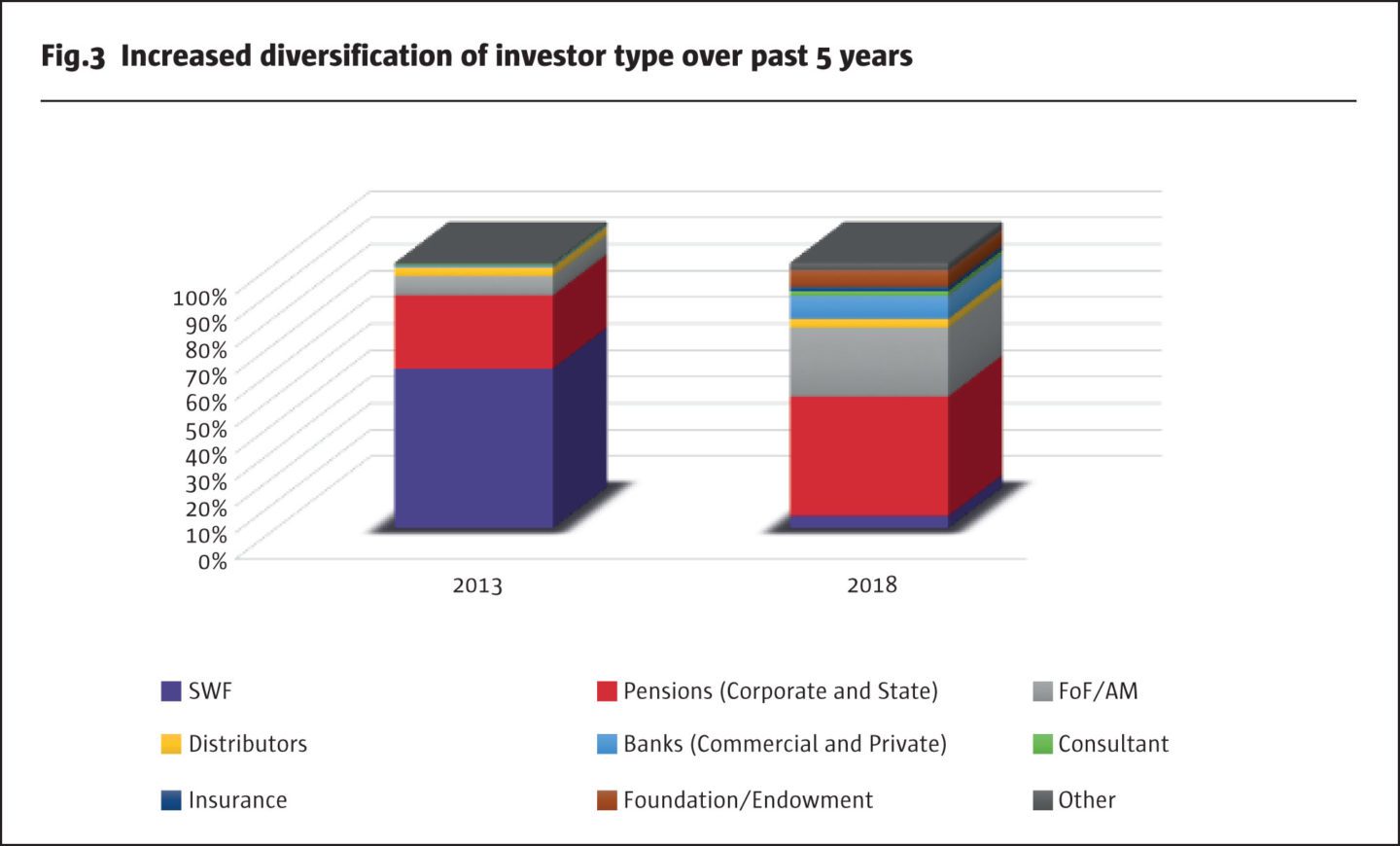

Sweden’s enlightened regulators have fostered the growth of their hedge fund industry by giving retail investors access to hedge fund strategies, and many Swedish hedge funds raise most or all of their assets locally, and from retail investors. In contrast IPM’s investor base is global and institutional. Argues Houles, “it is difficult to sell the diversification benefit to retail investors. We are more of a truck than a car. We do not really work with salespeople.” IPM has always catered for tier one institutions, such as state pensions, corporate pensions, and sovereign wealth funds. IPM’s risk reporting options geared towards institutions include Open Protocol Enabling Risk Aggregation, RiskMetrics, Hedgeplatform, and customised solutions.

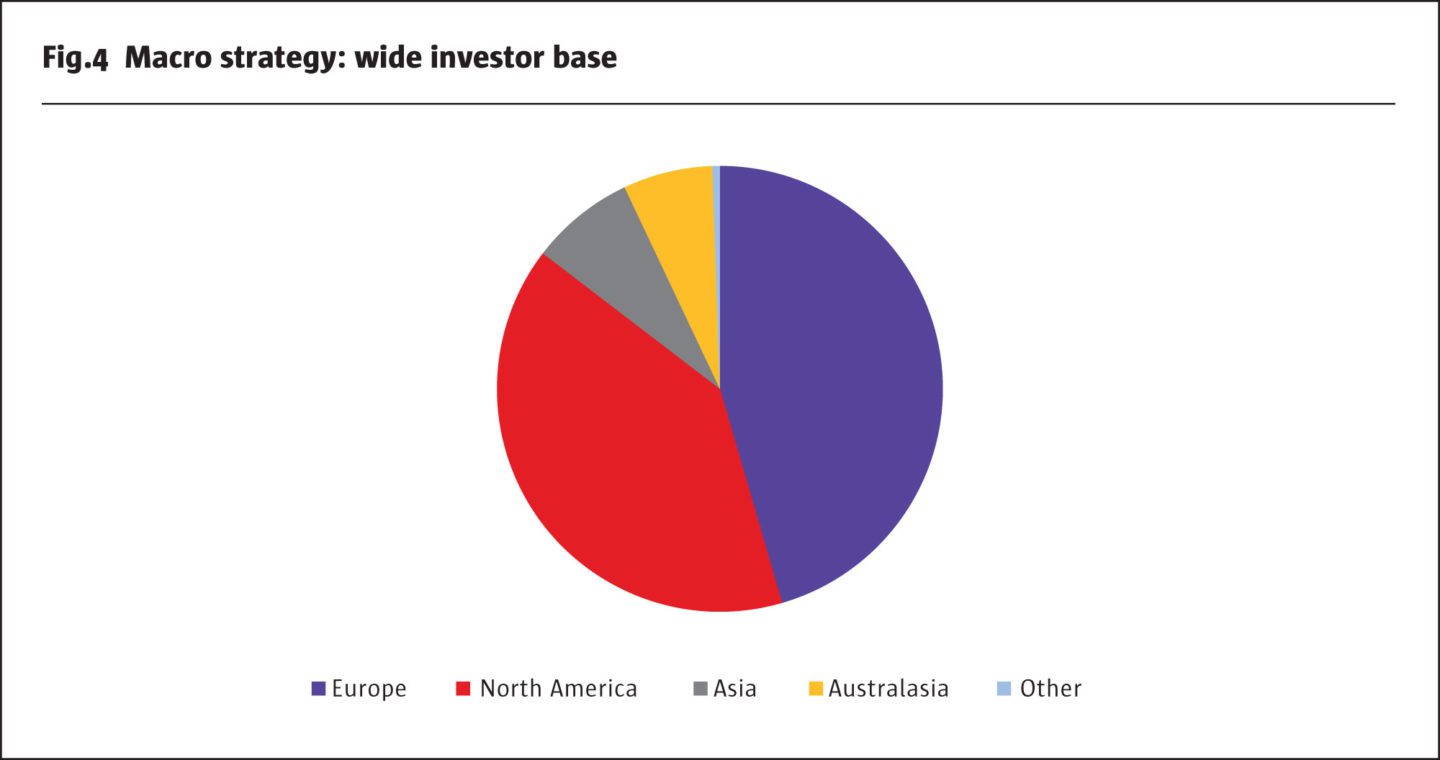

IPM’s geographic footprint has changed more than its investor profile.

In recent years, IPM has made inroads into the USA, Canada and Australia, after a series of visits and much dialogue with consultants. IPM is rated by many of the leading investment consultants, who liaise with a dedicated person, Head of Consultant Relations, Hanna Persson. “The number of questionnaires the consultants ask us to fill out has constantly increased over the years. This has probably peaked now as we see many of them moving over to digital solutions to systemise and streamline the work of collecting information and receiving updates from managers. I think that is great because it also frees up time for us. For IPM, the best time spent on consultants is always the face to face meetings where the most constructive discussions take place,” she says.

“Our interaction with consultants has been a great way to capture industry trends. A few years back, cyber security was on top of everyone’s DD agenda, which of course forced managers to think about these risks and make sure enough resources were spent to mitigate them. Now, I hear about ESG within alternatives everywhere. It will be interesting to see what comes out of those discussions in the end,” she adds.

It is difficult to sell the diversification benefit to retail investors. We are more of a truck than a car. We do not really work with salespeople.

Serge Houles, Head of Client Portfolio Management, IPM

IPM’s corporate social responsibility can be subdivided into two areas; the way it acts as a company and the way it invests and interacts with the companies it invests in. In terms of corporate behaviour, all activities at IPM should be characterised by professionalism and follow high ethical standards, always putting the interest of clients first. In terms of investment activity, this is governed by the IPM Responsible Investment Policy, which is particularly relevant for the long only equity strategy. The strategy, which has substantial spare capacity, integrates ESG factors, through exclusion, engagement and proxy voting, all overseen by the IPM ESG Committee.

IPM opened a London office in 2016, headed by Tara Skinner, who featured in The Hedge Fund Journal’s 2017 “50 Leading Women in Hedge Funds” report in association with EY. “Hiring Director of Business Development, Tara Skinner, from Brevan Howard was a great move. She has helped us to structure the sales effort and develop new channels,” says Houles.

