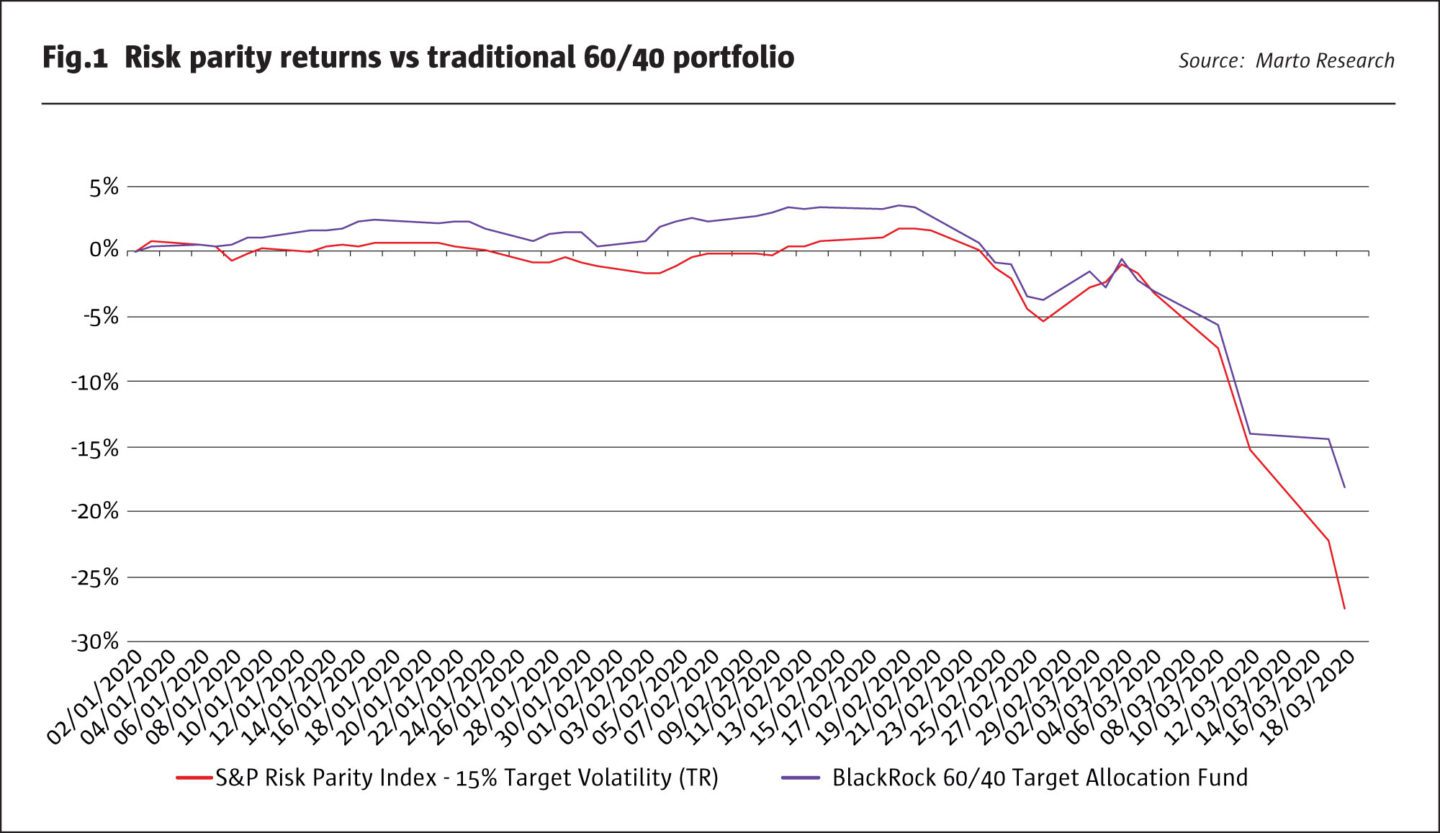

Risk Parity was dealt a heavy blow underperforming a more traditional 60/40 diversified portfolio allocation since January 2020. While BlackRock’s 60/40 Target Allocation Fund fell by 18% from peak-to-trough, the S&P Risk Parity Index fell by 28% during the same time.

This is particularly disappointing because Risk Parity has been promoted as the all-weather, long-only asset allocation portfolio for both institutional investors and retail investors. Risk parity managers claim that the strategy performs well in all major macroeconomic shocks such as inflation, deflation, upward growth and fall in growth. So why is it performing so abysmally now?

We believe that the golden age of risk parity is over. The coronavirus epidemic just sped up the strategy’s demise. It was by far the longest-running consistently winning bet in the known history of markets.

Katina Stefanova, CEO & CIO, Marto Capital

The portfolio managers who offer risk parity products would tell you that we are in uncharted territory and the coronavirus pandemic is the type of Black Swan event that has upturned all boats. While this is true, in this article we argue that risk parity strategies were already at risk and were destined to underperform even if the coronavirus epidemic did not occur.

Additionally, institutional investors buying risk parity products pay substantially higher fees, low-cost passive products, with the expectation that risk parity funds will outperform in a Black Swan event. Yet, risk parity strategies did not provide downside protection in 2020 and lost more money than their low-cost alternatives.

The 2019 backdrop provided a false sense of security

Coming into 2020, the underlying economic fundamentals in the US and globally were solid with (US GDP growth at 2.1%, unemployment at historic lows of 3.5%, and Purchasing Manager Indices above 50, indicating economic expansion). Equities rose by 31.5% in 2019 marking a 10-year expansion cycle — the longest in history. The astounding gains asset prices posted were accompanied by historically low levels of volatility. While markets soared, the underlying financial system was overextended, overleveraged and addicted to increasing central bank stimulus. The global economic machine was the equivalent of driving at full speed with no steering wheel and no breaks. That was fantastic as long as the road ahead remained straight and there were no sudden obstacles. We have been warning investors not to take low volatility as a sign of low risk and to keep leverage under control.

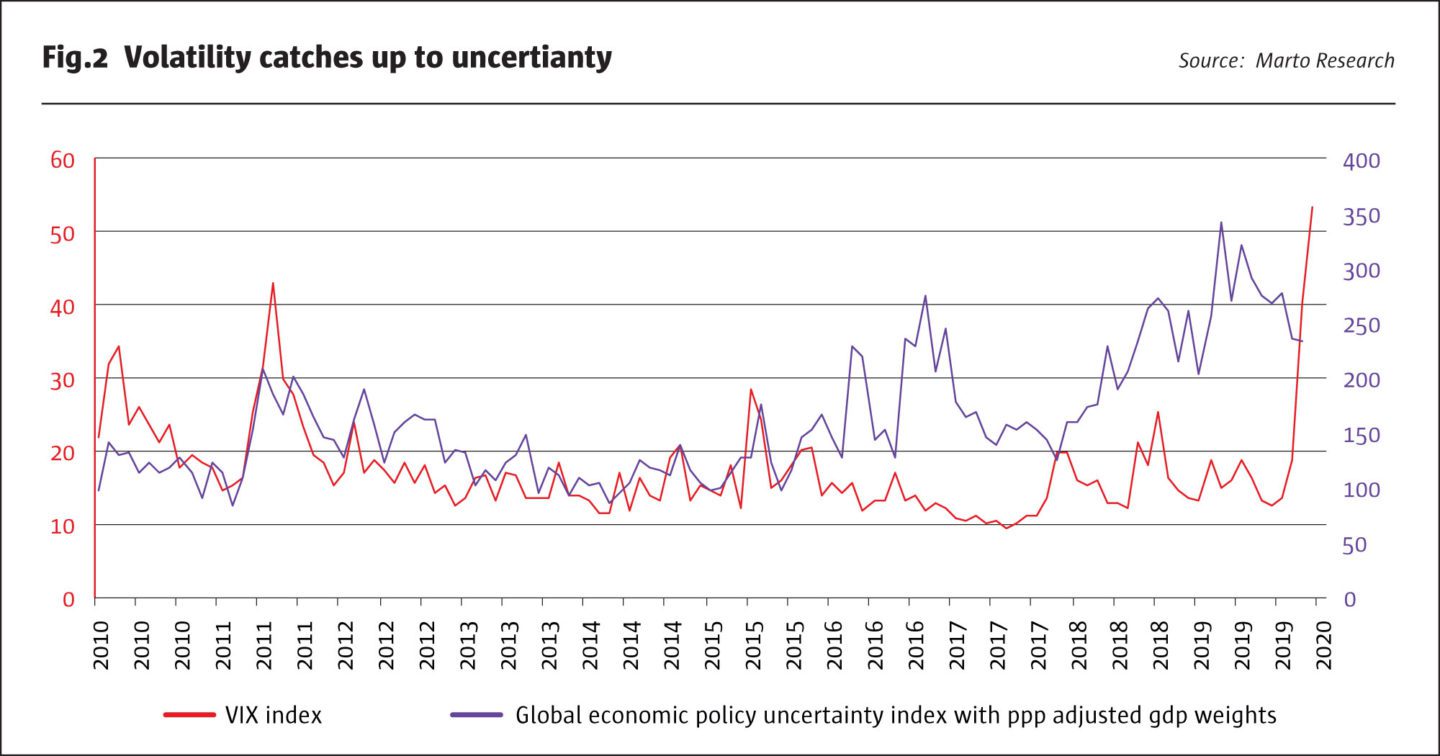

Marto Capital has been arguing that traditional models of calculating volatility for portfolio construction are broken. When calculating how much leverage to apply to various asset classes, portfolio managers use a formula that combines past volatility, current volatility, and implied volatility. However, in our view volatility was no longer a good indicator of market risk as volatility and market uncertainty began to diverge.

High level of monetary stimulus, low-interest rates, the expansion of passive ETFs, and the systematic volatility selling strategies (such as SVXY, ZIV) kept realized volatility down (VIX at 15-17), while simultaneously the uncertainty in the global economy was rising. Unprecedented global events and risk, the rise of populism in the US and Europe, the risk of military escalation with North Korea, the Syrian refugee crisis, technological innovation driving oil prices down and many others were not reflected in markets.

The entire picture changed, the coronavirus pandemic. Volatility spiked to 85% and correlations among assets converged to 1, with the price of equities, treasuries and even gold, falling simultaneously. Risk Parity is designed with the assumption of stable correlations and volatility which is an inherent flaw. Correlations are unstable especially in a crisis and volatility can easily spike from the low levels of 2019. The spike in volatility and the break of correlations made it impossible for risk parity to weather the storm exactly when investors needed downside protection.

Investors should ask themselves: “What return expectations should we have from risk parity going forward?” and “Do we have better alternatives?”

An analysis of risk parity history, performance, and forward-looking expectations show that risk parity was already positioned to underperform regardless of the coronavirus pandemic and that the golden age of risk parity is over.

There are two major steps in creating a risk parity portfolio:

Select a diversified basket of assets based on past correlation analysis and understanding of fundamental drivers. That basket, in theory, will perform well in all major economic environments making an all-weather strategy. The main four economic environments that risk parity is designed to perform well in are as follows:

- risk on assets – developed market equities, emerging market equities, emerging market currencies.

- risk-off assets – treasuries, gold

- inflation protection – inflation-linked bonds, gold, commodities

- deflation protection – long term bonds, zero-coupon bonds, and some dividend stocks

Allocate to each asset a risk budget, not a cash budget. Risk is adjusted with the use of leverage (borrowing). As a result, the lower volatility assets in the portfolio most notably bonds are leveraged up until their volatility is comparable to the volatility of equities (the high volatility assets).

Risk parity does not account for liquidity and how the strategy performs in expanding or shrinking liquidity environments, making that design-miss its Achilles heel. Historically, this has not been a problem because, for the last 20 or so years, liquidity has mostly been expanding.

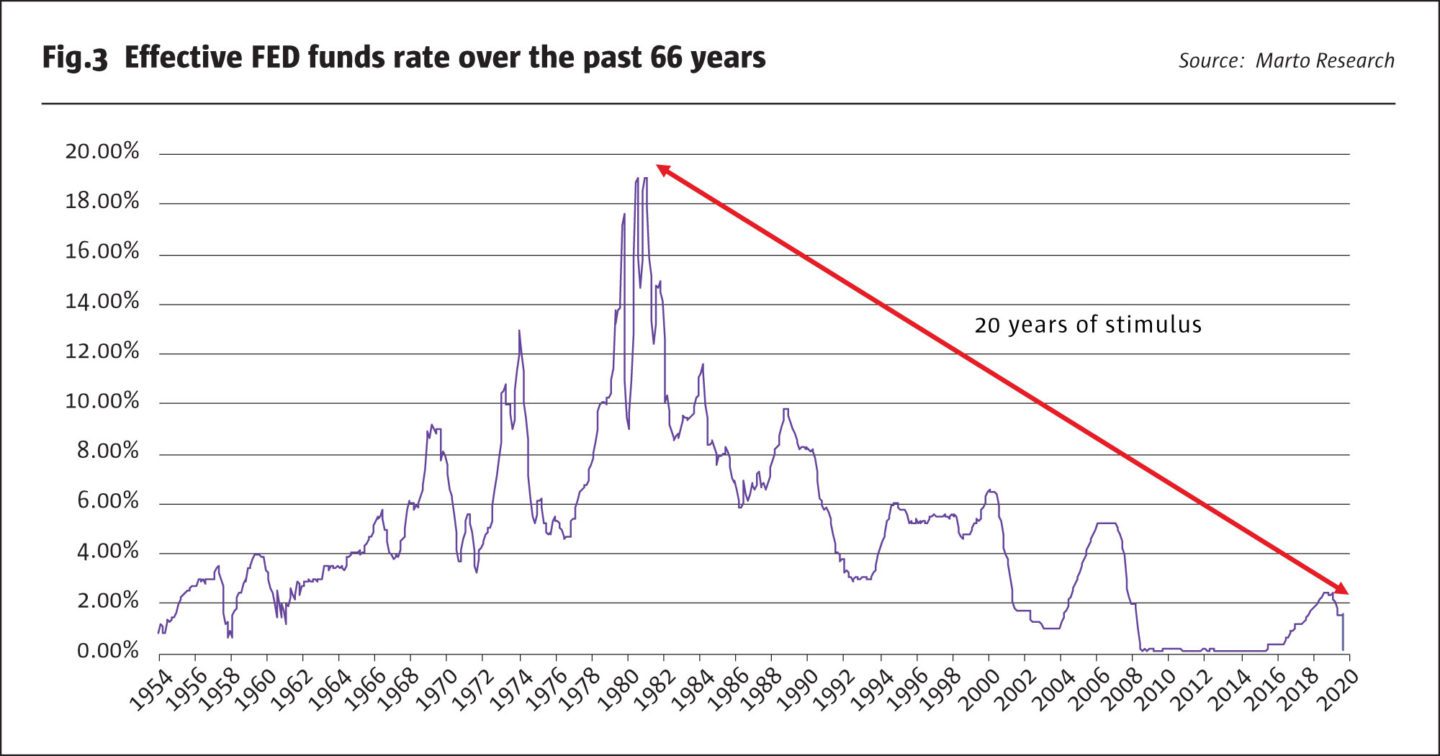

Risk parity performed beautifully for over two decades due to the largest liquidity expansion the world has ever seen

Leverage, when investors are right about their views, increases the return of a portfolio compared to its unlevered equivalent. And when it comes to risk parity, the asset managers who created it were right on the money. The strategy delivered equity-like returns with bond-like volatility. That was only possible because of the economic backdrop – the largest liquidity expansion and coordinated major Central Banks driven stimulus in the history of markets. Central Banks around the world engaged in cycle after cycle of accommodative monetary policy lowering interest rates, and when that was no longer possible, post-2009, expanding their balance sheets significantly. The Fed expanded its balance sheet by $3.6 trillion, ECB by $3.4 trillion, Bank of Japan by $4.7 trillion and People’s Bank of China by $3.4 trillion. This approach kept markets humming and led to the longest economic expansion cycle. During that period, risk parity, due to its application of leverage, outperformed a traditional 40/60 portfolio on a gross basis.

Like a drug, the stimulus has side effects Structural damage to the economic machine eroded over time due to the building up of leverage, creating an addiction to low-interest rates, increasing inequality between the rich (asset holders) and the poor (debtors) to unprecedented levels. Figuratively speaking, insensate stimulus turned the financial markets into a symptom-free but immunocompromised, low-cost debt addict.

In an environment like that, all asset prices got inflated. Instead of providing diversification, bonds and equities became correlated appreciating in unison. While the S&P 500 Index returned 17% per annum during these 10 years, the US Aggregate Bond Index returned 4.2% per annum, both of them with virtually no down years. Risk parity managers added leverage to further boost those returns. In return, institutional investors flocked into risk parity building up the product to close to $1 trillion in assets.

Why was risk parity hit so hard by the 2020 coronavirus bear market

The underlying structural market conditions that have been coming into place for the last five years have already significantly weakened the economic immunity of risk parity. It was only a matter of time before risk parity crumbled. We have argued that market volatility and uncertainty in the world have diverged, leading to investors significantly underestimating the downside risk in their portfolio.

In the last few years, we have witnessed such uncertainty across multiple dimensions — China trade conflict, military escalation in Korea, the Syrian refugee crisis, and the rise of populism in the Western World. Investors got particularly comfortable when in 2019, the SP 500 index gained 31.5%. Even crisis-weathered veterans like Ray Dalio jumped on the long bandwagon. Dalio infamously stated at Davos 2020 – “Cash is trash!” He could not have been more wrong. Just months later, the coronavirus pandemic hit markets. A Black Swan event cannot be predicted, says Dalio, defending his losses. But the signs that risk parity could not withstand the eventual shock were already there.

A combination of losses and redemptions shrank risk parity assets to $400 billion from close to $1 trillion in less than a month. The bloodshed is not over.

Risk Parity was precariously positioned coming into 2020 and the coronavirus pandemic was the impetus (proximate cause), not the root cause of the strategy’s demise.

There are multiple structural reasons why risk parity underperformed and is likely to continue to underperform during the next decade

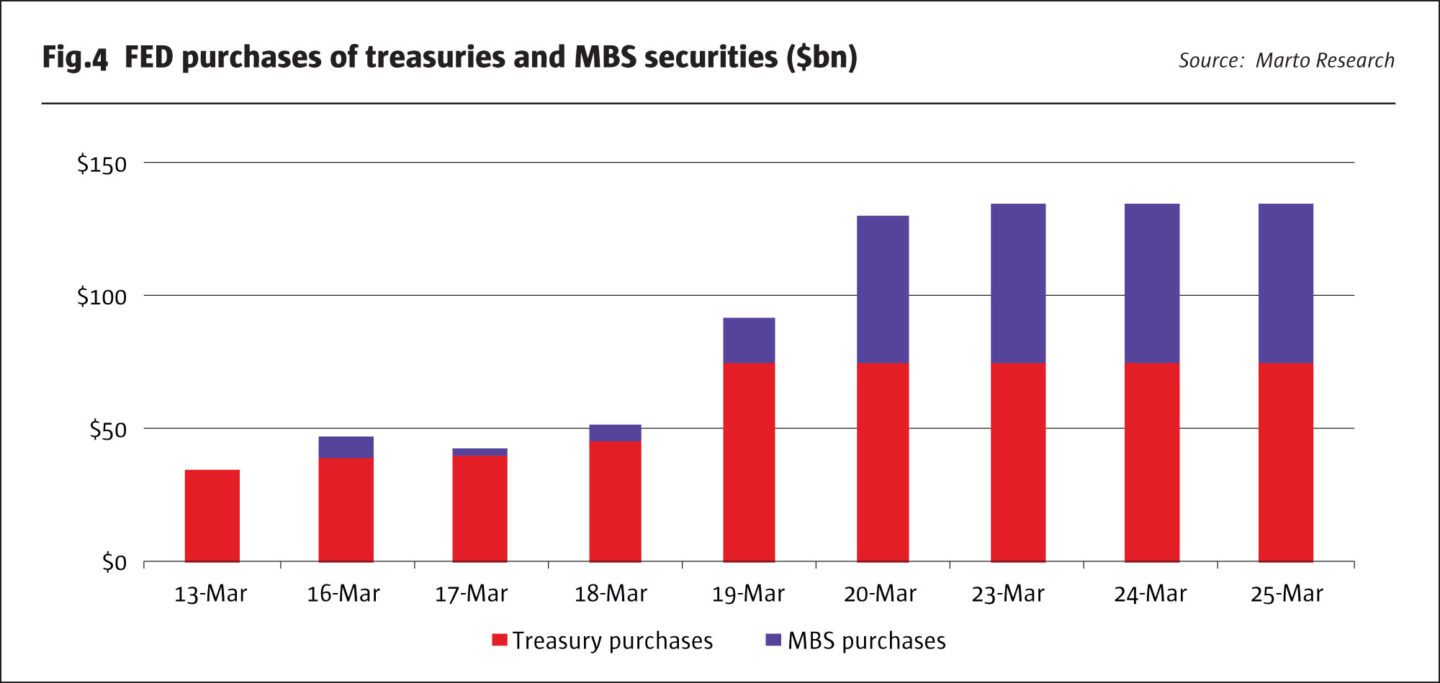

By far the main reason why risk parity’s future is bleak is the fact that central banks ran out of ammunition to stimulate the economy. With interest rates at 0% and with each consecutive cycle of stimulus infusion losing its effectiveness, Central Banks are powerless. We saw that powerlessness on Sunday, March 15th, 2020, when the Federal Reserve shot all the ammo it had left (benchmark rate to 0%, $800b treasury and MBS buy-backs, and a credit lending facility) and the equity markets continued to plummet losing 30% peak to through. Yields rose even when the Fed more than quadrupled its Treasury and MBS purchases in March.

It is clear that central bank stimulus can no longer support risk parity’s future outsized returns.

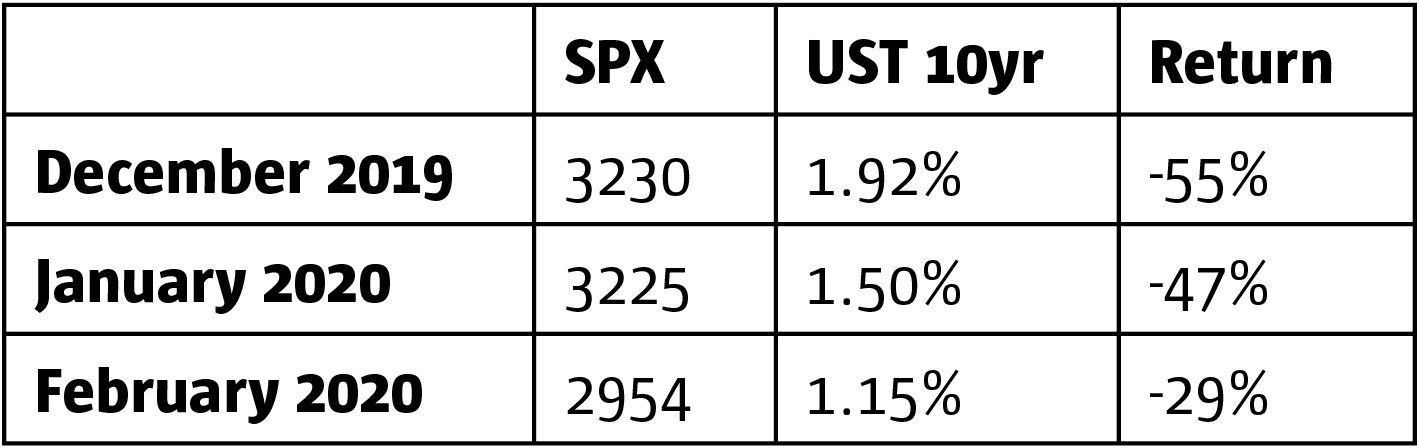

Additionally, treasuries, a key asset within the risk parity portfolio, are no longer a reliable safe haven or a good risk-off asset. Bonds have become so expensive that they have an asymmetrical payout expectation. It’s easy to see fairly limited potential for yields to fall materially while the possibility of a large repricing higher could wipe out gains as markets normalize. In the referenced piece below, using April 1st, closing market, we ran an analysis of what would happen to a simple portfolio of short S&P futures and long the equivalent risk position in 10-year US government bonds assuming the market normalized back to month end levels from December 2019 and January and February 2020. Risk parity methodology would state that it takes roughly three units of bonds to risk neutralize 1 unit of S&P. The following table shows the results:

Importantly, the expected $1 trillion US fiscal stimulus is raising concerns about debt levels leading to bonds selling off. Despite the Fed taking the benchmark interest rate to 0%, the 10-year treasury yield rose to 1.20% in March. The gains from rising bond prices have already been captured by risk parity during the last two decades. Future returns are likely to be lackluster.

Finally, coming into the 2020 sell-off, at $1 trillion of AUM, risk parity was one of the most overcrowded long trades. This is particularly a problem when liquidity in markets is thin as we saw in the last couple of weeks. While some of the assets risk parity buys such as treasuries are very liquid, others are not. And as seen this week, even US Treasuries can become illiquid and subject to gap moves in times of crisis. For example, risk parity products are one of the largest buyers of inflation-linked bonds (TIPs), making it very hard for risk parity managers to go in and out of the TIPs market, in times of thin liquidity.

It did not help that risk parity similar to other levered strategies, was overleveraged. As volatility kept going down, leverage kept going up to keep the risk budget steady. During the last few years, market volatility had basically died off, with realized volatility of single digits in US equity indices, forcing managers to take on more and more leverage. Risk Parity was no different. As a result, in a deleveraging cycle which is what is happening now when vol spikes (when VIX traded up to 85 on 18th of March), risk parity has to sell-off assets, which further exacerbates their losses.

What other strategies are likely to outperform risk parity during the next decade

Continued Fed stimulus coupled with the most aggressive fiscal intervention since the Great Depression will eventually have a positive effect. The market will recover and growth will pick up and as result asset prices will also appreciate. The current environment will present one of the best buying opportunities for investors in their life-time. The question is whether going forward, risk parity is worth the fees investors pay and whether the strategy can outperform other low cost diversified strategies.

We believe that the golden age of risk parity is over. The coronavirus epidemic just sped up the strategy’s demise. It was by far the longest-running consistently winning bet in the known history of markets. But the outstanding past performance of risk parity is no indication of future performance: The structural changes we describe above are not likely to change any time soon — 0% benchmark interest rate, less effective QE, and overpriced government bonds. The new economic reality poses long term challenges which will result in mediocre returns for risk parity for years to come.

In the short run, cash is king. An alternative to risk parity portfolio allocation is to stay in cash or remain underinvested during the uncertainty of the coronavirus epidemic. Within the next six to twelve months, equities present a fantastic buy opportunity. Once we have more information and a medical solution is in place, the fiscal stimulus will begin to kick in. At that point, a basket of equities or a low cost, passive portfolio of equity ETFs, gold and to a lesser extent unlevered treasury will likely outperform risk parity on a net of fees bases during the next decade.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 149

The End of The Golden Era for Risk Parity

Investors will face muted returns for the next decade

Katina Stefanova, CEO & CIO, Marto Capital

Originally published in the June | July 2020 issue