UBS O’Connor traces its roots back nearly 40 years to 1970s Chicago, which was home to a booming and growing derivatives market where options trader O’Connor & Associates nurtured many of today’s leading financial traders. The family office that has seeded the O’Connor Opportunist UCITS Fund, with €30 million, has also forged long ties with UBS O’Connor over the past 20 years. Why would this venerable financial trading house, founded in 1977, and acquired in 1992 by Swiss Bank Corporation, which in 1998 merged with Union Bank of Switzerland (UBS), be starting a UCITS fund?

Diversifying the investor base

O’Connor is no stranger to regulated onshore fund vehicles, and already has a quarterly liquidity ‘40 Act type product for the US market. O’Connor is now keen to diversify the investor base by region and product, and one of the O’Connor Opportunistic UCITS fund’s share classes has a minimum investment amount of only $10,000, reaching out beyond the institutional and ultra-high-net-worth profile of the current investor base. UCITS is a global brand, and the marketing effort will be expanded to Latin America and Asia, with preliminary conversations taking place in Japan.

The marketing effort kicked off in Switzerland and Asia in early January. Private banks in Europe are huge fans of UCITS – says the senior portfolio manager of the O’Connor Opportunistic UCITS Fund, Doc Horn, “The Swiss distribution team is very excited about the launch,” and UBS Wealth Management is no exception. UBS O’Connor is walled off from UBS Wealth Management, which operates an “open architecture” model, allowing it to offer multi-strategy funds from other managers, such as Balyasny or Millennium Partners. The Wealth Management team has high regard for the depth of trading expertise within O’Connor; thus, the affiliated private bank is no captive buyer, and O’Connor has earned its stripes on the shortlist based on its own merits.

“For the Opportunistic UCITS fund, we have taken a unique subset of our more liquid strategies within O’Connor and placed them into a UCITS framework,” says Horn. The weekly liquidity terms have led UBS O’Connor to decide that corporate credit and convertible bonds are unlikely to make up more than a tiny part of the product. It is focused on delivering a balance between equity hedged strategies (both fundamental and quantitative), alongside event driven strategies. The fundamental equity hedged strategies employ a bottom-up security selection approach with low market beta exposure – indeed, there are even some market-neutral strategies. And the event driven strategies, such as merger arbitrage and concentrated US long/short equity, can take views on a variety of corporate events and actions.

O’Connor expects the 10 or so strategies to be lowly correlated to both markets and one another, contributing to portfolio diversification, but that does not mean that the weightings are static. Far from it: “We shift capital between the strategies based on the perceived opportunity set,” explains Horn, with “overall O’Connor house views helping to set the allocations.” The key strategy dichotomy is the balance between around eight fundamental equity hedged and, currently, two event driven strategies, but weightings in the strategies can change.

Global collaborative team

These house tilts are derived from a huge resource of investment research and analysis. Of the 150 O’Connor staff, some 65 are on the investment management side, and there is a strong team ethos. “Collaboration between the teams is one of the defining characteristics of our platform and is what makes us unique – the information sharing is accretive to the overall strategy,” stresses Horn. For instance, a sector specialist following consumer stocks could offer the merger arbitrage team insights about management, ownership and deal responses – so the interplay between strategies is very high. Equity market coverage is “pretty comprehensive,” according to Horn, with 13 sector-specific managers focused on, say, materials or technology, media and telecoms, while the Asia region is split more along country than sector lines.

Just about every strategy is fundamental and discretionary, bar one quantitative strategy, but even here it is fundamental quant or “quantamental” rather than a purely technical quantitative strategy. The quant strategy cannot be viewed in isolation from the others, as its main signal input is the Fundamental Market Neutral Long Short Strategy, with an overlay of some more traditional quantitative signals designed to generate lower correlations.

Diversification is not just by security, sector and strategy, it is also geographic: the fund is expected to contain exposure to around 2,000 securities. The UCITS fund invests globally across all major regions, and O’Connor has developed a global reach from seven offices – in Chicago, New York, London, Zurich, Singapore, Hong Kong and Tokyo. O’Connor has had a presence in London and Asia for over a decade, and indeed Horn has been head of UBS O’Connor in Europe, and has also run the market neutral team in Asia. The geographic spread includes some emerging markets, with an emerging market long/short strategy covering Latin American and Central European markets. That said, “the bulk of the exposure is still expected to be in the US, where the markets tend to lend themselves best to relative value investing,” says Horn.

The approach is collaborative, but “the 10 strategies have autonomy within their own risk guidelines.” These risk limits are finely calibrated to each strategy, with caps on asset class, investment universe, and exposure levels, and sometimes even limits on the size of style and factor leans. The limits do not prevent portfolio managers (PMs) from taking different views, however. “No house view is forced upon the PMs, as our hope is to gain diversity via different styles, processes and views,” explains Horn. Sometimes portfolio managers have been in opposite and offsetting positions, and this could be because they are using positions for different purposes – perhaps different time horizons, for hedges instead of catalysts. Forecast correlations are low to negative amongst the current 10 strategies and more strategies may be added over time.

Dynamic rebalancing

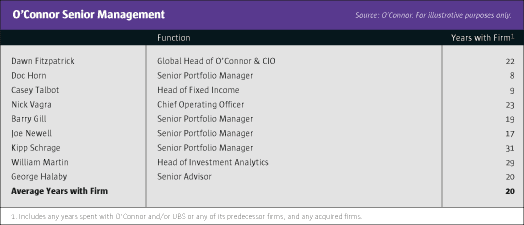

Investors should not imagine that the 10 strategies each receive a weighting of 10%. Sometimes one strategy can be weighted as high as 50%, which implies that the other nine would have average weights of between 5% and 6%. “We have evaluated which strategies make sense and in what environments, and the dynamic allocation process makes us unique compared with other multi-strategy UCITS funds,” claims Horn. Liquid strategies allow O’Connor to swiftly reallocate capital within a week. The monthly meeting of all of the senior portfolio managers generally lasts three to five hours, and includes a quantitative portfolio analytics team who assemble a bespoke package of 150 to 200 pages each month, with new risk views used to inform discussions. Each manager has to argue the case for their allocation afresh every month, setting out how much capital they can deploy. A second, smaller, meeting of the Capital Allocation Committee makes the final decision on allocations. The eight committee members have an average of 20 years at the firm. “The process has been honed over the 14 years of running multi-strategy products at O’Connor,” says Horn. O’Connor consistently reviews the process to check that their dynamic re-weighting is performing better than an equal-weighted approach.

At O’Connor the buck stops with global head of O’Connor and chief investment officer, Dawn Fitzpatrick. A University of Pennsylvania Wharton School of Business graduate, Fitzpatrick has worked in the pit, trading equity options on the floor of the Chicago Board of Options Exchange. She has ultimate veto power over all O’Connor products, although in practice most decisions are taken jointly with her Capital Allocation Committee, and these decisions, in turn, are informed by the monthly allocation meetings and ongoing dialogues with the investment team – in general, O’Connor does not have a “star culture”. In common with several O’Connor managers, Fitzpatrick was previously a proprietary trader at UBS Investment Bank. Fast forward to today and O’Connor stands independent, is not a proprietary trading firm and focuses on managing outside client capital.

Remuneration, recruitment and retention

“O’Connor has implemented a unique compensation scheme that is very competitive with other hedge fund platforms and allows us to hire and retain great talent,” asserts Horn. Remuneration policies at O’Connor contain a few distinct features. It is not a purely “eat what you kill” formula, because O’Connor wants managers to have some skin in the

game even when their own capital allocation has diminished. For example, Horn explains that if lots of merger deals are breaking and the view becomes less sanguine on the merger arbitrage opportunity set, leading to a capital reduction, O’Connor would still look for ways to compensate the merger arbitrage team for their broader contribution to the entire platform. Of course, the performance of a manager’s own book is still “the key component, but there are additional rewards based on team and platform contributions.” For instance, if a manager spends some extra time researching style and factor models that are of use to the whole firm, throwing light on risk from different angles, they can potentially be compensated for that.

The UCITS fund bears some netting risk because the fund charges performance fees on overall net performance – and not on individual managers’ books as some multi-strategy funds do. That said, Horn is proud that “historically our turnover is among the lowest on the street, as we look at PMs as people to invest in over a full market cycle.” O’Connor’s investment professionals have on average been in the industry for 16 years. “We can take a good PM, invest in them and turn them into a great PM,” asserts Horn. Behavioural analytics and dynamic risk systems are just two of the examples of techniques that can improve portfolio managers by alerting them to behavioural biases.

What is perhaps more unique is O’Connor’s “Incubator Programme”, which tries to access a different pool of talent than other hedge fund peers may do. “For instance, we looked to hire a senior member of the Treasury department of a top internet company,” recalls Horn, “who did not have any capital markets background but whose knowledge of the industry and balance sheet construction were unparalleled.” A former senior portfolio manager, Molly Carl, who had worked at O’Connor for 18 years, returned to O’Connor in 2014 to run the programme. There is a two-way traffic in terms of finding people for it, and O’Connor has had enquires from McKinsey staffers, top MBA programmes and trade journals.

Multi-layered risk management

The O’Connor UCITS fund’s strategy portfolio managers operate within a multi-faceted risk framework. Each strategy is held to a specific set of risk guidelines adapted for the strategy. For example, the market-neutral strategy extends its risk management beyond low beta. The strategy is expected to be generally region and sector-neutral, and is neutralised to style exposures such as growth, value, momentum and factor exposures such as interest rates and commodity prices, with foreign currency risk usually hedged out too. So the aim is to isolate alpha from stock picking, and Horn thinks the strategy is “pretty close to the definition of pure neutrality.”

There are multiple layers of risk management within O’Connor – individual portfolio manager, senior management and an independent risk management group. Each portfolio manager, senior management and the Market Risk Control team monitor risk on a real-time basis, using both in-house and off-the-shelf risk systems and a suite of quantitative analytics. O’Connor’s proprietary portfolio risk management analytics feed into both capital allocations and risk management, and are constantly evolving. Senior management provides a further oversight of risk guidelines within O’Connor, as do compliance and product control teams, which check pre and post-trade compliance, and also report on cash, collateral, FX hedging and counterparty exposures.

But “what is special about MRC (Market Risk Control) is that it is an independent resource that does not report to anyone in O’Connor,” explains Horn. The UBS Risk Control Group is deliberately segregated and independent from portfolio management. It keeps an additional eye on value at risk, stress testing, leverage, liquidity and concentration risks for the overall fund and the individual strategies. The Risk Control Group also monitors market and portfolio risks, and chairs the monthly Risk Committee meeting. The UCITS structure also provides a fourth level of oversight via the external management company, which monitors compliance with UCITS risk controls, including on diversification, counterparty exposure, liquidity – but the O’Connor UCITS fund does not have the 200% gross exposure leverage limit that applies to some other UCITS funds.

Structuring the UCITS

The UCITS IV regime was not structured with a leverage limit that could be overly restrictive, particularly for a low net exposure approach. Instead the UCITS is subject to a value at risk (VaR) limit and expects to be running VaR substantially below that limit. Most hedge funds are indeed well below the 99% confidence 20-day VaR of 20%.

Bringing the UCITS to market has taken some time because O’Connor wanted to ensure an appropriate and cost-effective structure and to source the right swap providers. While UCITS funds tend to gain short exposure via swaps, as they cannot borrow securities, the O’Connor product will gain exposure to both its longs and shorts via portfolio swaps.

The Irish-based platform, UBS Alternative Solutions, is operated by UBS Fund Services, within Global Asset Management, but in keeping with the open architecture mantra, there was no obligation for O’Connor and UBS Alternative Solutions to work together. “We could have partnered with other management companies,” says Horn, “but we chose UBS Fund Services based on the whole package.” Although it does sound as if the platform was competitively priced relative to others on the market, price was not the key consideration for O’Connor. O’Connor simply found it was easier to tie in with the integrated operating environment and get running swiftly. Gavin Byrnes, head of UK business development at UBS Fund Services, noted, “This is an exciting collaboration with our colleagues in O’Connor on a platform that is geared to supporting the private bank’s access to alternative strategies through regulated structures.”

O’Connor, as a platform, is not tied to using UBS as a broker, and is walled off from UBS Investment Bank and its prime brokerage group. O’Connor conducts business with a large number of brokers, including UBS, and the relationship with UBS is largely the same as with other sell-side firms – O’Connor pays out hard commissions for research provided and treats all its brokers in a similar manner. Sell-side research usage and consumption varies a lot by individual portfolio manager, with some managers finding huge value in it, while others emphasise their own proprietary research. O’Connor also has good access to sell-side research analysts where needed.

Horn observes that 2014 was challenging for a number of strategies, given the macro noise and volatility. In general UBS O’Connor welcomes a return to more volatile markets with greater divergences between stocks. “A market environment of good dispersion and low correlation, moving on fundamentals rather than just macro or central bank activity, is our preferred environment,” opines Horn, “but we’ll take a tick up in equity volatility, which should provide more mispricings and opportunities. This, in addition to an ongoing high level of corporate activity, should offer a solid market backdrop for our blend of equity hedged and event driven strategies in 2015.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical