The biggest current threat to global growth is a trade war. There are other risks, too. The U.S. Federal reserve is unwinding quantitative easing and raising rates, but is making the policy shifts very gradually, with careful market guidance. Governments are focused on whether they need to cut taxes, not raise them; so, no growth risks from fiscal policy. Consumer confidence is relatively high around the world, from mature industrial countries to young emerging-market nations. Equity market valuation might appear high to some, but stock market corrections do not cause recessions unless there is a financial panic – and systematic risks from financial institutions are much lower than when the last crisis occurred in 2008. After considering the other risks, we stand by our analysis that if the current synchronized global economic expansion is derailed, the most likely cause will be a trade war. YET, we are optimistic. So far, the actions taken earn only the terminology of “Skirmishes,” but if they escalate to “Battles” and then a “Trade War,” we will need to re-assess the risks. Here is our review of the issues and challenges.

The trade skirmishes began in earnest in March 2018 with the US imposing tariffs on steel and aluminum in the name of national security. The US temporarily exempted Mexico and Canada pending progress on the NAFTA negotiation, held open the possibility that other countries might be exempted, but did not exempt Europe. The European Union is expected to retaliate with highly focused tariffs, from jeans to bourbon to motorcycles, designed to hit some hot-button pain points involving name-brand companies. Later in March, the US leveled tariffs on China, aimed at intellectual property.

In progress in the spring of 2018 are the US-Canada-Mexico negotiations over the North American Free Trade Agreement (NAFTA). While technical committees involved in the negotiations reportedly have made some progress on the small issues, the big issues that separate the US from Canada and Mexico revolving around domestic-content rules (think autos) and how to handle disputes (the US wants a system more to its liking), are far from being resolved. Indeed, while the US rhetoric about unfair trade practices is often aimed at China, the steel and aluminum tariffs can also be seen as bargaining chips in the NAFTA negotiations. Our take-away is that the US is only a very short step away from announcing its intention to withdraw from NAFTA. We note that announcing the intention to withdraw triggers a six-month waiting period. At the end of the six months is when the final decision to withdraw or not would be made.

One should not ignore the Brexit negotiations between the United Kingdom (UK) and European Union (EU) for the UK to exit the free trade zone, as they are not going well – actually they are not moving much at all. The UK has tended to negotiate as if they were equals with the EU. By analogy, though, if this were a card game, the EU holds four aces and the UK does not have a single pair – yet the UK continues to poker bluff for better terms, even though everyone’s cards are on the table for all to view. The strategy is not working because there are some fundamental inconsistencies at its heart. The first problem for UK Prime Minister Theresa May is that the Conservative Party is split with some ‘hard’ Brexit advocates and some ‘soft’ Brexit advocates. Another problem for the UK is Ireland. May has promised to treat Northern Ireland the same as England, Scotland and Wales. She has also promised the Democratic Unionist Party (DUB), whose 10 votes she needs to remain in power in Parliament, that she will keep an open border between the Republic of Ireland and Northern Ireland. It is very hard to conceive of how one keeps an open border with Ireland without putting some border controls in place between Northern Ireland and the rest of the UK. And, how do you keep free trade between Northern Ireland and the Republic of Ireland yet impose different rules on the rest of the UK versus the EU? It just does not add up.

Thus, the odds have risen that either the Conservative Party will revolt and select a new Prime Minister, or the DUB will withdraw its 10 votes and force a new election. If there is a new election, the Labour Party would have a reasonable chance to win; indeed, it might even be favored. What this means for trade between the UK and EU is that the UK is currently headed down a path in which it will miss the 2019 deadline for a deal to leave the EU, and the EU may just say good-bye and force a ‘hard’ Brexit, meaning more political repercussions in the UK and damage to UK trade with the EU.

There has been some action toward freer trade. In March, a group of 11 nations, without the US, signed the Trans-Pacific Partnership, renaming it the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which cuts tariffs among the member nations. The signing of the CPTPP underscores the US withdrawal from a leadership role in multi-lateral global affairs and reaffirms the intent of many other countries to strengthen mutual trade ties. This has the potential to reshape long-term trading patterns in goods, services, and commodities in a way that would disadvantage US-based companies and producers.

The trade pact in Latin America is gaining new traction, in part as a reaction to US protectionism. Mercosur, effectively the “Common Market of the South,” is likely to move to lower tariffs with other countries and regions outside South America so as to better diversify their trade relationships. In Africa, 44 countries have signed a new free trade pact – although the two richest nations, Nigeria and South Africa, remain aloof.

In short, the sources of trade tensions are getting increasingly serious, yet there are signs of freer trade, too. On the negative side, the US is moving unilaterally to impose tariffs. The renegotiation of NAFTA is about to hit major roadblocks, and no Brexit deal is in sight, increasing the odds of a “hard” exit for the UK and the worst case for UK-EU trade. On the positive side of the ledger, Pacific Rim nations, the CPTPP-11, are moving to create a customs zone without the US Freer trade is coming to South America as Mercosur is re-energized. African nations are bonding together. The glass is half full, but there are many risks.

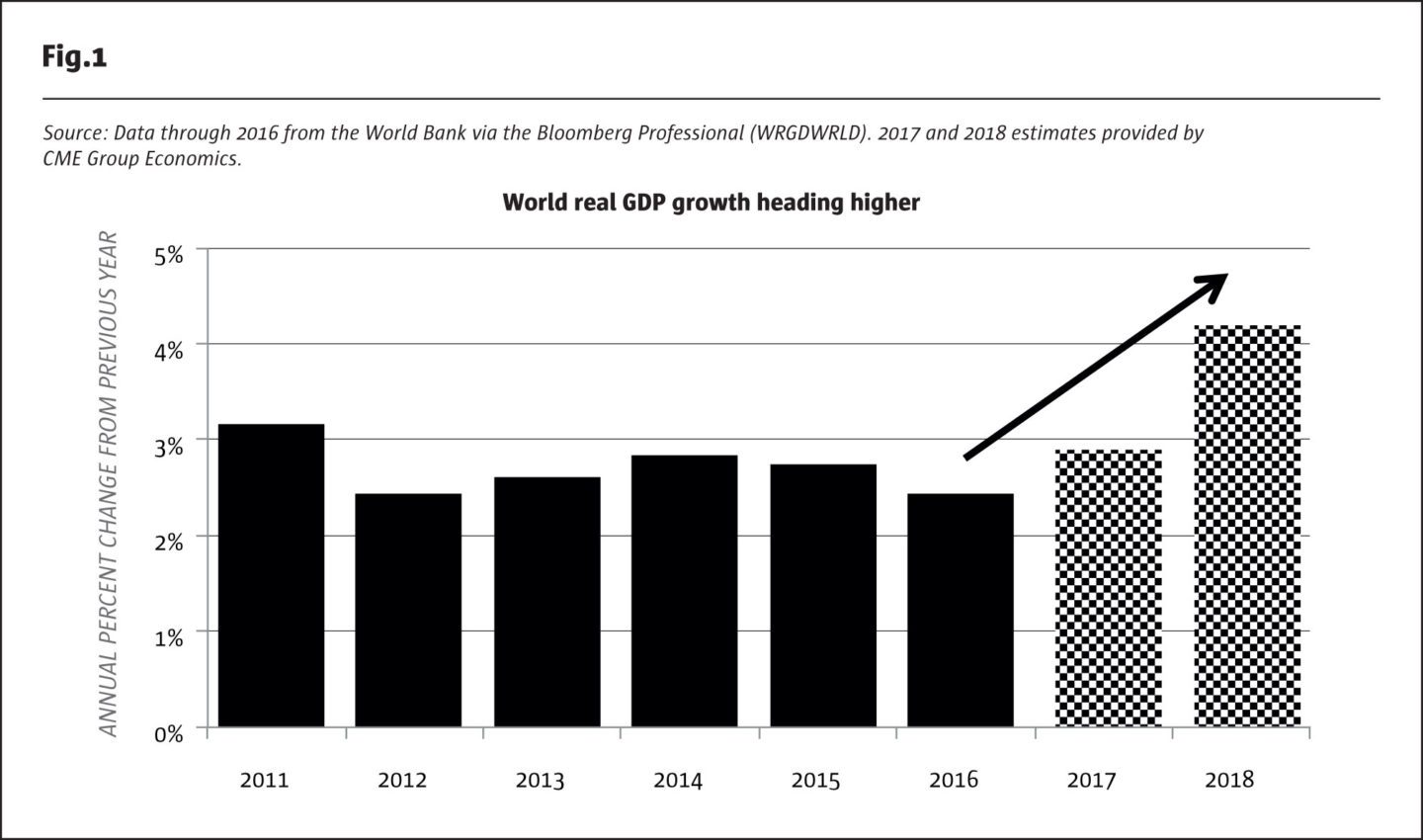

Fig.1

What are the economic implications of rising trade tensions?

There are considerable complex interactions in play when considering the implications of the path global trade negotiations have taken. While some politicians prefer to look at trade through bilateral lenses that focus on the net trade in goods between two countries, modern trade patterns are incredibly interconnected, involving trade in goods, services, and commodities, with direct and indirect implications on how trade flows are financed and how capital flows among countries. Our analysis here focuses on a few select challenges that highlight the complex network of trade and capital flows that could be potentially disrupted if growing trade tensions expand into a shift toward nationalist protectionist policies.

Global growth

2017 global growth was a solid improvement over 2016, and 2018 seems on track to exceed 4% real GDP growth. This accelerated pace of activity represents a synchronized growth path among virtually all regions and countries – a rising tide that is lifting all boats. The laggards of 2015-2016 were Brazil, due to its political problems, and Russia, due to the oil-price declines. Both of these countries are growing again. The mature industrial countries, from the US to Europe to Japan, are incrementally growing just a little bit faster.

China risk

China represents one of the major risks to world growth, but the government has asuccessfully managed to cushion the impact of an aging population and focus on a transition to a domestic growth model. Debt loads are very worrisome for China. Since China’s debt is domestic, not owed to foreigners, and not denominated in other currencies such as the US dollar or the euro, China probably has the tools to manage this challenge. All in all, a modest deceleration of growth in China in 2018-2019 is not expected to disrupt the higher pace of overall global growth.

The big risks to global growth are the rising trade tensions. So far, the initial salvos and skirmishes amount to very small potatoes. If a tit-for-tat tariff war starts to bite, the rosy growth scenario might dim. Economists are well aware of the US imposing the highly restrictive Smoot-Hawley Tariffs in 1930, along with the Federal Reserve inaction; trade protectionism helped to turn a recession into the Great Depression.

Retaliation

One of the big questions as the US embarks on a path of unilateral imposition of selected tariffs is what kind of retaliation might occur. We enter the world of game theory, and it is not pretty. The prevailing view among nations from Asia to Europe to Canada and Mexico is that the imposition of new unilateral tariffs has to be checked. Two responses are almost certain: (a) selectively impose retaliatory tariffs, and (b) simultaneously bring legal proceedings to the World Trade Organization. For the most part, if all that happens is one side fires a shot, the other side returns fire, and then there is a cease fire, the damage to global economic growth is likely to be quite small. The real danger is that trade pacts that have been in place start to unravel. That would be the case if the US pulled out of NAFTA or there was hard exit of the UK from the European customs union. This heightens the importance for markets if NAFTA or Brexit go badly, and one can expect stock markets to get quite jittery if the rhetoric gets cranked up.

The question of retaliation often revolves around who feels the pain. For example, the US Administration is taking a calculated bet that the gains to the steel and aluminum industries will be meaningful and measureable, while the pain felt by industries that use steel and aluminum, from beer and soft drink companies to aircraft companies to oil and gas well drillers, will be spread wide enough not to be easily attributable to the new tariffs. The argument goes that if the impact is less than a penny a beer can, no one will notice. The reality is that the companies hit by the “friendly-fire” will see it in their bottom lines and stock prices, and they will be less able to make new investments or create jobs. So, there is a political-economic disconnect, where the offsetting economic losses are not felt politically but are felt in the stock market, labor market and the economy.

The strongest case for protectionism has always revolved around emerging market countries. The idea was that tariffs could protect domestic industries from international competition, giving them time to develop and flourish. A developing nation might award a monopoly to give a local telephone company a protected environment to build cell phone service. Or, a national oil company would be protected from foreign competition so as to build up the domestic capabilities. Unfortunately, protectionism of this sort also seems to breed crony capitalism and industrial-political corruption. For a case study, one can examine Brazil’s “Car Wash” initiative to clean up the corruption partly caused by protectionist policies.

Most economists, although not all, have railed against protections. Mercantilist polices held sway in 1500s and 1600s as the national objective was focused on accumulating gold and having a strong navy. The French economics minister for the Sun King Louis XIV was Jean-Baptiste Colbert, and he was a key figure in promoting trade protectionism. By the 1700s, the free trade ideas of philosopher and political economist David Hume were gaining ground. In the early 1800s, David Ricardo’s theory of comparative advantage helped to build the foundation of why and how free trade led to much greater economic growth. Hume made the case eloquently as he argued:

“there still prevails, even in nations well acquainted with commerce, a strong jealousy with regard to the balance of trade … This seems to me, almost in every case, a groundless apprehension; and I should as soon dread, that all our springs and rivers should be exhausted, as that money should abandon a kingdom where there are people and industry. Let us carefully preserve these latter advantages; and we need never be apprehensive of losing the former.” (From David Hume, Essays, Moral, Political, and Literary, 1752, Part II, Section V).

Diversification of sources of imports

Just the risk of the demise of NAFTA or a hard Brexit has already caused trade patterns to shift a little. Mexico has started importing more corn from Brazil. Mexico will also be taking a hard look at how its energy resources are managed so as to lessen its growing dependency on US natural gas. The US is also a big exporter of cattle and beef products to Mexico that could soon face new competition from other countries. Mexico could also target cattle and beef imports for retaliatory tariffs.

Companies respond as well

Some financial companies have stopped hiring in London and starting making plans for expanded operations inside the EU. Japanese companies have long understood the risks of relying on production facilities in China and many years ago adopted the “China Plus One” approach to make sure they had supply chain capabilities outside of China.

US multi-nationals will often find themselves between a rock and a hard place. To take advantage of the new CPTPP, production and service support facilities may be needed to be physically located inside one of the 11 countries in the bloc or risk losing access to those markets on competitive terms.

Rise of China as global power

One of the key global consequences of the US withdrawal from a leadership role for free trade and other multi-lateral initiatives is the opening this policy shift has given to China to expand its influence much more rapidly than many had thought possible and to increasingly play the leading role in global affairs that it has long coveted. China is typically every nation’s number one or number two trading partner. All of the small nations in the Pacific region have significant China risk regarding their own

economies. Moreover, China is extremely aggressive in trying to influence the production of commodities that are essential to its economy. China’s President Xi Jinping has recently moved to consolidate power and to govern for life. While China’s rise as an economic power eventually would have given it a central place on the world’s stage, China’s more dramatic ascendency is a game-changer for countries in the Pacific region and how they manage their own trade relationships with China.

There still prevails, even in nations well acquainted with commerce, a strong jealousy with regard to the balance of trade … This seems to me, almost in every case, a groundless apprehension; and I should as soon dread, that all our springs and rivers should be exhausted, as that money should abandon a kingdom where there are people and industry. Let us carefully preserve these latter advantages; and we need never be apprehensive of losing the former.

David Hume Essays, Moral, Political, and Literary, 1752

Capital flows

All trade flows are financed by capital flows. This accounting observation should also be viewed from the opposite perspective. Namely, countries that provide attractive investment opportunities and are net attractors of capital will naturally run deficits in the balance of trade for goods and services. The point here is that trade flows do not necessarily drive capital flows and vice versa. The arithmetic that a negative (positive) balance on goods and services will be offset by positive (negative) net capital flows implies no direction of causality.

The corollary point is that a rise in trade protectionism will impact capital flows as much or even more than trade flows as markets adjudicate prices and allocate resources in the changed environment. Indeed, we would argue that a rise in trade protectionism is likely to have quite profound impacts on capital flows, particularly for the United States because of the role of the US dollar as the primary reserve currency and the primary currency of denomination for commodity pricing.

Let’s take trade with China as an example. The US imports large quantities of consumer goods from China. China buys large quantities of US Treasury securities. US consumers acquire goods at cheaper prices than they could be manufactured domestically, and China acquires the national debt of the United States. And, all of this trade, real goods for paper assets, occurred willingly and as Milton Friedman (Capitalism and Freedom, 1962) said: “The most important single central fact about a free market is that no exchange takes place unless both parties benefit.” If the US shifts toward trade protectionism causes US Treasury securities to be less desirable, as might arguably be the case as US economic and trade policy risk rises, then the US would see a rise in yields on US Treasury securities and a rise in the interest expense incurred by the federal government on new issues of Treasury securities.

The increased riskiness of the US dollar may well explain a conundrum for some economists in 2017. During 2017, the US Federal Reserve (Fed) was raising short-term interest rates, announcing plans to shrink its balance sheet and reverse quantitative easing, while the European Central Bank (ECB) and the Bank of Japan (BoJ) continued to expand their balance sheets and keep short-term rates near zero. The US dollar weakened against both the euro and the Japanese yen. If one believes exchange rates are partially driven by relative monetary policy, then this was the opposite of what was expected. If one also believes that a change in relative risk requires a higher risk premium, then one can start to appreciate the impact of policy uncertainty on the US dollar and US Treasury yields.

How to create a trade surplus – have a recession

The easiest way, although not recommended, for a major country to create a trade surplus is to have a recession. Import demand is driven by economic growth. Remove the economic growth and import demand will collapse. While it is probably not true, if other things remained equal, then the country in recession would still export goods while it imports would collapse. If a country’s economic performance outpaces the rest of the world, its demand for imports will rise relative to exports to the rest of the world. We are just trying to underscore the observation of David Hume that one should not make value judgments about trade deficits or surpluses. If a nation takes care of its economic growth, money flows – trade and capital — will take care of themselves.

This report is an adaption of an article published in the Global Commodity Applied Research Digest (GCARD) published by the J.P. Morgan Center for Commodities at the University of Colorado Denver Business School. www.jpmcc-gcard.com.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 131

The Initiation of Trade Wars? Battles? Skirmishes?

A review of the issues and challenges

Blu Putnam, Chief Economist, CME Group

Originally published in the April 2018 issue