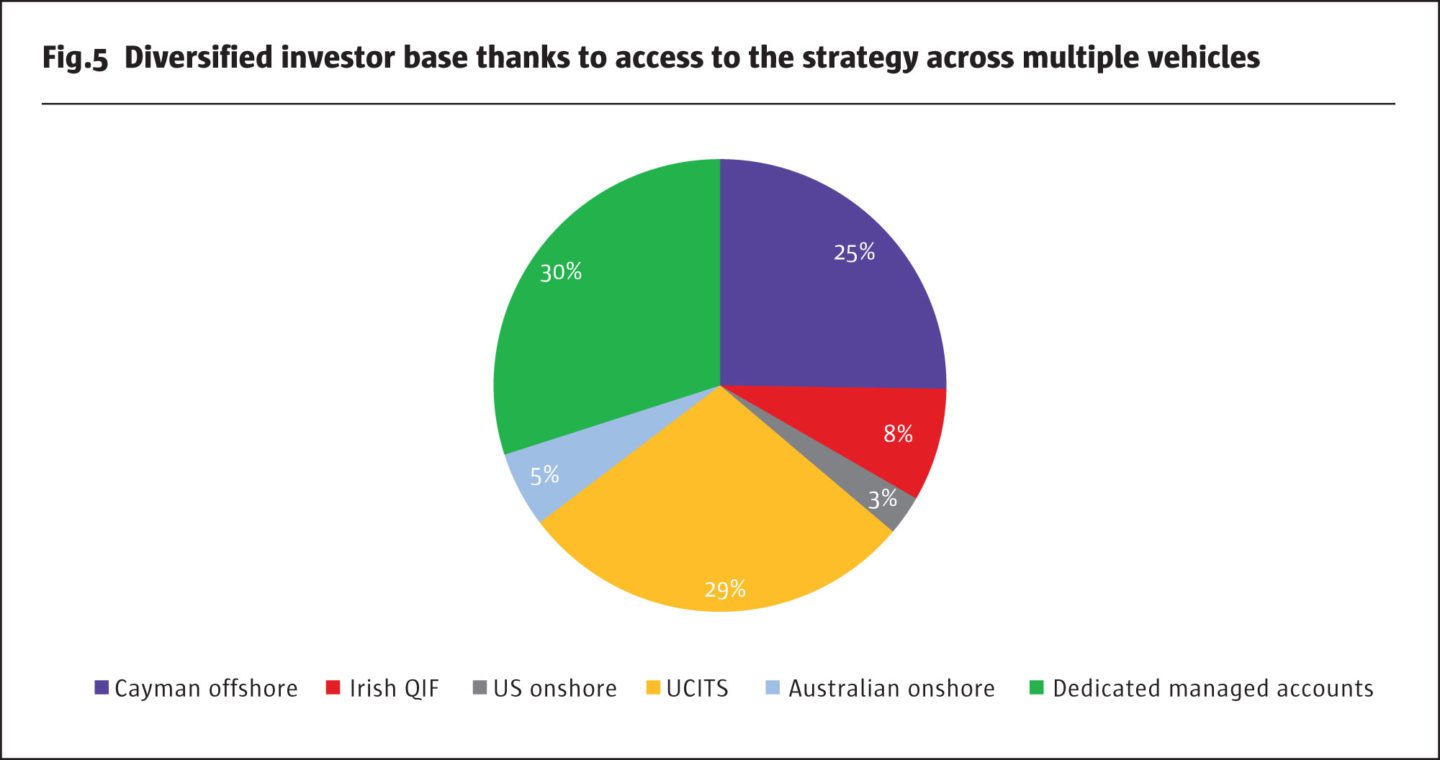

After winning its first US client in 2012, but only starting marketing efforts in North America in 2014, 40% of IPM’s assets now come from the region. In 2018, IPM opened a New York office, currently staffed with a compliance officer. In 2019, it will be expanded with a secondment from IPM’s Stockholm HQ. Macquarie Bank exclusively distributes IPM’s strategy (along with managers such as Winton and P/E Global) in Australia and New Zealand. IPM won its first client in mainland China in 2018.

“The average due diligence process lasts about a year,” says Houles. The focus remains on institutional investors and there are no plans to start marketing to retail investors; IPM’s UCITS, which was on the Morgan Stanley FundLogic platform but is now migrating to IPM’s own structure, is designed for institutions although available to retail in some markets. IPM advises both separately managed accounts and managed account platforms.

The flagship strategy is very close to full capacity of $8 billion as IPM aims to close for new investments at $6.5 billion to allow for organic growth. Capacity is limited partly because relative value trading entails substantial gross exposures – on average 8-10 times leverage – which eat up more capacity than the directional strategies. Through a version called Core Markets, trading a sub-set of only the most liquid markets IPM can offer additional capacity.

IPM will continue to develop the flagship strategy, potentially adding new markets and models. And “at some point over the next three to five years, we could be open to launching a new strategy that would build on our core DNA of systematic fundamental investing, using financial and economic theory. This might involve hiring new people but would also need to include the existing team, and leverage our unique competences in building models. IPM is a long-term partner for investors and has a deep dialogue with them,” says Ericsson.

As central bank balance sheets continue to contract in 2019, increased volatility and dispersion in macro markets should bode well for the flagship strategy’s opportunity set.

Footnote

1. Total strategy AUM as per December 31, 2018 across all accounts adjusted to 15% volatility target.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical