The financial crisis of 2008 forced many investors to re-evaluate the economic factors they previously took for granted. We have all had to face up to the fact that we are living in a new world of risk and opportunity where old hunting grounds for predictable returns no longer exist. Austerity and a change in the regulation of the banking sector are having unanticipated consequences on the way businesses are financed and the role banks play in the economy, in turn creating opportunities for other market participants.

The printing of money by central banks is changing the complexion of global financial markets. Higher premiums are being placed on real assets like property in preference to less tangible options. Traditional sources of yield have dried up and investors are now turning to alternative investments and equities for more stable and predictable returns.

These macro trends within the investment universe are clearly exhibited by equity market volumes, which have tended to stay below 2007 levels. More evidence comes from real wages, which have failed to rise, and while unemployment has dropped, government debt piles have remained steadfastly high.

From an investor’s perspective, there are worrying signs of deflation in the global economy, and markets that have acted as traditional sources of diversification, like commodities, have failed to provide the returns they historically delivered. Good examples can be seen in many of the core commodity markets in the last 12 months, for instance.

Uncharted waters

Taken together, these factors are creating a new and unfamiliar environment for the investor to navigate. Allocators are starting to investigate strategies that can take advantage of this new reality, capitalizing on opportunities that did not exist to the same extent five years ago. The new economic landscape is creating investment opportunities at the same time as investors are seeking non-traditional sources of returns. Prized among these are real-asset strategies, or those which take a more traditional approach to generating returns, for example by replacing banks as sources of credit finance.

Such opportunities have also been created as a result of the economic changes: we have seen considerable transformation in the energy sector in the UK, for example. It is changing drastically, both in terms of how energy is generated, and how it is consumed. The UK urgently needs to develop new sources of electricity, including from renewables, as other projects are decommissioned. A potential gap in generating capacity is starting to emerge, something the UK government is painfully aware of.

Since 2010, over £16 billion has been invested in onshore and offshore electricity networks. Ofgem (the UK energy regulator) estimates that investment in onshore electricity transmission and distribution networks increased by more than 20% between 2010 and 2014. However, between 2014 and 2020, the government thinks that a further £34 billion in electricity network investment alone will be required.

The previous UK government identified eight technologies capable of delivering 90% of the UK’s energy needsby 2020, and in 2011 adopted a program to provide +15% of the country’s energy from renewable sources by 2020. Investors, domestic and foreign, are being asked to help with the costs of this huge transformation of the UK power infrastructure.

Large power projects like that at Hinkley Point in Somerset, which is being jointly financed by EDF and China’s General Nuclear Power Corp, bring with them guaranteed price tags for the electricity they will provide over three decades or more. The UK government is committing over £1 billion of support for two carbon capture projects. For investors, projects like this can provide government-guaranteed income streams outside the bond market, as the government will need to underwrite price levels in order to attract capital.

The UK ranked behind only the US and China in terms of new-build renewables asset finance activity in 2013, and saw an increase in this sector of 59% from 2012, with over $7 billion committed. This compares well with other major markets like Germany (+$4.5 billion) and Japan (+$5 billion).

Investment in renewable electricity capacity from biomass and bioenergy projects alone, including biomass conversions, was estimated at £6.3 billion per annum in 2010–2013. The UK’s Department of Energy and Climate Change anticipates a further £5–£6 billion per year will be invested to the same sector between now and 2020.

Down on the farm

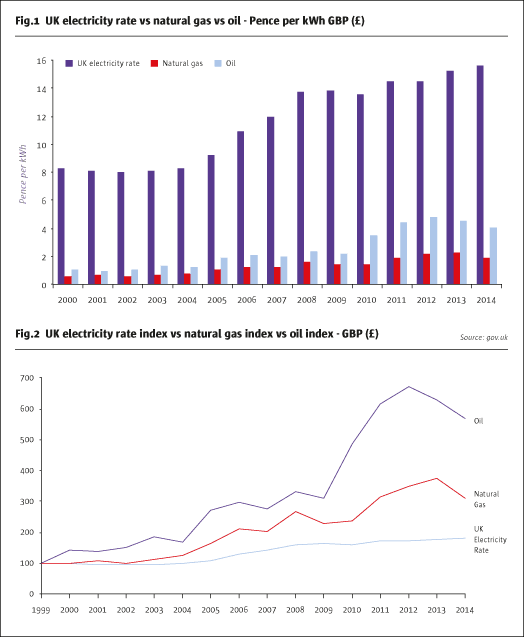

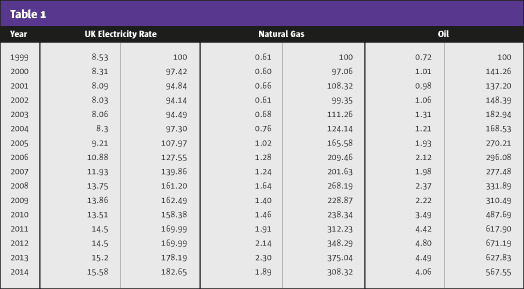

Beyond the energy sector, the UK’s farming and food processing industries have also seen tremendous change since the credit crisis. Energy costs have been rising for farmers and food groups, along with the price of specialist equipment, machinery and farmland itself. The cost of electricity in the UK has not fallen materially in the past year, despite the decline in the oil price, and the cost of electricity for UK consumers is 87% higher than it was a decade ago (see Fig.1 and Fig.2). All this contributes to the hampering of farming efficiency in the UK, with British farms lagging behind many others in the EU in terms of both technical innovation and relative outputs to inputs by value.

Energy consumed by UK agriculture exceeded £1.4 billion in value in 2012, and while farmers hope to see costs drop as a consequence of more renewable energy coming online, the capital investment cost of alternative sources of energy remains a significant barrier to the UK agriculture and food related industries.

The government is acutely aware of the negative political impact of blackouts – last winter in particular the potential for power shortages was enough to generate headlines in national newspapers. Farms, which have become increasingly reliant on an assumed uninterrupted flow of power and energy from UK utilities, could be faced with serious operational problems should such concerns become reality. The government is therefore keen to help find local solutions for farmers outside the national power grid.

Farmers are also finding that waste disposal via landfill is becoming economically challenging: on top of normal landfill rates – UK taxes on landfill have risen from £56 per tonne at the standard rate in 2011, to £80 per tonne in 2014. UK agricultural waste tends to be active and priced at the higher end of the market (compared with inactive waste like concrete), hence cost effective alternatives are starting to look far more attractive.

Filling the funding gap

As banks have exited the credit finance market, farm groups and food processing groups have experienced difficulty in obtaining the loans they need, including improving infrastructure on farms and on-site equipment requirements (e.g., investment in specialist equipment, machinery and renewable energy generation). Although lending to UK SMEs increased slightly last year (9% more than in 2013, according to the British Bankers Association), approved borrowing overall was lower in Q4. Borrowing from the agriculture sector from banks was also lower in Q4 2014 versus the previous year.

For the Bank of England, the problem has been how to encourage much-needed new lending to the UK agriculture and food processing sectors. Business investment in the UK has fallen 34% in five years and new firm creation is also lower. The overall impact is a negative one for UK farming and food processing – recent figures from the likes of the OECD and the US Department of Agriculture demonstrate that the British agriculture sector’s level of comparative efficiency has been falling steadily when compared with other developed economies.

Lack of investment in new equipment, machinery and vehicles has a large part to play in this tale. While the government has devoted some money towards R&D, it has not compensated for the high cost of power nor the ageing farming and food-processing infrastructure. Such items are left to the farmer to replace at his own cost, frequently with credit that can now be difficult or expensive to obtain in the new world order.

A gap has been created here for private investment strategies that can step into the vacuum created by the retreating banks. Loan strategies typically offer consistent positive returns coupled with lower volatility than market-based funds. In addition, they have the added benefit of low correlation to public markets.

Loan funds are credible market participants

In the alternative investment sector, we have seen an increase in the number of credit funds on the market. Direct lending funds accounted for over $29 billion in assets under management in 2014, according to Preqin data. Globally, as banks have retreated from the SME sector and regulatory guidance has impacted the syndicated loan market, so fund management firms have found they have a larger role to play.

Like real estate funds, hedge funds active in this sector require portfolio management teams that understand the SME sectors they are dealing with, and who can draw on backgrounds in commercial lending and auditing, for example. Frequently, loan teams are composed of professionals with credit finance backgrounds earned in the commercial banking world. There are no proprietary strategies to be hidden from investors, and loan books are by their nature transparent and predictable.

Credit strategies also have the advantage of being highly scalable, as the demand is there for loans from SMEs (e.g., due to the credit and investment shortfall in the UK agricultural sector). A well-managed fund can oversee a considerable loan portfolio with relatively few capacity issues.

The farming, food processing and renewable sectors present an attractive income stream for allocators who are casting around for consistent and non-correlated return profiles at a time when government bonds like the German 10-year bund are threatening to enter negative yield territory. Together, they can also provide a combined investment opportunity, namely the provision of “on farm” renewable energy.

More power to the farmers

Alternative energy sources, like solar, wind and biomass, are now stepping into the energy gap UK farms are facing, helping farmers to produce cheaper, on-site energy from sources they might control on their own properties. This can include wind turbines, solar panels and, increasingly, even bio mass and bio gas using waste from the same farm which would otherwise be costly or increasingly difficult to dispose ofin landfill.

On-farm energy generation brings with it the combined attractions of loans secured against UK farmland and additional 20-30 year guarantees from the UK government, which is acutely aware of the problems of a lack of commercial bank financing in this sector. In addition, the government is also providing additional funding for environmental schemes in the farming sector, for example via the £3.5 billion budget for the Rural Development Programme for England (RDPE), which runs until 2020.

Apart from a need for credit, cheaper energy and modern technology, UK farming also enjoys some of the highest land prices in the world for agricultural land. Strict UK planning laws and what some commentators call a “sentimental” attachment to traditional farming mores at local and national government level, have led to a high premium for UK farmland. This plays to the farmer’s advantage, however, when it comes to securing loan finance. Unlike other SME sectors, UK farming brings with it an easily priced asset to serve as collateral that will remain in limited supply.

Conclusion

The availability of dedicated credit finance pools for the development of local renewable energy sources is already helping farmers make their businesses more cost effective. This is critical as the sector is becoming more aware of the implications of potential power shortages in the future, particularly with more of the UK’s nuclear power generating capacity being decommissioned.

While providing these sectors with the capability to reform themselves and modernize, loan funds are also delivering the direct-to-market approach for participants who desire exposure to this sector coupled with a proper evaluation of its risk-return components – i.e., without banks acting as blanket intermediaries.

The emphasis now lies in the proper delivery of investment finance to the sector through managed assets strategies that can be effectively deployed, with the right terms and guarantees to support them over the medium to long-term. The loss of traditional finance sources from the farming and renewable energy sectors would prove hard to replace were it not for the involvement of dedicated funds as alternative sources of credit finance.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 106

Tackling UK Farming’s Funding Shortfall

Helping reform UK’s agriculture and alternative energy industries

CRAIG REEVES, FOUNDER, PRESTIGE ASSET MANAGEMENT

Originally published in the August 2015 issue