Morphic Asset Management (Morphic)’s co-CIOs, Chad Slater and Jack Lowenstein, have been fundamental investors, selectively employing ESG factors, for 10 and 20 years respectively, and have been shorting since they set up Morphic in 2012. In March 2018, they launched the daily dealing Trium Morphic global equity long/short UCITS fund, with discounted fees for the founders’ share class.

The top ten holdings look very different from those of many ESG and other global hedge funds, due to Morphic’s Asian and mid-cap focus, its distinguished investment process, and its distinctive approach to ESG. Morphic adds ESG factors to its fundamental investment process and ESG considerations somewhat constrain the investment universe. Longs must satisfy minimum ESG standards and shorts are generally of the lower rated ‘corporate citizens’ whilst consciously not shorting ‘better ESG citizens’.

For example, Tesla is a popular holding amongst some types of ESG investors, but it would fail both Morphic’s valuation criteria, and the ‘G’ for Governance in its ESG criteria, due to issues including the board of directors and the Solar City merger. Unlike many hedge fund managers, Morphic would not short Tesla however, “as that would drive up the cost of capital for a firm that is performing a social good in developing the electric car industry,” argues Slater, who began his career as an economist in Australia’s Treasury Department.

Morphic would not short Tesla as that would drive up the cost of capital for a firm that is performing a social good.

Chad Slater co-CIO, Morphic Asset Management

In broad-brush terms, Morphic will refrain from shorting firms ranked in the top ESG quartile and avoid buying those in the lowest ESG quartile. Some entire industries are excluded from the long book and Slater acknowledges that some companies with poor ESG scores, including so called ‘sin stocks’, have in fact been good investments though points to research from Statman and Glushkov (2016) that showed ESG investing can outperform despite excluding these ‘sin stocks’. Other poor corporate citizens have also disappointed shareholders. Morphic argue that ESG investing dovetails well with an absolute return philosophy because ESG funds proved more resilient during crises (per research from Varma and Nofsinger, 2014). The logical explanations for this are that good corporate citizens are less vulnerable to environmental, social, legal, accounting and governance related crises.

Morphic do not necessarily own the highest ranked ESG stocks however, as these stocks have not always been the best alpha generators and some of them are expensive. Morphic find ESG is most compelling as a source of alpha for ‘ESG improvers’: companies that are ascending the ESG rankings. Such firms have outperformed those that already boast the loftiest rankings, according to research, including a recent study from UBS (“Can ESG add alpha? An analysis of ESG Tilt and Momentum strategies”, Nagy, Kassam & Lee (2016). Identifying the improvers naturally requires a process that extends beyond ESG #1 – negative screening – to encompass second generation ESG: constructive dialogue and engagement.

The babble of many ESG tongues

ESG may be moving into the mainstream, with an estimated $8 trillion of assets in the US using some form of SRI or ESG. Yet instead of consensus, a proliferation of approaches to ESG can differ markedly, in terms of which companies can and cannot be invested in. Various ESG scoring and ranking systems have a high overlap in some areas, but little or no overlap, or even opposite ratings, in others. “This is because of the varying materiality and weightings attached to different factors. It is also due to the availability of various datasets. In any case, the rankings are not precisely comparable – as they slice and dice the data in different ways, and generate different types of output,” explains Head of Research, James Tayler.

A spectrum of ESG approaches also exists, ranging from negative screening of the entire investment universe; to exclusions only on the long book; to over-weighting or under-weighting, for benchmark constrained investors and to engagement – which can even entail ownership of, and engagement with, all companies (for some ‘passive’ long index investors). Negative screening, and active engagement to engender change, can be seen as opposite ways to use ESG. Morphic uses both approaches selectively.

Negative screening

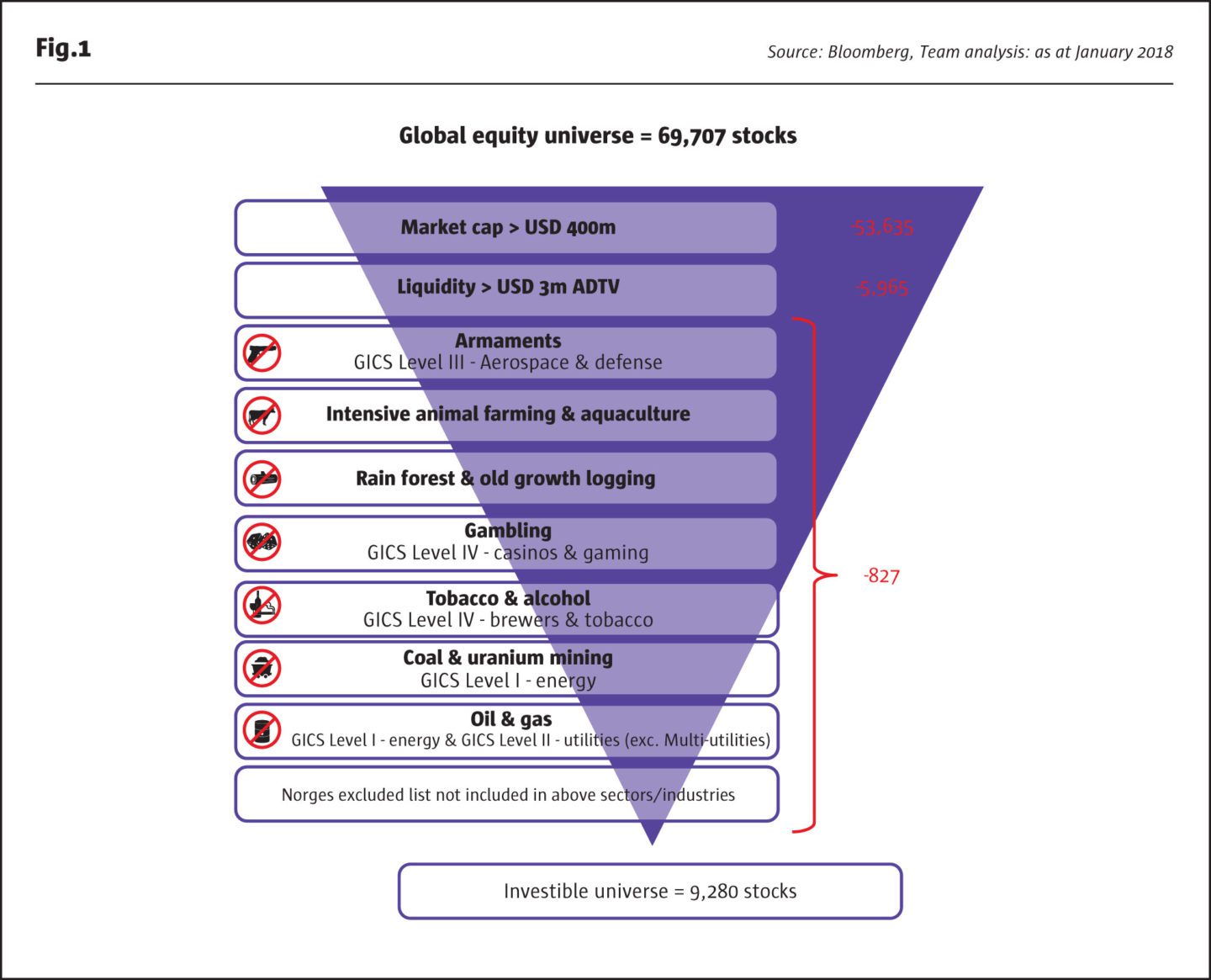

Morphic does not exclude companies based in its domicile, but does avoid long positions in companies that are involved in a range of industry groups which include oil and gas, armaments, gambling, tobacco and alcohol, rainforest logging, coal and uranium mining and intensive animal farming and aquaculture, defined by levels 1, 2 and 3 of GICS sectors. Based on this, Morphic exclude 827 stocks from a global universe of around 10,000 companies that meet Morphic’s liquidity criteria: minimum market cap of $400 million for longs, $1 billion for shorts, and average daily volume of $3 million; about 60,000 are not liquid enough. The filtering steps are illustrated above.

Although many SRI investors are comfortable with investments in alcohol producers, Morphic has excluded them to avoid managing separate mandates for many Christian groups. Other groups with different restrictions, e.g. who wish to avoid companies involved with contraception, abortion, and pornography, would need to negotiate separate accounts, which Morphic can offer.

After the industry based screens, it gets more complicated as “more qualitative and granular analysis is needed in areas such as labour sourcing,” says Tayler. Morphic avoids another 43 stocks, based on public research from Norway’s oil fund, Norges Bank; the full Norges list of excluded stocks partly overlaps with Morphic’s industry-based exclusions, and contains others that are not on Morphic’s list because they have already been ruled out for liquidity reasons. Stocks excluded from Morphic’s long universe due to the Norges screen include firms such as Walmart that do not meet certain criteria for labour standards within their supply chain. Morphic are transparent and share lists of both excluded stocks, and portfolio investments, subject to time lags.

Ratings and Morphic’s proprietary ESG audits

Additional stocks are being excluded from the long book, and sometimes shorted, as Morphic expands the coverage of its own ESG research. “We are not ‘greenwashing’ but are digging deeper,” says Slater. Tayler has investigated at least four providers of ESG ratings, Sustainalytics, MSCI, Thomson Reuters, and Canberra-based CAER, which has a joint venture with Vigeo/EIRIS, and expects that Morphic will commit to one of them at some point.

But Morphic need to do their own research as they are sceptical about whether an algorithm or published ranking system can be sensitive to all of the ESG related nuances that they would want to consider – such as corporate governance. Slater observes that “rather than having a holistic ESG focus, some ESG investors are focused on carbon, which can lead them to buy Facebook and overlook its shocking governance”.

Additionally, the ESG ratings providers have thus far focused on larger companies, meaning that mid cap and small cap stocks have little or no coverage – particularly in Asia, though Morphic finds CAER and its partners currently has the best coverage of Asian stocks. Gaps in Asia are partly a function of poor disclosure, particularly from some companies in Korea and China. This can in turn be down to accounting issues. “Though most Asian companies are now doing financial reporting under IAS GAAP, there are some where Morphic needs to get comfortable with local accounting standards,” says Slater.

Morphic engages with companies to ferret out more information and gauge the ESG risks. Morphic’s ESG audit could take two or three days where disclosure is good, but may take longer where more questions and answers are needed. “Some Asian companies are behind the curve on ESG, with some Japanese firms refusing to engage with non-Japanese shareholders,” says Tayler. The situation is improving however with multiple drivers: “the Japanese Government Pension Investment Fund has earmarked 3% for ESG investing, most recently via the MSCI Japan Empowering Women Select Index; Hong Kong listing rules require more comment on CSR matters, and the global CDP initiative encouraging more disclosure of carbon data,” illustrates Tayler.

Morphic has so far carried out 70 ESG audits, which is a reasonable number in relation to Morphic’s relatively concentrated portfolio, typically of 30-60 stocks. “We are not trying to create a rival ranking system,” says Tayler. Morphic has four analysts in addition to the two co-CIOs, Head of Research and Head of Macro.

Morphic’s ASX-listed vehicle, Morphic Ethical Equities Fund, has an independent board of directors who were specifically chosen for their expertise in the ESG area, and who have the final say over ‘grey areas’. Morphic advocates board diversity, including more women on boards. The board of Morphic Asset Management includes Katarina Royds, while the board of the listed fund includes Joanna Fisher and Virginia Malley.

8 trillion

An estimated $8 trillion of assets in the US use some form of SRI or ESG

Engagement and activism

“We engage with both good and bad ESG companies as well as with our peers in the broad Responsible Investment industry,” says Tayler. For instance, Morphic is supporting a private action group which is campaigning for improvements from the top 100 carbon emitters. Tayler also engages with good ESG citizens to learn more about them. “Engagement is part of our fiduciary duty to engage and hold accountable companies for their environmental, social and other risks,” he says.

Engagement comes naturally to Tayler, who led the analysis of UBS when he was Head of Research at Eric Knight’s activist manager, Knight Vinke, which sometimes wrote public letters but mostly operated discreetly. At Morphic, Tayler is vociferous behind closed doors. For example, Morphic joined forces with other activists who targeted a closed end fund trading at a 20% discount to NAV. Morphic has also agitated against very highly remunerated management who unsuccessfully tried to resist a takeover which was clearly in the best interests of its shareholders.

ESG longs

Morphic are transparent in disclosing their top ten positions at month end, and all positions with a one-month time lag. Slater estimates that around 30% of positions have an ESG angle. Morphic’s charter requires at least 5% of long holdings to be involved with water quality, air quality, conservation or renewable energy. We touch on most of the top ten positions below, none of which we have noticed on lists of ‘overcrowded’ positions.

Morphic’s longs need to satisfy four stages of its investment process: identifying a state of change; fundamental analysis of value, quality and momentum; alignment with the macro climate, and identification and consideration of material ESG criteria.

China Everbright is a long position with a high ESG ranking and a low valuation: “it recycles waste, generates electricity from the biomass, treats water and sells on steel. Mania for tech stocks has meant it is not so popular, but the stock is cheap, has good growth prospects to enter new cities and an English-speaking investor relations department that are easy to deal with,” says Slater.

French multinational train and tram maker, Alstom, is an example of an ESG ‘improver’, which is blazing the trail to hydrogen fuel-powered, zero emission regional trains. Alstom is also a strong growth story, with a record order book worth five years of revenue; scope to expand margins to match those of peers, and two special dividends due to be paid on completing a merging with Siemens’s rail unit.

ESG shorts

Morphic has publicly mentioned its short in Australian-listed Coca Cola bottler, Coca-Cola Amatil, which supplies Australia, Indonesia and Papua New Guinea. This stock is not automatically ruled out by Morphic’s industry-based screens, but is viewed as vulnerable to a government crackdown or taxation of sugar (which has been implemented in the UK). Crucially, Morphic also perceives the valuation to be high: “a PE multiple of 20 does not leave much room for error. With bottle recycling programs being implemented at the firms expense, it may have trouble passing on price rises,” argues Slater. Still, this may not be a short forever. Tayler holds out the prospect that if the company changes its policies, it could become an ‘ESG improver’, and therefore a long candidate. Active engagement is the instrument to push this agenda and also to judge the sincerity of management’s understanding and reaction.

Jack Lowenstein has also discussed a short in US bank Wells Fargo, partly due to governance concerns around the scandal of it opening accounts unbeknownst to customers – but also based on the fundamental rationale of the firm being too big to grow.

Non-ESG positions

Sometimes, ESG can be central to the investment thesis for a position, but some of Morphic’s holdings have no ESG angle per se, besides the minima for longs and maxima for shorts.

Asian mid-caps are one key source of ideas. Morphic is impressed by improving corporate governance in Japan, evinced in more independent directors, companies targets for return on equity and return on assets, and positive earnings revisions. Selected Japanese homebuilders and property developers, such as real estate developer, Open House, have seen their share prices quintuple in recent years from Tokyo’s continued population growth, and are distributing capital to shareholders. The core long theme has no ESG rationale, but Morphic has also paired Open House with a short in Iida Group, a family-dominated firm with inferior governance. Elsewhere in Japan, Morphic has invested in an industry-leading erasable pen-maker that has no sell side analyst coverage and which historically refused to engage with foreign shareholders. Morphic has tried to engage via an engagement strategy with other partners.

Morphic engages with companies to ferret out more information and gauge the ESG risks

Another pairs trade, with no ESG wrinkle, is in the logistics sector. A long in DSV is matched with a short in Panalpina, based on Morphic’s perceptions of relative valuations, relative profit margins, and management quality. The pair has the added attraction of neutralising an otherwise long exposure to a significant carbon emitting industry.

