Frontier markets have proven to be amongst the best investment destinations of the past decade and are increasingly attracting the attention of global investors. These rapidly expanding economies are already home to 25% of the world’s population and 11% of the world’s GDP. Today, their capital markets have already reached the critical size required to attract global investors. There is an increasing need, not only to better understand these new investment destinations, but also to determine the role these markets should play within investment portfolios.

Similar to the traditional long only strategies, most hedge funds have no exposure to these markets. We believe that we have now reached a turning point and that pioneering investors will be rewarded for building up positions in these markets today.

Today’s opportunity

Investors can build exposure to frontier markets across various asset classes. The combination of high growth prospects, attractive valuations and solid sovereign balance sheets makes the case for investing in frontier markets today as appealing as it was for the “BRIC” markets in the 1990s.

Just as was the case with the BRIC markets, the capital markets in today’s frontier countries are still relatively young. However, they already have an aggregate market capitalisation above $500 billion and daily trading volumes of over $300 million. If we were to include Saudi Arabia, the total market capitalisation would be above $800 billion with total frontier market trading volumes exceeding $2.8 billion.

Similar to what happened with the BRIC markets, we expect frontier capital markets to further deepen in the coming decade. As a point of reference, over the past 10 years, Brazil’s market capitalisation increased from around $100 billion to its current level of nearly $1 trillion. Moreover, its daily trading volumes grew from less than $100 million to a current total average turnover that exceeds $2 billion.

Phase I and II

As of June 2012, frontier markets have just completed their first 10-year cycle on the international stage and have delivered an annualised return of 5.8%, this is more than double than the MSCI World’s 2.2% performance over the same period.

The better returns for emerging markets are illustrative of what lies in store for frontier markets when they start to successfully absorb significant portfolio flows. African frontier markets have already delivered returns in line with their strong economic growth fundamentals as this cycle has generated an impressive 10.5% annualised return.

BRIC markets finished a 10-year cycle in December 2004 in which they underperformed both developed and emerging markets. During the next phase, this pattern was strongly reversed when the BRIC markets posted an annualised return of just under 12%. Looking ahead, we expect a similar trend for frontier markets in which they should outperform emerging markets by 3-4% annually. Global flows were one of the key catalysts for the BRIC markets and investors used the low valuations in 2004 as an entry point. Total assets of BRIC funds held by European investors jumped from only €100 million to €4 billion during that year. A similar momentum is building in frontier markets.

Benchmark weights

The constructors of the main benchmarks apply traditional factors like market capitalisation to define the constituents for various frontier market indices. This approach has resulted in weightings that fail to reflect the true macroeconomic identity of these regions. The recognised frontiers in the Middle East, the Americas and Europe account for around 70% of the weights of the main frontier markets indices; while in reality, these regions account for only 24% of the population in frontier markets.

Expanding frontier markets opportunity set

Beyond the drawback of a capitalisation-weighted methodology, these indices cover only a limited number of potential frontier countries. We believe that a better definition of frontier markets would be one that encompasses all countries which have or are in the process of opening up public markets. This consideration would not only dramatically increase the number of frontier markets to 83 countries, but it would also better reflect the weight of the frontier market countries in the world economy.

Using “market access” as a definition, the frontier markets represent 25% of the world’s population rather than the 14% reflected by traditional indices. Moreover, this extended Silk Invest frontiers universe accounts for 11% of world’s GDP instead of only 7% for the countries followed by the indices. As a perspective for contrast, India accounts for only 5% of the world’s GDP.

Beyond public markets

Private equity opportunities abound in frontier markets. However, data points on frontier market private equity are scarce. Analysing the performance of the IFC provides us with some insight into what the bigger picture looks like. The IFC, an investment division of the World Bank, is one of the most active players in frontier markets and has generated an annualised return of 22.2% on its private equity investments over the past 10 years. This is impressive when compared to the 11.4% return of the Cambridge US PE index and the 12.1% generated by its emerging markets index. IFC’s portfolio has a big bias towards frontier markets with around 25% of investments in Sub-Saharan Africa.

When it comes to private equity, more than most other asset classes, timing is of course important. Investing in the right “vintages” and avoiding periods of market crowding can have a big impact on performance. The returns that the IFC has generated have been a reward for being an investment pioneer in these new markets.

The world in 2100

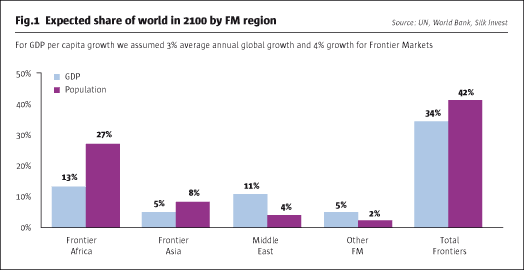

Forecasting what will happen in the short term is nearly impossible. However, to anticipate where the world is moving over the medium and long term can be a more fruitful exercise. Today the developing economies already account for more than 50% of world’s GDP. Only three decades ago, in 1981, this number was just 31%. This shift was predominantly driven by better infrastructure, the breakdown of information barriers, increased institutionalisation and the tremendously improving development of human capital. Today we are witnessing frontier markets going through a rapid convergence cycle which will allow them to capture 18% of the world’s GDP in 2050 and 34% of the world’s GDP in 2100 (see Fig.1).

Silk Road

The Silk route gave the world its first extensive and interconnected global trade network, spanning across Asia, Africa and the Middle East. Today, these three regions account for 70% of the total population in the frontier markets which render them the most relevant of regions within the category. Favourable demographics will only further increase the importance of these economies, driven by the significant number of individuals entering the work force to become consumers. These three Silk Road regions will account for 29% of world’s GDP and 39% of world’s population by the end of this century.

Growth opportunity

There is broad academic consensus on the clear relationship between GDP growth and corporate earnings. This relationship is especially strong in emerging markets where the earnings growth has often been a multiple of nominal GDP growth. This does not always translate into positive market returns as asset valuations matter and investors should avoid chasing growth at any cost. The positioning of portfolios towards future incremental growth should pay off as long as prices have not yet discounted all future upside. This strategy has already delivered for the early “BRIC” investors. We see a similar potential pattern for investors who are willing to allocate to frontier markets today. To fully capture this opportunity, investors should rely on fundamental macro-economic factors such as GDP to define their allocation rather than being guided by poorly constructed indices. Allocations should take into account the 14% share of global GDP represented through frontier markets.

Right time for frontier markets equities

Frontier markets represent less than 0.1% of most investment portfolios. This is clearly too low. With the current levels of market volatility many investors are reluctant to invest in these new markets. Our view is that investors would actually be de-risking by investing in frontier markets as diversification matters, especially during periods of uncertainty. The correction in frontier markets after 2008 was more severe than in most other markets. The result is that frontier markets today trade at less than 50% of theirfive-year peak levels. We see this as an attractive discount to global developed and emerging markets which are trading at around 75% of their peak levels. Consider that if frontier markets were to rise by 50%, they would still only be trading at similar levels to the rest of the world.

Valuations

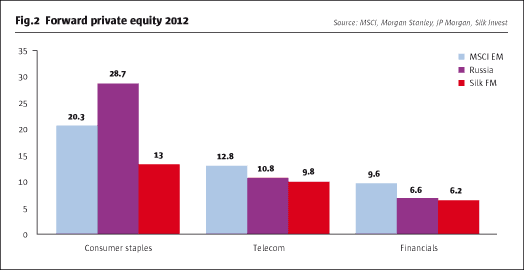

This discount in frontier markets is not driven by earnings compression but can be fully explained by valuation multiples. Consumer staples companies in Russia generally trade at twice the level of their peers in the frontier markets universe while the companies in the financial sector within our universe are typically valued at 50% when compared to similar companies of the same sector in the MSCI emerging markets (see Fig.2).

The bond opportunity

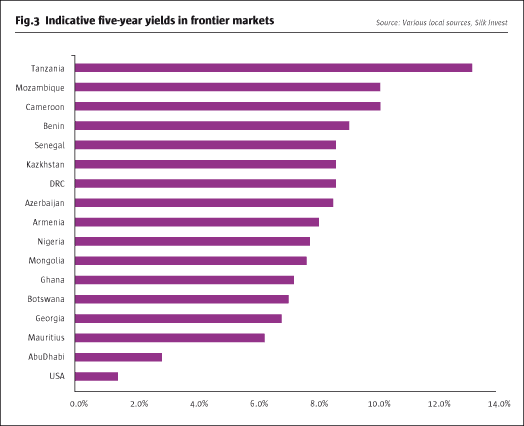

Looking at the Emerging Market credit curve, there are also opportunities in frontier markets which are by definition off benchmark but should not be missed. These opportunities are in both local currency and dollar-denominated bonds. From a portfolio construction standpoint, these bonds tend to have a unique combination of higher beta and a positive convexity profile that allows investors to capture higher returns. Hard currency yields in frontier markets are very attractive and mis-priced across the range. Fig 3. shows indicative five-year yields in the frontier markets space with yield to maturity (YTM) ranging from 2.8% in Abu Dhabi to 13% in Tanzania.

Frontier fixed income markets are often small and illiquid. The sovereigns are generally considered to be at an earlier stage of economic and financial market development than other emerging bond markets. That said, these markets are enjoying the benefits of globalisation, industrialisation, and technology.

The attraction of private equity

Frontier markets are under-explored regions with relatively low private equity penetration. EMPEA data indicates that, when compared to developed markets such as the United States, the private equity industry in frontier markets has ample room to develop. When corrected for GDP, India has seven times more private equity capital invested in comparison with frontier regions. This sets the scene for attractive investment opportunities where early investors have the first-mover’s advantage.

Growth capital

Investors looking for large buy-out opportunities tend to struggle to find opportunities in frontier markets as the current cycle favours growth capital. The most interesting private equity targets are generally smaller and in their “first generation” of ownership. Beyond the available universe, the success of companies is heavily driven by the quality of management and their ability to scale up. The right business model tends to differ from one country to another where a deep understanding of the integral value chain is critical. The differences range from product price points to optimal distribution strategies. A wise approach starts with acknowledging the importance of local management and aligning interests by building partnerships.

Conclusion

Opportunities in frontier markets exist in abundance across asset classes and investors can unlock the full potential of these markets if they follow a credible and active approach which is ‘in touch’ with local markets.

Zin Bekkali is the founder of Silk Invest, a specialist fund manager focused on frontier markets in Africa, the Middle East and Asia.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 79

The Frontier Markets Ship is Sailing

Unlocking the full potential of frontier markets

ZIN BEKKALI, CEO and GROUP CIO, SILK INVEST

Originally published in the August 2012 issue