In Asia, being aware of and having a view of the macroeconomic backdrop matters more than in any other part of the world. In early 2018, a more top down pairs trade going long of the Pakistan equity market, via the US listed Pakistan ETF (PAK-US) and short of the Indian market via futures listed on the Singapore exchange, worked well as Pakistan moved from a frontier market country emerging market status – hence an “improver”. Some idiosyncratic ideas in India do appeal however. Slater argues “Indian infrastructure fund, IRB InvIT Fund, which builds toll roads, is like an inflation linked bond paying a yield of 13%, which could compress towards Indian interest rates of 8%”. He feels comfortable with regulatory risk in India, pointing out that the government reimbursed the firm for providing toll-free travel during the demonetisation of certain bank notes. The stock has been drifting lower since it floated in May 2017 however.

Smaller and medium sized niche US banks have been a profitable portfolio theme that fits in well with Morphic’s upbeat economic outlook and surveys showing strong business confidence. The fragmentation and diversity of the US banking sector has allowed Slater to identify banks such as one specialised in lending to dental clinics, and another innovative firm – Bank of Internet (BoFI). “I have lived in the US and banking there has historically been slow to move, as evidenced by checking accounts. BoFI offers branchless banking which has grown very well, partly by acquiring the HR Block tax return banking business. Whereas other banks use generic credit models, the firm has correctly priced credit risk in more risk areas such as jumbo loans,” says Slater. Ultimately, investment is all about pricing risks – both conventional financial risks and ESG risks.

Trium UCITS and Trium strategies

Morphic had contemplated launching a 130/30 UCITS version of their strategy to mirror the two Australian vehicles; all three vehicles hold the same positions, sized differently according to their mandates. However, Trium’s Donald Pepper, having engaged with investors, was of the opinion that “this would fall between two stools. It would have too much leverage for long only investors, and too much beta for alternative investors”. Trium examined Morphic’s 5.5 year track record, with annualised returns of around 17% in Australian Dollars, and determined that the fund had averaged a ratio of approximately 70% long single stock ideas to 30% short single stock ideas. This provided a good foundation for an alpha product that can run variable net exposure, ranging between -25% and +75%. “We stripped out the ETF and index products which had ‘equitized’ the fund to Beta 1 on average. These positions, by definition, had no alpha. Taking them out allowed a bigger volatility budget which was used to increase single stock positions by 1.5x, creating a magnified alpha product. The variable net track record would have made annual returns of 6.2% with annual volatility of 5.7%, after fees, producing a Sharpe of 1.1. That is a good cash-plus return for UCITS investors who want low net exposure with some variability,” says Pepper. Capacity for the UCITS is estimated at $750 million, with the limiting factor being the Asian mid-cap sweet spot: Morphic expects to have 50-60% exposure in Asia, including mid-cap Japan.

The legal structure for Trium Morphic is an Irish UCITS. Typically, Trium Capital LLP as investment manager, brings in third party managers, including Morphic, to act as sub-investment advisers. Other Trium UCITS managers include Zug-based Blackwall, which has grown assets from $2.3 million to $288 million, and received The Hedge Fund Journal’s UCITS Hedge Awards 2018 for best risk adjusted returns in the European mid cap long/short category. Trium UCITS also hosts a third long/short equity strategy, Trium Opportunistic Equity Fund, run by Randeep Grewal, ex-Tudor Capital, and Andy Perkins, ex-Societe Generale.

Rather than a cookie cutter turnkey solution, Trium operates a flexible structure. Trium has also set up Cayman funds and managed accounts for other strategies. Some managers, such as Morphic, have their own back and middle offices, whereas others, such as Oliver Dobbs’ catalyst-driven hybrid securities arbitrage fund Credere, make use of Trium’s support. Certain managers have used Trium as a springboard for raising assets before spinning out alone: Selvan Masil, who featured in The Hedge Fund Journal’s ‘Tomorrow’s Titans 2016’ report has set up his own office.

Pepper and co-head, Shenan Dhanani, have big ambitions for Trium, with a number of teams being incubated with seed capital from Trium. Aspect Capital alumnus, Larry Lau, is running $5 million in a CTA strategy, while a multi-PM, multi-strategy, Cayman vehicle containing $20 million is bringing in new managers, such as Tom Ayres and Nikki Martin from Ivaldi and BlueCrest.

Trium is conscious that smaller vehicles can have higher costs, and has in some cases agreed to cap total expense ratios of funds.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical